What to Expect from the Databricks IPO in Early 2026: Key Dates, Valuation & Risks

Databricks is preparing for a highly anticipated IPO in 2026, with early estimates suggesting H1; though timing remains fluid pending market conditions, S-1 filing, and regulatory approvals. As a leader in data and AI platforms, the company's public debut has captured the attention of investors. Here's a quick breakdown of what you need to know as of January 2026:

Timeline: While early 2026 was initially targeted, recent analyst commentary and the lack of S-1 filing suggest H2 2026 is increasingly likely. The $1.8 billion debt financing announced in January 2026 indicates accelerated IPO preparation, but the company has not confirmed specific timing.

Valuation: Following a $4 billion Series L funding round in December 2025, Databricks' latest valuation is $134 billion, driven by strong revenue growth, which has surpassed a $4.8 billion annualized revenue run rate.

Opportunities: The company’s leadership in AI and data analytics positions it well to capitalize on growing enterprise demand, including more than $1 billion in AI product revenue.

Risks: Challenges include intense competition, profitability concerns, and recent leadership changes, such as the departure of AI Chief, Naveen Rao.

Investors should monitor key milestones, including the S-1 filing, IPO pricing, and market sentiment, as Databricks approaches its public debut. While the opportunities in AI and data analytics are promising, evaluating risks is essential for making informed investment decisions.

Databricks IPO Timeline and Key Dates

Expected IPO Timeline

Databricks is aiming to go public sometime in 2026. The exact timing will hinge on several factors, including the standard preparation process, regulatory approvals, and overall market conditions. How quickly the SEC clears the filing, alongside Databricks' performance and market trends, will play a big role in determining the final date.

Important Milestones to Track

Several key steps will unfold as Databricks moves closer to its IPO. These include:

Filing the S-1 registration statement with the Securities and Exchange Commission (SEC), which will provide detailed insights into the company’s financials and business strategy.

Choosing lead underwriters, who will guide the IPO process and help set the stage for a successful launch.

Conducting the investor roadshow, where Databricks will pitch its business to potential investors.

Announcing the IPO price, typically released just before trading begins, which will offer a glimpse into the company's market valuation.

Investors should also pay attention to periodic earnings reports and any major developments that could influence market sentiment. These milestones will be critical for assessing Databricks' financial health and overall readiness for its public debut.

IPO Readiness Status - January 2026 Update

S-1 Filing Status

As of January 28, 2026, Databricks has not publicly filed an S-1 registration statement with the SEC. The company has also not announced a confidential S-1 filing, which typically occurs 6-12 months before a public IPO.

What We Know:

$1.8 billion in additional debt was secured in January 2026 (led by JPMorgan), bringing Databrick’s total debt to more than $7 billion, suggesting IPO preparation [9].

CEO Ali Ghodsi confirmed in February 2025 that Databricks is "IPO-ready" with proper board structure, auditing systems, and financial reporting in place.

In a December 2025 CNBC interview, CEO Ali Ghodsi said he wouldn’t rule out a 2026 IPO.

The company is expected to list on the Nasdaq when market conditions align.

The latest $134 billion Series L valuation announced on December 16, 2025, and the prior 20x Series K oversubscription, announced in September 2025, suggest strong institutional appetite for the eventual Databricks IPO.

As of December 16, 2025, the company closed a $4 billion Series L round of funding at a pre-money valuation of $134 billion.

2026 remains the target window, pending market conditions and strategic timing.

Key Indicators to Monitor:

Confidential S-1 filing announcement (typically 6-12 months before public filing).

Lead underwriter selection announcement (typically Goldman Sachs, Morgan Stanley, or JPMorgan for tech mega-IPOs).

Market conditions for tech IPOs (recent comparable: Cerebras IPO in October 2025).

Public S-1 release (IPO typically 30-45 days after).

Investors should check the SEC's EDGAR database regularly for any confidential filing disclosures.

Databricks IPO 2026: Buy the Next AI Giant or Avoid the Hype?

