How FX Risk Impacts Startup Valuations

Currency fluctuations can make or break a startup's financial health. If your business operates internationally or secures funding in foreign currencies, exchange rate shifts can directly affect your revenue, costs, and overall valuation.

Key Takeaways:

What is FX risk? It's the financial impact caused by changes in currency exchange rates, affecting transactions, financial statements, and long-term competitiveness.

Why it matters: 80% of international SMEs report FX-related impacts, and startups often face tighter budgets, making these fluctuations harder to absorb.

Effects on valuation: FX volatility can shrink revenue, increase costs, and make cash flow forecasts unreliable, leading to lower valuation multiples and investor hesitation.

Examples: Nigerian startups and UK businesses have faced severe FX challenges, from shrinking purchasing power to unpredictable cash flow.

How to manage FX risk: Align revenue and expenses in the same currency (natural hedging), use tools like forward contracts or currency options, and integrate FX sensitivity into financial models.

Bottom line: Managing FX risk isn't optional for startups with international exposure. It's key to maintaining stable cash flow, attracting investors, and protecting your valuation.

Currency Fluctuations: Understanding Exchange Rate Impacts on Business

How Currency Changes Impact Startup Valuations

Currency fluctuations can ripple through a startup's daily operations and long-term growth potential. For founders and investors, understanding how these shifts work is crucial when navigating fundraising rounds and planning for the future.

Revenue and Cost Effects

If your startup operates internationally, exchange rate changes can directly affect both revenue and costs. For instance, if your reporting currency strengthens against a foreign currency, the revenue converted back into your home currency could shrink, reducing reported profits. Imagine a U.S.-based startup earning €500,000 annually: when the euro drops from $1.20 to $1.10, revenue in dollars falls from $600,000 to $550,000. That’s a significant hit [3].

On the flip side, costs can rise when your local currency weakens. If your startup imports materials or components, a weaker currency means higher expenses, which can squeeze already tight margins - especially during growth phases. For example, a manufacturing startup sourcing parts internationally might suddenly find its procurement budget stretched thin. Exchange rate swings can also lead to reduced customer spending power, further complicating the financial picture [4].

These revenue and cost pressures naturally spill over into cash flow and valuation, which we’ll explore next.

