Liquidation Preferences: Investor vs. Founder Interests

Liquidation preferences determine how exit proceeds (from acquisitions, IPOs, or liquidations) are distributed between investors and founders. They ensure investors recover their capital first, often shaping exit outcomes significantly. While investors use these terms to manage risk and secure returns, founders may see reduced payouts, especially in smaller exits or when preferences stack across funding rounds.

Key points:

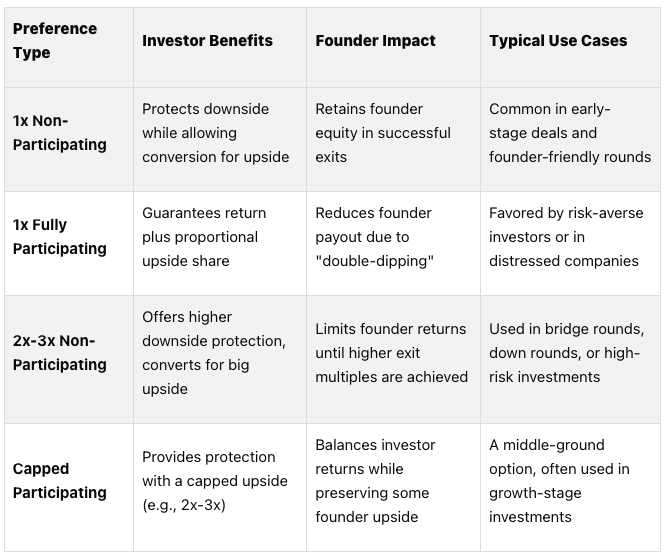

Types of Preferences:

1x Non-Participating: Investors recover their investment or convert to common stock, not both.

Participating Preferences: Investors recover their investment and get a share (i.e., participate) in the remaining proceeds from common stock.

Multiples (e.g., 2x, 3x): Allow investors to claim 2-3 times their investment before common shareholders are paid.

Capped Participation: Limits investor returns to a set cap (e.g., 2x or 3x).

Investor Goals: Protect capital, optimize returns, and influence exit negotiations.

Founder Challenges: Reduced payouts, misaligned incentives, and equity erosion from stacked preferences.

Balanced Solutions: Participation caps, milestone-based conversions, and equal treatment across funding rounds.

The article explores how liquidation preferences impact both sides, common negotiation conflicts, and strategies to align interests for fairer outcomes.

Venture Deals Part 2: Liquidation Preferences

Investor Interests in Liquidation Preferences

For investors, liquidation preferences aren't just a minor detail in a contract - they're critical tools for managing risk in the unpredictable world of startups. These terms help protect their capital and shape the structure of most venture deals. Let’s break down the goals and strategies behind these preferences and the structures investors often use.

Investor Goals with Liquidation Preferences

Liquidation preferences serve as a key safeguard against the risk of loss. When venture capitalists or angel investors, like Allied Venture Partners, invest in early-stage companies, they’re stepping into a high-risk environment where failure is common, and outcomes are uncertain. In this context, ensuring they can recover their capital is essential.

At their core, liquidation preferences aim to secure capital recovery and optimize returns. If a startup is acquired for less than expected - or worse, liquidates - these terms ensure investors recoup their initial investment before anyone else is paid. This protection becomes especially crucial in situations like down rounds or soft exits, which have grown more frequent amid tighter market conditions.

Liquidation preferences also provide investors with leverage during exit negotiations. When a potential buyer evaluates a startup, the preference stack directly impacts how proceeds are divided. This can influence both the likelihood of a deal closing and the final purchase price. These goals shape the specific structures investors choose to include in their agreements.

Common Liquidation Preference Structures for Investors

Several liquidation preference structures are commonly used, each offering different levels of protection and benefits for investors:

1x Non-Participating Preference: This is the most common structure, appearing in 96% of deals in Q3 2024 [2]. Here, investors recover their original investment first and then decide whether to keep that amount or convert to common stock to participate in the remaining proceeds. For example, if a VC invests $20 million with a 1x non-participating preference for a 50% ownership stake and the startup sells for $100 million, the VC can either take $20 million or convert their stake to receive $50 million [1].

Participating Preferences: These allow investors to recover their investment and share in the remaining proceeds. For instance, with a 1x fully participating preference, a VC who invests $5 million for a 25% ownership stake in a startup that sells for $50 million would first take $5 million and then receive 25% of the remaining $45 million, totaling $16.25 million [1].

Multiple Liquidation Preferences: Preferences like 2x or 3x have become more common, rising to 5.5% of deals in 2023, compared to 2.3% in 2021 [2]. These structures allow investors to claim two or three times their original investment before others receive anything. They’re often used in later-stage or higher-risk deals where investors demand stronger protections.

