How the GENIUS Act 2025 Shapes U.S. Stablecoin Regulation and Global Finance

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) of 2025, passed by the U.S. Senate on June 17, 2025, with a bipartisan vote of 68-30, is a game-changer for stablecoin regulation in the United States. Stablecoins, digital assets pegged to stable values such as the U.S. dollar, are reshaping finance, with a global market cap exceeding $200 billion [1, 6].

In this article, we examine the impact of the GENIUS Act 2025 on Fintech, the digital asset ecosystem, financial stability, and institutional adoption, exploring its provisions, consumer protections, market effects, and global influence.

Why the GENIUS Act Matters

By addressing regulatory uncertainties, the GENIUS Act promotes innovation while safeguarding consumers and maintaining financial stability. However, some critics argue it may prioritize industry interests over robust safeguards. From payments to decentralized finance (DeFi), this legislation could redefine how digital assets operate in the U.S. and beyond [2, 4].

Key Takeaways

Regulatory Clarity: The GENIUS Act 2025 establishes a federal framework for stablecoin regulation, providing clarity for issuers and users.

Consumer Protection: Mandates 1:1 asset backing and monthly disclosures, though critics highlight gaps in consumer safeguards.

Institutional Adoption: Encourages banks and fintechs to issue stablecoins, boosting their use in payments and DeFi.

Global Impact: Positions the U.S. as a leader in stablecoin regulation, influencing global digital finance standards.

Challenges: Debates persist over regulatory loopholes and insufficient consumer protections.

What the GENIUS Act means for the crypto industry

Legislative Context and Rationale

Why Was the GENIUS Act 2025 Passed?

The GENIUS Act was introduced to address regulatory ambiguity in the rapidly growing stablecoin market, driven by both political and economic motivations. Introduced by Senator Bill Hagerty (R-Tenn.) and co-sponsored by Senators Tim Scott (R-S.C.), Kirsten Gillibrand (D-N.Y.), Cynthia Lummis (R-Wyo.), and Angela Alsobrooks (D-Md.), it secured a 68-30 Senate vote, including 18 Democrats, despite concerns over ties to President Trump’s crypto ventures. The act aims to protect consumers, ensure financial stability, and maintain the U.S. dollar’s global dominance [1, 5].

Senator Bill Hagerty emphasized its importance, stating,

“The GENIUS Act will cement U.S. dollar dominance, protect customers, drive demand for U.S. Treasuries, & ensure that digital asset innovation happens in the U.S., not overseas.”

Economically, stablecoins offer faster, cheaper transactions than traditional systems, making them vital for digital payments and remittances. However, the 2022 Terra Luna collapse underscored the need for oversight to prevent systemic risks [6, 9].

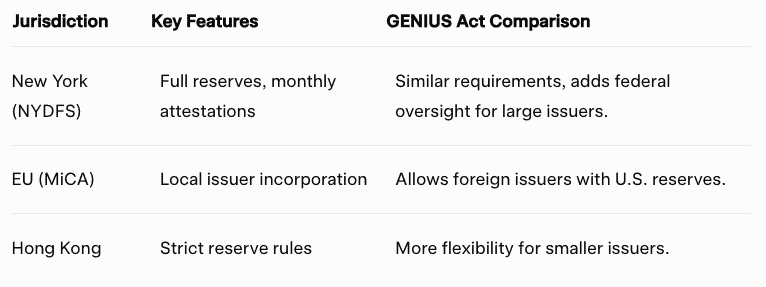

How Does It Compare to Existing Stablecoin Regulations?

Before the GENIUS Act, U.S. stablecoin regulation was state-driven. New York’s NYDFS required full reserves and 1:1 redemption since 2018, with 2022 updates mandating monthly attestations . States like Florida and Wyoming used regulatory sandboxes to balance innovation and oversight. Globally, the EU’s MiCA framework, Hong Kong, and Singapore enforce strict reserve and consumer protection rules. The GENIUS Act aligns with these but introduces a unique federal-state oversight model, allowing foreign issuers under comparable regimes [10, 11, 12, 4].

