ARR Growth vs. Revenue Multiples: Unveiling Their Distinct Roles in SaaS Valuation

Key Takeaways

ARR growth measures internal performance – it's the "engine" showing how well your company executes across sales, retention, and expansion, serving as a leading indicator of future success.

Revenue multiples reflect external perception – they're the "price tag" representing what the market is willing to pay for each dollar of your recurring revenue based on current sentiment.

Higher growth commands higher multiples – companies growing at 100% year-over-year typically receive significantly higher valuations than those growing at 30%, all else being equal.

Quality of growth matters as much as speed – investors scrutinize capital efficiency, Net Revenue Retention above 100%, and gross margins to determine if growth is sustainable and worth a premium multiple.

Strategic priorities shift by stage – early-stage companies should focus on explosive ARR growth to prove product-market fit, while mature companies emphasize predictability, profitability, and cash flow.

The Rule of 40 becomes critical at the growth stage – combining ARR growth rate and profit margin into a single metric helps investors assess balanced performance and long-term scalability.

Master the fundamentals to command premium valuation – focus on acquiring the right customers, driving retention and expansion, and managing capital-efficient growth rather than chasing a target multiple.

Beyond the Buzzwords – Why SaaS Valuation Demands Deeper Understanding

In the dynamic world of Software-as-a-Service (SaaS), valuation is both an art and a science. For founders seeking investment and investors looking for the next breakout star, understanding the financial metrics that define a company's worth is paramount. Two terms that dominate these conversations are Annual Recurring Revenue (ARR) Growth and Revenue Multiples. While often mentioned in the same breath, they are not interchangeable. They represent two fundamentally different, yet deeply interconnected, aspects of a company's story. Mistaking one for the other, or failing to appreciate their distinct roles, can lead to misaligned expectations, flawed strategies, and missed opportunities. This article moves beyond the buzzwords to dissect the unique functions of these two critical metrics, revealing how one measures internal performance and the other reflects external perception.

The Centrality of ARR and Multiples in SaaS Investment

The subscription-based model of SaaS makes traditional valuation methods, like those based on profit or assets, less relevant, especially for high-growth companies that reinvest heavily in expansion. Instead, the focus shifts to the predictability and scalability of revenue. Annual Recurring Revenue (ARR) provides a clear measure of this predictable revenue stream. Investors fixate on ARR because it represents a stable, contractual baseline from which a company can grow. Revenue multiples, in turn, provide a shorthand for valuation by telling us what the market is willing to pay for each dollar of that recurring revenue. Together, these metrics form the bedrock of most SaaS valuation discussions, from seed-stage pitches to late-stage private equity deals.

Why This Distinction Matters for Founders and Investors Alike

For founders, understanding the difference is crucial for strategic planning. Focusing solely on a target multiple without building the underlying growth engine is putting the cart before the horse. Conversely, achieving high growth without understanding how it's perceived by the market can lead to a valuation disconnect during fundraising.

For investors, the distinction is key to risk assessment and opportunity analysis. A high growth rate signals a company with strong product-market fit and operational momentum. A high multiple reflects the market's confidence in that growth continuing, but it also signals a higher price and potentially greater risk if that growth falters.

Article Roadmap: Deciphering the Dynamic Interplay

This article will guide you through a comprehensive exploration of these two foundational concepts. First, we will demystify ARR growth, defining it as the engine of future value and exploring its key drivers. Next, we will unpack revenue multiples, positioning them as a snapshot of the market's current perception. We will then directly compare their distinct roles before examining their powerful interplay—how strong growth fuels and justifies high multiples. Finally, we will outline how strategic priorities shift based on a company's lifecycle and provide an actionable framework for driving valuation success.

Demystifying ARR Growth: The Engine of Future Value

Before a company can be assigned a market value, it must first create intrinsic value. In SaaS, the primary measure of this value creation is the growth of its recurring revenue. ARR growth isn't just a metric; it's the vital sign of a company's health, momentum, and future potential.

What is Annual Recurring Revenue (ARR)?