Capped Participation: This strikes a balance between investor protection and terms that are more favorable to founders. For example, if a VC invests $1 million with a 1x participating preference capped at $3 million for a 50% ownership stake, the maximum the VC can take without converting to common stock is $3 million: $1 million from the liquidation preference and $2 million from participation in the remaining proceeds [1].

Impact on Exit Scenarios

The true impact of liquidation preferences becomes clear during exit events, where they can dramatically affect how proceeds are distributed. A well-known example is the 2005 sale of Trados. When the company sold for $60 million, preferred stockholders received $49.2 million, while common stockholders walked away with nothing. Management received 13% through an incentive plan, but the uneven distribution led to litigation and highlighted the potential for conflict between shareholder groups [2].

In challenging exit scenarios, liquidation preferences are especially valuable to investors. Imagine an investor puts $2 million into a startup with a $10 million pre-money valuation and a 1x non-participating preference. If the company exits for just $2 million, the investor recovers their full investment, leaving nothing for founders or employees [3]. This kind of protection has become increasingly important as more startups face tough exit conditions.

Senior Liquidation Preferences have also gained traction, particularly in complex deal structures. By Q4 2023, 16% of post-Series A financings included senior preferences, with their use jumping from 29.6% of deals in 2022 to 47.0% in 2023 [2]. These preferences ensure that later-round investors are paid before earlier investors, creating a hierarchy that significantly affects how exit proceeds are distributed.

As Brad Feld explains:

"It gets much more complicated to understand what is going on as a company matures and sells additional series of equity as understanding how liquidation preferences work between the series is often mathematically (and structurally) challenging." [2]

This complexity requires investors to carefully model different scenarios to understand their potential outcomes. Founders, meanwhile, may be surprised to find their equity value significantly lower than expected. Micah Rosenbloom from Founder Collective cautions:

"Your holdings may be dramatically lower in value than you think, after all this structure comes into play." [3]

While liquidation preferences protect investors and justify the risks they take, they can also lead to tensions with founders during exit negotiations. Balancing these competing interests is critical to maintaining strong relationships throughout the investment process, setting the stage for the next discussion on the challenges faced by founders.

Founder Interests in Liquidation Preferences

For founders, liquidation preferences often feel like a cap on their potential earnings during an exit. Addressing these concerns and finding structures that balance the interests of both founders and investors is key to crafting fair agreements. Let’s dive into the challenges founders face and the terms that can help alleviate these issues.

Challenges for Founders

Liquidation preferences can significantly reduce the payout founders receive during an exit, especially in smaller-scale sales. This impact extends beyond founders to early employees holding stock options. When preferences stack across multiple funding rounds, the equity value for employees can shrink dramatically. This situation makes it harder for founders to retain and motivate key team members, especially when their hard work may not translate into meaningful equity returns.

Additionally, harsh liquidation terms can create friction between founders and investors. If investors are guaranteed returns regardless of the company’s overall success, it can lead to a misalignment of incentives. Founders and employees often feel the brunt of the downside risk, which can cause tension during critical moments like exit negotiations or strategic decision-making.

Founder-Friendly Liquidation Terms

While liquidation preferences exist to protect investor capital, there are structures that also protect founder interests. One of the most balanced options is the 1x non-participating preferred. Under this arrangement, investors can either recover their initial investment or convert their preferred shares into common stock to claim a proportional share of the exit proceeds - but not both. This prevents “double-dipping,” a scenario where investors claim both their preference and a share of the remaining proceeds, which can erode founder returns. In fact, by 2024, 97% of non-participating shares globally carried a 1x multiple, and 87% of preference shares in the UK were structured as non-participating [5].

Another approach is capped participating preferred stock, which strikes a middle ground. Here, investors receive both their liquidation preference and a share of the remaining proceeds, but only up to a predefined cap - typically 2x or 3x their original investment. Beyond this cap, any additional proceeds go to common shareholders, helping to preserve founder payouts.

Ensuring equal treatment across funding rounds is another way to protect founder interests. Instead of prioritizing preferences based on the hierarchy of funding rounds, all preferred shareholders share proceeds proportionally. This avoids the compounding effect of stacked preferences, which can drastically reduce founder payouts in multi-round financings.

In the US, particularly in Silicon Valley, these founder-friendly terms have become increasingly common. The 1x non-participating preference is now a standard feature in many early-stage deals [4]. This shift reflects a broader understanding that overly aggressive terms can harm long-term relationships and, ultimately, the company’s performance.

Impact on Founders During Exits

The structure of liquidation preferences can be the deciding factor between a transformative payout for founders or a far less rewarding outcome.