Key Provisions of the GENIUS Act 2025

What Is a Payment Stablecoin?

The GENIUS Act defines a “payment stablecoin” as a digital asset for payments or settlements, pegged to a national currency like the U.S. dollar, excluding bank deposits and securities [1]. Algorithmic stablecoins are excluded, with further study planned. This clarity is crucial for the digital asset ecosystem, distinguishing stablecoins from other crypto assets.

Licensing Structure for Stablecoin Issuers

The act creates a dual licensing system:

Federal Path: Allows subsidiaries of insured depository institutions (IDIs), federal nonbank issuers, and foreign bank branches to operate under Federal Reserve or OCC oversight [7].

State Path: Permits state-qualified issuers with under $10 billion in issuance to operate under state regimes certified as “substantially similar” to federal standards. Issuers exceeding $10 billion transition to federal oversight within 360 days [7].

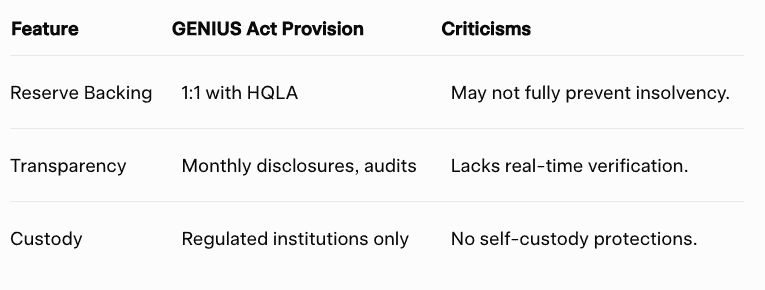

Reserve and Compliance Requirements

To ensure financial stability, issuers must:

Maintain 1:1 reserves with high-quality liquid assets (HQLA) like U.S. cash or short-term Treasuries [7].

Provide monthly reserve disclosures, with annual audits for issuers over $50 billion [7].

Comply with AML, KYC, and sanctions under the Bank Secrecy Act [7].

These measures aim to boost transparency and prevent reserve mismanagement.

Federal Preemption and Consumer Protection

How Does Federal Preemption Work?

The GENIUS Act preempts state licensing for stablecoin issuance, creating a unified federal framework. However, it preserves state consumer protection laws, allowing enforcement against fraud and disputes [10]. This balance ensures consistency while respecting local oversight.

Consumer Protection Measures

Key protections include:

1:1 Reserve Backing: Ensures redemption with HQLA, reducing de-pegging risks [7].

Transparency: Mandates monthly reserve disclosures and annual audits [7].

Custody Rules: Limits custody to regulated institutions, banning asset commingling [7].

No Misleading Claims: Prohibits implying federal insurance, with clear risk disclosures [7].

Critics, like Consumer Reports, argue the act lacks protections akin to the Electronic Fund Transfer Act, risking fraud or insolvency [2]. Concerns also arise about tech giants issuing stablecoins without sufficient banking oversight [5].

Financial, Legal, and Market Impacts

Legal Clarity for Stablecoins

By excluding payment stablecoins from securities and commodities classifications, the GENIUS Act removes legal barriers, simplifying compliance for issuers and enabling financial institutions to adopt stablecoins [3]. This clarity bypasses SEC and CFTC oversight, streamlining the digital asset ecosystem.

Impact on Financial Institutions

The act allows banks, non-banks, and credit unions to issue stablecoins, integrating them into payment systems. Federal Reserve and OCC oversight ensures robust standards, potentially reducing transaction costs and settlement times [3, 6].

Market Growth and Institutional Adoption

Regulatory clarity is set to drive institutional participation, with giants like Amazon and Walmart exploring stablecoin offerings [13]. This could boost adoption in:

Payments: Faster, cheaper transactions.

