Startup Funding & Angel Investing Guides for Founders & Investors

Step-by-step guides, expert walkthroughs, and tactical strategies for startup founders and angel investors in the USA and Canada—covering fundraising, cap tables, valuations, and more.

Most Popular Guides

All Guides

Unlocking Startup Revenue: Navigating the Impact of Seasonality

Learn how startups can master seasonality to unlock consistent revenue. Proven strategies for cash flow management, forecasting, and turning seasonal fluctuations into growth opportunities.

How Startup Investors Evaluate Your Competition: A Deep Dive

Learn how VCs evaluate startup competition. Master competitive analysis, identify market gaps, build defensible moats, and craft winning investor pitches.

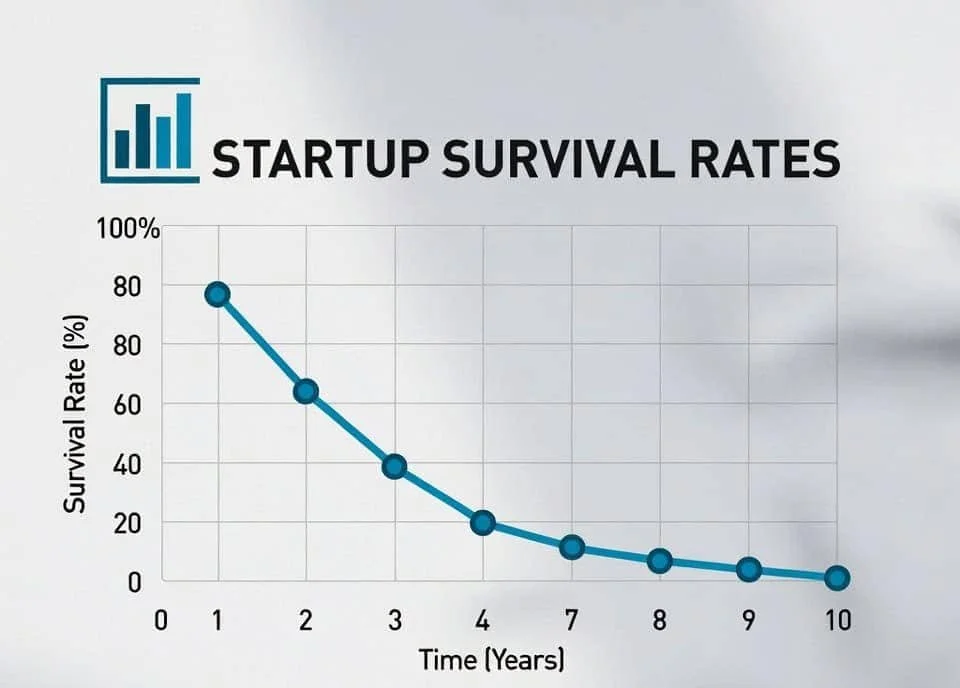

Startup Survival Rates for Angel Investors: Critical Data and Actionable Insights

Comprehensive guide to startup survival rates for angel investors. Learn data-driven strategies for due diligence, portfolio diversification, and post-investment support to maximize returns.

