Startup Survival Rates for Angel Investors: Critical Data and Actionable Insights

Key Takeaways

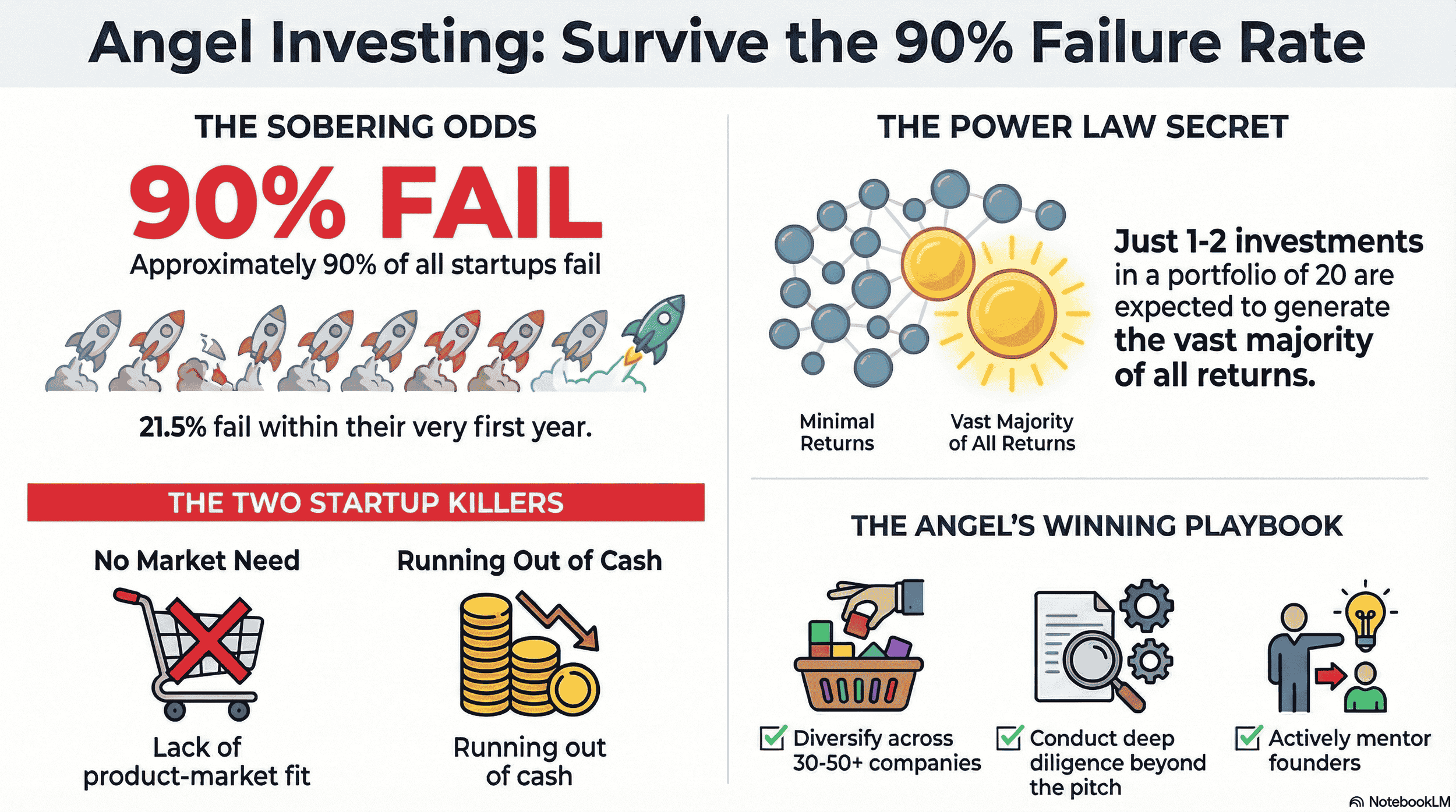

The stakes are high: Approximately 90% of startups fail, with 21.5% failing within their first year and only 20% surviving beyond two years—making rigorous selection and active support essential for angel investors (source).