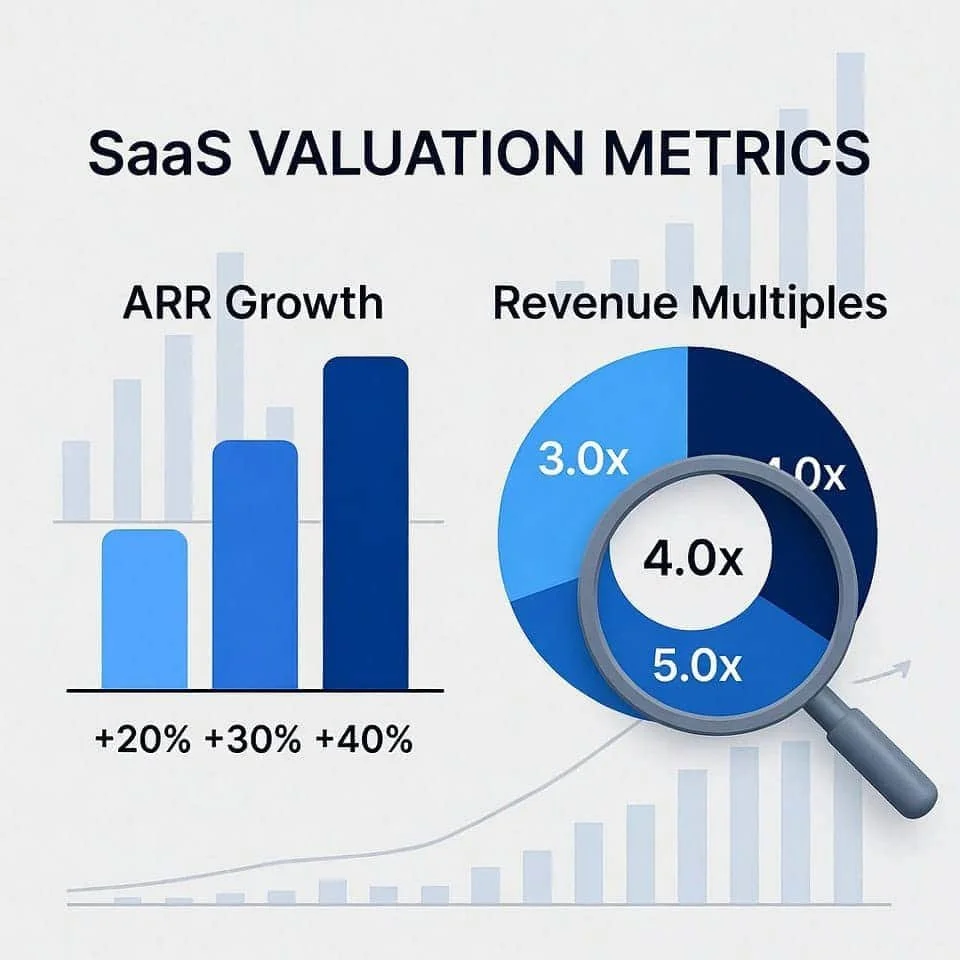

Cash Flow and Valuation Multiples

Currency volatility doesn’t just mess with your financial statements - it can also make cash flow projections unreliable. And when investors can’t trust a startup’s forecasts due to foreign exchange (FX) risks, they often apply lower valuation multiples [7].

Let’s consider funding in a foreign currency. If your startup secures investment in USD, EUR, or GBP, exchange rate shifts can alter the final amount received. For example, a $1,000,000 investment at an exchange rate of 1 GBP = 1.29 USD would yield about £772,000. But if the rate shifts to 1 GBP = 1.33 USD, you’d receive roughly £751,000 - a drop of £21,000 [7]. For startups, which often lack the financial buffers of larger corporations, such fluctuations can make cash flow unpredictable and margins inconsistent. This uncertainty increases perceived investment risk, making startups more vulnerable to FX challenges [6].

Real Examples of FX Impact on Startups

History provides clear examples of how FX risk can derail even promising ventures. In 1980, Laker Airways collapsed under the weight of its FX exposure when the weakening British pound doubled the cost of its dollar-denominated aircraft purchases [5].

More recently, Nigerian startups have grappled with severe FX challenges. In 2023, the exchange rate surged by 205%, from 462.88 NGN/USD to 1413.625 NGN/USD. This drastic shift has forced many startups to rethink their business models, with some adopting dollar-based pricing to stabilize revenue streams [8]. Similarly, a UK-based business receiving payments in USD or EUR could see its revenue shrink if the British pound strengthens against those currencies [7].

These examples highlight why startups must actively monitor exchange rates and adopt strategies to mitigate FX risks. For startups seeking international funding or serving global markets, managing FX exposure isn’t just a financial detail - it’s a critical part of ensuring long-term survival and success [4].

Main FX Risk Factors in Cross-Border Fundraising

When startups turn to international funding, they face several foreign exchange (FX) risks that can significantly influence their valuations and day-to-day operations. These risks are crucial considerations for any cross-border fundraising effort.

Exchange Rate Volatility

One of the biggest hurdles in international fundraising is exchange rate volatility. Currency values can shift unpredictably, and these fluctuations can have a major impact on both investment returns and operational budgets. Research shows that a 1% uptick in exchange rate volatility can lead to a 15–20% drop in bilateral Foreign Portfolio Equity. Over a five-year period, countries with higher bilateral volatility see a 12% reduction in such equity flows [9].

For instance, in H1 2025, the U.S. Dollar declined by over 8%, hitting its lowest point in three years. This drop was tied to concerns over tariff policies, fears of a recession, and decreased global demand [2]. For startups raising funds in USD while operating in other currencies, such swings can create serious valuation challenges.

Despite this, exchange rate volatility is often overlooked during due diligence, even though it directly impacts companies engaged in international trade [6]. This volatility becomes even more critical when funding and spending currencies don’t align.

Currency Mismatches in Funding and Spending

Currency mismatches occur when startups secure funding in one currency but pay most of their expenses in another. At Allied VC, we often see this with Canadian startups that raise venture capital from U.S. VCs (in USD), even though most of their employees remain based in Canada.

This disparity complicates financial planning and can shorten a company’s runway. For example, in 2022, 42% of Venture Capital investments were directed toward countries outside the investors’ home markets, meaning startups increasingly need to manage operations across multiple currencies [12].