Take this example: A founder owns 25% of a company that has raised $10 million with 1x non-participating preferences. If the company sells for $50 million, investors will choose to convert their preferred shares into common stock if it yields a higher return. In this scenario, the founder keeps a meaningful share of the exit proceeds.

Now, consider the same scenario under a 1x fully participating preference. Investors would first reclaim their $10 million investment and then claim a proportional share of the remaining proceeds. This "double-dipping" drastically reduces the amount left for common shareholders, including the founder. The difference between these two outcomes highlights how fully participating preferences can significantly cut into founder returns compared to more balanced, non-participating structures.

The tension between investor protections and founder upside often makes liquidation preferences a focal point of negotiations. Both sides aim to secure terms that align with their financial goals and risk tolerance, making these discussions a critical part of any funding agreement.

The push and pull between protecting investor interests and maximizing founder returns often leads to predictable negotiation challenges. By understanding where their priorities clash - and where they can align - both sides can approach these discussions with a clearer strategy. Below, we break down the key differences that shape these negotiations.

Liquidation Preferences Comparison Table

Here’s a quick overview of the main types of liquidation preferences and how they affect investors and founders differently:

As this table shows, liquidation preferences are a key battleground in funding negotiations. For instance, a founder dealing with 1x fully participating preferences across multiple funding rounds may face significant ownership erosion.

Common Negotiation Conflicts

Several recurring issues tend to create friction between investors and founders during these discussions:

Multiple preferences: One of the biggest pain points. For example, if Series A investors insist on 2x preferences and Series B investors demand 3x, the compounding effect can severely reduce founder payouts. While investors justify this as risk compensation, founders often see it as overly punitive and discouraging.

Participation rights: Another divisive issue. Investors argue that participation rights protect their capital, but founders feel these rights unfairly shift all downside risk onto them. This can lead to disputes during exits, especially if investors push for lower offers that meet their preference thresholds.

Seniority demands: In multi-round financings, seniority preferences can leave founders and early employees with little to no returns. Later-stage investors often demand senior liquidation preferences, creating a "waterfall" payout structure. Series C investors get paid first, followed by Series B, Series A, and finally, the founders and employees.

Anti-dilution clauses: Weighted average anti-dilution provisions protect investors during down rounds by adjusting their conversion ratios. While investors see these as standard safeguards, founders view them as penalties for market conditions outside their control.

The balance of power in these negotiations often shifts with market conditions. In bullish markets, founders can push for more favorable terms, such as 1x non-participating preferences. During downturns or when startups struggle, investors gain leverage to demand higher multiples and stronger participation rights. This cyclical nature makes liquidation preference terms a useful indicator of broader trends in the startup ecosystem.

Ultimately, smart negotiators understand that overly aggressive terms can backfire. Harsh preferences can demotivate founders and employees, negatively impacting the company’s performance. On the other hand, terms that fail to protect investors can make future fundraising more challenging. The best agreements strike a balance - offering enough protection for investors while ensuring founders retain meaningful upside. Next, we’ll dive into negotiation tactics that help achieve this balance.

Methods for Aligning Investor and Founder Interests

Finding common ground on liquidation preferences often requires a shift from confrontation to collaboration. The best deals happen when both investors and founders recognize that overly aggressive terms can harm everyone involved. Below are strategies designed to create balanced outcomes, addressing the tension between investor protection and founder equity discussed earlier.

Negotiation Tactics That Work

One effective approach is setting participation caps. This tactic ensures there’s a limit to how much investors can earn on their initial investment. For instance, a 1x participating preference with a 3x cap allows investors to recover their initial investment plus their share of remaining proceeds - up to three times their original investment. Beyond that cap, they convert to common stock. This method safeguards investors while still allowing founders to benefit from high-value exits.

Another option is graduated liquidation multiples, which offer flexibility over time. Instead of locking in a 2x or 3x preference from the start, investors can agree to terms that decrease over time or as the company hits performance milestones. For example, a Series A investor might start with a 2x preference that drops to 1.5x after 18 months and then to 1x after three years. This rewards patient investors while easing the burden on founders.

Anti-dilution modifications also help balance investor protection with fairness to founders. Instead of rigid anti-dilution clauses, modified weighted average provisions offer a middle ground. Narrow-based weighted averages favor investors, while broad-based ones are more founder-friendly. Many successful negotiations land on broad-based averages as a fair compromise.

Milestone-based conversions align liquidation preferences with company performance. For example, investors may agree to convert from participating to non-participating preferences once specific revenue or valuation goals are met. This rewards execution and reduces investor risk during the company’s early, uncertain stages.