Power Law drives returns: A small number of investments (1-2 out of 20) will generate the vast majority of portfolio returns through 10x, 50x, or 100x exits, while 10-12 will fail completely—diversification across 30-50 companies is critical to capture these outliers (source).

Survival means exit potential, not just staying alive: "Zombie" startups that generate cash flow without growth prospects represent locked capital—true success requires companies progressing toward acquisitions, mergers, or later funding rounds with increasing valuations.

Two primary killers dominate failure: Lack of product-market fit (no market need) and running out of cash—both can be addressed through deep due diligence on market validation and rigorous post-investment financial monitoring.

Due diligence must go beyond the pitch: Verify founder claims through customer conversations, assess team completeness and domain expertise, analyze defensibility of the product/technology, and scrutinize cash flow assumptions and burn rate projections.

Active involvement improves outcomes: Successful angels provide strategic mentorship, leverage their networks for customer and investor introductions, monitor runway and KPIs closely, and help founders navigate pivots when market feedback demands course corrections.

Financial vigilance is non-negotiable: Monitor burn rate and monthly runway, start fundraising at least 6 months before cash depletion, and instill a culture of financial discipline from day one to prevent the most common cause of startup failure.

Risk varies by sector and stage: Deep tech and hardware startups have different risk profiles than SaaS companies; pre-seed investments bet primarily on founders, while Series A companies should demonstrate significant traction and repeatable customer acquisition.

Data and analytics provide a competitive edge: Machine learning models, cohort analysis, and benchmarking against industry metrics (like Y Combinator's median $3.1M seed round) enable more informed, evidence-based investment decisions.

Patience is paramount: The journey from pre-seed to exit typically takes 7-10 years, with successful angel-funded companies reaching profitability in approximately 3.5 years. Patient capital gives founders time to build truly valuable businesses and generate substantial returns (source).

Startup investing is a high-stakes game of navigating immense risk for the chance of monumental returns. With a landscape where approximately 90% of startups fail, angel investors operate on the front lines, providing the critical early-stage capital that fuels innovation. Success in this arena is not merely about picking winners; it's about understanding the complex dynamics of startup survival, leveraging data to inform decisions, and actively contributing to the growth and resilience of portfolio companies.

This article provides a comprehensive analysis of startup survival rates, deconstructs the reasons for failure, and offers actionable insights for angel investors aiming to build a successful, impactful portfolio. We will explore the critical data, pre-investment diligence, and post-investment strategies that separate the top-performing angels from the rest.

The Angel Investor's Imperative: Navigating Startup Survival in a High-Risk Landscape

Understanding the terrain is the first step toward successfully navigating it. For angel investors, this means internalizing the statistical realities of early-stage ventures while simultaneously adopting a framework that looks beyond simple survival. The goal isn't just to keep startups alive; it's to position them for significant growth and a successful exit.

The Reality of Startup Investing: High Risk, High Reward

Angel investing is fundamentally an asset class defined by asymmetry. The vast majority of investments will yield minimal to no returns. The potential for failure is the default assumption. However, the returns from a single successful investment—a "unicorn" or a company with a significant exit—can compensate for all the losses and generate substantial overall portfolio gains. This high-risk, high-reward profile demands a disciplined approach, one grounded in data and a clear understanding of the odds. The challenge for the angel is to develop a methodology that mitigates downside risk where possible while maximizing exposure to ventures with true breakout potential. This involves rigorous research, a diversified portfolio, and a long-term perspective.

Defining "Survival" for the Angel Portfolio: Beyond Just Staying Alive

For an angel investor, a startup that simply avoids bankruptcy is not a success. True "survival" from a portfolio perspective means a company is progressing toward a liquidity event that provides a return on investment. This includes several potential outcomes:

Profitable acquisition

Merger

Progressing to later funding stages, like a Series A round, which validates the business model and increases its valuation.