Annual Recurring Revenue (ARR) is the normalized measure of a company’s recurring revenue components for a single year. It represents the value of the contracted, predictable revenue a company expects to receive from its customers over a twelve-month period. To calculate it, you sum the yearly subscription value from all active customers. ARR specifically excludes one-time fees, such as setup charges or professional services, focusing purely on the repeatable, core subscription revenue that forms the foundation of a SaaS business model. This focus on predictability is what makes it such a prized metric for both internal planning and external investors.

The Crucial Role of ARR in SaaS

ARR's importance stems from its ability to provide a clear, forward-looking view of a company's financial health. Unlike traditional revenue figures that can be skewed by one-off sales, ARR offers a stable baseline. This stability allows a company to forecast future cash flows with greater accuracy, make informed decisions about hiring and investment, and manage its operations more effectively. For investors, ARR is the clearest indicator of a scalable business model. A consistent and growing ARR base demonstrates product-market fit, customer commitment, and a reliable stream of income that can be built upon year after year.

Defining ARR Growth: More Than Just a Number

ARR growth is the rate at which a company's Annual Recurring Revenue is increasing over time, typically measured year-over-year. However, it's far more than a simple percentage. A healthy ARR growth figure is a composite indicator reflecting a company's success across multiple fronts. It encapsulates the ability of the sales and marketing teams to acquire new customers, the product team's capacity to retain existing ones, and the customer success team's effectiveness in expanding relationships through upsells and cross-sells. It is the quantifiable output of a well-executed company strategy.

Why ARR Growth is a Leading Indicator for SaaS Businesses

ARR growth is considered a leading indicator because it signals future success and value, rather than just reporting on past performance. A rapidly growing ARR suggests several positive underlying dynamics:

Strong Product-Market Fit: The product is solving a real problem that customers are willing to pay for on a recurring basis.

Effective Go-to-Market Strategy: The company's sales and marketing engine is successfully capturing its target market.

High Customer Satisfaction and Retention: Customers are seeing value in the product and are not only staying but often increasing their spend over time.

Scalability: The business model has been proven and is capable of expanding efficiently. Investors view strong ARR growth as direct evidence that a company is capturing a significant market opportunity and is on a trajectory to become a category leader.

Key Drivers and Levers for Sustaining High ARR Growth

Sustaining high ARR growth requires a multi-faceted approach focused on three primary levers:

New Customer Acquisition: This is the most straightforward driver, representing the ARR generated from new logos. Success here depends on an efficient customer acquisition model where the lifetime value (LTV) of a customer significantly exceeds the customer acquisition cost (CAC).

Expansion Revenue (Net Revenue Retention): This involves generating more revenue from the existing customer base through upsells (upgrading to a higher-tier plan), cross-sells (adding new products or features), and usage-based increases. Strong expansion revenue, leading to a Net Revenue Retention (NRR) rate over 100%, is a powerful sign of a "sticky" product and a healthy business.

Minimizing Churn: Churn, the rate at which customers cancel their subscriptions, is the direct antagonist to ARR growth. Minimizing both customer churn (logo churn) and revenue churn (ARR lost) is critical. High retention is the foundation upon which all other growth is built.

Pro tip: Based on our experience investing in dozens of software startups at Allied Venture Partners, SaaS investors prefer companies with:

CAC-to-LTV ratio of at least 3-to-1

NRR above 105%

Monthly churn rate below 2%

Understanding Revenue Multiples: A Snapshot of Current Market Perception

If ARR growth is the measure of a company's internal performance, the revenue multiple is the market's external judgment of that performance and its future prospects. It’s a shorthand metric that translates a company's revenue into a potential valuation.

What are Revenue Multiples in SaaS Valuation?

A revenue multiple is a valuation metric that compares a company's enterprise value (or equity value) to its revenue. In SaaS, the most common variation is the Enterprise Value-to-ARR (EV/ARR) multiple. The formula is simple: Valuation = ARR x Multiple.

For example, a SaaS company with $10 million in ARR that is assigned a 12x multiple would have an enterprise value of $120 million. This multiple is not an arbitrary number; it’s a reflection of what investors are willing to pay for each dollar of the company's annual recurring revenue.