Databricks Valuation and Financial Performance

After examining the IPO timeline, let’s take a closer look at Databricks' financial health and its position in the market.

Current Valuation and Revenue Growth

Databricks has cemented itself as one of the most highly valued private companies in enterprise software, fueled by impressive revenue growth driven by a scalable recurring revenue model and strong customer loyalty.

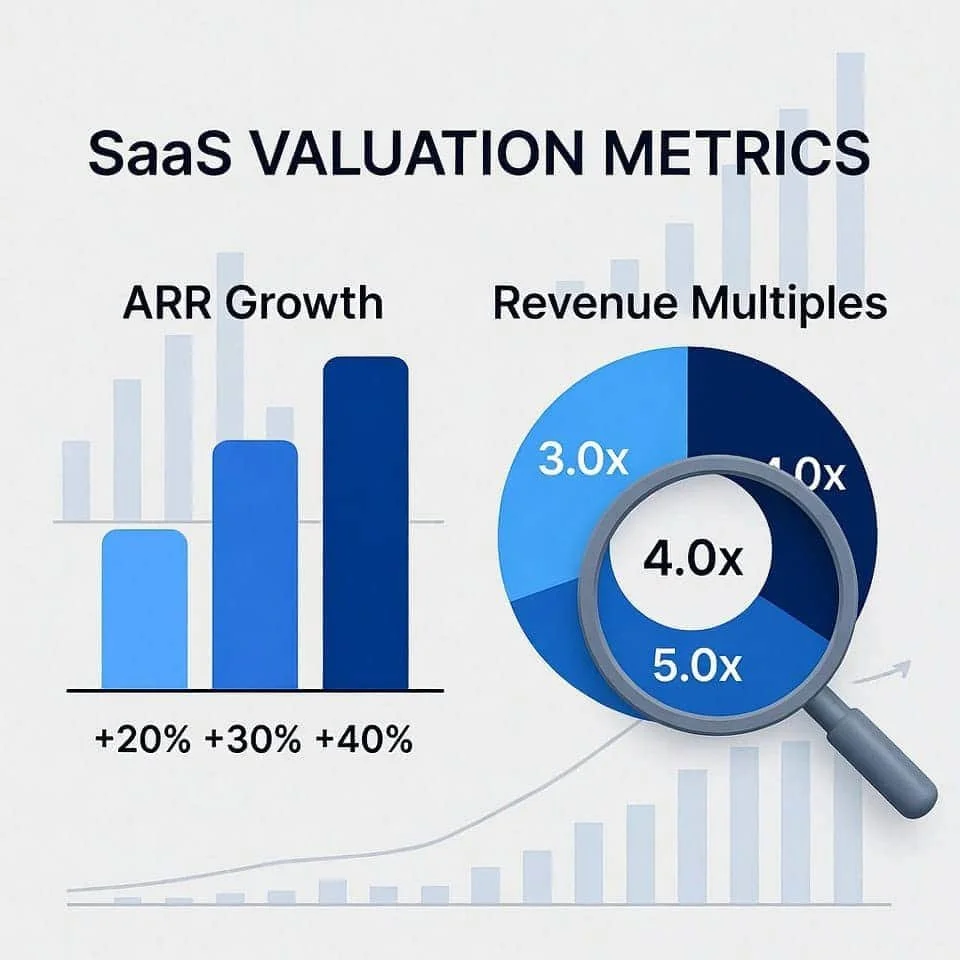

The latest Series L round in December 2025 raised $4 billion at a pre-money valuation of $134 billion – approximately 28 times the projected 2025 revenue of $4.8 billion. Prior to this, the latest Series K round, completed in September 2025, was oversubscribed by nearly 20x, validating Databricks as one of the most valuable private software firms in history. This $1 billion Series K investment increased Databricks’ valuation to over $100 billion—approximately 27 times ARR—reflecting investor confidence in the company's market position and growth prospects, and placing it among the few private tech firms to reach that milestone, with the capital supporting further AI investment, product growth, and global hiring. For a Databricks IPO, this valuation framework suggests significant upside potential.