A "zombie" startup—one that generates enough cash flow to stay in business but has no significant growth prospects—represents a locked-up investment with little chance of returning capital. Therefore, angel investors must assess survival through the lens of growth trajectory and exit potential, constantly evaluating whether a company is on a path to becoming a meaningful contributor to the fund's overall performance.

Pro tip: As an angel investor, it's not your job to keep a struggling portfolio company alive. You have to be willing to cut your losses and walk away if the company consistently underperforms.

The Power Law in Angel Investing: Embracing the Exception

Venture capital and angel investing operate under the Power Law distribution, which posits that a small number of investments will generate the vast majority of returns. This is the mathematical principle behind the high-risk, high-reward model. An investor's portfolio might consist of 20 startups. Of those, perhaps 10-12 will fail completely, 5-7 will return the initial capital or a small multiple, and only 1 or 2 will achieve the massive growth needed for a 10x, 50x, or 100x return (source).

Understanding and embracing this principle is crucial. It means that while mitigating failure is important, the primary strategic focus must be on identifying and supporting those few companies with the potential for exceptional outcomes. This mindset shifts the focus from avoiding all failures to ensuring the portfolio has exposure to potential grand slams.

Additional reading: Diversification Tips for Early-stage Tech Investors

Deconstructing Failure: Key Data and Underlying Principles

To improve survival rates, one must first understand the anatomy of failure. The reasons startups falter are not random; they follow predictable patterns. By analyzing the data and understanding the core principles behind these failures, angel investors can better identify red flags during due diligence and provide more effective support post-investment.

Startup Failure Statistics: The Sobering Reality

The statistics surrounding startup longevity are stark and serve as a constant reminder of the inherent risk. Data indicates that 21.5% of startups fail within their first year, a period often defined by the frantic search for product-market fit and the rapid depletion of initial capital. The risk remains high in the initial phase, with approximately 20% of startups surviving their first two years. These figures underscore the fragility of early-stage ventures. For an angel investor, this data isn't a deterrent but a critical input for risk modeling. It reinforces the necessity of portfolio diversification and highlights the immense value of providing hands-on support during that perilous first 24-month window when a fledgling company is most vulnerable.

Top Reasons for Startup Failure: A Deeper Dive into the "Why"

Behind the statistics are tangible reasons for collapse. CB Insights research consistently points to a handful of primary culprits. The most common is the failure to achieve product-market fit, which translates to "no market need" (source). A founder may build a technologically elegant product, but if it doesn't solve a painful problem for a significant customer base, it will not gain traction.

The second leading cause is running out of cash. This is often a symptom of other issues—poor financial planning, a high burn rate without corresponding growth, or an inability to secure follow-on funding. Other significant factors include:

Having the wrong team

Being outcompeted

Pricing/cost issues

Flawed business model

A savvy angel investor uses this knowledge as a checklist during due diligence, probing the founder's assumptions about the market, scrutinizing cash flow projections, and assessing the team's ability to execute.

Having invested in more than 100 early-stage startups since 2012, the most common reason that I've seen for why a startup fails is running out of cash while searching for product-market fit. – Matt Wilson, Founder & Managing Director, Allied Venture Partners

Survival by Sector and Stage: Nuance in Risk

Startup risk is not uniform across all industries or funding stages. Deep tech, hardware, or biotech startups, for instance, often have longer development cycles and higher capital requirements, leading to different risk profiles than SaaS companies. A B2B enterprise software startup may have a longer sales cycle but higher customer lifetime value compared to a B2C mobile app.

Similarly, risk evolves with each stage. A pre-seed company is often little more than a team with an idea, making the investment a bet almost entirely on the founder. By the seed stage, there should be a prototype or early product with some initial customer feedback. A startup raising a Series A is expected to have demonstrated significant traction and a repeatable model for customer acquisition. Angel investors must calibrate their expectations and evaluation criteria based on the specific sector and the maturity of the investment opportunity.

