Why Investors Value the Rule of 40 in SaaS Startups

The Rule of 40 is a simple formula that combines a SaaS company's revenue growth rate and profit margin to evaluate its overall health. If the sum equals or exceeds 40%, the company is considered well-balanced and attractive to investors. This metric helps assess whether a startup is effectively balancing growth and profitability, which is crucial for long-term success.

Key Points:

Formula: Revenue Growth Rate (%) + Profit Margin (%) = Rule of 40 Score.

Example: A company with 30% growth and 10% profit margin scores 40%.

Early-stage startups often focus on growth, while mature companies aim to balance growth with profitability.

Investors use the Rule of 40 as a quick way to screen SaaS startups and evaluate their efficiency.

What is the Rule of 40 and How Do You Calculate It?

Rule of 40 Definition

The Rule of 40 combines your annual revenue growth rate with your profit margin. If the total reaches 40% or higher, it signals a healthy SaaS business performance [1][2][3].

First introduced by venture capitalist Brad Feld in 2015, this metric is designed to balance growth and profitability. It recognizes that SaaS companies often face a trade-off between the two. A business can achieve a strong Rule of 40 score by excelling in one area while being moderate in the other - whether through rapid growth with slim profits, solid profitability with moderate growth, or a mix of both.

For example, a SaaS startup with a 30% revenue growth rate and a 20% profit margin achieves a Rule of 40 score of 50%, comfortably surpassing the benchmark [4]. Meanwhile, another company growing at 35% but with a 10% profit margin scores 45%, which is still strong but suggests room to improve profitability [4].

This metric is particularly effective for SaaS companies because it accounts for the natural tension between reinvesting in growth and maintaining profitability. While originally aimed at companies generating over $50 million in annual revenue, Feld has noted its relevance for smaller SaaS businesses with as little as $1 million in revenue [2].

Step-by-Step Calculation

Calculating the Rule of 40 is straightforward and requires just two basic financial figures: your annual revenue growth rate and your profit margin.

1. Calculate Your Annual Revenue Growth Rate

To find your growth rate, subtract last year’s revenue from this year’s revenue, divide by last year’s revenue, and multiply by 100.

2. Calculate Your Profit Margin

Decide whether to use EBITDA or free cash flow margin, depending on your company’s stage and what investors prioritize [1][5]. Then, divide your EBITDA (or free cash flow) by total revenue and multiply by 100.

3. Add Them Together

Here's an example: Imagine your SaaS company earned $3,000,000 last year and $3,900,000 this year, with an EBITDA of $390,000 for the current year.

Revenue growth rate: ($3,900,000 - $3,000,000) ÷ $3,000,000 × 100 = 30%

Profit margin: $390,000 ÷ $3,900,000 × 100 = 10%

Rule of 40 score: 30% + 10% = 40%

This company hits the Rule of 40 target precisely [4].

A real-world illustration comes from McKinsey's 2021 analysis of a $600 million enterprise SaaS business. As its revenue growth slowed to 15%, management shifted focus to improving its free cash flow margin from 10% to 30% over two years. This adjustment led to a Rule of 40 score of 45%, maintaining investor confidence [5].

While the Rule of 40 is a handy benchmark, it’s not a replacement for deeper financial analysis. Instead, think of it as a quick snapshot of your company’s health and a useful tool for communicating your financial priorities to investors [1][3][4].

Now that you know how to calculate it, let’s dive into why investors place so much importance on this metric.

Why Investors Use the Rule of 40 for SaaS Startups

Measuring Growth Efficiency

The Rule of 40 gives investors a straightforward way to assess whether a SaaS startup is striking the right balance between growth and profitability. By combining growth rates with profit margins, it offers a snapshot of a company's overall efficiency.

SaaS startups often prioritize rapid customer acquisition and product development over short-term profits, making traditional financial metrics less relevant. The Rule of 40 adapts to this reality, accommodating startups with varying strategies - whether they focus on high growth with slim margins or moderate growth with strong profitability.

Take this example: a startup with 60% growth but a negative 20% profit margin achieves a Rule of 40 score of 40%, showing a clear focus on scaling over immediate profits. On the other hand, a more mature company with 15% growth and 30% margins scores 45%, reflecting a disciplined approach to operations. In contrast, a company with 10% growth and just 5% margins scores a mere 15%, which might indicate challenges like poor product-market fit, ineffective pricing, or operational inefficiencies.