Remittances: Cost-effective cross-border transfers.

DeFi: Enhanced liquidity and interoperability.

While reserve requirements build trust, weak enforcement could favor large crypto firms, risking market concentration [5].

Operational and Strategic Considerations

Compliance Challenges for Issuers

The GENIUS Act’s 120-day licensing response timeframe pushes issuers like Circle (USDC) and Tether (USDT) to meet HQLA and AML/KYC requirements quickly. New entrants face high compliance costs, potentially limiting smaller players [14].

Industry Trends

The act may trigger:

Consolidation: High costs could lead to mergers among smaller issuers.

Innovation: New use cases like programmable payments.

Strategic Shifts: Banks competing with Visa and Mastercard via stablecoins.

Global Policy and Influence

Shaping International Stablecoin and CBDC Regulation

The GENIUS Act 2025 positions the U.S. as a global leader in stablecoin regulation, setting a benchmark for other jurisdictions. Its framework, emphasizing 1:1 reserve backing and transparency, mirrors the EU’s Markets in Crypto-Assets (MiCA) regulation but introduces a flexible federal-state model [12].

By allowing foreign issuers to operate in the U.S. under comparable regimes with U.S.-held reserves, the act encourages international harmonization while prioritizing U.S. oversight. For instance, jurisdictions like Singapore and Hong Kong, with stringent stablecoin rules, may align their frameworks to facilitate cross-border operations with U.S.-based issuers [12]. As David Sacks, Crypto and AI Czar, noted,

“The GENIUS Act provides regulatory clarity, enhances consumer protection, and extends US dollar dominance online.”

The act also influences central bank digital currency (CBDC) development. As countries like China and the EU advance their CBDC pilots, the GENIUS Act’s stablecoin framework could pressure global regulators to integrate private stablecoins into CBDC ecosystems, fostering interoperability [8].

However, challenges remain, including regulatory fragmentation. Some nations may resist adopting U.S.-style standards due to geopolitical tensions or differing financial priorities, potentially creating a patchwork of regulations that complicates global compliance for issuers [4]. The U.S. Treasury’s planned coordination with international bodies like the Financial Stability Board (FSB) aims to mitigate this, but success hinges on diplomatic efforts.

Boosting Cross-Border Commerce

The GENIUS Act strengthens the U.S. dollar’s role in global digital finance by promoting dollar-backed stablecoins. With stablecoins offering transaction costs as low as 0.1% compared to 2-3% for traditional remittances, they could revolutionize cross-border payments, benefiting industries like e-commerce and international trade [6].

For example, small businesses in emerging markets could leverage U.S. stablecoins for faster, cheaper supplier payments, enhancing global supply chain efficiency. However, reliance on dollar-based stablecoins may raise concerns in countries seeking to reduce dollar dominance, such as those in the BRICS bloc, potentially leading to competing stablecoin ecosystems [4].

Setting Global Digital Finance Standards

The act’s focus on AML/CFT compliance aligns with global efforts to combat illicit finance, as outlined by the Financial Action Task Force (FATF). By requiring robust KYC and sanctions compliance, the GENIUS Act sets a precedent for secure, transparent digital finance. This could lead to reciprocal regulatory agreements, reducing legal conflicts for multinational issuers [4, 8]. For instance, the act’s reserve disclosure requirements may inspire similar transparency mandates in jurisdictions like Japan or the UK, fostering trust in stablecoins globally.

However, implementation challenges loom. Regulatory bottlenecks, such as delays in certifying foreign regimes as “comparable,” could hinder cross-border adoption. Additionally, the act’s emphasis on U.S.-held reserves may deter issuers in jurisdictions with strict capital controls, limiting global reach [14, 4].

