SAFE vs Convertible Notes: Key Differences

Need funding for your startup but unsure whether to choose a SAFE or convertible note? Here’s the quick answer:

SAFE (Simple Agreements for Future Equity):

No interest, no maturity date.

Converts to equity during a future event (like a funding round).

Faster, simpler, and founder-friendly.

Convertible Notes:

Acts as a loan with interest (5–8%) and a maturity date (12–24 months).

Converts to equity later or requires repayment if no conversion happens.

Offers more investor protection but is more complex.

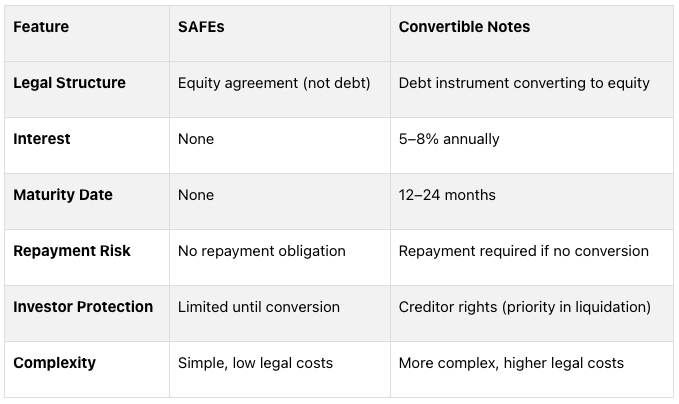

Quick Comparison:

Which should you choose?

Use SAFEs for quick, simple fundraising with minimal negotiation.

Opt for convertible notes if investors want added security or if you’re comfortable with debt terms.

Both tools can help startups secure funding fast - pick the one that aligns with your goals and investor expectations.

Pro tip: Take a look at some of our favorite term sheet and financing document generators listed below.

What Is the Difference Between a SAFE and a Convertible Note?

What Are SAFEs?

Definition and Origin

A SAFE (Simple Agreement for Future Equity) is a financial instrument that gives investors the right to acquire equity in a startup at a later date, triggered by specific events, while providing the startup with upfront funding [3].

Introduced by Y Combinator in 2013, SAFEs were designed to simplify early-stage fundraising. They emerged as a quicker, less complicated alternative to convertible notes, which combine debt and equity characteristics [3][1][4]. Unlike convertible notes, SAFEs are not structured as loans - they focus solely on converting investments into equity. Since their launch, SAFEs have become a go-to option for nearly all startups backed by Y Combinator during their initial funding stages [5].

"SAFEs were designed to simplify and replace convertible notes, so a SAFE allows a startup to take in money on a rolling basis from multiple angel and pre-angel investors in exchange for a promise of equity later down the line." – Gust.com [6]

Key Features

SAFEs stand out for their simplicity and adaptability. They don’t accrue interest and don’t have a maturity date [3]. Instead of requiring repayment, the investment converts into equity during a specific event - typically a funding round, acquisition, or IPO [3]. This conversion is often based on a discount or valuation cap.

SAFE agreements can also be tailored to suit the needs of both the startup and the investor. Terms like valuation caps, discount rates, and whether the structure is pre-money or post-money can be adjusted [3]. This streamlined process allows SAFE rounds to close much faster than traditional equity deals.

Benefits of SAFEs

For founders, SAFEs offer several advantages. They provide quicker access to funding without the lengthy negotiations, heavy documentation, or immediate valuation discussions required in other fundraising methods [7]. This speed can help startups achieve critical milestones sooner. Additionally, SAFEs cut down on legal fees and paperwork, making them a cost-effective option [9]. Since equity conversion happens later, existing shareholders’ ownership stakes remain unaffected until that point [8].

"I was surprised at how quickly a round came together using SAFEs… in conjunction with Cake, it's like I've had a tougher time getting RSVPs to in-person events than getting investors to sign on because it just made the process templated, quick, and sort of seamless. Once everything was set, it just went so smoothly." – Joshua Ismin, Co-founder & CEO at Ps ylo [1]

Investors, on the other hand, are drawn to SAFEs for their potential upside. If the startup succeeds, the equity received upon conversion can significantly increase in value [3]. SAFEs also allow investors to enter at a lower initial cost, reducing their risk. In some cases, early investors receive preferential terms, like discounts on future funding rounds or early access to additional shares [3]. Once the SAFE converts to equity, investors gain clearer exit opportunities, whether through secondary sales, acquisitions, or an IPO. This makes SAFEs an appealing way to back startups with a standardized, straightforward agreement [3][7].