This metric simplifies the evaluation process for investors, helping them quickly identify whether a company is on the right track.

Importance for Venture Capital and Angel Investment

For venture capital firms and angel investors, the Rule of 40 serves as a practical screening tool to sift through a large number of SaaS investment opportunities. For instance, when Allied Venture Partners evaluates early-stage SaaS startups in Canada and the United States, this metric helps us pinpoint companies that balance financial discipline with solid growth aspirations.

The Rule of 40 is especially useful for pre-seed and seed-stage investments, where profitability is often nonexistent. Even startups operating at a loss can demonstrate promising unit economics if their Rule of 40 score is strong.

Angel investors value the metric because it allows for consistent comparisons across different SaaS business models and industries. Whether a company is building enterprise software or a consumer-facing platform, the Rule of 40 provides a common framework for evaluation. This consistency is crucial for investors building diverse portfolios that span multiple sectors and growth phases.

Additionally, the Rule of 40 offers insights into a startup's leadership and strategy. Founders who monitor and articulate their Rule of 40 performance show an understanding of investor expectations and SaaS fundamentals. They’re better equipped to decide when to prioritize growth spending and when to shift focus toward improving margins and cash flow.

For Series A and beyond, the Rule of 40 becomes even more critical. Investors expect startups at this stage to demonstrate a clear path to sustainable unit economics. A company that steadily improves its Rule of 40 score signals its ability to optimize both growth and operational efficiency as it scales.

How the Rule of 40 Shapes SaaS Investments

Rule of 40 at Different Startup Stages

The way the Rule of 40 is applied and evaluated shifts as SaaS startups progress through different stages. Early on, the focus is on aggressive growth, but as startups mature, the emphasis transitions to achieving a balance between growth and profitability. Investors adjust their expectations accordingly.

Early-Stage Startups: Aiming for Growth

In the early stages, such as pre-seed and seed, SaaS startups prioritize rapid revenue growth over profitability. It's common for these companies to operate at a loss as they focus on building a scalable business model and proving product-market fit. A high Rule of 40 score at this stage is often driven almost entirely by growth.

Significant investments in areas like customer acquisition, product development, and team expansion are expected, even if they result in short-term losses. What matters to investors is that these expenses are intentional and measurable, with clear unit economics and a roadmap toward profitability. This approach signals long-term potential and reassures investors that the company is laying the groundwork for future success.

Mature Startups: Shifting Toward Profitability

As startups move into Series A and beyond, the focus shifts. Investors now look for a balance between growth and profitability. Simply chasing high growth rates is no longer enough; mature startups need to demonstrate operational discipline and sustainable economics.

At this stage, growth often becomes more modest, but it is paired with efforts to achieve positive margins. This balance reflects a company’s ability to optimize operations, adjust pricing strategies, and benefit from economies of scale. For example, a startup showing steady growth alongside modest profitability is often seen as more stable than one chasing high growth while incurring significant losses.

Mature startups also work on improving customer acquisition costs and retention metrics. With more predictable revenue streams, reduced churn, and refined sales processes, these companies are better equipped to sustain strong Rule of 40 performance, even as growth naturally slows.

Rule of 40 Scores by Stage

The way startups achieve the Rule of 40 evolves as they grow. Early-stage companies often rely heavily on rapid growth, while mature startups focus more on improving margins. This progression mirrors the broader shift in priorities - from proving the viability of the business to ensuring its long-term sustainability.

Consistent progress in Rule of 40 scores is a key signal for investors. Steady improvement demonstrates strong fundamentals and positions startups as reliable investments. These benchmarks not only guide founders but also serve as a foundation for strategies to enhance Rule of 40 performance as the company scales.

How to Improve Your Rule of 40 Score

Boosting your Rule of 40 score is all about finding the right balance between accelerating growth and managing costs. The key is to focus on impactful strategies that align with your company's stage, without resorting to drastic cuts that could harm long-term success.