For example, some industry analysts project Databricks could achieve $10 billion ARR by 2028, which, at current market multiples, could support a public market valuation between $220 to $300 billion. This trajectory positions a Databricks IPO as potentially offering 3 to 4 times upside for late-stage Series K investors.

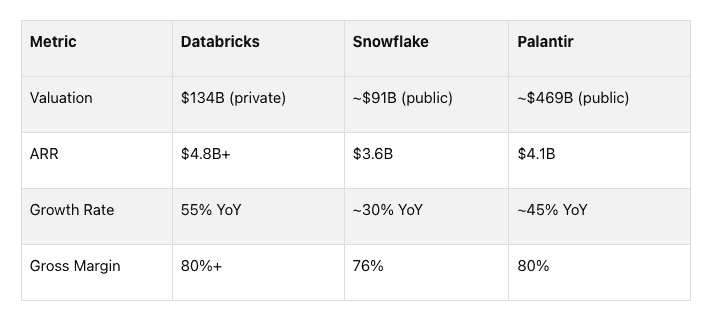

Moreover, the numbers behind a potential Databricks IPO tell a remarkable growth story. At approximately $4.8 billion in ARR and growing at an impressive 55% year-over-year—nearly double the pace of competitors like Snowflake—Databricks demonstrates the kind of scalable, high-quality revenue that public markets reward [1].

Key metrics strengthening the Databricks IPO thesis include:

Over 20,000 customers worldwide, including >60% of the Fortune 500 and more than 700 clients generating $1M+ in ARR. [2]

Over 140% net revenue retention, showing robust customer growth.

80%+ gross margins, demonstrating strong operational efficiency.

Aggressive expansion into high-growth sectors such as generative AI and unstructured data processing.

Top-tier execution and support from leading investors, including Microsoft, Google, Nvidia, and a16z, confirm Databricks’ role as vital infrastructure [4].

$1.8 billion in additional debt secured (as of January 23, 2026), bringing total debt to more than $7 billion. This additional debt, led by JPMorgan, signals aggressive IPO preparation [9].

In its first six months, Lakebase already has thousands of customers and is growing revenue at twice the pace of its Data Warehousing product" (from December 2025 Series L announcement). Lakebase moved to Public Preview with autoscaling features in late 2025.

Industry Peer Comparison

In the competitive world of data analytics and cloud infrastructure, companies like Snowflake, Palantir, and MongoDB have carved out solid positions by focusing on specific niches. Databricks, however, differentiates itself by offering a unified analytics platform that spans data engineering, machine learning, and business intelligence.

This comprehensive approach, combined with strategic acquisitions like MosaicML (which grew from $35M to $400M in ARR in less than two years), has strengthened Databricks’ AI advantage through rapid expansion among both new and existing customers, allowing Databricks to command a higher valuation multiple compared to its peers [5].

For example, Databricks' acquisition strategy accelerated significantly in 2025, completing three strategic purchases:

BladeBridge (February 2025): Added AI-powered data migration capabilities, simplifying customer transitions from competitors like Snowflake and Teradata.

Neon (May 2025): A $1 billion acquisition adding serverless PostgreSQL databases, with 80% of Neon databases created automatically by AI agents—demonstrating explosive growth in agentic workloads.

Tecton (August 2025): Acquired the leading real-time ML feature store (valued at $900M) to power Agent Bricks with sub-10ms latency for fraud detection, personalization, and real-time AI applications.

These acquisitions demonstrate Databricks' ability to deploy its $10 billion Series J capital strategically while rapidly expanding its AI agent capabilities ahead of the anticipated IPO.

Product Strategy – CEO’s Trillion-Dollar Vision

CEO Ali Ghodsi stated publicly (December 2025 Fortune Brainstorm AI) that Databricks has "a shot to be a trillion-dollar company" through three growth vectors:

Lakebase (operational database market - disrupting Oracle's 40-year dominance).

AI-powered coding ("vibe coding" - 80%+ of databases on Databricks are launched by AI agents, not humans).