Why Revenue Multiples are Widely Used in the SaaS Industry

Revenue multiples have become the standard in SaaS for a simple reason: profit is often a poor indicator of value for high-growth companies. Many of the most promising SaaS businesses are not profitable in their early and growth stages because they are aggressively reinvesting capital into product development, sales, and marketing to capture market share. Focusing on revenue, particularly predictable recurring revenue, allows investors to value these companies based on their traction, market position, and future growth potential, rather than near-term profitability. This aligns valuation with the long-term, scalable nature of the SaaS model.

Factors Influencing Revenue Multiples

The multiple a company can command is not static; it’s influenced by a host of quantitative and qualitative factors. While the market sets a general range, a specific company’s multiple is determined by its unique profile. Key factors include:

ARR Growth Rate: This is the single most significant driver. Higher, more sustainable growth rates command premium multiples (source: Adams Street Partners).

Gross Margin: High gross margins (typically 75%+) indicate an efficient, scalable business model and contribute to higher multiples.

Net Revenue Retention (NRR): An NRR over 100% shows the company is growing even without adding new customers, a highly valued trait.

Total Addressable Market (TAM): A large and growing market provides a longer runway for growth, justifying a higher valuation.

Capital Efficiency: How effectively a company uses its investment to generate new ARR (e.g., CAC payback period) influences investor confidence.

Competitive Landscape: A strong defensible position or "moat" in a less crowded market can boost a multiple.

Market Sentiment: Broader economic conditions and investor appetite for risk heavily influence the range of multiples across the entire SaaS market.

The Snapshot Nature of Revenue Multiples: Reflecting Current Sentiment

It is critical to understand that a revenue multiple is a point-in-time assessment. It reflects the market's sentiment and expectations today. When the market is bullish and capital is abundant, multiples expand across the board. Conversely, during economic downturns or periods of uncertainty, multiples contract, even for strong companies. This means a company's valuation can change without any change in its underlying performance. This is why focusing solely on the multiple is a flawed strategy; it’s an outcome dictated by both internal performance and external forces beyond a company's control.

The Distinct Roles: Growth as Potential, Multiples as Present Value

Understanding ARR growth and revenue multiples individually is foundational. The real strategic insight, however, comes from appreciating their distinct and complementary roles in the valuation equation. One is the story of what the company is doing; the other is the market's verdict on what that story is worth.

ARR Growth: The Story of Potential and Trajectory

ARR growth is the narrative of a company's momentum. It is a direct, internal measure of operational execution. It answers fundamental questions:

Is the product resonating with the market?

Can the sales team close deals?

Are customers happy and expanding their usage?

A strong growth rate provides tangible proof of traction and paints a clear picture of the company's trajectory. For an investor, a compelling ARR growth story reduces risk by demonstrating that the business model works and is scalable. It is the evidence that transforms a founder’s vision into a quantifiable, investable reality.

Revenue Multiples: The Market's Current Assessment of Value

If ARR growth is the story, the revenue multiple is the price the audience is willing to pay to be a part of it. The multiple is an external assessment, a market-driven consensus that synthesizes all available information about the company—its growth, efficiency, market, and team—and benchmarks it against its peers and prevailing economic conditions. It reflects the collective belief in the company’s ability to not only sustain its current trajectory but also to eventually generate significant cash flow and profits. It's the market's way of placing a present value on future potential.

Analogy: The Seedling vs. The Market Price Tag

A simple analogy can clarify this distinction. Think of ARR growth as the health and vigor of a seedling. A botanist can measure its growth rate, the strength of its roots (retention), and its ability to sprout new leaves (new customers). These are intrinsic, measurable signs of health and potential. This is the company's internal reality.

The revenue multiple, on the other hand, is the price tag for that seedling at a rare plant auction. The price will be heavily influenced by the seedling's measured growth, but it will also depend on other factors: the current market demand for that specific type of plant (market trends), the perceived size of the tree it could become (TAM), and the number of other bidders in the room (investor appetite). The seedling’s health is the foundation, but the final price is set by the market.