Next, we’ll explore how SAFEs compare to convertible notes.

What Are Convertible Notes?

Definition and Structure

A convertible note is a short-term debt instrument that transforms into equity during a later financing round [11]. Unlike SAFEs, convertible notes function as loans that startups are obligated to repay or convert into equity. Essentially, issuing a convertible note allows a startup to borrow money that will later convert into shares when a qualified financing round occurs, typically when the company secures equity investment exceeding a specific threshold (typically, $1 million for Seed or Series A companies).

This financing tool gives startups quick access to capital without the immediate need to settle on a valuation, much like SAFEs. However, convertible notes come with the added layer of debt obligations, which must be addressed within a given timeframe.

Key Features

Convertible notes come with several distinct terms that set them apart from other funding options:

Interest Rate: Convertible notes usually accrue interest at an annual rate of 5% to 8% until conversion or repayment [12]. The company doesn’t typically pay this interest in cash. Instead, this accrued interest increases the amount that eventually converts into equity.

Maturity Date: These notes include a deadline (typically 12 to 24 months) by which the debt must either convert into equity or be repaid in cash [10]. This timeline establishes a clear endpoint for the agreement. However, most maturity dates for convertible notes in early-stage financings can be extended if the company needs more time.

Conversion Provisions: These define how the debt transitions into equity. Most notes offer a conversion discount (often 10% to 30%), giving early investors a lower share price compared to later investors in the qualifying round [12]. Many also include a valuation cap, which sets an upper limit on the company’s valuation for conversion purposes, protecting investors if the startup’s value soars.

The use of convertible notes has grown significantly. Between 2010 and 2016, the number of funding rounds involving debt instruments like convertible notes increased fourfold. By 2019, 37% of angel investment deals included convertible notes [10][13].

Pros and Cons

Convertible notes offer startups a way to secure funding quickly while postponing valuation discussions. Jason Atkins, President & CEO of Cake Equity, shared his experience with this funding method:

"A Convertible Note worked well for Cake as we were able to obtain early funding which allowed us to build and grow, while avoiding the delays and complications of a valuation. It still offered a financial return to investors via the 30% discount to the priced round. With the Convertible Note funding we progressed the company to achieve milestones that allowed a priced equity Seed Round." [12][1]

For startups, the major appeal lies in the speed and simplicity of raising capital. However, convertible notes come with debt obligations that SAFEs do not. If a startup fails to secure additional funding before the maturity date, it may face the challenge of repaying the principal and accrued interest in cash - a scenario that can be tough for early-stage companies with limited resources [10].

From an investor’s perspective, convertible notes provide several advantages. The accrued interest ensures the investment grows over time, and the conversion discount rewards early participation. The maturity date serves as a safeguard, offering legal recourse if the startup doesn’t perform as expected. Additionally, the debt structure gives investors creditor rights, meaning they take priority over equity holders if the company runs into financial trouble.

There are notable success stories tied to convertible notes. For example, Airbnb raised $600,000 through a convertible note in 2009, which later converted with a 20% discount during its $7.2 million Series A round. Similarly, Dropbox secured a $1.2 million convertible note from Sequoia Capital in 2007, which converted at a 20% discount during its 2008 Series A round [12].

On the downside, convertible notes can be more complex than SAFEs. Negotiating terms like interest rates, maturity dates, conversion triggers, and discount rates can slow the process and increase legal expenses, making them less straightforward than other funding options.

Next, we’ll explore how convertible notes compare to SAFEs across key areas.

SAFEs vs Convertible Notes: Side-by-Side Comparison

Comparison Table

Understanding the distinctions between SAFEs and convertible notes is easier when viewed side by side. Here’s a breakdown of how these two funding tools differ in key areas:

The table provides a snapshot of their differences. Let’s dive deeper into each factor for a clearer understanding.

Detailed Comparison

The legal structure is the most fundamental difference. SAFEs are not loans - they’re agreements for future equity without creating a debt obligation. Convertible notes, on the other hand, are loans that convert into equity later. This distinction affects how startups handle accounting and how investors’ rights are structured.