Agent Bricks (enterprise AI agents on proprietary data).

Databricks vs. Competitors: Comparative Analysis Table

IPO Pricing Factors

The financial fundamentals of Databricks (as outlined above) will play a significant role in shaping its IPO strategy. Key factors influencing its IPO pricing include recent funding valuations, market conditions, and investor appetite for growth-oriented stocks. If market conditions are favorable, the company will likely aim for a valuation that exceeds its December 2025 pre-money valuation of $134 billion. On the other hand, market volatility could lead to more cautious pricing.

Although Databricks has not officially confirmed whether it will pursue a traditional IPO or a direct listing, insiders widely expect Databricks to eventually list on the Nasdaq, with speculation centering on a conventional IPO as the most probable route due to its recent fundraising and strong institutional investor interest. However, the company’s leadership, including CEO Ali Ghodsi, has stated it will choose the timing and structure based on market conditions and internal readiness, leaving the possibility open for either an IPO or an alternative approach [6].

Investors will closely examine critical metrics such as revenue growth, progress toward profitability, and cash flow management, as detailed in the S-1 filing. Additionally, the overall sentiment toward the data and AI sectors, combined with Databricks' ability to demonstrate improving unit economics and a clear path to profitability, will weigh heavily on its final valuation in the public markets.

Recent Strategic Partnerships Strengthening IPO Prospects

Databricks and OpenAI announced a multi-year partnership on September 25, 2025, valued at over $100 million, making OpenAI's GPT-5 model natively available to Databricks' 20,000+ enterprise customers. The partnership represents OpenAI's first formal integration with a business-focused product vendor, with Databricks committing to spend at least $100 million over multiple years on OpenAI models. This new partnership further strengthens Databricks’ IPO narrative, demonstrates strategic positioning, enterprise traction, and product differentiation.

Databricks also formed a partnership with Google Gemini 3 in November 2025, adding it natively and securely to the Databricks platform. This partnership further demonstrates Databricks’ positioning as "AI Switzerland" - partnering with multiple frontier model providers.

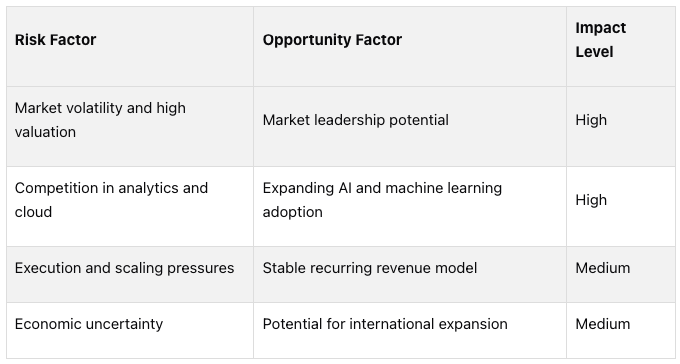

Investment Opportunities and Risks

When considering the Databricks IPO, it's crucial to evaluate both the potential rewards and the associated risks. Databricks' rapid growth offers exciting possibilities, but it also brings notable challenges. This section builds on the earlier discussion of the company's financial performance and market position.

Investment Opportunities

The IPO provides a gateway to tap into the dynamic fields of data analytics and AI, offering several promising opportunities:

Market Leadership: Databricks has established itself as a leader in unified data analytics, combining traditional analytics with cutting-edge AI and machine learning capabilities.

AI and Machine Learning Expansion: As businesses increasingly rely on AI, Databricks stands to benefit from the growing adoption of AI and machine learning across industries.

Subscription Revenue Model: The company's subscription-based approach ensures a steady, predictable, and high-margin revenue stream, while fostering long-term relationships with customers and leading to stronger net revenue retention.

Global Growth Potential: Databricks' strong foothold in key markets positions it to capitalize on emerging opportunities in regions where data analytics adoption is on the rise.

While these opportunities are compelling, investors should also weigh the risks involved.

