10 Questions to Ask Founders Before Investing

Angel investing is more about people than numbers. Founders' vision, leadership, and experience are critical in determining a startup's success, especially in early stages like pre-seed to Series A. Asking the right questions helps investors assess their ability to execute and navigate challenges.

Here’s a quick breakdown of essential questions to ask founders:

What inspired you to start this company?

Understand their motivation and connection to the problem they're solving.What relevant domain experience does your team have?

Gauge their expertise and ability to handle industry-specific challenges.Who are the key team members, and what are their roles?

Assess team structure, scalability, and cohesion.What is your business model, and how do you plan to scale?

Evaluate their revenue strategy and growth potential.What is your customer acquisition strategy?

Learn how they attract and retain customers efficiently.How much money are you looking to raise, and how will it be used?

Ensure their funding plan aligns with business goals and milestones.What are your biggest challenges and risks, and how do you plan to mitigate them?

Identify their preparedness for obstacles and risk management.How do you envision the industry evolving in the next 5 years?

Check their foresight and alignment with market trends.What is your governance structure, and what control do investors have?

Understand decision-making processes and investor protections.What are your expectations for exit timelines or potential pivots?

Clarify their long-term vision and return expectations.

These questions provide a structured framework to evaluate founders' strategic thinking, leadership, and execution ability, ensuring smarter investment decisions.

The Art of Due Diligence in Early-Stage Investing - An Interview with Angela Lee of 37 Angels

1. What inspired you to start this company?

This question digs into the heart of a founder's motivation - often rooted in personal experiences and a desire to address a real, tangible problem.

What to Listen For

Great founders often tie their personal experiences to the opportunity they’re pursuing. They’ve either lived the problem themselves or conducted thorough research to uncover gaps in existing solutions. This firsthand understanding often sets them apart.

"Entrepreneurship Is About Solving Problems, Not Fame or Money" - Ashton Kutcher [1]

Be cautious of founders who focus too heavily on market size or profit potential without addressing the core issue they aim to solve. This can indicate a lack of genuine connection to the problem, which is critical when navigating the inevitable challenges of building a business. The most resilient entrepreneurs that we see at Allied VC are those driven by a mission to solve a problem, correct an injustice, or serve a specific group of people.

Red Flags vs. Green Flags

Red Flag: A founder fixated solely on profits or market opportunity without a clear understanding of the problem they’re addressing.

Green Flag: A founder whose enthusiasm and belief in their solution are palpable. These individuals often radiate a sense of purpose, driven by the conviction that their idea is worth pursuing - even against the odds [3].

Testing Problem-Solution Fit

To dig deeper, ask follow-up questions about how they identified the problem and validated it. Strong founders can articulate not only what inspired them but also how they confirmed that others share the same pain point. They understand that passion alone isn’t enough - it must align with strategic thinking and market realities [2].

Take the story of Bluedot’s founders, Filip and Emil, as an example. They tackled the challenge of enabling apps to use GPRS without draining phone batteries. Despite being told their idea was impossible, their unwavering belief in the solution eventually led to partnerships with major companies like Samsung [1].

A founder’s inspiration story should blend emotional commitment with logical reasoning. Passion is what fuels them through tough times, but it’s their ability to pair that passion with clear strategy that often determines success [2].

Understanding a founder’s motivation provides a glimpse into their resilience, setting the tone for assessing their team and strategy.

2. What relevant domain experience does your team have?

When it comes to evaluating a startup, the founder's industry experience is a key factor. Deep domain knowledge often sets apart the startups that thrive from those that struggle. Founders who truly understand their field are better equipped to navigate obstacles and recognize opportunities that others might overlook.

Evaluating Industry Knowledge

Founders with strong industry knowledge can confidently discuss trends, regulatory hurdles, and competitive landscapes. Their insight goes beyond surface-level understanding, reflecting years of direct involvement in the market. This kind of experience allows them to develop solutions that address real customer challenges, rather than relying on assumptions.

A solid grasp of the industry means founders can explain complex challenges clearly and demonstrate familiarity with essential elements like key competitors, distribution networks, and customer behaviors. Hands-on experience in the same sector - whether as employees, consultants, or advisors - often provides invaluable perspective that no amount of market research can replicate.

Technical Capabilities and Execution

A successful team is one that blends the right technical expertise with strong business instincts. For instance, in software, engineering skills are critical, while in biotech, scientific knowledge is essential. But technical know-how alone isn’t enough - teams also need the ability to execute.