The Interplay: How ARR Growth Fuels and Justifies Multiples

ARR growth and revenue multiples are not independent variables; they exist in a dynamic, causal relationship. Strong operational performance, measured by ARR growth, is the primary fuel that ignites investor interest and justifies a premium valuation multiple.

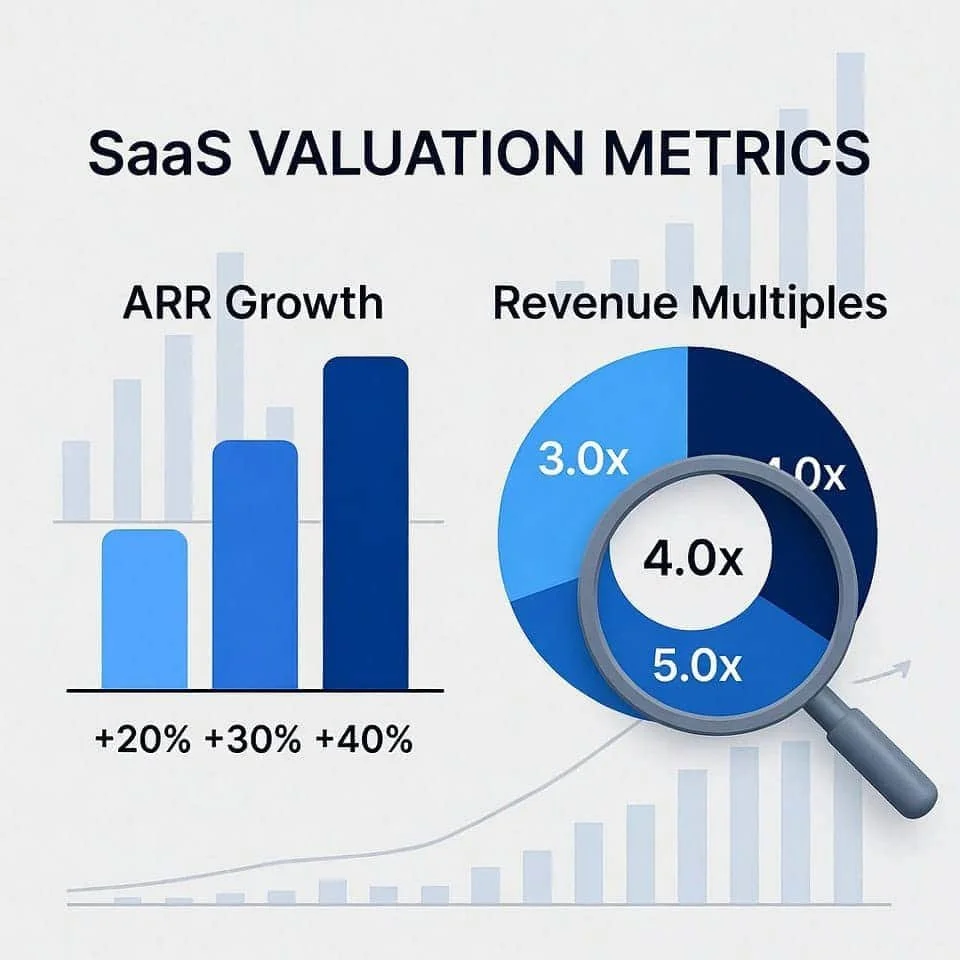

The Direct Correlation: Higher ARR Growth Often Commands Higher Multiples

The most direct link between the two metrics is correlation. All else being equal, a company growing at 100% year-over-year will command a significantly higher revenue multiple than a similar company growing at 30% (source: Acquire.com). This premium exists because high growth is the clearest signal of future value creation. Investors are willing to pay more today for a dollar of revenue that is rapidly compounding, as it has a much shorter path to becoming ten or a hundred dollars of revenue in the future. This growth premium is the cornerstone of venture capital and growth equity investment theses.