Privacy concerns also arise, as AML/KYC requirements may clash with data protection laws like the EU’s GDPR, complicating compliance for global firms. Despite these hurdles, the GENIUS Act’s framework could drive innovation in tokenized assets and programmable money, positioning the U.S. as a hub for digital finance standards [17].

Geopolitical and Economic Implications

The act’s promotion of dollar-backed stablecoins reinforces U.S. financial influence, potentially countering the rise of alternative digital currencies like China’s digital yuan. By enabling stablecoins to integrate with DeFi and traditional finance, the U.S. could maintain its edge in global payment systems [3].

Yet, critics warn that overregulation or inconsistent enforcement could push innovation to less-regulated jurisdictions, undermining the act’s global impact [5]. The Treasury’s forthcoming report on algorithmic stablecoins, due in 2026, will further shape the global regulatory landscape, addressing risks that could affect international confidence in stablecoins.

Let’s Recap

The GENIUS Act 2025 stands as a transformative milestone in stablecoin regulation, poised to reshape the digital asset ecosystem, bolster financial stability, and drive institutional adoption in the United States. By establishing a clear federal framework with 1:1 reserve backing, monthly disclosures, and robust AML/CFT compliance, the act fosters trust and encourages innovation, enabling banks, fintechs, and retailers to integrate stablecoins into payments, remittances, and decentralized finance (DeFi) applications.

Furthermore, its dual federal-state oversight model strikes a balance between regulatory consistency and local consumer protections, addressing long-standing uncertainties that have hindered the digital asset market.

However, criticisms highlight potential gaps in consumer safeguards, such as the lack of protections akin to the Electronic Fund Transfer Act, raising concerns about fraud, insolvency, and the role of tech giants in stablecoin issuance.

Globally, the GENIUS Act positions the U.S. as a leader in digital finance, influencing the development of stablecoin and CBDC regulations while reinforcing the U.S. dollar’s dominance in cross-border commerce. Its emphasis on transparency and security sets a precedent for global standards, but challenges like regulatory fragmentation, geopolitical tensions, and privacy conflicts could hinder its international impact.

Implementation will be critical, with potential bottlenecks in licensing, compliance costs, and enforcement risking market concentration or regulatory arbitrage.

Looking ahead, the act’s success will depend on the U.S. Treasury’s coordination with global regulators, effective oversight by the Federal Reserve and OCC, and addressing consumer concerns to maintain public trust. By striking a balance between innovation and regulation, the GENIUS Act 2025 could usher in a new era of digital finance, positioning the U.S. as a hub for tokenized assets and programmable money while navigating the complex interplay of domestic and global financial systems.

FAQs

What is the GENIUS Act?

The GENIUS Act 2025, officially known as the Guiding and Establishing National Innovation for U.S. Stablecoins Act, is a U.S. federal law passed on June 17, 2025, to regulate payment stablecoins—digital assets pegged to stable values, such as the U.S. dollar. It establishes a dual federal-state licensing framework, mandates 1:1 reserve backing with high-quality assets, and ensures AML/CFT compliance to promote financial stability and consumer trust. The act aims to foster innovation while addressing regulatory uncertainties in the digital asset ecosystem.

How does the GENIUS Act protect consumers?

The GENIUS Act includes consumer protections, such as 1:1 reserve backing with high-quality liquid assets (HQLA), monthly reserve disclosures, and custody rules that limit services to regulated institutions. These measures aim to ensure redemption and transparency, reducing risks of fraud or insolvency.

However, critics argue it lacks robust safeguards, such as those in the Electronic Fund Transfer Act, potentially exposing users to risks from tech giants or issuer failures.

How will the GENIUS Act impact global digital finance?

The GENIUS Act positions the U.S. as a leader in stablecoin regulation, influencing global standards for stablecoins and CBDCs. By promoting U.S. dollar-backed stablecoins, it strengthens the dollar’s role in cross-border commerce, offering low-cost transactions for global trade.