Interestingly, founders who’ve faced failure in previous startups often bring valuable lessons to the table. Experiences with product development missteps, fundraising challenges, or team-building issues can make them more prepared and resilient, sometimes even more so than first-time founders.

Identifying Skill Gaps

No team is perfect, and strong founders recognize this. They’re upfront about their weaknesses and have a clear plan to address them. Whether it’s hiring key personnel or seeking guidance from advisors, successful teams actively work to fill critical gaps.

Pay attention to how founders discuss their hiring strategies. Do they know which roles are most urgent to fill? Are they specific about the expertise they’re looking for? Teams that acknowledge their limitations while presenting a plan to overcome them demonstrate the kind of self-awareness that investors find appealing.

When a team combines deep industry expertise, technical skills, and an honest assessment of their own gaps, they build a solid foundation for success. This combination not only strengthens product development but also sets the stage for evaluating team dynamics in greater detail later on.

3. Who are the key team members, and what are their roles?

Once you've assessed the founders' drive and expertise, the next logical step is to take a closer look at their team. A startup's ability to grow and succeed often hinges on the strength and structure of its team, making this evaluation a crucial part of the process.

Team Expertise and Scalability

Clearly defined roles are a must for early-stage startups. Founders who can precisely explain each team member's responsibilities and their importance to the company demonstrate a level of preparedness that inspires confidence. Look for teams where roles are well-defined, non-overlapping, and tailored to the specific needs of the business.

Pay attention to how founders describe their team structure. Successful startups identify the critical roles necessary for their growth and either fill them early or have a clear plan to do so. For instance, a fintech startup should have key positions dedicated to regulatory compliance, product development, and customer acquisition - or at least a strategy for addressing these needs.

Scalability often depends on whether the current team can take on more responsibilities as the company grows or if there’s a plan in place to bring in additional talent. Founders who acknowledge their team’s limits and have a roadmap for future hiring show the kind of foresight investors value. Beyond the roles themselves, the dynamics and cohesion of the team play a pivotal role in supporting the startup’s vision.

Founder Motivation and Experience

The chemistry among the founding team is just as important as their individual skills. Teams that come together around a shared problem or complementary expertise tend to perform better than those formed out of convenience or casual networking. Co-founders with a history of working together - whether through previous jobs, school projects, or other ventures - often have an edge because they already understand each other's strengths and working styles.

It’s worth asking about how the team operates together. How do they handle disagreements? Who takes the lead in specific areas? A clear decision-making process and effective communication are essential for managing conflicts and maintaining momentum.

While prior collaborations build trust, they can sometimes limit diversity. The best teams strike a balance by blending familiarity with a variety of perspectives, creating an environment where team members trust one another while still challenging assumptions.

Long-term commitment is another key factor. High turnover in a startup’s early days can signal deeper problems, whether in leadership, company culture, or the market itself. Founders should not only explain what their team members do but also share why those individuals joined the company and what keeps them motivated through tough times. A team that’s united by a shared vision and resilience is far more likely to weather the inevitable challenges of building a startup.

4. What is your business model, and how do you plan to scale?

Understanding a founder’s vision and the team's strengths is only part of the equation - digging into the business model reveals how growth can be sustained over time. A solid business model not only drives revenue but also showcases the founder’s understanding of market dynamics and their strategic approach to scaling.