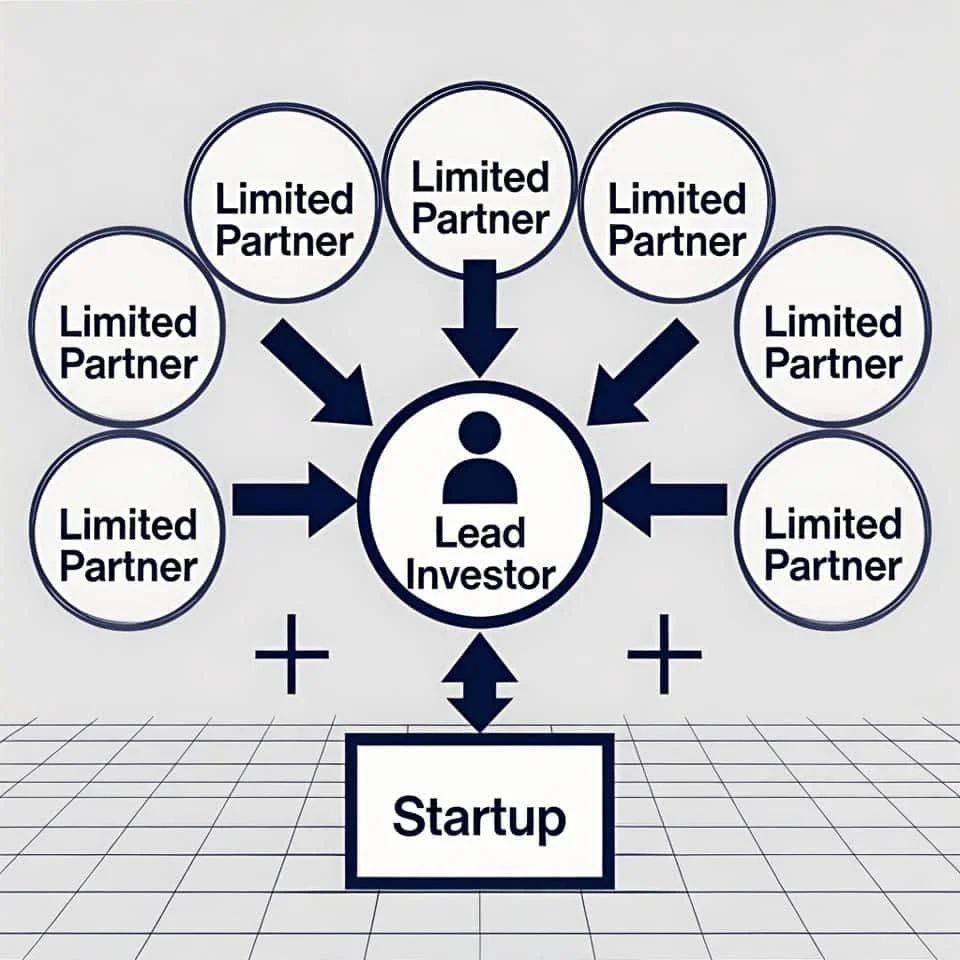

The Definitive Guide to the Role and Responsibilities of Lead Investors in Syndicates

Comprehensive guide to Lead Investor roles in investment syndicates: deal sourcing, due diligence, SPV management, carried interest, and post-investment support.

Rule 506(b) vs. 506(c): Choosing the Optimal Path for Your Private Capital Raise

Comparing Rule 506(b) and 506(c) for private fundraising. Learn investor qualification, verification requirements, general solicitation rules, and more.

How Strategic Advisors Elevate Your Startups' Fundraising: Network, Credibility, and Deal-Making

Learn how strategic advisors accelerate startup fundraising through investor networks, credibility building, and expert deal-making. Guide to equity compensation and advisory agreements.

The Founders Playbook: Mastering Seed Funding Due Diligence for a Seamless Close

Complete guide to seed funding due diligence for startup founders. Learn how to prepare your team, financials, IP, and business model to close funding faster.

CPU vs GPU vs TPU: The Ultimate Guide to Choosing the Right Accelerator for AI & ML

CPU vs GPU vs TPU for AI and ML accelerators. We explore architectures, strengths, weaknesses, and best use cases for deep learning training, inference, and hardware selection.

Angel Networks: The Complete Guide for Canadian Startups & Investors

Discover how angel networks connect Canadian startups with early-stage investors. This comprehensive guide covers the funding process, investment readiness, due diligence, and portfolio strategy.

Milestone-Based VC Funding Explained: How Startups Secure Capital Through Strategic Milestones

Learn how milestone-based venture capital funding works for startups. Discover how to structure deals, set SMART goals, minimize dilution, and build investor trust through strategic milestone achievement across seed to Series A.

Mastering Discount Rates in SAFEs: A Founder’s Strategic Guide to Valuation & Equity

Master SAFE discount rates for startup funding. Learn how Simple Agreements for Future Equity work, calculate dilution, and negotiate better terms to protect founder ownership.

How to Write Tech Startup Job Descriptions That Attract Top Talent (and Avoid Bad Hires)

Learn how to write compelling tech startup job descriptions that attract elite engineers, product managers, and sales talent while filtering out bad hires. Includes strategies for equity transparency, remote work policies, and employer branding.