Pre-Investment Assessment: Spotting Survival Potential in Deal Flow

The most effective way to manage portfolio survival rates is to be selective at the point of entry. Rigorous pre-investment assessment, anchored on a core investment thesis, allows an angel to filter out ventures with fatal flaws and identify those with the foundational elements for success. This process goes far beyond the enthusiasm of a pitch.

The Art of Deal Flow Intelligence: Identifying Promising Ventures

High-quality deal flow is the lifeblood of angel investing. Building a robust pipeline of opportunities requires a proactive and networked approach. This involves cultivating relationships with other investors, venture capital funds, university tech transfer offices, and industry experts. Participating in angel groups and attending demo days can provide access to curated deals.

However, the true "art" lies in developing a reputation as a value-add investor, which attracts top-tier founders. The best entrepreneurs seek "smart money"—capital accompanied by expertise, mentorship, and valuable network connections. By establishing this reputation, an investor can move from passively receiving pitches to actively sourcing opportunities from trusted referrals, significantly increasing the baseline quality of the deal flow they review.

Additional reading:

Deep Dive Due Diligence: Beyond the Pitch Deck

The pitch deck is a marketing document; due diligence is the investigation. This critical phase involves verifying the claims made by the founder and assessing the underlying health of the business. Key areas of focus include a thorough evaluation of the founding team. Does the founder possess deep domain expertise, resilience, and a coachable mindset? Is the team complete, or are there critical skill gaps?

Next is market validation. Talk to potential customers. Do they confirm the problem the startup is trying to solve is a high-priority pain point? Does the proposed solution resonate with them? Scrutinize the product or technology. Is it defensible? What are the barriers to entry for competitors?

Finally, dive into the financials. Analyze the burn rate, cash flows, and the assumptions behind the revenue projections. This rigorous, multi-faceted diligence process is an investor's best defense against unforced errors and is fundamental to spotting true survival potential.

Additional reading:

Post-Investment Strategies: Actively Enhancing Survival Probability

Writing the check is the beginning, not the end, of an angel's involvement. The most successful angels are active participants in their portfolio companies' journeys. By providing strategic guidance, leveraging their networks, and ensuring financial discipline, they can tangibly improve a startup's chances of survival and success.

Strategic Follow-On Rounds: Doubling Down on Success (or Survival)

Follow-on investment is a powerful tool in an angel's arsenal. When a portfolio company is performing well and meeting its milestones, participating in its next funding round (e.g., a Series A) can significantly increase an investor's potential return. It's an opportunity to double down on a proven winner. However, follow-on capital can also be a lifeline. A bridge round might be necessary to extend a company's runway while it navigates a challenging market or finalizes a key product feature. The decision to provide follow-on funding requires a dispassionate re-evaluation of the company's prospects. Is the team still strong? Has the market opportunity changed? Answering these questions helps determine whether the additional investment is a smart strategic move or merely throwing good money after bad.

Active Mentorship and Network Leverage

Beyond capital, an angel's most valuable assets are their experience and network. Active mentorship involves scheduling regular check-ins with the founder to act as a sounding board, offer strategic advice on key decisions, and provide an objective perspective. This guidance is invaluable for first-time founders navigating the complexities of building a business.

Equally important is leveraging one's professional network. An introduction to a potential key customer can be transformative for a startup struggling to gain market traction. Connecting a founder with a seasoned executive for a board position can fill a critical experience gap. Facilitating an introduction to a venture capital fund can pave the way for the next round of funding. This active support is a direct investment in the startup's human and social capital, strengthening its foundation for growth.

Additional reading: How Angel Investors Support Early-stage Startups

Financial Vigilance: Monitoring Runway and Cash Flow

Cash is the oxygen for a startup; when it runs out, the business dies. Angel investors must instill a culture of financial discipline from day one. This means working with the founder to establish key performance indicators (KPIs) and regularly reviewing financial statements. The two most critical metrics to monitor are burn rate (the net negative cash flow per month) and runway (the number of months the company can operate before running out of money). By keeping a close eye on these figures, an investor can help the founder make proactive decisions. This might involve cutting unnecessary expenses, accelerating sales efforts, or starting the fundraising process for the next round well before cash becomes critically low (we recommend starting to fundraise at least 6 months before the cash-out date). This financial vigilance acts as an early warning system, preventing many startups from succumbing to the most common cause of failure.