Business Model and Market Strategy

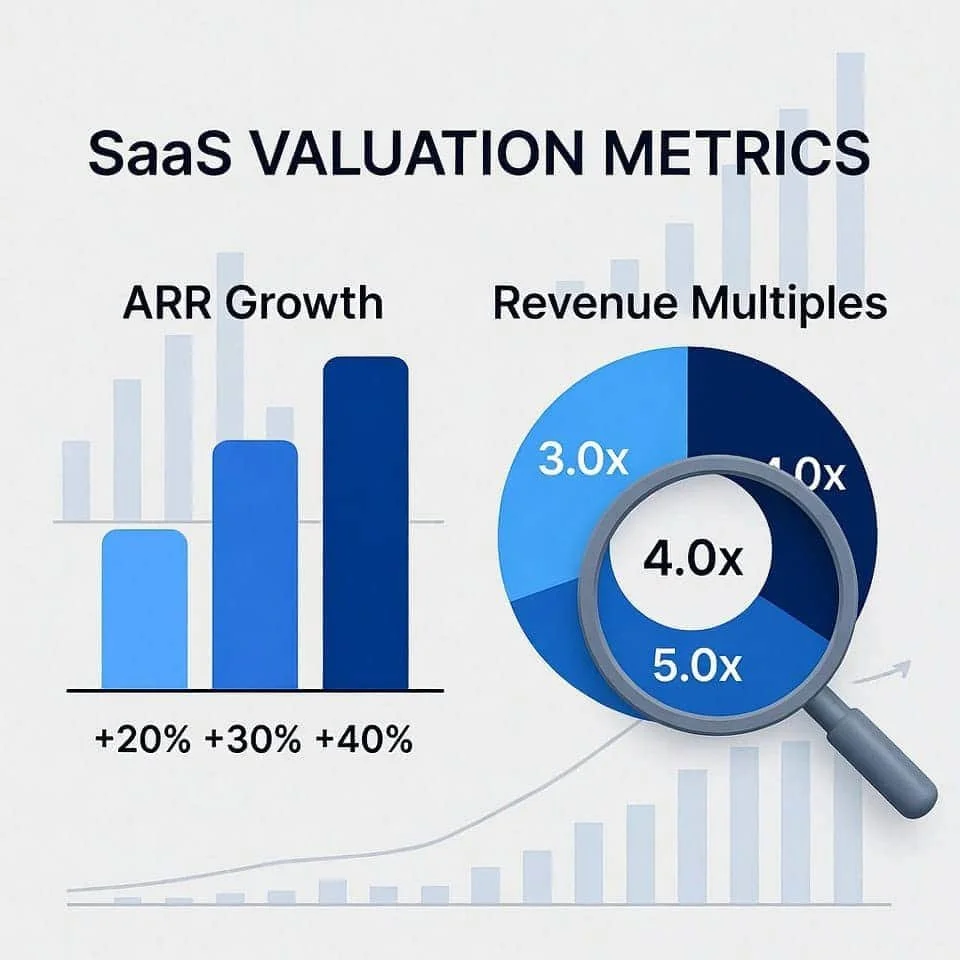

A business model’s scalability often hinges on strong unit economics. Metrics like the LTV-to-CAC ratio (ideally in the range of 3:1 to 5:1) provide insight into whether the business is set up for efficient growth. Founders who can explain how they’ll maintain or improve these metrics demonstrate a clear understanding of their revenue engine.

Different revenue models come with unique challenges and opportunities:

Subscription models deliver predictable recurring income but require robust retention strategies to keep churn in check.

Transaction-based models can grow quickly but often face pressure to maintain healthy profit margins.

Marketplace models thrive on network effects but need to solve the classic chicken-and-egg dilemma of building both supply and demand simultaneously.

An adaptable approach to pricing and revenue generation is a strong indicator of growth potential. Founders who’ve tested pricing strategies, explored alternative revenue streams, or pivoted their model based on customer feedback show they’re in tune with market needs. Evidence that customers are willing to pay the proposed price point is a critical signal of market validation.

Scalable businesses often have competitive advantages that make them harder to disrupt. These can include diversified revenue streams, intellectual property like patents, network effects, proprietary data, or high switching costs that create a protective moat. These elements reduce risk and help the business stand out in competitive markets.

Ultimately, a robust business model is backed by clear metrics and validated revenue strategies.

Team Expertise and Scalability

Scaling isn’t just about the business model - it’s also about whether the team has the expertise and infrastructure to execute ambitious growth plans. Founders need to articulate how their operations, processes, and team will evolve as they scale from hundreds to thousands - or even millions - of customers.

A critical part of this is technology infrastructure. Can the current platform handle a 10x or 100x increase in users? Are there plans for expanding into new markets, complying with regulations, or integrating with enterprise clients if that’s part of the growth strategy? Founders who anticipate these challenges and have a roadmap to address them are better positioned for success.

Hiring plans also need to align with scalability goals. For example:

A B2B software company targeting enterprise clients may need to restructure its sales team to include experienced account managers.

A hardware company scaling production will require supply chain expertise, which differs significantly from the needs of a software business.

Operational complexity grows as startups move beyond the founder-led stage. Companies scaling through partnerships will need different systems and processes compared to those relying on direct sales. Founders who’ve thought through these operational shifts and are ready to build the necessary infrastructure demonstrate a level of foresight that investors value.