For example, three out of eleven UK-based startups that achieved unicorn status in 2021 raised capital in British Pounds during Series D but switched to USD for Series E funding [11]. When the USD depreciated against the GBP during the signing and closing period, their available funds for GBP-denominated expenses shrank.

For a UK startup raising $5 million USD but spending in Pounds, exchange rate shifts could reduce its 18-month runway by two to three months [12].

Emerging markets face even greater challenges. In any given year, one in eight low-income countries may see their currency lose 20% or more of its value, while one in 20 could experience a staggering 50% depreciation. Between January 2023 and January 2024, the Nigerian naira lost more than half its buying power, and the Kenyan shilling dropped 22% before rebounding by 18%. Similarly, in 2022, the Sierra Leonean leone depreciated by 60%, and the Ghanaian cedi lost 50% of its value [13].

Such mismatches, coupled with broader economic trends, amplify FX risks for startups.

Economic Factors That Drive FX Risk

Beyond direct currency exposure, broader economic conditions further complicate FX risks. Key drivers include interest rates, inflation, and public debt, all of which are interconnected. Central banks adjust interest rates to influence inflation and currency values: higher rates attract foreign capital and strengthen the currency, while lower rates have the opposite effect [14].

Inflation also plays a pivotal role. Countries with high inflation often see their currencies weaken, while those with low inflation typically enjoy stronger currencies due to greater purchasing power. Public debt adds another layer of complexity. Large national debts can stoke inflation and erode investor confidence, leading to weaker currencies. Political instability compounds these risks by driving capital out of volatile regions into safer markets, further straining startups operating in uncertain environments [14].

Investors generally prefer currencies from nations with stable economies and sound monetary policies, as these factors tend to support currency strength [15].

Grasping these economic dynamics is essential for startups aiming to navigate and mitigate FX risks in international fundraising.

How to Reduce FX Risk in Startup Fundraising

Managing FX risk effectively involves strategies tailored to your startup's business model and stage of growth.

Currency Matching

One straightforward way to reduce FX risk is by aligning your revenue and expenses in the same currency. This approach, often called natural hedging, minimizes the impact of exchange rate fluctuations without relying on complex financial products. For instance, if your startup earns most of its revenue in euros, you could base key operations in Europe to balance euro-denominated income and expenses more effectively. This strategy works particularly well for software companies that can relocate teams, such as developers or customer support, to align with their primary revenue sources [16].

Another layer of this strategy involves maintaining bank accounts in multiple currencies. This setup helps you sidestep conversion fees and delays by keeping payments and expenses in their original currency. For example, if you’re paid in euros and also incur costs in euros, having a euro-denominated account eliminates unnecessary conversions. Additionally, forecasting cash flows across currencies and setting aside buffers for unexpected fluctuations can protect your financial stability. Flexible pricing strategies that account for currency variations can also help your business stay competitive [1].

When natural hedging isn’t enough, other tools can provide additional protection.

Hedging Tools and Methods

If currency matching doesn't fully address your FX exposure, hedging instruments can help. Forward contracts allow you to lock in exchange rates for future transactions, ensuring predictability. Currency options, on the other hand, give you the flexibility to exchange currencies at a set rate while retaining the ability to benefit from favorable rate changes. Multi-currency accounts are another useful tool, enabling you to hold and manage funds in various currencies, reducing the need for constant conversions and giving you more control over transaction timing.

These operational measures should be supported by strong financial modeling to quantify and manage FX risks effectively.

Testing Financial Models for FX Impact

Robust financial modeling is essential for understanding and mitigating FX risk, especially when seeking to reassure investors. By integrating FX sensitivity into your forecasts, you can better anticipate potential challenges and communicate them clearly.

Start by identifying all revenue streams influenced by currency fluctuations, such as international sales or contracts in foreign currencies. When modeling, choose exchange rates based on whether the currencies are free-floating, pegged, or hybrids, as these factors impact their volatility. A simple formula for revenue conversions might look like this:

Revenue in Base Currency = Source Currency × Exchange Rate [3].

For example, if your startup earns €100,000 in Europe and the EUR/USD rate is 1.1, your revenue in USD would be $110,000 [3]. Regularly monitor how changes in exchange rates affect these projections.