The Quality of Growth Matters: Beyond Just the Percentage

However, the market is sophisticated enough to look beyond the headline growth number. The quality and sustainability of the ARR growth profoundly impact the multiple. Investors will scrutinize the underlying metrics to determine if the growth is healthy:

Capital Efficiency: Is the growth being bought at an unsustainable cost? A low burn multiple and CAC payback period suggest efficient growth, which is valued more highly.

Net Revenue Retention: Growth driven by existing customer expansion (NRR > 120%) is considered higher quality than growth solely from new, and often expensive, customer acquisition.

Gross Margins: Growth that comes with healthy gross margins is more valuable because it demonstrates a clear path to future profitability. Two companies with the same 70% ARR growth rate can receive vastly different multiples based on the quality and efficiency of that growth.

Crafting the Narrative: How a Compelling Growth Story Influences Valuation

Valuation is not just a spreadsheet exercise; it’s about storytelling. A company must craft a compelling narrative around its financials to achieve a premium multiple. This narrative connects the "what" (the ARR growth number) with the "why" (the unique product, massive market opportunity, and exceptional team). A founder who can clearly articulate how their company's growth is a result of a durable competitive advantage and a scalable go-to-market strategy can inspire greater confidence. This confidence translates directly into an investor's willingness to assign a higher multiple, as they are buying into not just the current numbers but the long-term vision.

External Modulators: Market Conditions and Investor Appetite

Finally, the relationship is modulated by external market forces. In a bull market with low interest rates, investor appetite for growth stocks is high, and capital is plentiful. This environment inflates multiples across the entire SaaS sector. A rising tide lifts all boats, and strong growth is rewarded with exceptionally high multiples. Conversely, in a bear market, investor sentiment shifts towards safety and profitability. Multiples contract, and even companies with strong growth may see their valuations moderated. This underscores that while a company controls its ARR growth, its multiple is always subject to the whims of the broader market.

Strategic Prioritization: When to Emphasize One Over the Other

The strategic focus for a SaaS company evolves as it matures. The relative importance of demonstrating raw ARR growth versus optimizing for a higher multiple shifts depending on the company's stage.

Early-Stage Companies (Seed to Series A): The Primacy of Explosive ARR Growth

For early-stage companies, the single most important objective is to prove product-market fit and demonstrate a scalable model. At this stage, valuation is almost entirely a function of trajectory and potential. Investors are betting on the team and the market, and the most convincing evidence is explosive ARR growth. The focus should be on acquiring new customers and validating the core value proposition. While metrics like churn and capital efficiency are important, they are secondary to demonstrating a steep growth curve. The primary goal is to create a compelling growth story that signals a massive opportunity, even if the path to profitability is not yet clear.

Growth-Stage Companies (Series B to D+): Balancing Growth with Efficiency

As a company enters the growth stage, the goalposts shift. While high ARR growth remains critical, investors now expect it to be paired with increasing operational efficiency. The narrative moves from "can this grow?" to "can this grow efficiently and predictably?" Metrics like the Rule of 40 (where ARR growth rate + profit margin should exceed 40%) become benchmarks for balanced performance. Companies in this phase must demonstrate not only top-line growth but also improving unit economics, high net revenue retention, and a clear path to profitability. The focus is on building a durable growth engine that can scale without burning excessive capital, thereby justifying a strong, stable multiple.

Mature SaaS Companies: Value Shifts to Predictability, Profitability, and Cash Flow

For mature, often public, SaaS companies, the emphasis shifts again. While growth is still valued, its pace naturally slows. Here, predictability, profitability, and free cash flow generation become the primary drivers of value. Investors are looking for a stable, market-leading company that can consistently deliver results. The revenue multiple may be lower than in hyper-growth stages, but it's supported by a solid foundation of profits and durable revenue streams. The focus is on operational excellence, maximizing customer lifetime value, and returning capital to shareholders, proving the long-term viability of the business model.

Actionable Framework for Driving Valuation Success

Understanding the distinct roles of ARR growth and revenue multiples is the first step; applying that knowledge is what creates value. For founders and leadership teams, the goal is to build a business that excels internally (driving ARR growth) in a way that is rewarded externally (commanding a high multiple).