Common Mistakes to Avoid

Many SaaS startups fall into traps that weaken their Rule of 40 performance. One of the biggest pitfalls is the "growth-at-all-costs" mindset, where founders prioritize rapid expansion without considering unit economics. Pouring money into customer acquisition without a clear view of lifetime profitability can backfire.

Another common issue is mismanaging cost allocation. When expenses like sales, marketing, and product development are lumped together, it becomes nearly impossible to pinpoint inefficiencies. This lack of clarity can mask where money is being wasted, making it harder to improve.

Overlooking customer retention is another costly mistake. While chasing new customers, many startups ignore high churn rates among existing ones. This creates a "leaky bucket" problem, where new revenue barely offsets the losses, and acquisition costs spiral out of control.

Scaling too early is also a frequent misstep. Startups often expand their teams aggressively after a funding round, even before proving their sales model works. This leads to inflated expenses without corresponding revenue growth, dragging down Rule of 40 metrics.

Ways to Improve Your Score

To improve your Rule of 40 score, focus on strategies that enhance both growth and margins:

Lower customer acquisition costs: Prioritize channels that attract high-quality customers at a lower cost. For example, shift resources from expensive paid ads to content marketing or referral programs that drive sustainable growth.

Increase customer retention: Small gains in retention can have a massive impact on long-term revenue. Invest in better onboarding, proactive customer success outreach, and support systems to reduce churn.

Streamline operations: Automate repetitive tasks, simplify workflows, and eliminate redundant tools. Many startups waste money on overlapping software solutions that don't add value.

Revisit pricing strategies: Review your pricing tiers to ensure you're capturing the full value of your product. Undervaluing your offering leaves money on the table that could immediately improve your metrics.

Expand revenue from existing customers: Upselling and cross-selling to your current customer base is a high-margin way to grow. These strategies strengthen customer relationships while keeping acquisition costs low.

By focusing on these areas, you can make meaningful improvements that position your business for sustainable growth.

Summary: Rule of 40 Benefits for SaaS Startups and Investors

The Rule of 40 is a straightforward yet powerful metric that balances rapid growth with sustainable profitability. It provides SaaS founders and investors with a clear framework for making decisions that support long-term success. By focusing on this balance, both parties can approach strategic planning with greater confidence.

For SaaS founders, the Rule of 40 acts as a guide to maintaining operational health. It encourages a balanced strategy that boosts company value. Companies that consistently meet or surpass the 40% threshold often demonstrate disciplined management and financial strength. This, in turn, can lead to higher valuations and easier access to capital.

For investors, the Rule of 40 simplifies the evaluation process. It offers a standardized way to assess a company’s performance and risk profile. By using this metric, investors can more easily identify businesses that effectively balance growth investments with profitability.

One of the Rule of 40’s greatest strengths lies in its flexibility. Early-stage startups, for example, might justify higher burn rates if they’re achieving rapid growth, while more mature companies may need to prioritize profitability as growth slows. This adaptability ensures the metric remains relevant across different stages of a company’s journey.

If you’re a SaaS founder, take a moment to calculate your Rule of 40 score and compare it to industry benchmarks. If your score falls below the 40% mark, consider whether you need to focus on accelerating growth, improving margins, or both. A strong Rule of 40 score not only signals sustainable success but also demonstrates resilience during economic downturns.

Companies that excel at balancing growth and profitability often attract better funding opportunities and build scalable, durable businesses.

FAQs

How does the Rule of 40 differ for early-stage and mature SaaS startups?

The Rule of 40 takes on different meanings depending on where a SaaS startup is in its journey, as the priorities for growth and profitability shift over time.

For early-stage startups, the spotlight is on driving rapid revenue growth - even if it means sacrificing profitability. These companies might operate with negative profit margins, but they can still meet the Rule of 40 if their growth rates are high enough to offset the lack of profits.

On the other hand, mature SaaS companies focus on achieving a balance between growth and profitability. At this stage, the Rule of 40 serves as a key benchmark for investors to evaluate whether the business is maintaining solid growth while also delivering healthy profit margins.

Recognizing these distinctions helps startups tailor their financial strategies to align with what investors expect at different stages of their development.

How can SaaS startups effectively improve their Rule of 40 score to attract investors?

