Due Diligence Process: What Founders Need to Know

Due diligence is the make-or-break step in securing funding for your startup. Investors use this process to verify your claims, identify risks, and decide if your business is worth their investment. Here’s what you need to know:

Key Areas Investors Review:

Financials: Revenue, cash flow, burn rate, projections, and cap table.

Legal Compliance: Corporate structure, contracts, and regulatory risks.

Intellectual Property: Patents, trademarks, and ownership agreements.

Market Validation: Customer demand, growth metrics, and market size.

Common Red Flags:

Inconsistent financial records.

Legal issues, like missing documents or unclear IP ownership.

Team problems, such as founder disputes or overdependence on one person.

How to Prepare:

Organize Documents: Use a secure virtual data room with clear sections.

Work with Experts: Hire accountants and lawyers to spot risks.

Run Internal Audits: Identify and fix issues before investors do.

Pro Tip: Transparency and preparation can speed up funding and build trust with investors. Address potential issues head-on and show you’re ready for long-term success.

Crucial Early Stage Startup Checks: A VC's Guide to Due Diligence | Caroline Casson from VITALIZE VC

What Investors Evaluate During Due Diligence

When investors conduct due diligence, they’re not just taking your pitch deck at face value - they’re digging deep to verify the real health and potential of your startup. Here’s a breakdown of the key areas they meticulously assess.

Financial Records and Metrics

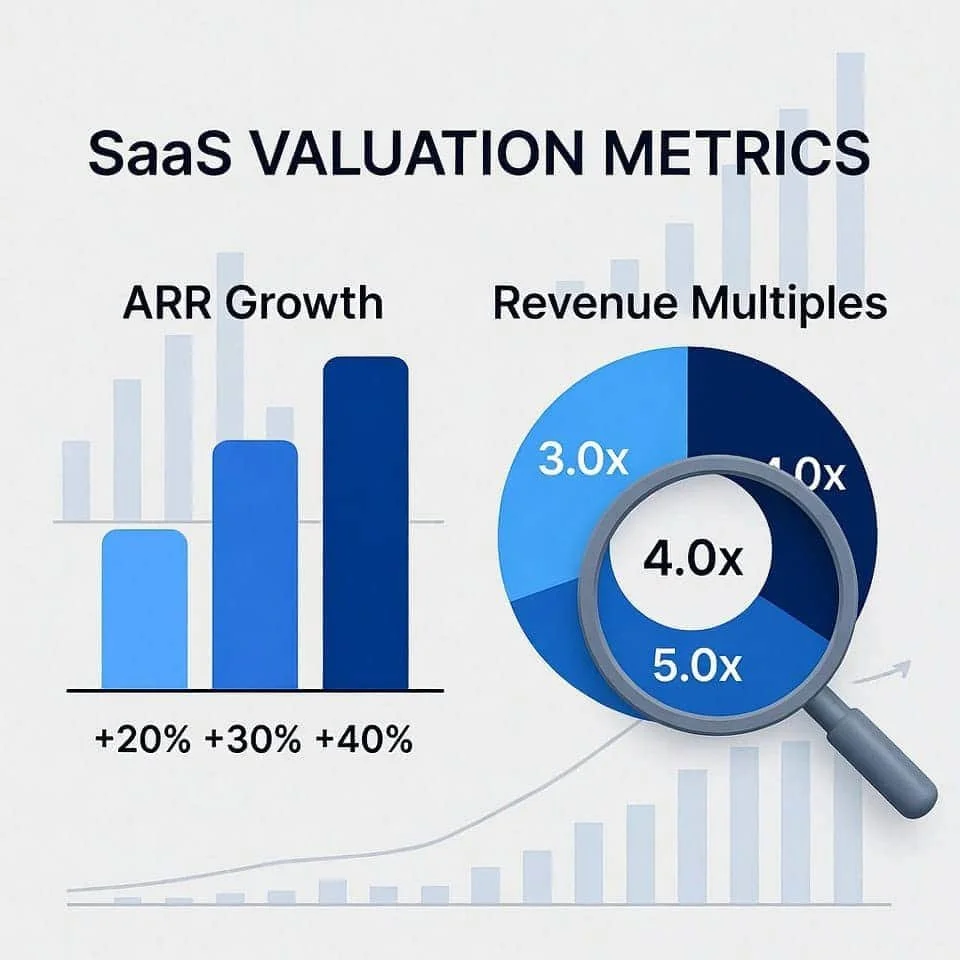

Your financial documentation - like profit and loss statements, balance sheets, and cash flow statements [3] - is where investors start to gauge your financial acumen. They’ll dive into revenue streams, customer metrics such as Customer Acquisition Cost (CAC) and Lifetime Value (LTV) [4], and key indicators like margins, EBITDA, and burn rate.