Financial planning is another cornerstone of scaling successfully. Growth often requires upfront investments - whether in technology, inventory, or team expansion - before revenue catches up. Founders should have a clear plan for how they’ll manage these J-curve demands, including realistic timelines and resource allocation. This kind of financial sophistication is a strong indicator of a team’s readiness to deliver meaningful results for investors.

5. What is your customer acquisition strategy?

A customer acquisition strategy is more than just a marketing plan - it’s a window into a founder’s understanding of their market and their ability to grow the business. This question helps uncover how well founders know their target audience, how effectively they can reach them, and whether they’ve built a repeatable system for scaling.

A solid strategy starts with clear customer segmentation. Founders should go beyond basic demographics and dive into behaviors, pain points, and buying triggers. This level of detail ensures resources are used efficiently and acquisition efforts resonate with the right audience.

Another key factor is channel diversification. Relying on just one channel - whether it’s paid ads, content marketing, or referrals - can leave a business vulnerable. Founders who test multiple channels and understand which ones deliver the best results for each customer segment are better positioned for long-term success.

Metrics also play a critical role in evaluating acquisition strategies. Founders should understand the relationship between Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV). A healthy balance between the two signals potential for sustainable growth, but the time it takes to recover CAC matters too. For instance, B2B businesses might tolerate longer payback periods, while consumer-focused companies often need quicker returns.

Pro Tip: A customer acquisition strategy that depends mainly on paid ads is a warning sign for investors. Relying on paid ads eventually increases customer acquisition costs without consistently generating organic inbound leads. Proceed with caution.

Early traction metrics, like conversion rates, retention by channel, and cohort analyses, provide evidence that a strategy is working. Founders who refine their approach based on real-world data demonstrate adaptability and a commitment to improvement.

As startups grow, their acquisition strategies should evolve too. Early-stage companies might rely on high-touch, founder-led initiatives or community-building efforts. In contrast, mature startups need scalable, data-driven systems that can adapt to market changes and resource constraints.

Risk Awareness and Mitigation

Smart founders don’t just focus on growth - they also anticipate and prepare for risks. For example, depending too heavily on a single platform (i.e., platform risk) can backfire if algorithms or policies suddenly change – Meta is notorious for changing algorithms in ways that completely disrupt startups.

Another common risk is channel saturation. As more players enter the market, advertising costs can rise, forcing founders to tweak their tactics to maintain efficiency.

Regulatory changes, such as GDPR or Apple’s iOS App Tracking Transparency updates, can also disrupt acquisition efforts. Founders in regulated industries must ensure their strategies align with current privacy standards to avoid setbacks.

Retention is another critical piece of the puzzle. High churn rates above 2% monthly can erode the gains from even the most efficient acquisition efforts. Founders should explain how their product, marketing, and customer success teams collaborate to keep new customers engaged and satisfied.

Lastly, external factors like economic downturns, competitive pressures, or shifts in customer behavior can impact acquisition strategies. Founders who stress-test their plans against different scenarios show the kind of forward-thinking approach valued by Allied Venture Partners.

Balancing bold goals with realistic, well-thought-out tactics lays the groundwork for overcoming future challenges.

6. How much money are you looking to raise, and how will it be used?

This question digs into a founder's ability to plan financially and think strategically. It sheds light on whether they grasp their business needs, have realistic growth expectations, and can handle investor capital responsibly.

Founders should present a detailed breakdown of how every dollar will be allocated - whether it's for product development, team expansion, marketing, operations, or working capital. This level of specificity demonstrates a clear plan and accountability.

The funding amount needs to align with the company's stage and market potential. For instance, a pre-seed SaaS startup raising $500,000 to build an MVP and validate product-market fit is reasonable. However, asking for $5 million at the same stage raises concerns about their understanding of how venture funding works.

Pro Tip: Venture Capital is a milestone-based funding system, which means the company should raise enough capital to successfully test their market assumptions over the next 18-24 months. If their assumptions are correct and the business shows signs of product-market fit, then they should raise their next round of funding, and so on, to continue validating the business and achieving growth milestones.

Business Model and Market Strategy

Beyond the funding breakdown, a solid business model ensures that every expenditure contributes to growth. Ideally, the funds raised should provide 18–24 months of runway, with spending tied to clear milestones like product development, customer acquisition, or preparing for a Series A round. Each phase should have measurable goals that justify the investment.