Interest rates also set these two apart. Convertible notes typically carry annual interest rates of 5% to 8% [14], which can add to a startup’s financial burden. SAFEs, however, don’t accrue interest, making them simpler and less costly in this regard.

Maturity dates are another key factor. Convertible notes come with a deadline - commonly 18 to 24 months - after which repayment may be required if conversion hasn’t occurred [14]. SAFEs, by contrast, have no such time limit (unless outlined in a side letter), allowing founders to focus on scaling the business without the pressure of a looming repayment, extension, or conversion.

When it comes to investor protection, convertible notes offer more security. Noteholders have creditor rights, giving them priority in liquidation scenarios and the ability to demand repayment if conversion doesn’t take place. SAFE holders, however, must wait for a qualifying financing event to see any return on their investment.

The simplicity of SAFEs is another major selling point for founders. They require minimal negotiation and documentation, enabling startups to close funding rounds faster. Convertible notes, with their added layers of complexity - like interest rates, maturity dates, and conversion triggers - tend to involve longer timelines and higher legal costs.

Recent market trends reflect these differences. By Q1 2024, around 80% of pre-seed rounds used SAFEs, and during the first half of 2023, approximately 83% of pre-seed investments on Carta utilized SAFEs instead of convertible notes [15][16]. These numbers highlight a clear preference for SAFEs among early-stage startups, primarily because they’re quicker and more founder-friendly.

Tax considerations also differ between the two. Convertible notes allow startups to deduct interest payments, which can provide some tax relief. However, investors must pay ordinary income tax on the interest they earn. SAFEs, lacking an interest component, avoid these tax-related complexities entirely.

Lastly, negotiation dynamics vary. Convertible notes come with more customizable terms - like interest rates and maturity dates - giving investors greater flexibility. But this added complexity often slows down the process, which can be a drawback for startups looking to secure funding quickly.

These differences play a crucial role in determining whether SAFEs or convertible notes are the better fit for your funding needs. Up next, we’ll explore how to decide between these two options.

How to Choose Between SAFEs and Convertible Notes

Key Factors to Consider

Selecting the right funding option for your startup depends on several factors that match your specific needs and stage of growth. For early-stage companies, particularly those at the pre-seed or seed stage, SAFEs (Simple Agreements for Future Equity) often stand out because of their straightforward nature. They’re quick to execute and don’t require lengthy negotiations over terms like interest rates or maturity dates (unless requested by the investor via side letter). This simplicity allows founders to focus their energy on building their product and gaining traction. In fact, 85% of startups raising less than $1 million choose SAFEs over priced equity rounds [17].

Timing is another critical consideration. If you’re in a rush to secure funding, SAFEs can be a game-changer. Startups using SAFEs close their rounds about 30% faster than those opting for traditional priced rounds [17]. This speed has made SAFEs increasingly popular, with many industry experts praising their efficiency in early-stage fundraising.

Investor preferences also play a big role in this decision. While SAFEs are widely accepted - nearly 60% of venture capitalists report seeing them most frequently in early-stage deals [17] - some investors still favor the structure and security of convertible notes. Convertible notes come with features like interest accrual, a maturity date, and built-in pro-rata (versus side letter), which can appeal to investors who prioritize various rights.

Geography and investor familiarity can also influence the choice. For example, startups in Silicon Valley use SAFEs 25% more often than those in other regions, whereas investors outside major startup hubs may lean toward traditional convertible notes [17]. Additionally, SAFEs tend to be more cost-effective. Startups using SAFEs report 15% lower legal fees compared to those pursuing priced rounds, and over 85% of them rely on the standard templates provided by Y Combinator [17]. For smaller rounds (typically under $500,000), around 65% of startups choose SAFEs as their funding instrument [17]. To keep things simple, most startups issue two to three different SAFEs to their investors during initial rounds, allowing for flexibility while avoiding overly complex documentation [17].

These factors highlight why SAFEs have become a go-to option for many startups, particularly in the early stages of their journey.

Current Trends in U.S. Startup Fundraising

In the U.S., SAFEs have become the dominant choice for early-stage fundraising. Over 60% of startups use SAFEs for their first funding round, and this number jumps to roughly 70% among Y Combinator–backed startups. Y Combinator itself conducts over 95% of its pre-seed investments using SAFEs [17].

Accelerator programs have also embraced SAFEs, with about 90% of seed-stage deals at accelerators now structured this way. For startups participating in accelerators, roughly half secure their first external funding through SAFEs, underscoring the need for speed and standardized processes in these environments [17].

