Top 5 Red Flags Investors Look for in Startups

Startups fail often - 90% don't make it. Investors spot red flags to avoid risky bets. Here are the top 5 warning signs that can make or break your chances of securing funding:

Team Problems: Dysfunctional leadership or unresolved conflicts signal trouble. Investors prioritize strong, aligned teams.

Weak Defensibility or Intellectual Property (IP): Without proprietary knowledge or data, competitors can easily replicate your ideas.

Lack of Market Research: If there's no proven demand for your product, investors won't bite.

Poor Financial Planning: Mismanaged cash flow or unrealistic projections erode trust.

Legal and Regulatory Gaps: Missing compliance or legal oversights can scare off investors.

Quick Overview

Investors don’t expect perfection. They want clarity, competence, and the ability to solve problems. Fix these issues early to build trust and increase your chances of success.

5 Red Flags VC Investors Spot When Startups Pitch: Avoid These Mistakes!

1. Team Problems and Leadership Issues

A dysfunctional founding team can sink investor confidence. While investors may focus on markets and products, their ultimate investment is in people. Even the most promising technology can't save a startup if its leadership dynamics are fractured.

Leadership issues are among the top reasons startups fail[9]. In fact, venture capitalists often replace 20% to 40% of founders with seasoned managers during critical growth phases[3]. This highlights just how seriously investors view team-related challenges.

Impact on Investor Confidence

Team conflicts don’t just stay behind closed doors - they seep into operations. When founders can't collaborate effectively, the resulting tension drains energy, dampens morale, and slows down decision-making [source: Inc.com].

Take the example of Gravyty's co-founders, Adam Martel and Rich Palmer. Their partnership initially faced skepticism from investors, but their complementary strengths ultimately became a key asset. Adam shared:

"The first thing that we got right was being able to make space for each other... Rich lets me do what I'm best at, and allows me not to do what I'm not very good at... between the two of us, we have a more complete team than most other founders."[6]

Christopher Mirabile, an investor in Gravyty, noted:

"The way Adam and Rich ran Gravyty reflected their differences as individuals. They each had the EQ and self-awareness to know what they were good at and what they weren't."[6]

This self-awareness and balance helped them push through initial setbacks and secure funding, even after receiving early negative feedback from investors[6].

Frequency and Impact on Growth

Team dysfunction is more common than many founders expect. Research shows that only 1 in 10 leadership hires successfully scales beyond Series B funding[5]. Warning signs include high employee turnover, unresolved conflicts, and a lack of transparency[1]. Investors are also wary of teams with shifting or unclear visions and missions, which often indicate deeper alignment problems.

These issues don't just threaten immediate funding - they can stall long-term growth. Strong team dynamics are essential for quick decision-making, fostering creativity, and building a resilient organizational culture[1]. When leadership alignment falters, the effects ripple across the company. Studies reveal that over 70% of organizational transformations fail to meet their goals, with leadership misalignment being a major factor[8].

To address these challenges, founders need to evaluate their team’s strengths and resolve conflicts early. Investing in leadership development and creating open communication channels are critical steps[1]. Additionally, bringing together a diverse mix of skills and perspectives can help avoid blind spots that might raise red flags during investor due diligence[1].

Next, we’ll explore the importance of intellectual property protection as another key concern for startups.

2. Weak or Missing Intellectual Property Protection

When it comes to early-stage startups, intellectual property (IP) protection is a make-or-break factor for attracting investors. Without solid safeguards in place, even the most inventive companies can face stiff competition and struggle to secure funding.

Impact on Investor Confidence

A well-rounded IP portfolio isn't just a legal formality - it’s a statement of a startup’s preparedness and vision. In fact, startups with established IP rights are 4.3 times more likely to land venture capital funding[13]. For investors, this demonstrates that founders understand their competitive environment and are serious about protecting their innovations. As Daniel Schacht, an IP expert and Partner at Donahue Fitzgerald, aptly notes:

"People know from The Shark Tank that if the new idea has a patent, people get 10 times more excited."[12]

The numbers back this up: startups with both trademarks and patents consistently raise more capital during early VC rounds[14].