To boost their Rule of 40 score, SaaS startups need to strike the right balance between growth and profitability. This involves focusing on key areas like improving customer retention, acquiring new customers strategically, and keeping operational expenses in check.

Startups should also look at optimizing investments in critical areas such as research and development (R&D) and scaling go-to-market strategies effectively. By driving revenue growth while maintaining tight control over costs, companies can improve profit margins and hit - or even surpass - the 40% benchmark that investors prioritize.

Why do investors prioritize the Rule of 40 when evaluating SaaS startups?

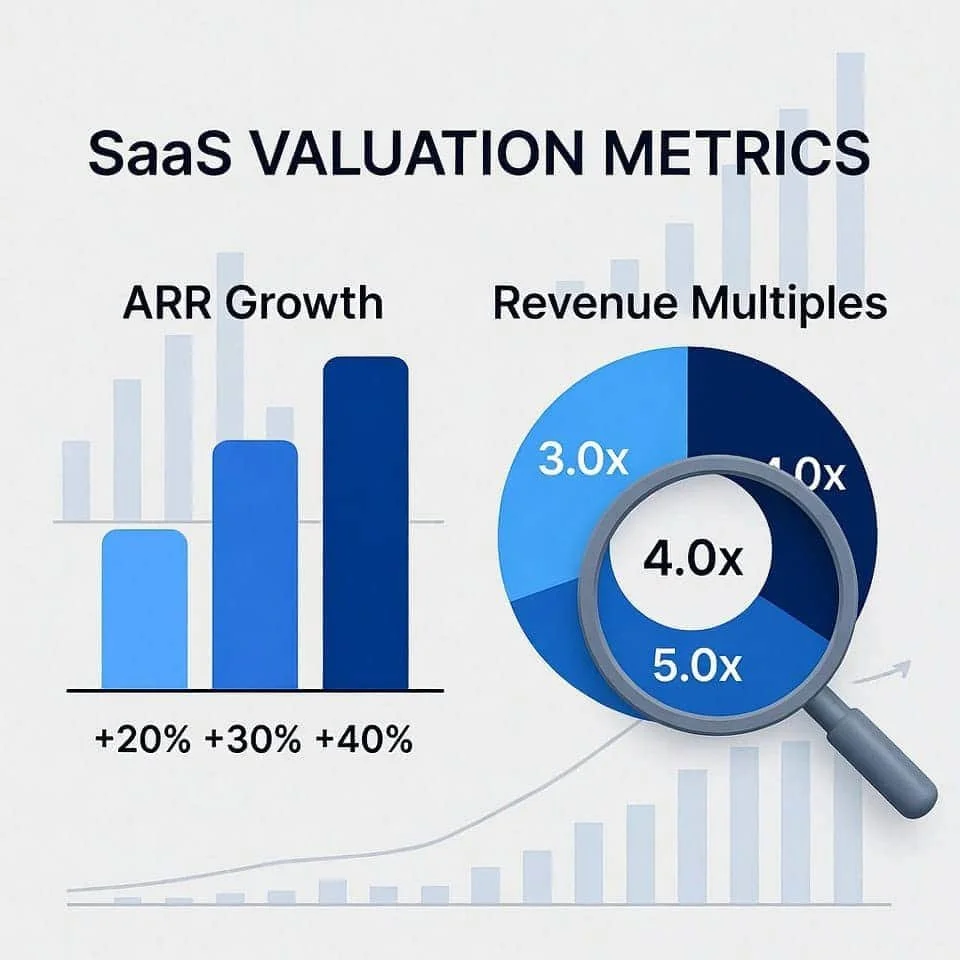

The Rule of 40 is a crucial metric for investors evaluating SaaS startups, as it highlights a company’s ability to balance two essential elements: growth and profitability. According to this rule, the sum of a company's revenue growth rate and profit margin should equal or exceed 40%. For instance, if a startup achieves a 30% annual revenue growth rate and a 10% profit margin, it hits this benchmark.

Startups that meet the Rule of 40 often stand out for their efficient operations and steady growth, making them more appealing to investors. Hitting or surpassing this mark can also lead to higher valuation multiples, as it signals the company’s ability to scale while staying financially disciplined. This balance is particularly vital in the SaaS sector, where scalability and profitability are under constant scrutiny from investors.