How founders prioritize their spending is equally important. For example, team expansion - often the largest expense - should be supported by well-defined hiring plans and a clear understanding of the expected impact.

Different industries have varying cost structures. A hardware startup may require significant capital for manufacturing, while a software company might focus on development tools. The critical factor is ensuring these investments lead to scalable growth rather than just keeping the lights on.

Marketing budgets should be tied to specific performance metrics. For example, a $300,000 digital marketing investment should connect to customer acquisition costs, conversion rates, and projected revenue outcomes. Founders who can link spending to measurable results display a clear understanding of how to drive growth.

Risk Awareness and Mitigation

No financial plan is complete without addressing potential risks. Founders need to prepare for scenarios where fundraising falls short or is delayed. This kind of contingency planning signals maturity and reduces execution risk.

Flexibility in milestone planning is key when funding doesn't go as planned. Founders should identify which objectives are critical and which can be adjusted or delayed. This ability to prioritize reveals a deep understanding of what truly drives their business forward.

External factors like economic downturns, industry-specific hurdles, or shifts in investor sentiment can also impact fundraising success. Savvy founders build a buffer into their financial models and identify areas where spending can be trimmed without jeopardizing core operations.

Managing cash flow effectively is just as important as securing funding. Founders should have a firm grasp on their monthly burn rate and how it might evolve as they scale. While revenue growth can offset some costs, it's risky to assume a straight-line progression. Seasonal trends, customer payment cycles, and unforeseen expenses can all disrupt cash flow.

At Allied Venture Partners, we value founders who think strategically about making the most of their capital. This means maximizing the impact of every dollar while staying focused on creating long-term value. Founders who can clearly connect their funding requests to specific business outcomes demonstrate the financial discipline needed for successful exits.

The funding discussion also reveals how founders view their relationship with investors. Are they seeking "smart money" - investors who bring expertise and connections - or do they simply need capital? The best founders understand that the right investors can become invaluable partners in building their businesses.

A disciplined, well-thought-out approach to fundraising not only builds credibility but also signals that the founder is prepared for the challenges of scaling a successful company.

7. What are your biggest challenges and risks, and how do you plan to mitigate them?

Once financial and customer strategies are outlined, it's crucial to explore how founders tackle the risks inherent to their business. This question helps distinguish seasoned entrepreneurs from those who haven’t fully thought through their challenges.

Vague answers like “competition” or “lack of capital” are red flags unless paired with a thorough analysis. The strongest founders pinpoint specific challenges tied to their industry and business model over the next 18-24 months.

Risk Awareness and Mitigation

The ability to identify risks speaks volumes about a founder's understanding of their market. For instance, a fintech startup might highlight concerns about regulatory shifts affecting payment processing, while a hardware company might focus on supply chain disruptions or production delays.

Take a SaaS founder as an example. If they discuss customer churn, integration hurdles with enterprise clients, or the challenge of competing with established players, it shows they’ve done their homework on the competitive landscape.

Technical risks are particularly important for software and hardware startups. Founders should address potential bottlenecks in development, scalability challenges, or reliance on third-party platforms. More importantly, they need to explain how their team’s expertise, partnerships, or resources will help overcome these obstacles.

Market timing is another significant factor. Founders who recognize the risks of entering the market too early - or too late - and have strategies to adapt demonstrate a level of foresight. This might involve shifting their target audience or tweaking their product roadmap based on feedback from the market.

For every identified risk, founders should provide specific mitigation strategies. This could include diversifying suppliers to reduce dependency, forming strategic partnerships, or exploring alternative revenue streams to cushion against market volatility.

Founder Motivation and Experience

A founder’s past experience often provides clues about their ability to manage risks. For example, someone who has previously navigated regulatory challenges is better equipped to handle compliance issues. Similarly, a founder with a track record of scaling teams is more likely to manage the pressures of rapid growth effectively.

Interestingly, past failures can also be a strong indicator of resilience. Entrepreneurs who’ve faced setbacks before often have sharper risk awareness and more realistic expectations. They’ve learned to anticipate challenges and have honed their problem-solving skills.

The best founders are also self-aware. They openly acknowledge their own limitations and explain how they plan to address them - whether by hiring experts, building an advisory board, or partnering with seasoned professionals. This level of humility and preparedness is a strong indicator of leadership.