Lastly, employee pool carve-outs ensure the team benefits from an exit. Setting aside 10-15% of exit proceeds for the employee option pool before applying liquidation preferences keeps employees motivated, even in modest exit scenarios.

These strategies, when used thoughtfully, can help investors and founders find common ground while maintaining their respective priorities.

How Venture Networks Support Balanced Agreements

Aligning interests isn’t just about structuring terms - it’s also about tapping into the expertise and resources of established venture networks. These networks bring institutional knowledge, standardized processes, and a focus on long-term relationships that benefit both sides.

Take Allied Venture Partners as an example. With a global network of angel investors and venture capitalists, we review several thousand investment opportunities each year. Our focus on pre-seed, seed, and Series A investments ensures we are particularly attuned to the challenges early-stage founders face with liquidation preferences.

In our experience, when liquidation preferences are clearly documented and fairly structured from the outset, later investors can easily assess the existing preference stack. This transparency reduces the risk of compounding issues in future funding rounds.

We also have the benefit of mentorship and guidance provided by seasoned investors within our network. For example, experienced angels who’ve seen hundreds of deals can advise our founders to help them understand market norms and the long-term impact of different preference structures. Acting as informal mediators, we often help founders and lead investors reach mutually beneficial agreements.

Moreover, when negotiating term sheets, we encourage investors to take a long-term view. Knowing they may participate in future rounds, investors are more inclined to structure current terms in ways that support growth and simplify future fundraising.

These collective efforts foster a system where fair and balanced terms become the norm. In our experience, investors who consistently push for aggressive terms risk being excluded from the best opportunities. Meanwhile, those who balance protection with founder incentives build stronger reputations and achieve better returns. For founders, this means working with investors who understand that successful exits require motivated teams with meaningful equity stakes.

Conclusion and Key Takeaways

Liquidation preferences highlight the differing goals of investors and founders, making it essential to strike a balance that protects investors while preserving founder equity. When both parties avoid overly aggressive terms and focus on fair agreements, they create the foundation for partnerships that can thrive over time.

One crucial takeaway is that aligning investor protection with founder motivation leads to better results than an adversarial approach. Investors aim for reasonable returns and risk management, while founders need enough equity to stay committed through the tough journey of building a business. Strategies like participation caps, graduated multiples, or milestone-based conversions can provide middle-ground solutions that satisfy both sides. These approaches foster collaboration across funding rounds and set the stage for long-term success.

Organizations like Allied VC play a key role in creating balanced agreements. By prioritizing long-term relationships and offering experienced mentorship, we help bridge the gap between investor needs and founder incentives. Our expertise ensures negotiations focus on fair, market-standard terms that benefit everyone involved and do not handcuff founders.

Ultimately, successful venture partnerships are built on mutual respect and shared rewards. Overly aggressive investor terms can deter promising opportunities, while founders who understand investor priorities are better equipped to negotiate effectively. Fairly structured liquidation preferences from the outset create a solid foundation for growth and pave the way for successful exits, ensuring all parties benefit from the company’s long-term value.

FAQs

What’s the difference between participating and non-participating liquidation preferences, and how do they affect founders and investors?

Participating liquidation preferences give investors a chance to recover their initial investment first and then take part in the remaining proceeds. This setup can significantly boost investor returns, especially in lucrative exits. However, it often comes at the expense of founders, as it reduces the portion of proceeds they receive.

On the other hand, non-participating liquidation preferences offer a different approach. Investors are entitled to either their initial investment (or a predetermined multiple of it) or a share of the proceeds - whichever amount is greater. This structure is generally more favorable for founders because it avoids the "double-dipping" effect, enabling them to keep a larger share of the exit proceeds.

Choosing between these two options often involves balancing investor returns with founder equity. Aligning these interests early on is crucial for fostering a strong and mutually beneficial partnership.

How can founders negotiate liquidation preferences to protect their equity during an exit?

Founders can opt for non-participating liquidation preferences, a structure that allows them to claim their share of exit proceeds without facing heavy dilution. This setup strikes a balance between protecting the founder's equity and aligning their interests with those of investors.

To negotiate better terms, it's crucial for founders to establish clear expectations from the outset. Caps on participation rights can be a key point of discussion, ensuring agreements remain fair. Collaborating with seasoned legal advisors is also essential to draft agreements that protect both parties.

How can founders and investors align their interests when structuring liquidation preferences?

When structuring liquidation preferences, it’s essential to strike a balance that works for both founders and investors. Approaches like single liquidation preferences with caps or restricting participation rights can help ensure payouts are fair while keeping dilution under control.

Clear and open communication plays a big role here. By modeling various exit scenarios, both sides can better understand how different liquidation preferences affect payouts. This level of transparency builds trust and promotes stronger, long-term alignment between founders and investors.