Common IP Pitfalls in Early-Stage Startups

IP missteps are surprisingly frequent among startups, often due to limited experience or tight budgets. For instance, making public disclosures before filing for patents can permanently destroy the chance to secure IP rights[16]. Another common error is skipping thorough searches for existing patents, trademarks, or designs, which can lead to costly rebranding or legal disputes. A classic example? Afterpay. The Australian company failed to check trademarks thoroughly and discovered a Dutch business had already registered the "Afterpay" name in the UK and EU. This oversight forced them to rebrand in Europe as "Clearpay"[15].

Addressing IP Issues

The good news? Many IP problems can be fixed if caught early. Startups should:

Conduct an IP audit to identify gaps.

Register trademarks and file for patents to protect their innovations.

Ensure that founders, employees, and contractors sign strong proprietary assignment agreements[11][12].

Partnering with experienced IP attorneys is crucial for crafting a robust protection strategy. DIY approaches might save money upfront, but can lead to costly mistakes down the road.

Risks to Growth and Fundraising

Weak IP protection creates a breeding ground for competitors to replicate innovations, sparking legal disputes and threatening a startup’s market position[19]. Sara Rona, Managing Director of Global Gateway at Silicon Valley Bank, underscores the importance of IP:

"In the innovation ecosystem, your intellectual property, or your IP, is the DNA of your organization which undoubtedly serves as your competitive advantage. Knowing how to protect that before making your solution to a problem public is critical."[12]

Lacking proper IP coverage in key markets can also stifle commercialization efforts[20]. On the flip side, strong IP protection boosts valuation, attracts strategic partners, and reassures investors about the company’s long-term potential[10].

Next, we'll dive into how poor market research and weak customer validation can further erode a startup's appeal to investors.

3. Lack of Market Research and Customer Validation

When a startup can't demonstrate market demand, it sends red flags to investors. Market research and customer validation aren't optional - they're the bedrock that separates a promising business from a costly gamble.

Frequency of Occurrence in Early-Stage Startups

Failing to validate the market is a widespread issue among startups. According to research, 42% of startups fail because there’s no market need, while 34% fail due to poor product-market fit[25]. These numbers highlight a recurring problem: many founders are so attached to their ideas that they neglect to confirm if customers actually share their enthusiasm.

A common mistake is mistaking polite encouragement from friends or family as genuine interest. Another is focusing too much on product features instead of addressing the real problems customers face. This disconnect often leads startups to build something nobody truly needs.

Impact on Investor Confidence

Investors heavily rely on market validation to assess risk. Startups that conduct thorough research show they understand their audience, competitors, and pain points. As one expert explains:

"Market validation determines what customers will pay for. Like all science, it relies on data, not assumptions, or someone's gut feeling." - FORGE [22]

Without this foundation, investors are left questioning why they should risk their money on a product with uncertain demand. Market validation provides clarity - it helps startups figure out if their product solves a real problem, predicts customer interest, and assesses profitability[23]. Without it, investor confidence takes a hit.

Potential to Derail Growth or Fundraising Efforts

Skipping market validation can derail both growth and fundraising. Startups that scale too quickly - pouring resources into production and marketing without confirming demand - often find themselves with products that miss the mark. This misstep can result in poor timing and a mismatch with market needs[27].

Take Quibi, for example. Despite raising billions, the company flopped because it didn’t properly validate demand for short-form premium content. It misjudged consumer preferences and couldn’t compete with established platforms[24].

On the flip side, MailChimp offers a success story. Its founders initially ran a web design agency with email marketing as a side service. They noticed small businesses struggled with email tools and validated this demand directly with potential customers. After confirming the market need, they pivoted entirely to email marketing. This customer-first approach helped MailChimp grow into a billion-dollar company[21].

Ease of Mitigation or Resolution

The upside? Market validation issues are highly fixable. Start by clearly defining the customer problems your product aims to solve. Talk to potential customers to uncover their pain points and gather unbiased insights. Build prototypes or minimum viable products (MVPs) to observe how people interact with your solution. Focus on what customers do, not just what they say.

Leverage tools like online surveys and social media to reach a broader audience. Consider forming advisory boards that include industry experts and potential customers for honest feedback. Most importantly, adopt a mindset where negative feedback is seen as valuable data, not personal criticism.

"Market validation is a critical process for any company of any size. It helps reduce the risks associated with bringing a new product or service to prospective customers." - Userlytics [24]

Break the process into small, manageable experiments. Test key assumptions early, one at a time, before making big commitments to development or marketing. By validating the market early, startups not only gain investor trust but also build a solid foundation for sustained growth.