Team-related risks are another area mature founders address head-on. Whether it’s dependency on key personnel, struggles with attracting top talent, or potential conflicts between co-founders, these are real challenges. Mitigation strategies might include cross-training employees, fostering a strong company culture, or establishing clear decision-making frameworks to prevent bottlenecks.

How a founder frames challenges is equally telling. Those who see obstacles as opportunities to strengthen their competitive edge are often more reliable long-term partners than those who view risks solely as threats.

At Allied Ventures, founders who combine a realistic outlook with actionable problem-solving stand out. In our experience, entrepreneurs who succeed are those who can identify potential pitfalls, develop contingency plans, and remain confident in their ability to navigate the unexpected.

This question also sheds light on whether founders have integrated contingency planning into their strategy. The most prepared entrepreneurs rigorously test their assumptions and consider multiple scenarios for how their business might evolve. These insights are key to evaluating the team's resilience and readiness to adapt.

8. How do you envision the industry evolving in the next 5 years?

When founders share their vision for how their industry will evolve, they reveal whether they're focused on the present or preparing for the opportunities of tomorrow. This question distinguishes leaders with foresight from those merely reacting to current trends.

The best founders steer clear of buzzwords. Instead, they dive into how shifts in technology, regulations, and consumer behavior will reshape their industry - and, crucially, how these changes will influence their business model.

Business Model and Market Strategy

Exceptional founders see beyond the surface. They identify second-order effects - the less obvious consequences of major trends. For example, while many fintech leaders might talk about the rise of embedded finance, standout founders explain how this trend will alter customer acquisition costs, redefine partnerships, or create new regulatory challenges within their niche.

Take healthcare as an example. A forward-thinking founder might discuss how wearable devices, AI-driven diagnostics, and telemedicine are converging to create entirely new care delivery models. But they won't stop there - they'll explain how their company is uniquely positioned to thrive in this evolving landscape.

Regulations often play a pivotal role in shaping industries, and founders with deep expertise can articulate how upcoming policy changes will impact market dynamics. A cybersecurity founder, for instance, might highlight how state-specific data privacy laws are creating both compliance hurdles and new opportunities.

Market timing is another critical factor. Founders who grasp adoption curves can explain whether their market is ready for their solution or if they'll need to spend time educating customers. This ability to assess timing often ties into a broader understanding of how emerging risks could influence trends.

Great founders also show an acute awareness of how customer expectations are shifting. They understand that evolving demands will drive future opportunities - and they’re ready to meet those demands head-on.

Risk Awareness and Mitigation

Understanding industry evolution isn't just about spotting opportunities; it's also about recognizing the risks. Savvy founders can clearly articulate how emerging competitors - both direct and indirect - might challenge their position. This includes companies from adjacent industries that could expand into their space.

For software businesses, platform risk is a key concern. Founders need to anticipate how updates to iOS, changes in cloud provider policies, or shifts in APIs might impact their operations. The best leaders already have contingency plans in place.

For hardware and physical product companies, the supply chain presents its own set of challenges. Founders must account for how trends in manufacturing, trade policies, and material availability could affect production and costs. For example, at Allied, we experienced this impact and the importance of diversifying supply chains firsthand across our portfolio companies during the 2020 global pandemic.

Talent markets are also evolving. Remote work, AI tools, and shifting skill requirements are changing how companies build and scale their teams. Founders who understand these dynamics are better equipped to navigate hiring challenges, especially as immigration policies and industry consolidation reshape the talent landscape.

Another critical factor is the evolution of capital markets. Founders who keep a close eye on investor preferences, funding trends, and market conditions can better align their growth strategies with the realities of financing.

At Allied Venture Partners, we’re particularly impressed by founders who connect these industry shifts to specific strategic advantages for their business. Instead of viewing change as a threat, they see it as a chance to build stronger competitive moats or explore new expansion opportunities.

The most forward-thinking founders also excel at scenario planning. They’ve considered multiple potential futures for their industry and designed their strategies to remain flexible. This ability to adapt to changing conditions signals that they’re building businesses capable of thriving no matter how trends unfold. Such foresight is a strong indicator of a founder’s capacity to lead and succeed in a dynamic landscape.

9. What is your governance structure, and what control do investors have?

A startup's governance structure plays a critical role in shaping decision-making and distributing power. It directly influences investor risk and potential returns, making it a key area of focus for anyone considering an investment. This question dives deep into how investor protection and operational control are managed - two factors that can significantly impact the success of your investment.