Navigating Pivots and Market Dynamics

Few startups end up executing their original business plan without modification. The market provides constant feedback, and the ability to listen and adapt is a hallmark of successful founders. A pivot is a structured course correction designed to test a new fundamental hypothesis about the product, market, or business model. Angel investors can play a crucial role in this process by helping the founder recognize when a pivot is necessary and when it's simply a distraction. They can provide an external, objective viewpoint, helping to analyze the data and assess the new direction. Their experience, having seen other companies navigate similar challenges, can provide the founder with the confidence and strategic framework needed to execute a successful pivot and find a more viable path to product-market fit.

Leveraging Data Science and Emerging Tools for Predictive Insights

The art of angel investing is increasingly being augmented by science. The proliferation of data and the advancement of analytical tools are providing investors with new ways to assess risk, identify opportunities, and monitor portfolio health. Embracing these quantitative methods can provide a significant competitive edge.

The Promise of Machine Learning in Startup Prediction

Like Monneyball, machine learning models are now being trained on vast datasets of company information—including funding history, team composition, market size, and web traffic—to identify patterns correlated with success and failure. While not a crystal ball, these algorithms can serve as powerful screening tools, helping investors flag high-potential startups or identify hidden risks in a pitch. For example, a model might identify that startups with a specific ratio of technical to non-technical founders in a particular sector have a higher probability of reaching a Series A. These predictive insights can augment an investor's intuition and experience, leading to a more data-informed and disciplined selection process.

Quantitative Approaches to Risk Assessment and Growth Projections

Beyond predictive models, quantitative analysis can be applied throughout the investment lifecycle. Investors can use cohort analysis to better understand a company's customer retention and unit economics. Financial modeling can stress-test a startup's cash flow projections under different growth scenarios. Benchmarking a startup's metrics against industry data, such as the median Y Combinator seed round size of $3.1 million, provides crucial context for valuation and performance expectations. As the funding environment fluctuates, with global funding showing both yearly increases and quarterly drops like the $91 billion seen in Q2 2025, a quantitative approach allows investors to adapt their strategies based on market realities rather than just gut feeling.

Additional reading: The New Era of Startup Growth: From T2D3 to Rapid ARR Expansion

Building a Resilient Angel Portfolio: A Holistic Approach

A successful angel investment strategy is built at the portfolio level, not on the fate of any single company. By adopting a holistic approach that emphasizes diversification, patience, and continuous improvement, investors can construct a portfolio designed to weather the inherent volatility of the asset class and capture the upside of the Power Law.

Diversification as a Survival Strategy

Diversification is the single most important principle for managing risk in angel investing. Given that most startups will fail, concentrating a significant amount of capital in just a few companies is a recipe for disaster. A well-diversified angel portfolio typically consists of 30-50 or more investments spread across different industries, business models, and founding teams. This strategy increases the probability of having at least one or two breakout companies that can generate the returns needed to make the entire portfolio successful. It smooths out returns over time and protects the investor from the catastrophic loss that could result from the failure of a single, oversized investment.

Long-Term Vision and Patience

Angel investing is not a get-rich-quick scheme. It is a long-term game that requires immense patience. The journey from a pre-seed investment to a successful exit can often take 7-10 years or more. Data shows that even for successful companies, it takes time to reach key milestones, with angel-funded companies reaching profitability in approximately 3.5 years on average. During this time, startups will face numerous near-death experiences and market fluctuations. Investors who lack a long-term vision may be tempted to pull support or push for a premature, low-value exit. Patient capital, on the other hand, gives founders the time and space they need to build a truly valuable and enduring business, ultimately leading to more substantial returns.