To prepare for uncertainty, model different exchange rate scenarios - base, optimistic, and pessimistic - to identify risks and validate contingency plans [17]. Variance analysis, which compares expected exchange rates to actual outcomes, can further highlight FX impacts on your financial performance. For instance, if you budgeted for a 1.1 EUR/USD rate but the actual rate drops to 1.05, that variance should be factored into your revenue and cash flow calculations.

Keeping your financial models updated with real-time data ensures your valuations remain accurate and supports better decision-making throughout the fundraising process [3].

Comparing FX Risk Management Methods

When it comes to managing FX risk, selecting the right strategy depends on your startup's resources, comfort level with complexity, and current growth stage. Let’s dive into how these strategies compare so you can identify the best fit for your business.

Strategy Comparison Table

The table below breaks down FX risk management strategies based on cost, complexity, and their potential impact on your startup's valuation. Use this as a guide to find the right balance for your needs.

Currency matching is a straightforward way to cut down on conversion costs. It’s a great option for startups that can easily set up flexible bank account structures to handle multiple currencies [1].

Forward contracts allow you to lock in an exchange rate for a future transaction, providing certainty and protection against unfavorable currency shifts. Chris Braun, Head of Foreign Exchange at U.S. Bank, explains:

"The focus of any currency hedging program should be on the reduction of risk, not on trading the market." [18]

For example, if your business imports raw materials, you can use a forward contract to secure an exchange rate three months ahead, shielding yourself from potential losses due to currency fluctuations [20].

Currency options, unlike forward contracts, offer flexibility. They give you the right - but not the obligation - to exchange currency at a predetermined rate. This flexibility makes them especially useful when transaction timing is uncertain. A recent report showed that 90% of U.S. businesses plan to increase their use of currency options to manage FX exposure. Additionally, companies hedged 48% of their currency exposure in the second quarter 2025, up from 46% in the prior quarter [2].

Natural hedging involves structuring your operations to offset foreign currency revenues with expenses in the same currency. By doing this, you can reduce reliance on complex financial instruments [19]. This approach works best for startups that can align their income and expenditure streams.

Automated FX platforms simplify the process for startups with frequent international transactions. These platforms offer real-time monitoring and execution, integrating with your existing systems to reduce manual errors and improve efficiency [21].

The right approach depends on your startup's unique circumstances. Many businesses with limited treasury resources start with simpler methods like currency matching and gradually move to more advanced tools as their FX exposure increases. The key is to align your strategy with your risk tolerance, operational needs, and available resources.

For startups involved in cross-border fundraising, it’s essential to strike a balance between immediate costs and long-term valuation stability. Early-stage companies often benefit from starting with low-complexity methods and scaling up to advanced strategies as their operations grow. By understanding these options, you can seamlessly integrate FX risk management into your broader fundraising strategy.

Conclusion: Why FX Risk Management Matters

Throughout this article, we’ve seen how managing foreign exchange (FX) risk is essential for protecting startup valuations. Currency fluctuations can significantly impact a startup’s value, especially when funds are reported in USD but invested internationally. Ignoring these fluctuations can result in substantial losses during currency conversions, a risk no founder or investor can afford to overlook.

Key Takeaways for Founders and Investors

The financial consequences of poor FX management are both immediate and measurable. For instance, a 10% depreciation in the local currency can heavily impact a VC fund’s internal rate of return (IRR). For example, a USD-denominated fund investing in Brazilian Real (BRL) faces a potential loss of $263,000 for every million dollars invested due to the currency’s 16% annual volatility [22].

In the past 18 months, major currency pairs like EUR/USD and USD/JPY have experienced 5–10% shifts in remarkably short periods, levels of volatility unseen in a decade. Emerging market currencies, meanwhile, have seen even larger double-digit changes within months. These swings aren’t just numbers - they can disrupt operations, destabilize cash flow, and make budgeting unpredictable. Such instability becomes particularly risky in emerging markets, where aggressive valuations can magnify the impact [26].

Investors are increasingly emphasizing the importance of FX risk management. The fear of seeing investment returns eroded when converting back to USD or euros is a growing concern, especially in emerging markets [22]. As Rebecca Hwang, co-founder and CEO of YouNoodle, aptly puts it:

"One reason these emerging markets appeal to investors is that they are ideal testing grounds for new products, with a young population that is connected to social media." [22]

But this appeal comes with inherent currency risks that demand active management.