Next, let's dive into how poor financial planning can further erode investor confidence.

4. Poor Financial Planning and Cash Management

Poor financial planning isn’t just an oversight - it’s a glaring weakness that investors notice immediately. When founders lack financial discipline, it often signals deeper problems with how the business is run and led.

Frequency of Occurrence in Early-Stage Startups

Financial mismanagement is a surprisingly common issue for startups. About 38% of startups fail because they run out of cash, while another 15% cite pricing and cost issues as their downfall[28][35]. Startups frequently face uneven income, significant upfront expenses, and dependence on a single client, all of which can disrupt cash flow. Many grow faster than their financial systems can handle, leading to sloppy spending and poor planning[33]. As Amy Kux, CFO of Unbabel, explains:

"Cash management in the early stages is one of the hardest things." - Amy Kux, CFO of Unbabel[32]

Another major risk is relying too heavily on a single client. Startups that generate over 30% of their revenue from one client are especially vulnerable to cash flow issues if that client’s payments are delayed or reduced[28].

Impact on Investor Confidence

Investors see poor financial management as more than just a numbers problem - it’s a sign of weak leadership and poor decision-making. Disorganized financial records, unrealistic projections, or unsustainable burn rates make investors question whether the team has what it takes to scale the business. As Liam Fairbairn from SVB points out:

"Messy books will not reflect well on your business savvy." - Liam Fairbairn, SVB[32]

Financial instability doesn’t just hurt investor confidence; it can also demoralize employees, lead to talent loss, and cause the company to miss key opportunities[33]. These issues compound concerns about the startup’s overall health and long-term viability.

Potential to Derail Growth or Fundraising Efforts

Even the most promising startups can stumble if they don’t manage their finances properly. Poor budgeting can lead to inefficiencies like overstaffing, redundant tools, or unnecessary subscriptions - all of which drain resources. Cash flow problems might push founders into desperate fundraising situations, where they lose negotiating power. Misjudging cash inflows or underestimating costs during critical growth phases can quickly result in a financial crisis[33]. Addressing these issues early is essential to maintaining momentum.

Ease of Mitigation or Resolution

The good news? Financial planning issues can be resolved with the right tools and habits. Russell Rosario, Co-founder of Profit Leap, advises:

"Track your cash daily. This helps you anticipate shortfalls and avoid surprises. Even profitable businesses can fail if they don't manage their cash flow well." - Russell Rosario, Co-founder of Profit Leap.

Start by implementing basic cash flow management practices. Regularly prepare cash flow statements and base projections on actual data, not wishful thinking[37]. Build a financial cushion - aim for 3–6 months of operating expenses - to handle unexpected challenges[34].

Introduce financial controls early, such as requiring dual approvals for large transfers, limiting bank access, and documenting purchase approvals[36]. Olivia Balboa-Lopez, CFO and co-founder of IMPCT, emphasizes:

"Regular reconciliation of accounts... This practice not only keeps your records accurate but also prepares you for investor reviews." - Olivia Balboa-Lopez, CFO and co-founder at IMPCT

Operational efficiency is another key area to focus on. Negotiate longer payment terms with suppliers, invoice customers promptly, and diversify your client base to avoid over-reliance on a single account. Track important metrics like burn rate, gross margin, and customer acquisition cost to stay on top of your financial health[30].

Investing in solid financial infrastructure early can also make a big difference. Modern accounting software can automate routine tasks and provide real-time insights[31]. Additionally, working with financial experts or consultants before problems arise can help you avoid common pitfalls. Building relationships with potential investors early on can also make fundraising smoother when the time comes.

Financial discipline might not be the most exciting part of running a startup, but it’s one of the most critical. Investors know this, which is why they scrutinize financial planning so closely during due diligence.

5. Missing Legal and Regulatory Requirements

Legal and regulatory compliance isn’t just a box to check - it’s a signal to investors about how seriously founders take their business. Skipping these requirements is like building a house on unstable ground. It might hold up for a while, but cracks will show, and confidence - especially from investors - can crumble. Legal diligence is just as crucial as financial planning and market validation in proving a startup’s stability.

Frequency of Occurrence in Early-Stage Startups

Overlooking legal requirements happens far too often in early-stage startups. With around 4.7 million new businesses launched annually in the U.S., many founders neglect key areas like securities regulations, intellectual property (IP) protection, data privacy, and industry-specific rules. The assumption? These can be handled later. But this mindset often backfires, especially when it’s time to seek funding.