Continuous Learning and Adaptation

The startup ecosystem is in a constant state of flux. New technologies emerge, consumer behaviors shift, and funding dynamics evolve. The strategies that worked five years ago may not be effective today. The best angel investors are lifelong learners. They stay informed about market trends, study both successes and failures (their own and others'), and continually refine their investment thesis and due diligence process. They actively seek feedback from founders and co-investors and are not afraid to adapt their approach based on new information. This commitment to continuous learning ensures that their investment strategy remains relevant and effective in a rapidly changing world.

Summary: Empowering Angel Investors for Greater Survival and Success

Navigating the world of angel investing is a formidable challenge, defined by high failure rates and the elusive hunt for transformative growth. Yet, it is also an endeavor of immense importance, providing the fuel for innovation and the creation of future industries. Success is not a matter of chance but a product of strategy, discipline, and active engagement.

Recap of Critical Data and Actionable Insights

We have seen that while the headline statistics on startup failure are sobering, they also provide a clear roadmap for mitigation. CB Insights data shows that the primary drivers of failure are a lack of product-market fit and the depletion of cash—both of which can be addressed through rigorous due diligence and active post-investment support. The actionable insights for investors are clear:

Establish a core investment thesis and high-quality dealflow pipeline

Conduct deep diligence that goes beyond the pitch deck to assess the founder and validate the market

Build a diversified portfolio of 30-50 companies to manage risk and increase your odds of hitting the Power Law

Actively mentor your companies, focusing on financial discipline and strategic connections

By understanding that survival from an investor's perspective means a path to a profitable exit, the focus shifts from merely keeping a company alive to actively steering it toward scalable growth.

The Future of Angel Investing: Informed, Strategic, and Impactful

The future of angel investing belongs to those who blend the art of founder assessment with the science of data analysis. The increasing availability of analytical tools and predictive models will empower investors to make more informed, evidence-based decisions. This data-driven approach, combined with the irreplaceable value of human experience, mentorship, and network leverage, creates a powerful formula for success. By being strategic in their selections, disciplined in their portfolio construction, and impactful in their post-investment contributions, angel investors can not only improve their own returns but also significantly increase the survival and success rates of the innovative startups they champion, shaping the economy of tomorrow.

Frequently Asked Questions: Startup Survival Rates for Angel Investors

General Angel Investing Questions

What qualifies someone to angel invest, and are there regulatory requirements I need to meet?

In most jurisdictions, you need to be an accredited investor to participate in private investing opportunities. Canadian securities regulators define specific income and net worth thresholds for accredited investors, though some provinces also recognize self-certified investor categories. Regulatory requirements vary by region, so it's essential to research the rules in your jurisdiction. Platforms like Equivesto have emerged to facilitate equity crowdfunding for both accredited and non-accredited investors under specific regulatory frameworks.

How do startup failure rates differ across funding stages?

Startup failure rates decrease as companies progress through funding stages. Pre-seed companies face the highest risk, as they're often just a team with an idea. By the seed stages, startups should have a prototype and early customer feedback, improving their survival probability. Companies reaching Series B and Series C rounds have demonstrated significant traction and repeatable customer acquisition models, substantially lowering their failure risk. Research shows that approximately 21.5% of startups fail within their first year, with only 20% surviving their first two years (source).

What's the difference between angel investing and investing in small businesses?

Angel investing focuses on high-growth potential startups targeting venture-scale returns, often in technology sectors like software, blockchain, deep tech, healthcare technology, and e-commerce. These investments carry higher risk but offer the possibility of exponential returns if a company becomes a unicorn. Small business investing typically involves more stable, established businesses with predictable cash flows but lower growth trajectories. Angel investments operate under the Power Law, where one unicorn can compensate for multiple failures, while small business investments aim for steadier, more modest returns.

Due Diligence and Valuation

What valuation models should I use when evaluating early-stage startups?