This requires a holistic approach:

Obsess Over the Growth Engine: Make ARR growth the company's North Star. Instrument your business to track its core drivers—new bookings, expansion, and churn—in real-time. Empower your product, sales, and customer success teams with the resources they need to acquire, retain, and grow customer accounts.

Focus on Quality, Not Just Speed: Look beyond the headline growth rate. Invest in initiatives that improve Net Revenue Retention, as this is the most efficient form of growth. Monitor and optimize your Customer Acquisition Cost to ensure your growth is sustainable and capital-efficient.

Build the Narrative in Parallel: Don't wait for a fundraising round to think about your story. Continuously articulate your vision, your market opportunity, and your competitive moat. Use your strong growth and efficiency metrics as the "proof points" that validate your compelling narrative.

Understand the Market Context: Stay informed about the broader market environment and current valuation trends. Know where the bar is set for companies at your stage. This allows you to set realistic expectations and position your company effectively when speaking with investors.

By focusing on building a fundamentally strong business defined by high-quality ARR growth, you create the undeniable evidence that justifies a premium market valuation. The multiple is not the goal; it is the outcome of excellence.

Summary: ARR Growth vs. Revenue Multiples – Key Differences

In the complex calculus of SaaS valuation, ARR growth and revenue multiples serve as the two indispensable coordinates. ARR growth is the measure of a company’s intrinsic health and operational velocity—it is the engine. Revenue multiples are the market’s extrinsic assessment of that engine’s power and future potential—it is the price tag. Confusing the two is like confusing the speed of a car with its sticker price.

The ultimate takeaway for founders and investors is that these metrics are locked in a symbiotic relationship. A powerful, efficient, and accelerating growth engine is the most potent force for creating a premium valuation. By focusing relentlessly on the levers of sustainable ARR growth—acquiring the right customers, delivering immense value to drive retention and expansion, and managing growth with capital efficiency—a company provides the market with an irrefutable case for a higher multiple. The journey to a successful valuation is not about chasing a specific multiple, but about building a business whose performance commands it. Master the engine, and the market will reward you with the price.

Frequently Asked Questions (FAQ)

Why do investors place so much emphasis on the Rule of 40 when evaluating a SaaS startup?

The Rule of 40 matters because it blends revenue growth and profitability into a single score of financial health. A SaaS startup that consistently meets or exceeds the Rule of 40 demonstrates balanced execution across core metrics, healthy unit economics, efficient spending, and durable growth potential. Investors also use the Rule of 40 to compare companies across varying company size, market conditions, and industry benchmarks, especially when analyzing private companies where fiscal revenues and other financials may not be publicly disclosed. Because many subscription-based businesses reinvest heavily into growth, the Rule of 40 provides a quick lens into long-term scalability and the likelihood of maintaining strong financial health and long-term health.

How do revenue multiples differ from ARR growth when valuing early-stage companies?

ARR growth reflects internal traction and the effectiveness of subscription models, while valuation multiples reflect external perception. High ARR growth demonstrates momentum, but valuation multiples capture how strongly the market rewards that performance. For early-stage companies, ARR growth often matters more because they are still proving market fit, while multiples (including EV/ARR growth-adjusted, growth-adjusted multiple, P/ARR, and sales-based valuation approaches) become more relevant as the startup matures. Investors compare a company’s ARR growth, total revenue, annual revenue, churn rate, quality of contracts, and subscription contracts against market data to determine an appropriate multiple for startup valuation.

What role do financials and unit economics play in SaaS valuation?

Strong financials, paired with solid unit economics, help investors assess sustainability and efficiency. Key areas include gross profit, EBITDA margin, customer retention, monthly recurring revenue, profitability, profitability metrics, and the balance of subscription fees versus one-time charges. For SaaS subscription-based businesses, reliable monthly recurring revenue and sticky customer retention reduce risk and support higher valuation multiple outcomes. Healthy financials also reinforce confidence in funding decisions and help investors evaluate the management team, cost discipline, growth initiatives, and the ability to compound value over time.