Investment Risks

Market Volatility and High Valuation: High-growth stocks like Databricks often experience significant price fluctuations, and its lofty valuation heightens the pressure to consistently deliver strong results.

Intense Competition: The data analytics and cloud services sectors are highly competitive, with both established giants and new entrants vying for market share.

Challenges in Execution and Scaling: Transitioning to a public company subjects Databricks to increased scrutiny and the relentless demands of quarterly performance, which could complicate scaling efforts.

Economic Sensitivity: Fluctuations in the economy can impact enterprise technology budgets, potentially slowing growth during uncertain times.

To summarize these factors, the table below provides a balanced view of risks and opportunities:

Recent leadership changes within Databricks add another layer of complexity, introducing potential uncertainties in the company's strategic direction. Investors will need to keep a close eye on how these shifts influence the company's ability to execute its growth plans.

Ultimately, deciding whether to invest requires a careful assessment of your personal risk tolerance, investment timeline, and confidence in Databricks' ability to navigate its competitive environment and market challenges.

Next, we'll explore how recent leadership changes may shape the company's future strategy.

Naveen Rao's Departure and Its Impact

Leadership changes often ripple through investor sentiment, especially when they occur close to a major event like an IPO. Naveen Rao's exit as of September 2025 adds a layer of complexity for those evaluating Databricks. Let’s take a closer look at his contributions and what his departure might mean for the company's strategy.

Naveen Rao's Contributions at Databricks

Naveen Rao left his executive role at Databricks as of September 2025. He stepped down as the company’s influential AI chief to launch a new startup focused on innovative hardware for AI applications – Unconventional, Inc.

Since acquiring MosaicML in 2023, the company where Rao was co-founder and CEO, he has played a key role in shaping Databricks' AI initiatives. His work focused on integrating cutting-edge AI technologies into the platform, enabling the company to better meet the shifting demands of enterprise clients. Rao’s expertise in the AI field was instrumental in driving these advancements forward, helping Databricks stay competitive in a rapidly evolving market.

Leadership and Strategy Impact

Although Rao is transitioning into an advisory role at Databricks, and the company is supporting his new venture as an early investor, his departure comes at a critical moment, with Databricks gearing up for its highly anticipated IPO. This timing raises questions about leadership stability and continuity, particularly as the company navigates its ambitious AI goals.

However, it’s worth noting that the $1.3 billion Databricks–MosaicML acquisition price is noted as “inclusive of retention packages”—a standard structure suggesting that key members, including Rao, were incentivized to remain for a certain period following the deal [7]. Furthermore, in comparable Silicon Valley acquisitions, a two-year earn-out or retention period for founders and core technical leaders is quite standard, often tied to continued employment, integration milestones, and vesting schedules.

Since Rao led Databricks’ AI division from mid-2023 through September 2025 before transitioning to launch his own venture, this timeline closely matches a typical two-year earn-out window. Thus, it is highly likely that Rao’s employment and compensation agreement included a retention package with a standard duration of 18–24 months as part of the acquisition.

“Naveen Rao is a visionary AI leader who has played a crucial role in integrating cutting-edge generative AI capabilities at Databricks. His deep technical expertise and entrepreneurial spirit have been instrumental in advancing our AI platform and supporting our goal to democratize AI for enterprises worldwide.” – Databricks CEO, Ali Ghodsi [8]

Nevertheless, while losing a high-profile leader might shake investor confidence, Databricks’ strong market position and the depth of its leadership team could help steady the ship. For now, all eyes will be on how effectively the company handles this transition while pushing ahead with its AI initiatives. Investors are likely to scrutinize these developments closely as they weigh the company’s long-term potential.

Conclusion: Getting Ready for the Databricks IPO

The Databricks IPO, expected to take place in 2026, is shaping up to be a major event in the data analytics and AI landscape, attracting significant interest from investors.

As highlighted earlier, the company's financial performance, competitive positioning, and leadership stability will be key factors to watch. For investors, this IPO presents a unique opportunity to tap into the growing data analytics market. Keeping a close eye on revenue trends, market share, and management decisions will be crucial during this period.