However, market conditions are influencing the landscape. Convertible notes have seen a slight resurgence, making up 31.9% of convertible instruments in Q1 2024, a shift that reflects some investors’ desire for more structured terms. Interest rates on convertible notes with valuation caps also climbed to an average of 8% in Q1 2024, compared to 6% the previous year, reflecting broader economic trends (according to data from Aumni).

Other factors, like founder demographics and deal sizes, also shape funding choices. Women-led startups, for instance, use SAFEs 10% more frequently than male-led ones, and 76% of first-time founders prefer SAFEs over priced equity rounds [17]. Smaller deals (those under $250,000) accounted for 44% of pre-priced rounds in Q4 2024, up from 30% in the same quarter of 2023. For first-time fundraises, the median SAFE round size is $450,000 [19][17]. Interestingly, nearly 40% of startups that eventually reach Series A initially raised funds through SAFEs, and many continue using them for subsequent rounds without transitioning to priced equity [17].

Outside the U.S., SAFEs are less common - startups abroad are about 25% less likely to use them. However, in tech-heavy sectors like fintech and SaaS, SAFEs are used in around 68% of early-stage rounds. Across the board, 70% of founders cite the speed and simplicity of SAFEs as their primary reason for choosing them [17].

These trends highlight the importance of tailoring your funding strategy to your startup’s stage, funding needs, and investor preferences. For early-stage companies, tapping into experienced investor networks - like us at Allied Venture Partners - can provide valuable guidance in navigating these decisions effectively.

Templates and Customization Options

Using standardized templates for SAFEs and convertible notes simplifies the fundraising process, but they differ in how flexible they are for customization.

Y Combinator introduced its widely used SAFE template in late 2013 to reduce negotiation hurdles and legal complexities. Today, most companies raising funds with SAFEs rely on this template, which is readily available on Y Combinator's website [21].

Platforms like SeedLegals and Cake Equity also offer lawyer-reviewed templates for both SAFEs and convertible notes. For example, Cake Equity provides a SAFE note agreement that can either be used as-is or tailored with legal assistance. Users can input details like their funding goal, valuation cap, and discount rate to generate a standard agreement automatically [1].

Convertible notes, on the other hand, offer more room for customization but require additional legal guidance. Unlike SAFEs, there isn't a single dominant template for convertible notes, allowing for greater flexibility but also introducing more complexity [22][1]. Cooley GO and Wilson Sosini offer free online convertible note and SAFE generators for term sheets and whole notes.

Cooley GO: Convertible Note Term Sheet Generator

Cooley GO: Convertible Note Financing Package Generator, including term sheet, convertible note, investor suitability questionnaire, and board consent.

Wilson Sonsini: Convertible Note Term Sheet Generator

Key Negotiable Terms

SAFEs primarily involve negotiations around valuation caps, discount rates, and Most Favored Nation (MFN) clauses. Convertible notes, however, include additional terms like interest rates and maturity dates [22]. Interest rates for convertible notes typically range from 5% to 10% annually, while discount rates for conversion usually fall between 10% and 30% (20% is most common) [23]. The maturity dates for these notes are generally set at around two years [22].

From an investor's perspective, higher discount rates and lower valuation caps are often preferred, as they maximize potential returns. Companies, on the other hand, aim for lower discount rates and higher valuation caps to minimize equity dilution [22].

"Convertible instruments offer potential benefits for both the investor and the company, such as the ability to convert debt into equity at a later date and providing protection for the investor in case of a down round." – Daria Kurishko, startup legal expert [24]

Regulatory Compliance for U.S. Startups

In addition to negotiating terms, both SAFEs and convertible notes must comply with U.S. securities regulations. Like other fundraising instruments, these are classified as securities by the SEC, meaning they must adhere to federal securities laws and state-specific blue sky laws [20]. Regulation D is the primary exemption framework for private placements [20].

Under Rule 506(b), companies can raise unlimited funds from accredited investors and up to 35 non-accredited but sophisticated investors, provided no public solicitation is involved. Rule 506(c) allows for public solicitation but requires all investors to be accredited and their status verified [20].

Filing Form D with the SEC is mandatory after the first sale of securities. Additionally, companies must ensure compliance with the securities laws of each state where their investors are based [20]. Consulting a legal expert is crucial when customizing SAFEs or convertible notes to ensure both compliance and favorable terms [20].