However, challenges like regulatory fragmentation, geopolitical tensions, and privacy conflicts with laws like GDPR could limit its global reach. The act’s AML/CFT focus aligns with international efforts, potentially fostering reciprocal agreements.

References

Congress.gov. (2025). S.1582 - GENIUS Act.

The New Yorker. (2025). Why Passing the Stablecoin GENIUS Act Might Not Be So Smart. Retrieved from https://www.newyorker.com/news/the-financial-page/why-passing-the-stablecoin-genius-act-might-not-be-so-smart

Debevoise & Plimpton. (2025). Stablecoin Legislation Clears Senate. Retrieved from https://www.debevoise.com/insights/publications/2025/07/genius-act-progresses-in-congress-as-stablecoin

McMillan LLP. (2025). Overview and Analysis of the GENIUS Act. Retrieved from https://mcmillan.ca/insights/publications/overview-and-analysis-of-the-genius-act/

ABC News. (2025). What to know about the GENIUS Act. Retrieved from https://abcnews.go.com/Business/genius-act-crypto-regulation-bill/story?id=121981442

Cointelegraph. (2025). Stablecoin Regulations in the US. Retrieved from https://cointelegraph.com/learn/articles/stablecoin-regulations-in-the-us-a-beginners-guide

United States Committee on Banking, Housing, and Urban Affairs. (2025). FACT SHEET: The GENIUS Act Protects Consumers. Retrieved from https://www.banking.senate.gov

Kroll. (2025). Navigating the Future of Stablecoin Regulation. Retrieved from https://www.kroll.com/en/publications/financial-compliance-regulation/navigating-future-of-stablecoin-regulation

CNBC. (2025). Senate passes landmark GENIUS Act stablecoin bill. Retrieved from https://www.cnbc.com/2025/06/17/genius-stablecoin-bill-crypto.html

Paul Hastings. (2025). State Stablecoin Legislation. Retrieved from https://www.paulhastings.com/insights/crypto-policy-tracker/state-stablecoin-legislation

Caldwell Law. (2025). Guiding Innovation: Understanding the GENIUS Act of 2025. Retrieved from https://caldwelllaw.com/news/genius-act-stablecoin-regulation-2025/

Galaxy. (2025). Stablecoins in the Senate: The Latest on the GENIUS Act. Retrieved from https://www.galaxy.com/insights/research/genius-act-stablecoin-regulation

AINVEST. (2025). The Implications of the GENIUS Act on Tech and Crypto Sectors. Retrieved from https://www.ainvest.com/news/implications-genius-act-tech-crypto-sectors-2507/

Troutman Pepper. (2025). The GENIUS Act: What Is It and What's Next? Retrieved from https://www.troutman.com/insights/the-genius-act-what-is-it-and-whats-next.html

Forbes. (2025). The GENIUS Act Is A Good Start, But Congress Could Make It Smarter. Retrieved from https://www.forbes.com/sites/digital-assets/2025/06/04/the-genius-act-is-a-good-start-but-congress-could-make-it-smarter/

CCN. (2025). Genius Act: A Guide to the US Senate’s Stablecoin Legislation. Retrieved from https://www.ccn.com/education/crypto/genius-act-us-senate-stablecoin-legislation/

Forvis Mazars. (2025). GENIUS Act – Ushering in a Transformative Era of Digital Assets. Retrieved from https://www.forvismazars.us/forsights/2025/06/genius-act-ushering-in-a-transformative-era-of-digital-assets

PYMNTS. (2025). Revisions to GENIUS Act Could Impact US Stablecoin Market. Retrieved from https://www.pymnts.com/cryptocurrency/2025/how-lawmaker-revisions-to-genius-act-could-impact-us-stablecoin-market/

Northeastern University. (2025). What Impacts Might the GENIUS Act Have on the Crypto Industry? Retrieved from https://news.northeastern.edu/2025/05/21/genius-act-crypto-industry-expert/