Several valuation models are common in the startup world. The scorecard approach compares your target startup against typical angel-funded companies in the region, adjusting for factors like management team strength, market opportunity, and product/technology. The Berkus Method assigns monetary values to five key success factors, including the soundness of the business plan and the quality of the prototype or beta version. For pre-seed and seed startups with limited financial history, these qualitative approaches often work better than traditional revenue multiples. When investing via a SAFE (Simple Agreement for Future Equity) or convertible note, pay close attention to the valuation cap and how it affects potential dilution in future rounds.

How important are patents and intellectual property in my research process?

Patents can provide valuable competitive advantages, particularly in deep tech, healthcare technology, and hardware sectors. During your research and due diligence, evaluate whether the startup has defensible intellectual property and what barriers to entry exist for competitors. However, don't overweigh patents in your decision. Many successful startups, especially in software and e-commerce, build competitive moats through network effects, brand, or execution speed rather than patents. The competitive environment and market demand often matter more than patent portfolios alone.

What should I look for in financial projections and cash flow management?

Scrutinize the assumptions behind financial projections through scenario analysis. Do the revenue projections align with realistic customer acquisition costs and market demand? Is the management team accounting for the competitive environment? Most importantly, focus on cash flow management and runway. Ask founders about their burn rate, when they plan to reach profitability, and their contingency plans if market conditions deteriorate. Strong financial projections show multiple scenarios, acknowledge risks, and demonstrate that the team understands the path from their current minimum viable product to sustainable revenue.

Portfolio Strategy

How many companies should I include in my angel portfolio to maximize survivability?

Diversification is critical for managing risk and improving overall portfolio survivability. A well-diversified angel portfolio typically consists of 30-50 or more investments spread across different industries, business models, founding teams, and vintage years (the years you made the investments)(source). This strategy increases your probability of capturing at least one unicorn that can generate returns to compensate for multiple failures. Given that most startups will fail, concentrating capital in just a few companies exposes you to catastrophic loss.

Should I invest more in Silicon Valley startups or look elsewhere?

While Silicon Valley has historically been the epicenter of venture capital, there are significant disparities in startup valuations and competition between regions. Silicon Valley startups often command higher pre-money valuations due to intense competition from growth-stage investors, which can affect your potential returns. Consider diversifying geographically to access opportunities in emerging hubs with lower startup valuations and strong economic development initiatives. Market analysis should focus on the quality of the opportunity and team rather than geography alone, though location can influence access to follow-on funding and talent.

How do I balance supporting struggling portfolio companies versus cutting my losses?

This is one of the hardest decisions in angel investing. Conduct honest reassessments at each potential follow-on round. Has the market opportunity changed? Is the management team still capable and coachable? Has the company made meaningful progress toward product-market fit? Remember that your goal isn't to keep zombie companies alive—it's to identify paths to profitable exits. If a company consistently underperforms despite adequate capital and support, and market conditions don't support its business model, it may be time to walk away and preserve capital for better opportunities.

Investment Structures and Terms

What's the difference between a SAFE and a convertible note, and which should I use?

A SAFE (Simple Agreement for Future Equity) and a convertible note are both common pre-seed and seed-stage investment instruments. A convertible note is debt that converts to equity at a future funding round, typically with an interest rate and maturity date. A SAFE is not debt—it's a contract for future equity without interest or maturity. SAFEs have become increasingly popular because they're simpler and founder-friendly. Both instruments typically include a valuation cap and discount rate to reward early investors. Your choice depends on the deal terms, but SAFEs are now standard for many early-stage rounds, particularly for companies emerging from accelerators like Y Combinator or those backed by funds like Hustle Fund and Angel Squad.

To learn more, read our full guide: SAFE vs Convertible Notes: Key Differences

How does dilution work across multiple funding rounds?

Dilution occurs when a company issues new shares, reducing your ownership percentage. If you own 2% after your initial investment and the company raises a Series A, your percentage might drop to 1.5% due to dilution. This continues through Series B, Series C, and beyond. However, dilution isn't inherently bad—owning 0.5% of a billion-dollar company is better than owning 2% of a company worth $10 million. To manage dilution, consider participating in follow-on rounds (pro-rata rights) when companies perform well. The key is ensuring that your absolute return increases even as your percentage ownership decreases.