How do subscription models and contracts influence revenue multiples?

The strength of a company’s subscription engine directly impacts revenue growth, predictability, and valuation. Investors examine contracts, renewal patterns, subscription contracts, payment options, subscription fees, and expansion potential within the customer base. Highly predictable contracts and high-quality retention justify stronger revenue growth expectations and thus higher valuation multiples. Companies with long-term contracts, low churn rate, and high customer retention are perceived as lower risk. This predictability translates into higher market capitalization, stronger enterprise value, and premium multiples, especially when combined with compelling ARR trends, efficient unit economics, and durable growth trends.

Why is cohort-based ARR important for valuing subscription businesses?

Cohort-based ARR reveals how different groups of customers behave over time, making it essential for understanding customer retention, expansion, and growth potential. Investors use cohort-based ARR and the cohort-based ARR multiple to measure the quality of recurring revenue by tracking how cohorts expand or contract after initial conversion. Strong cohort-based ARR demonstrates durable value, supports premium valuation multiples, and highlights efficient consulting projects, upsell motion, product-led growth, and long-term subscription strength. Modern SaaS investors increasingly rely on cohort-based ARR to evaluate AI startups, companies facing potential market saturation, or those serving a fragmented long tail of customers.

How do revenue multiples incorporate EBITDA margin, EV/EBITDA, and EV/Gross Profit multiple?

Multiples vary depending on what part of the business investors want to assess. Growth-focused investors look at valuation multiples like EV/ARR or the cohort-based ARR multiple, while efficiency-oriented investors may emphasize EBITDA margin, the EV/EBITDA multiple, or the EV/Gross Profit multiple. As a company matures, improving EBITDA margin plays a larger role in valuation because it shows a clear path to sustained profitability. Combined with ARR growth and contract durability, these metrics contribute to a coherent valuation method and directly influence market capitalization and enterprise value.

What impact do one-time charges and fiscal revenues have on startup valuation?

Although SaaS valuation focuses heavily on recurring subscription revenue, investors still adjust financials for one-time charges to understand true operating performance. One-time charges such as restructuring costs, unusual consulting projects, or non-recurring legal fees may inflate or depress reported results. When analyzing fiscal revenues, investors strip out distortions and focus on annual revenue, total revenue, and ARR quality. A startup with stable contracts, predictable cash flow, and limited one-time charges typically earns a higher valuation multiple and stronger outcomes in investment decisions.

How do market conditions affect valuation multiples and revenue expectations?

Shifts in market conditions influence investor sentiment and the range of acceptable valuation multiples. During bullish markets—especially for SaaS or AI startups—multiples expand; in tougher markets, even companies with excellent financials may see multiples compress. Investors will assess market data, growth trends, market capitalization, liquidity conditions, and prevailing industry benchmarks. Companies demonstrating strong Rule of 40 performance, resilient contracts, superior customer retention, and efficient unit economics tend to maintain higher multiples despite fluctuations.

Why is customer retention crucial for both ARR growth and valuation?

High customer retention strengthens ARR stability, fuels expansion, and improves revenue growth predictability. It also reduces churn rate, supports long-term health, and elevates confidence in the company’s financial health. Strong retention in existing contracts and new subscription contracts often produces exceptional cohort-based ARR performance. Investors see this as a sign that the management team has built a defensible product with low switching risk, making the business more attractive for funding and supporting premium valuation methods such as EV/ARR or growth-adjusted multiple frameworks.

How do startups demonstrate growth potential when raising funding?

A startup demonstrates growth potential by showing accelerating ARR, improving ARR trends, efficient unit economics, sticky contracts, a growing customer base, disciplined financials, and strong Rule of 40 performance. Presenting clear charts, customer insights, and customer feedback helps the user or investor understand momentum and validate the narrative. Additionally, showcasing diversified payment options, thoughtful growth initiatives, and sustainable profitability signals readiness for long-term scale. Strong fundamentals and credible storytelling support better startup valuation outcomes across both early and later funding rounds.