Take TWG Tea, for example. One co-founder registered the company’s domain name under his personal ownership. When he left in 2012 amidst internal disputes, the business discovered it didn’t actually own its domain. It took until 2019 - and a court ruling - for the domain to be transferred to the company[47]. Similarly, the Project Genom game faced removal from the Steam store because the startup failed to secure an IP transfer agreement, leading to a DMCA claim by a developer[47].

Impact on Investor Confidence

Legal missteps can send a troubling message to potential investors. They suggest a lack of preparation and foresight, raising doubts about a founder’s ability to manage risks and run a sustainable business. As Robyn Ferreira, Senior GRC Manager at Scytale, puts it:

"Being compliant demonstrates to investors that you're running a business built for scale, one that won't fall apart as soon as your security and privacy practices are put under the microscope. It tells them, 'We're not just focused on growth, we're focused on doing things right.'"[40]

Investors don’t just look at the big picture - they dig into details. Discovering compliance gaps can make them question everything from a founder’s attention to detail to their overall business acumen. The Faison Law Group puts it bluntly:

"Ignoring SEC compliance for startups can derail your company's future before it even gets off the ground."[39]

Potential to Derail Growth or Fundraising Efforts

Legal and regulatory gaps don’t just create headaches - they can bring growth and fundraising efforts to a screeching halt. Investors may insist on costly fixes before moving forward, or worse, walk away entirely. For instance, GDPR violations can lead to fines as high as €20 million or 4% of revenue. High-profile cases like Uber and FedEx have also faced penalties for employee misclassification issues[45].

Beyond fines and reputational damage, compliance problems can block a startup’s ability to scale. Expansion plans might stall, and future fundraising rounds could become more challenging. These risks highlight why addressing legal requirements early is critical to maintaining momentum.

Ease of Mitigation or Resolution

Here’s the silver lining: most legal and regulatory issues can be avoided with early planning and expert guidance. The earlier you address these matters, the fewer problems you’ll face down the road.

Start by choosing the right business structure - LLCs offer liability protection, while C-corps allow for unlimited stock issuance[41].

Pro tip: Most VCs cannot invest in LLCs, so start with a proper C-corp structure from the beginning to save additional headaches and expenses down the road.

Secure founder agreements and protect your intellectual property from the beginning, including having all IP assigned to the company.

Put compliance measures in place, such as regular regulatory monitoring, timely disclosures, and thorough record-keeping. Depending on your industry, you may need to comply with frameworks like SOC 2, ISO 27001, GDPR, HIPAA, or PCI DSS[40]. Conduct risk assessments regularly to spot vulnerabilities and create strategies to address them. This proactive approach not only keeps you ahead of regulatory changes but also reassures investors that your business is built to last.

Leveraging governance software can simplify compliance efforts, ensuring your startup is always investor-ready. Early consultations on tax reporting, privacy policies, required licenses, and AML/KYC policies can further solidify your legal foundation[47]. By tackling these issues head-on, you can focus on growth without worrying about legal surprises down the line.

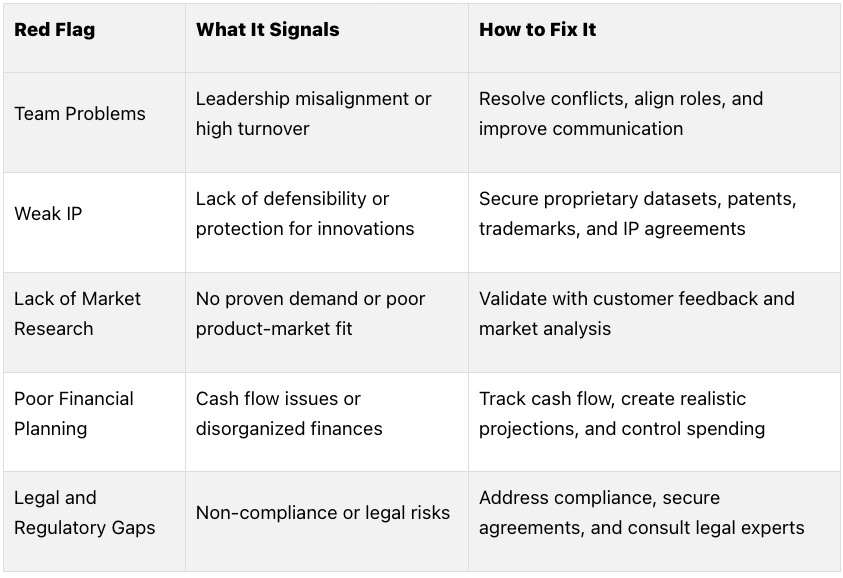

Red Flag Comparison Chart

Benchmarking against industry standards can help identify potential issues before they escalate. The chart below highlights areas that might undermine investor confidence, allowing startups to address concerns proactively.