To learn more, read our full guide: How Cap Tables Change Across Funding Rounds

Sector-Specific Questions

Are there differences in survival probability across sectors like blockchain, healthcare technology, or e-commerce?

Yes, sector-specific factors significantly impact survival probability. Deep tech and hardware startups often have longer development cycles, higher capital requirements, and different risk profiles than software-as-a-service companies. Healthcare technology startups may face regulatory hurdles, but can have strong defensibility once approved. E-commerce companies might scale quickly but face intense competition and thin margins. Blockchain startups experienced a boom-and-bust cycle tied to cryptocurrency market conditions. When evaluating market opportunity, consider sector-specific metrics, typical time-to-revenue, and capital intensity. Different sectors require different expectations and evaluation criteria.

What role do accelerators and angel groups play in improving startup outcomes?

Accelerators like Y Combinator have demonstrably improved startup survival rates by providing mentorship, network access, and structured programs that help founders avoid common pitfalls (source). Companies that go through top accelerators often achieve higher valuations and better access to follow-on funding. Angel groups like Allied VC and Angel Squad provide deal flow, shared due diligence, and collective wisdom that can improve investment selection. Platforms like Hustle Fund take a portfolio approach, investing in hundreds of seed startups to capture Power Law returns. These organizations can be valuable sources of dealflow and co-investment opportunities.

Market Dynamics and Timing

How do market conditions and vintage years affect startup survival and returns?

Market conditions significantly impact startup survival across different vintage years. Companies funded during frothy markets may have inflated startup valuations and face difficulty raising follow-on rounds when market conditions tighten. Conversely, companies funded during downturns often benefit from disciplined valuations and reduced competition. Market timing risk is real—the 2021-2022 funding boom saw dramatic valuation increases followed by corrections. When evaluating opportunities, consider whether current market conditions support the company's business plan and whether the valuation reflects realistic expectations given comparable companies and revenue multiples in the sector.

What are "unicorn hunters" and should that be my strategy?

Unicorn hunters specifically seek companies with the potential to reach billion-dollar valuations. While finding a unicorn can return an entire fund and more, this shouldn't be your only filter. The Power Law means you need exposure to potential grand slams, but focusing exclusively on unicorn hunting can cause you to overlook solid companies with strong exit potential at lower valuations. A $50 million acquisition can still generate excellent returns on a pre-seed investment (depending on your entry price). Balance your portfolio between potential unicorns and companies with clear paths to meaningful returns in relation to entry price.

Practical Support and Post-Investment

How hands-on should I be with portfolio companies after investing?

The level of involvement depends on your expertise, time availability, and the founder's needs. At a minimum, schedule regular check-ins to monitor financial projections, cash flow management, and progress toward milestones. Your most valuable contributions often come from strategic introductions—connecting founders with potential customers, key hires, or growth-stage investors for their next funding stage. Help founders think through pivots when market demand doesn't materialize as expected, and provide an objective perspective during critical decisions. Active mentorship, particularly during the vulnerable first 24 months, can tangibly improve a company's survivability and your returns.

DISCLAIMER: This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Allied Venture Partners LLC and its affiliates, officers, directors, employees, and agents make no representations or warranties regarding the accuracy, completeness, or suitability of the information contained herein and expressly disclaim all liability for any errors, omissions, or consequences arising from the use of this information. Angel investing and early-stage venture capital investments are inherently high-risk activities that involve substantial risk of loss, including the total loss of invested capital. Past performance is not indicative of future results, and no guarantee of investment returns or outcomes is implied or should be inferred. The statistics, data, and strategies discussed in this article are subject to change and may not be applicable to all investment situations or risk tolerances. Readers should conduct their own thorough due diligence and consult with qualified financial advisors, legal counsel, and tax professionals before making any investment decisions. By reading this article, you acknowledge and agree that Allied Venture Partners LLC bears no responsibility or liability for any investment decisions, losses, damages, or consequences that may result from reliance on the information provided herein.