Let’s Recap

Deciding between SAFEs and convertible notes ultimately comes down to what aligns best with your startup's goals and what your investors are looking for. SAFEs are known for their simplicity and speed, making them a popular choice for very early-stage companies, particularly in the pre-seed or seed rounds.

On the other hand, convertible notes have been used for decades, provide more structure, and offer investors added protection through features like interest accrual (usually between 5% and 10%) and set maturity dates. Because convertible notes function as debt instruments, they provide a level of downside protection for investors. In contrast, SAFEs, as equity instruments, inherently carry more risk [25]. These differences highlight the strategic factors we've explored throughout this discussion.

In today’s fundraising environment, investors are placing greater emphasis on financial discipline and sustainability rather than chasing pure growth [26][27]. When choosing the right funding instrument, you’ll need to weigh factors such as your startup's stage, traction, your investors' appetite for risk, and your timeline for raising a priced round. Beyond just addressing funding needs and investor preferences, selecting the right option can also help you avoid potential compliance pitfalls.

As outlined earlier, clear and transparent communication with your investors is essential. Whether you lean toward a SAFE or a convertible note, working closely with legal and financial advisors can help ensure that your choice aligns with your startup's long-term strategy and objectives.

FAQs

What are the key benefits of using SAFEs instead of convertible notes for early-stage startups?

Simple Agreements for Future Equity (SAFEs) have become a go-to option for early-stage startups looking to raise funds. Here’s why they often outshine convertible notes:

1. No Maturity Dates or Interest Rates

One of the standout benefits of SAFEs is that they don’t come with maturity dates or interest rates. This means startups aren’t burdened with repayment deadlines or the stress of accumulating interest. It’s a more flexible option that gives founders breathing room to focus on growth.

2. Simplified Fundraising

SAFEs allow startups to sidestep complicated valuation discussions during the initial fundraising phase. Instead, those conversations are deferred until a later financing round. This streamlined approach helps startups secure funding faster, which is crucial in the early stages when time and resources are often limited.

3. No Debt Classification

Unlike convertible notes, SAFEs aren’t treated as debt. For investors, this creates a cleaner, more straightforward equity agreement without the added layers of complexity that come with debt instruments. It’s a win-win for both founders and investors looking for simplicity.

In short, SAFEs provide a flexible, efficient, and founder-friendly way for startups to raise early capital without the baggage of traditional debt-based agreements.

What are valuation caps and discount rates in SAFEs and convertible notes, and why do they matter?

Valuation caps and discount rates are two essential features of SAFEs (Simple Agreements for Future Equity) and convertible notes. These terms are designed to reward early investors for taking on more risk and to encourage funding for startups.

A valuation cap sets a ceiling on the company's valuation when converting an investor's money into equity. For instance, if a SAFE includes a post-money valuation cap of $8 million and the company later raises funds at a $12 million valuation, the investor's equity will convert at the lower $8 million cap. This means the investor gets more shares, effectively protecting them from dilution if the company’s valuation significantly increases.

In contrast, a discount rate allows early investors to convert their investment into equity at a reduced price compared to later investors in the next funding round. These discounts typically fall between 10% and 30%, depending on the terms of the agreement. Together, valuation caps and discount rates make SAFEs and convertible notes more attractive to investors while enabling startups to secure funding in a way that balances risk and reward.

What should startups consider when choosing between a SAFE and a convertible note for fundraising?

When choosing between a SAFE (Simple Agreement for Future Equity) and a convertible note, startups need to weigh a few important considerations.

SAFEs are generally not classified as debt, which means they don’t come with interest payments or a maturity date (unless requested by the investor via side letter). This makes them a more flexible and less burdensome option for startups. In contrast, convertible notes are generally classified as debt instruments. They accrue interest and come with a repayment obligation if they don’t eventually convert into equity, which can introduce financial strain (although the maturity date can often be extended).

Another key difference lies in complexity and speed. SAFEs are straightforward and quicker to finalize, which is why they’re a go-to choice for early-stage startups aiming to simplify the fundraising process. On the other hand, convertible notes might be more appealing to investors who prefer the added security of debt terms and interest provisions.

The choice ultimately depends on your startup’s financial strategy, current stage of growth, and what potential investors are looking for.