Cash flow management is another critical area. Investors want to know exactly how long your current runway will last and how you plan to stretch resources under different scenarios [4]. For example, a healthcare startup in Illinois successfully secured a $75,000 stretch loan by presenting clear financial records and solid contractual agreements during the due diligence process [5]. Additionally, an up-to-date cap table, detailing equity structure, ownership percentages, and outstanding shares, is non-negotiable [3].

Legal Compliance and Corporate Structure

Legal issues can derail deals, so investors carefully review your corporate structure and compliance. They’ll examine documents like articles of incorporation, bylaws, shareholder agreements, and board minutes to understand your capitalization and shareholder rights [7].

Contracts are another focal point. Investors expect transparency around customer agreements, vendor contracts, leases, loans, and other key documents to identify any liabilities or restrictive terms. This is especially critical in regulated industries. Andrew Prodromos, Managing Director and Chief Compliance Officer at Insight Partners, highlights a common pitfall for tech companies:

"Sales tax is often an issue with tech companies, particularly operating in the U.S., since they may have exposure in every state. This can create reporting complexity and potential liability for the company if not managed properly." [6]

A weak legal framework can spell disaster. Consider TWG Tea’s domain registration issues or Project Genom’s financial loss from the Steam store - both are examples of how poor legal agreements can lead to significant setbacks [8].

Data privacy is also a growing concern. Prodromos emphasizes the need for dedicated expertise in this area:

"More and more, companies are finding they need a qualified data privacy professional - either on a contract basis or full-time - or even a senior-level resource like a chief data privacy officer." [6]

Lastly, intellectual property (IP) is a key component of legal due diligence.

Intellectual Property Protection

A strong IP strategy can significantly enhance your company’s valuation. Startups with secured IP rights are 4.3 times more likely to attract venture capital [11]. Investors will review your patents, trademarks, and licensing agreements [10] to ensure you have defensible barriers to entry. For example, Amazon’s early patent for "1-click shopping" gave it a lasting edge in e-commerce [9].

As Sara Rona, Managing Director of Global Gateway at SVB, puts it:

"In the innovation ecosystem, your intellectual property, or your IP, is the DNA of your organization which undoubtedly serves as your competitive advantage. Knowing how to protect that before making your solution to a problem public is critical." [9]

Proper documentation is the foundation of IP protection. Every founder, employee, and contractor should sign a proprietary information and invention assignment agreement (PIIA) to ensure all creations are owned by the company [9]. Trade secrets require extra vigilance, as Daniel Schacht, Partner specializing in IP at Donahue Fitzgerald, explains:

"Secrets depend on them being secret. If you do not take reasonable measures to keep them secret, they are no longer protectible." [9]

Market Validation and Traction

Investors also need to see evidence that your product or service has real market demand. They’ll look for sustainable growth, strong retention rates, and a detailed analysis of Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) to confirm the opportunity is worth pursuing.

Customer data is crucial here. Metrics like customer growth trends, retention rates, and churn patterns provide a clear picture of your traction [4]. Additionally, tangible evidence such as pilot programs, letters of intent, or signed contracts can further solidify the case that your offering meets a genuine need. These insights collectively shape investor confidence in your startup’s potential.

Common Red Flags That Kill Deals

When due diligence uncovers serious issues, funding can quickly disappear. Identifying these potential deal-breakers early gives you a chance to resolve them before they derail your fundraising efforts.

Financial and Legal Risks

Financial inconsistencies are a major stumbling block, appearing in over 40% of small business acquisitions [13]. For instance, past acquisitions with hidden accounting irregularities have led to significant financial losses [12]. Investors are quick to flag issues like inconsistent financial records, hidden debts, or overly aggressive accounting practices [12]. A steady revenue decline can also signal deeper problems with your business model rather than just short-term market challenges [13].

Watch out for unexplained cash transactions or undocumented expenses, as these can point to deeper transparency and management issues [13]. Another red flag is high customer concentration - when a large chunk of your revenue depends on a single client, it raises concerns about the long-term stability of your business.