Governance, much like team dynamics and risk management, determines how strategic decisions are made as the company grows. It’s important to evaluate how founders balance their decision-making autonomy with investor oversight. The most effective founders understand that governance isn’t just about control - it’s about creating a system that protects all stakeholders while enabling smart, efficient decisions.

Pro Tip: Startups usually don't establish an official board of directors until their first priced round, which is typically at Series A. Until then, it's common for startups not to have a board of directors.

Risk Awareness and Mitigation

The composition of the board is a strong indicator of how decisions are made. Founders should be able to explain their current board structure and how it might evolve over time. This includes ensuring proper representation for both founders and investors, with clear roles and responsibilities for each.

Voting rights are another crucial area to examine. These define the level of influence investors have over major decisions. Founders should clarify which decisions require board approval and which can be made by a simple majority vote. Key areas to discuss include executive hiring, large budget allocations, and major strategic shifts.

It’s becoming more common for venture capitalists to demand detailed control rights earlier in the investment process. These may include voting rights for board members, extended inspection rights, and approval authority for critical hires and compensation decisions[5].

Founder Motivation and Experience

How founders approach governance discussions can reveal a lot about their experience and mindset. Experienced entrepreneurs understand that investors bring more than just funding - they bring valuable networks, expertise, and strategic insights.

Be cautious of founders who resist reasonable governance measures or are reluctant to share decision-making authority. This could indicate a lack of experience or potential control issues down the line. Strong founders will have clear plans for leadership transitions, well-defined roles, and strategies to ensure organizational continuity.

Just as a solid team and thoughtful financial planning signal a startup’s resilience, a robust governance structure is a cornerstone of long-term success. The best founders go beyond the basics by implementing audit and compensation committees, anti-corruption policies, ESG (Environmental, Social, and Governance) frameworks, and transparent reporting processes[5].

At Allied Venture Partners, we prioritize founders who see governance as a strategic tool rather than a bureaucratic obstacle. These leaders understand that a well-structured governance framework attracts top-tier investors, minimizes operational risks, and sets the stage for sustainable growth. When founders can clearly articulate how their governance will evolve as the business scales, it reflects the kind of strategic thinking that drives successful, venture-backed companies.

10. What are your expectations for exit timelines or potential pivots?

A founder's exit strategy provides a window into their long-term vision and their approach to delivering investor returns. It’s about more than just planning for liquidity - it’s about ensuring that decisions around funding, team building, and timelines align with the goal of achieving profitable outcomes [7][8]. When founders articulate clear expectations for exits, they demonstrate a strong connection between their personal ambitions and the realities of the market.

Business Model and Market Strategy

Exit expectations play a key role in shaping a startup’s overall strategy. Founders who understand that the best exit option depends on the unique circumstances of their business, its goals, and the broader market conditions show a higher level of adaptability and insight [7]. This strategic clarity reflects a founder's ability to think ahead and pivot when necessary, ensuring the business remains aligned with evolving opportunities and challenges.

It’s also important to consider how a founder’s personal aspirations fit within their business model and market environment. These goals can vary widely, and their alignment with market realities often impacts the startup's trajectory.

At Allied, we’ve noticed a pattern: founders with well-defined exit timelines tend to create stronger, more adaptable companies. Their clear exit plans not only influence critical business decisions but also provide investors with a transparent path to liquidity, which builds confidence and trust among stakeholders.

Founder Evaluation Framework

Using a structured framework helps investors objectively assess founders, avoiding decisions based solely on gut feelings or a single standout moment. By focusing on clear evaluation criteria, investors can better identify founders with the potential to build successful businesses. This framework emphasizes three key areas: vision alignment, execution capability, and market understanding. Together, these dimensions provide a well-rounded perspective on a founder's ability to transform a strong idea into a thriving company.

Vision and Strategic Alignment

Start by examining how well a founder's vision aligns with real market needs and their business model. Exceptional founders articulate the problem they aim to solve, the market opportunity, and why their solution is the right fit. They back up their claims with evidence, such as customer feedback, market trends, or financial data.

Another critical factor is founder-market fit. This goes beyond surface knowledge, reflecting a deep understanding of their industry and customer base. Look for founders who can adapt to changing market conditions while staying committed to their long-term goals. Additionally, their vision should align with the market opportunity, showing a clear connection between their aspirations and the realities of the industry.