There’s also a feedback loop between valuations and FX risk. Missing milestones due to inflated valuations can damage investor trust and complicate future funding rounds. Startups with overly aggressive initial valuations may find it harder to secure additional funding, further underscoring the importance of proactive FX management.

At Allied Venture Partners, we focus on early-stage software and technology companies across Canada and the United States, so we’ve witnessed firsthand the importance of FX dynamics in cross-border investments.

Stay Proactive and Adapt

FX risk management isn’t a one-and-done task - it’s an ongoing process. Currency markets move quickly, and strategies must evolve in response. A common pitfall for startups is implementing a hedging strategy once and failing to update it, which can lead to costly mistakes.

To start, map out your FX exposure. Identify where you’re raising capital, where it’s being deployed, and where returns are expected. Develop an FX policy that outlines hedging triggers, tools, and responsibilities, and treat this as a living document that adapts to your business’s changing needs.

Education is also critical. Ensuring your team understands how currency fluctuations affect returns and valuations can help them make smarter decisions and identify potential risks early. Modern tools that provide real-time monitoring and automated execution can further safeguard against sudden currency swings without requiring constant manual oversight.

The goal is to strike a balance: align entry valuations with revenue diversification, minimize reliance on a single market, and spread exposure across both hard and soft currencies [26]. Venture capital fund managers should also implement hedging strategies at the portfolio company level to mitigate risks.

While short-term currency fluctuations can be dramatic, historical trends suggest that these effects tend to level out over time. For example, from 1980 through July 2023, the local-currency MSCI EAFE index lagged behind its U.S.-dollar-denominated counterpart by only 35 basis points annually. This indicates that long-term investors can often weather currency volatility, but short-term cash flow management remains critical for startups [25].

In today’s interconnected world, FX risk management is a key differentiator between startups that thrive and those that fall victim to preventable financial pitfalls. It’s not just about protecting your bottom line - it’s about ensuring your business has the stability to grow and succeed.

FAQs

How can startups manage FX risks in their financial models to gain investor confidence?

Startups can strengthen investor trust by weaving FX risk management into their financial planning. The first step is to pinpoint potential currency risks through a thorough scenario analysis. This process sheds light on vulnerabilities and areas that might need attention. Using hedging tools like forward contracts or options can then help shield the business from exchange rate swings, offering more stable and predictable financial results.

On top of that, keeping tabs on FX exposure through real-time monitoring is crucial. This allows startups to respond swiftly to market shifts. Such a proactive stance reassures investors that the company is well-equipped to handle currency challenges, protect profits, and maintain clarity in its international business.

What’s the difference between forward contracts and currency options for managing FX risk in startups?

Forward contracts and currency options are two popular tools for managing foreign exchange (FX) risk, each catering to different needs.

Forward contracts allow businesses to lock in an exchange rate for a future date. This guarantees a set rate, shielding startups from unfavorable currency swings. The downside? If the exchange rate moves in their favor, they can’t take advantage of the better rate.

Currency options, on the other hand, provide more wiggle room. They give the holder the right - but not the obligation - to exchange currency at a predetermined rate before a specific date. This means startups can benefit from favorable shifts in the market. However, this flexibility comes at a price, as the upfront premium for options is generally higher than the cost of forward contracts.

For startups, forward contracts are a go-to when keeping costs predictable is the priority. Currency options, meanwhile, are a better fit when flexibility and the chance to capitalize on market movements are key.

How do interest rates and inflation affect currency risk, and what can startups do to manage it?

Interest rates and inflation are major factors that influence currency values, and their impact can ripple through startups with international operations. When interest rates rise, they often draw in foreign investments, which can strengthen the local currency. On the flip side, inflation typically weakens a currency, leading to more unpredictable fluctuations. For startups, these shifts can translate into higher operating costs or shrinking revenues.

To navigate these challenges, startups have a few tools at their disposal. Forward contracts allow businesses to lock in exchange rates, protecting them from unfavorable changes. Currency matching aligns income and expenses in the same currency, reducing exposure to exchange rate swings. Additionally, multi-currency accounts make managing transactions across different currencies easier. Together, these strategies help stabilize cash flow, safeguard profit margins, and bring a level of financial certainty in an unpredictable market.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial, investment, or legal advice. Readers should consult with qualified professionals regarding specific matters related to foreign exchange (FX) risk and startup valuations.