Legal missteps can be equally damaging. Missing or poorly prepared investment documents can delay closings or even invalidate your offering [14]. One fintech startup learned this the hard way when its founder personally guaranteed compliance with financial regulations. A legal issue arose, and the founder was forced to cover hefty fines - something proper legal structuring could have prevented [16]. Additionally, incomplete incorporation documents, messy cap tables, or missing intellectual property (IP) assignments can increase transaction costs and delay funding unnecessarily [17].

But it’s not just numbers and paperwork - investors also pay close attention to the people behind the business.

Team and Operations Problems

Issues within the team can derail deals faster than almost anything else. In fact, founder disputes and team breakups are among the top reasons early startups fail, which is why investors scrutinize team dynamics so closely [19].

Uneven commitment or disputes among founders are immediate red flags. A study by Startup Wiseguys revealed that startups with fully committed, full-time founders outperformed those with less dedicated teams [20].

Relying too heavily on one individual also raises operational concerns. If your business depends entirely on a single person - especially someone without industry experience or a history of staying focused on projects - investors see this as a major risk. It’s essentially a single point of failure.

Leadership behavior can also set off alarm bells. Excessive founder salaries, unexplained expenses, or unnecessary lavish spending suggest poor judgment and misaligned priorities, which make investors wary [18]. Additionally, missing technical documentation or unclear product ownership makes it harder for investors to understand what they’re backing, shaking their confidence in your ability to scale and maintain a competitive edge [15].

Studies show that 70% to 90% of acquisitions fail to deliver expected value due to overlooked red flags [13]. Catching these issues early gives founders the opportunity to address them before they become deal-breakers.

How to Prepare for Due Diligence

Getting ready for due diligence is about more than just gathering paperwork - it's about showing investors you're organized, transparent, and serious. Studies reveal that startups that prepare early for due diligence boost their chances of securing investments by 65% [24].

Start by organizing your documents, bringing in professionals where necessary, and conducting internal reviews well in advance.

Setting Up a Virtual Data Room

Think of a virtual data room as your base of operations during due diligence. This secure online platform acts as a centralized hub where investors can access critical documents without the hassle of emails or security concerns. It’s not just convenient - it’s essential.

The virtual data room market is expected to grow from $1.9 billion in 2022 to $5.5 billion by 2030 [21]. For sellers, these tools can shorten the merger and acquisition process by three months and potentially add up to $45 million in value [22].

But a data room isn’t just about uploading files - it needs to make sense to someone who’s never seen your business before. Organize it into clear sections like financials, legal documents, operations, and commercial data. Here's a quick guide:

If pre-Series A, a simple Google Drive will suffice, but for later-stage startups, security is non-negotiable when choosing a platform. Ido Hart from Maor Investments shares:

"When searching for a virtual data room, security was our top priority. We felt that DocSend provided strong security features, including access restrictions, authentication, and NDAs, that would allow us to better control the documents we are sharing with potential investors." [23]

Set strict access controls and update permissions as roles change [23]. And don’t forget to keep your data room current - outdated financials or expired contracts can leave a bad impression.

Working with Third-Party Auditors and Legal Experts

Bringing in external experts can save you from costly oversights. In fact, 68% of startups miss risks when they handle due diligence alone [2]. Professionals like accountants and attorneys can identify issues you might overlook, especially in industries with complex regulations [26].

Choose experts with experience in your specific field. A startup-focused lawyer, for instance, will spot nuances that a general corporate attorney might miss. Similarly, a CPA familiar with early-stage companies can better navigate your financials.

Make sure to have written agreements that outline each expert's responsibilities, timelines, and deliverables [25]. This avoids misunderstandings and keeps everyone on track. Let potential investors know you’re working with professionals - it adds credibility [26].

Don’t just take their findings at face value. Review their work, ask questions, and ensure you understand their recommendations. While their expertise is invaluable, you’re ultimately responsible for the final decisions. Starting this process early gives you time to address any red flags without feeling rushed.

Running Internal Readiness Audits

Internal audits are your chance to catch problems before investors do. According to PwC, nearly half of startup failures are tied to a lack of due diligence [24]. Many of these issues could have been avoided with thorough preparation.

Start by reviewing your financial records for inconsistencies and verifying that all legal documents are properly signed and filed. Missing or outdated information can raise red flags. Since 23% of startup failures stem from unidentified legal and financial risks [24], this step is critical.