Execution and Operational Excellence

Execution is where vision meets reality. Evaluate founders based on measurable achievements, such as customer growth, revenue increases, or product milestones. These tangible results demonstrate their ability to turn ideas into action.

The team's experience and skill set are equally important. A management team with a history of successfully executing business models is often better equipped to overcome challenges and drive growth. Beyond individual accomplishments, assess whether the business model itself is built for long-term sustainability. Founders who can execute effectively and ensure their business model is viable stand out as strong candidates.

Business Model Viability

Understanding the mechanics of the business is essential. Assess how well founders grasp their revenue streams, cost structures, and competitive advantages. A scalable and reliable revenue model, combined with strategies to protect their market position, is a strong indicator of future success.

Founders who can clearly define their competitive edge - whether through proprietary technology, patents, or first-mover advantage - are better positioned to thrive. They should also have strategies for maintaining and strengthening this edge, such as innovation or strategic partnerships. Equally important is their ability to manage costs and pricing strategies effectively, ensuring profitability without compromising customer loyalty.

At Allied Venture Partners, we’ve observed that founders who excel in these areas tend to build more resilient companies. They bring clarity of vision, operational expertise, and deep market understanding to the table, enabling them to tackle the challenges of scaling a business. This evaluation framework has proven invaluable to our network of limited partners in identifying promising investments across pre-seed, seed, and Series A stages.

Let’s Recap (Conclusion)

These ten questions provide a solid framework for assessing founders, focusing on their motivation, experience, and strategic thinking. For investors, this approach highlights the leadership qualities and vision needed to build thriving companies.

A 2023 survey by First Round Capital revealed that 38% of venture capitalists ranked "team" as the most critical factor in investment decisions - outweighing considerations like market size or product [9]. This aligns with the importance of data-backed, thoughtful evaluations when assessing potential investments.

Effective founder evaluation goes beyond surface-level responses. Investors should dig deeper, seeking specific, measurable answers that reflect genuine understanding and preparation. Founders who can clearly articulate financial projections, detailed fund allocation plans, and evidence-based growth strategies are better positioned for scalability.

According to PitchBook (2024), more than 60% of early-stage investments fail to return capital. A structured evaluation process can help investors avoid common pitfalls, such as being swayed by charisma or neglecting critical risks.

For those investing at the pre-seed, seed, or Series A stages, these questions lay the groundwork for building stronger, more diversified portfolios. By emphasizing founder-market fit, execution ability, and a long-term vision, this approach aligns with current trends in early-stage investing. At Allied Venture Partners, this rigorous evaluation process instills confidence across our global network of angels and VCs.

When founders deliver data-driven, well-thought-out answers, they demonstrate the strategic mindset and preparedness that investors value. This fosters transparency, builds trust, and creates partnerships that are built to last.

FAQs

What questions should I ask a founder to assess their ability to handle industry-specific challenges?

To gauge how well a founder can tackle challenges unique to their industry, start by delving into their experience. Ask them to share examples of situations where they encountered comparable obstacles and how they worked through them. Pay attention to signs of resilience, sharp problem-solving abilities, and strategic decision-making in their responses.

Next, explore their knowledge of the industry. Discuss their grasp of market trends, competitor movements, and potential risks. Also, ask how they stay updated on industry changes and adjust their strategies accordingly. These discussions can reveal a lot about their leadership style and their capacity to steer through tough situations.

What are the signs that a startup's business model can grow successfully and sustainably?

A business model that can grow effectively without costs rising at the same rate is vital for any startup aiming for long-term success. This type of model supports increased revenue while keeping expenses in check, ensuring that the company can handle a growing customer base and rising market demand without sacrificing quality or profitability.

When evaluating startups, focus on those with a well-established business model, clear evidence of strong market demand, and efficient systems to manage growth. A model like this not only supports scaling but also shows the potential to boost profits as resources expand, helping the business thrive in a competitive environment.

What should I ask founders to evaluate their ability to handle risks and challenges?

To gauge how well a founder can handle risks and challenges, it’s worth diving into how they pinpoint and address potential roadblocks. Ask them about their process for evaluating risks, deciding which ones to tackle first, and putting strategies in place to manage them. It’s also important to understand how they’ve dealt with unexpected challenges and whether they can adjust their plans as situations evolve.

You might also want to explore real-life examples where they’ve successfully navigated major obstacles. These stories can reveal a lot about their problem-solving abilities, resilience, and how prepared they are to steer the company through uncertain times.