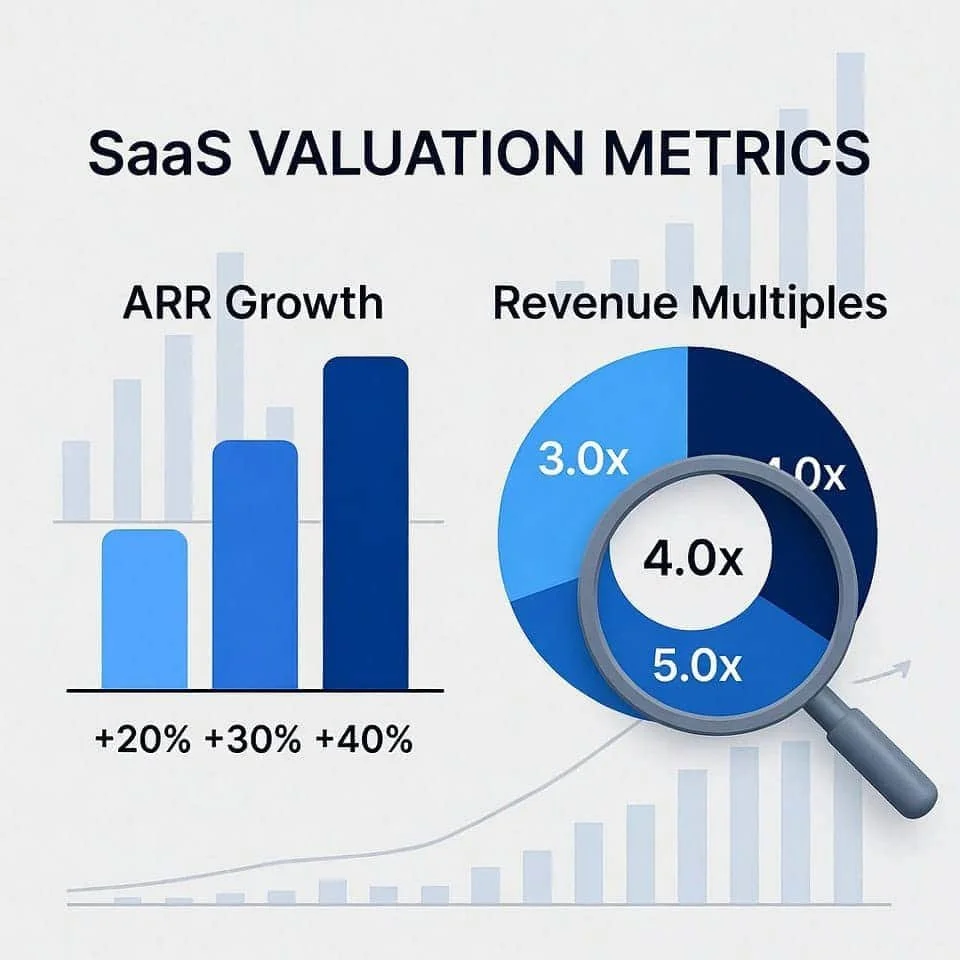

These benchmarks provide a framework for evaluating potential red flags under investor scrutiny. While they offer general guidance, it's important to remember that every business operates within its unique context. For instance, Brad Feld's "40% Rule" for SaaS businesses suggests that the sum of your net burn rate and growth rate should equal at least 40% [49].

Key Insights on Red Flags

Equity splits, for example, often reveal deeper alignment issues. Research shows startups defaulting to a 50/50 equity split without a clear rationale are three times more likely to encounter founder disagreements. As Peter Pham, a seasoned entrepreneur and angel investor, puts it:

"Generally the CEO gets more... the equity should be split based on value creation."[50][51]

Burn rate is another critical area. In 2023, 32% of founders expressed concerns about burning cash too quickly [48]. Additionally, legal non-compliance can be a costly mistake, with potential fines ranging from $500,000 to $5 million.