Build a comprehensive document library, including financials, legal records, and customer data. As you do this, you’ll likely discover gaps or areas that need updating. Address these weaknesses head-on - whether that means refinancing debts, fixing contracts, or auditing your tech stack.

Transparency is key. If you uncover issues, don’t try to hide them. Instead, provide context about what went wrong and how you’re addressing it [1].

Think of this process as a trial run. The more thoroughly you examine your business, the better prepared you’ll be when investors start their review. Assign someone to lead the audit and set clear deadlines for completion [1].

While this preparation takes time, it’s worth it. Companies that are ready for due diligence often experience quicker deals, better offers, and smoother negotiations [26].

How to Navigate Due Diligence Successfully

Once you've laid the groundwork with thorough preparation, the next step is mastering the due diligence process itself. This stage is about more than just meeting investor expectations - it's a chance to prove your credibility and build lasting trust. The key? Preparation, open communication, and a proactive approach.

Adopt the right mindset. Karen Grant, a seasoned investor, highlights the importance of perspective: "When you're conducting due diligence, it transforms challenges into opportunities" [source: Forbes]. Instead of viewing investor questions as obstacles, treat them as moments to showcase your expertise and your commitment to solving problems.

Communication is your secret weapon. Responding quickly and clearly to investor inquiries keeps the process moving smoothly. Keep a record of all communications to ensure transparency and avoid misunderstandings. Consistent, clear communication not only keeps everyone aligned but also reinforces trust.

Transparency is non-negotiable. If issues arise, address them directly. Explain the situation honestly and outline your plan to fix it. Karen Grant emphasizes this point:

"Keep an eye out for a lack of transparency. If you catch the founders in a lie, do not do business with them. Integrity in this business is crucial–both integrity from the founders and integrity of the investors" [source: Forbes].

Set up clear processes and expectations. Work closely with your lead investor to create a structured timeline and schedule regular updates. This keeps everyone on the same page and minimizes confusion. A well-organized process complements your earlier efforts to prepare documents and engage professionally.

Turn obstacles into opportunities. Use this process as a chance to identify and address weak spots in your business. By tackling challenges head-on, you'll not only improve your operations but also demonstrate strong leadership to potential investors.

FAQs

How can founders effectively organize and maintain a virtual data room during due diligence?

To maintain an organized and efficient virtual data room during due diligence, start with a well-defined folder structure. Organize documents into main categories such as financials, legal, intellectual property, and market data, and create subfolders for more specific items within each category. This makes navigating the data room much easier. Additionally, adopt consistent naming conventions for all files, so you can quickly locate the information you need.

Protect sensitive documents by setting user-specific access permissions, ensuring only authorized individuals can view or edit certain files. It's also a good idea to regularly review and update the data room to remove outdated materials and confirm that all information is accurate and relevant. A clean, up-to-date data room not only saves time but also leaves a positive impression on potential investors.

How can founders prepare their startups to avoid red flags during due diligence?

To steer clear of potential issues during due diligence, founders should prioritize being prepared, staying organized, and maintaining transparency. Start by keeping your financial records accurate and current, addressing any discrepancies, and ensuring your business complies with all legal and regulatory standards.

Set up a well-structured data room that includes essential documents like financial statements, contracts, intellectual property information, and relevant licenses. This not only simplifies the due diligence process but also signals to investors that your startup is well-organized and ready for scrutiny.

Equally important is open and honest communication with potential investors. Tackle any challenges head-on and provide clear, straightforward explanations when questions arise. By showing reliability and a readiness to engage, you can build trust and position your startup as an appealing investment opportunity.

What do third-party auditors and legal experts do during due diligence, and how can founders work with them effectively?

Third-party auditors and legal experts play a pivotal role in the due diligence process. Their job is to provide an impartial assessment of your startup’s financial health, legal compliance, and overall risk factors. They dig into the details - verifying financial records, ensuring regulatory compliance, and examining key areas like intellectual property and operational stability.

To make this collaboration as smooth as possible, founders should come prepared. This means organizing critical documents such as financial statements, contracts, and legal filings ahead of time. Clear and timely communication is equally important. Responding quickly to their requests not only keeps the process moving but also shows investors that your startup is well-prepared and professional. By working hand-in-hand with these experts, you can build credibility and position your business as a solid investment choice.