Of course, investment risks shouldn’t be overlooked. Challenges like achieving profitability and navigating a competitive cloud data platform space remain critical concerns. Leadership changes also bring an element of uncertainty. However, Databricks’ strong market foothold and increasing adoption by enterprises suggest it has long-term potential.

Ultimately, the Databricks IPO will serve as a litmus test for investor confidence in AI and data-focused companies. Success will hinge on the company’s ability to balance rapid growth with a clear trajectory toward profitability. This IPO could easily become one of the most closely followed events of 2026, depending on market conditions and the company’s execution.

Stay tuned for updates from the SEC, details on roadshow schedules, and pricing announcements. If the timing and fundamentals align, this could be one of the standout public offerings in the near future.

FAQs

How could Naveen Rao's departure affect Databricks' IPO and future direction?

Naveen Rao's exit from Databricks in September 2025 comes at a pivotal moment, as the company gears up for its anticipated IPO in 2026. His departure could spark questions about leadership stability, potentially affecting investor confidence during this crucial phase.

Databricks may now look to deepen its focus on AI advancements and explore hardware innovations - areas where Rao played a significant role. While this shift could open doors for growth, it also brings some uncertainty, which might influence both the company's valuation and its long-term strategic direction.

How could Databricks' valuation and revenue growth shape its IPO pricing and attract investors?

Databricks boasts a valuation exceeding $134 billion, with annual revenue topping $4.8 billion and an impressive growth rate of more than 55% year-over-year. These figures firmly establish the company as a powerhouse in AI and data analytics, drawing substantial attention from investors.

With such a high valuation paired with rapid growth, the company is likely to command a premium IPO price. The anticipated IPO, set for 2026, is expected to attract significant interest as investors look to align with a company leading the charge in transformative technologies.

How can investors manage risks tied to Databricks' high valuation and competitive market challenges?

Investors looking to approach Databricks' anticipated IPO with caution should focus on diversifying their portfolios. Putting all your eggs in one basket - especially a high-growth tech stock - can be risky. Spreading investments across different sectors and asset types can help reduce the impact of any single stock's volatility.

It's equally important to dig deep into Databricks' fundamentals. Take time to evaluate the company's financial health, its business model, and the stability of its leadership team. Understanding how Databricks plans to sustain its competitive position in a fast-moving and crowded market is crucial for assessing its long-term potential.

Another key approach is to apply active risk management strategies. For instance, using stop-loss orders can help limit potential losses if the stock's value drops. Stay informed about market trends and closely monitor Databricks' performance after it goes public. These proactive measures can help investors navigate the uncertainties of the IPO while keeping risks in check.

How to Invest in Databricks Before the IPO?

While Databricks’ stock is not yet publicly available, qualified investors have several pre-IPO investment options:

For Accredited Investors:

Secondary marketplaces (EquityZen, Forge Global, Hiive) allow purchases of employee stock options. Investors wanting to buy Databricks stock pre-IPO should monitor these secondary marketplaces for potential allocations.

Note: Pre-IPO investments are illiquid, pricing is volatile, and access is not guaranteed.

For All Investors:

Fundrise Innovation Fund occasionally offers exposure to Databricks with a low minimum investment (~$10/share).

Indirect exposure through publicly traded investors (Microsoft, NVIDIA, Meta).

Important Considerations:

Secondary market prices may not reflect IPO valuation.

Liquidity events depend on IPO timing.

Minimum investment requirements apply.

Disclaimer: The content of this article reflects the author’s opinions and analysis based on publicly available information at the time of writing. While efforts have been made to ensure accuracy, the information presented is for informational purposes only and should not be taken as legal, financial, or investment advice. Readers are encouraged to conduct their own due diligence and consult with qualified professionals before making any decisions based on this material. The author and Allied Venture Partners LLC do not accept any responsibility or liability for any loss or damage resulting from the use of this content. Any critical comments or evaluations in this article constitute fair comment on matters of public interest and are intended to contribute to informed discussion.