Context and Patterns Matter

While these guidelines are helpful, the specifics of your business model, industry, and growth stage play a significant role. For example, a startup with rapid customer acquisition might justify a higher burn rate, while a deep-tech company might require more time for validation. However, if a company falls into multiple red zones simultaneously, it creates a pattern that investors are unlikely to overlook. The goal is to recognize where you stand and craft a clear plan to address any concerns before they derail your fundraising efforts.

Conclusion

Early intervention is crucial when it comes to addressing potential obstacles in fundraising. The warning signs we've discussed - team conflicts, weak intellectual property safeguards, lack of market validation, poor financial planning, and missing legal compliance - can heavily influence your chances of securing investment. The solution lies in transparency and taking proactive steps to resolve these issues. As Steve Walsh, Techstars Mentor-in-Residence and Founder of Hands On Angel LLC, aptly states:

"Investors aren't looking for perfection - they're looking for clarity, competence, and potential." [2]

This underscores the importance of tackling challenges head-on. Define clear roles within your team, ensure your intellectual property is protected, validate your market, maintain accurate financial records, and meet all legal requirements. Ignoring these elements can raise doubts, but addressing them shows your commitment to building a solid foundation. As Parker Gilbert, co-founder and CEO of Numeric, advises:

"You never want to be hiding the ball or be perceived as possibly hiding the ball. So, you have to make sure you're being upfront and practical when it comes to informing people about what's going well and not going well." [53]

Being upfront about challenges not only provides clarity but also sets the stage for constructive due diligence. Open communication during this process allows investors to address and resolve any concerns efficiently. Additionally, cultivating relationships outside of formal settings can help reinforce trust and openness.

Ultimately, investors value founders who demonstrate the ability to identify and address issues effectively. By confronting these red flags directly, you showcase not just your problem-solving skills but also your readiness to handle the inevitable hurdles of building a successful company.

FAQs

What steps can startups take to improve team dynamics and avoid leadership issues that concern investors?

Startups can strengthen their team dynamics by prioritizing open communication and promoting regular, constructive feedback. When team members feel safe sharing their ideas and concerns, it fosters trust and makes collaboration smoother and more effective.

Equally important is aligning the team around a shared vision. Ensuring that individual goals connect with the startup's overarching mission not only minimizes conflicts but also creates a sense of unity. Tools like 360-degree feedback can be especially useful for spotting areas that need improvement and refining leadership approaches. Plus, a well-aligned and cohesive team often stands out to potential investors.

How can startups protect their intellectual property to build investor confidence?

Startups can protect their intellectual property (IP) and build investor confidence by taking deliberate steps to secure and manage these valuable assets. Start by identifying and thoroughly documenting all forms of IP, including patents, trademarks, copyrights, and trade secrets. Filing for legal protections - like patents and trademarks - early in the process is key to avoiding disputes down the road.

Beyond legal filings, safeguarding IP requires practical measures. Use confidentiality agreements, train employees on handling sensitive information, and ensure data security protocols and IP assignments are in place. Conduct regular audits of your IP portfolio to spot weaknesses and maintain compliance. Working with experienced IP attorneys can also help you navigate complex legal landscapes and show investors that your approach to protecting your assets is both strategic and solid.

Why is proving market demand important for attracting investors, and how can startups show it effectively?

Why Demonstrating Market Demand Matters

Showing that there’s a real demand for your product is a key step in convincing investors to back your startup. It reassures them that your idea addresses a real problem and has the potential to connect with your target audience. In short, it reduces their risk and boosts their confidence in your ability to turn a profit.

So, how can you prove there’s demand? Start with market research. Tools like surveys, interviews, and pilot programs can help you gather valuable insights into customer needs and pain points. Beyond that, showcasing social proof - whether it’s glowing testimonials, compelling case studies, or even early sales numbers - can go a long way in demonstrating your product’s appeal.

You can also leverage demand-generation strategies to make your case even stronger. Techniques like targeted outreach or content marketing can show how you’re actively engaging potential customers and building momentum. Together, these efforts paint a clear picture of your market fit and growth potential, making your startup an attractive investment opportunity.