How Long Does Fundraising Actually Take in Canada?

Fundraising for startups is a long process, often taking 6–9 months. Here’s what you need to know about the timeline and how to prepare:

Start Early: Begin at least 6 months before you run out of cash. Preparation is key.

Three Phases of Fundraising:

Preparation (6–12 weeks): Develop your pitch, financial models, and legal documents.

Outreach & Pitching (12–16 weeks): Build relationships, pitch investors, and secure interest.

Due Diligence & Closing (8–12 weeks): Finalize legal and financial reviews, and close the deal.

Canadian Challenges: Time zone differences, compliance with Canadian laws, and slower investor timelines make early planning essential.

Key Factors Affecting Timelines:

Investor location and industry specifics (e.g., SaaS vs. biotech).

Organized documentation and compliance can speed things up.

Tips to Speed Up Fundraising:

Use syndication platforms to pool investors.

Run tasks in parallel (e.g., outreach and legal prep).

Maintain clear, consistent communication with investors.

Quick Overview of Timelines:

Start small with non-dilutive funding (grants, loans) and build relationships early to streamline future rounds. Fundraising takes time, so plan strategically to keep your business moving forward before you’re out of runway.

Startup Fundraising Secrets: Timelines and Milestones

The 3 Main Fundraising Phases

Breaking fundraising into distinct phases helps Canadian founders set achievable timelines. Each phase comes with its own hurdles, requirements, and timeframes that can shape your overall strategy.

Preparation Stage (6–12 Weeks)

The preparation phase lays the groundwork for a smoother fundraising process [2]. During this stage, you'll focus on developing financial models, crafting a compelling pitch deck, and identifying the right investors for your startup.

Your financial model should include realistic projections, factoring in R&D credits. It's also wise to research investors who align with your industry, company size, and growth stage. Using cloud accounting can simplify record-keeping, while conducting a legal audit (if applicable) ensures compliance with Canadian regulations [5].

Once these essentials are in place, begin targeted outreach to start building relationships with potential investors.

Outreach and Pitching (12–16 Weeks)

This phase often takes the most time and effort. It involves reaching out to investors, securing introductions, and delivering pitches. Canadian founders should connect with both local angel networks and international venture capitalists (VCs), keeping in mind that response times can vary.

Patrick Racine from Chillskyn, a Montreal-based startup, advises:

Start engaging investors earlier - even before actively raising. [3]

Building relationships ahead of time creates momentum when you're ready to pitch. Timing is also key, as Wayne McIntyre from Montreal-based Relocalize explains:

Use traction and execution. We always raise after achieving a significant milestone or new value-creating event. [3]

Clear communication is crucial during this stage. Jennifer Cote from Montreal-based Opalia highlights:

Investment is about partnerships. You have to be open to feedback and willing to adapt. [3]

Canadian founders should emphasize commercial traction and unit economics over purely technological achievements. As Patrick Racine puts it:

Focus on how your business makes money - unit economics matter. [3]

Angel networks tend to move quicker than institutional VCs, which may take weeks between the initial pitch and follow-ups. Once you’ve secured interest, the focus shifts to the due diligence and closing phase.

Due Diligence and Closing (8–12 Weeks)

The final phase centres on thorough legal and financial reviews under Canadian securities regulations. Being well-prepared can prevent delays that might derail your progress.

Amanda Truscott from Rithmik notes:

Investors can be pretty exacting in terms of information requirements. [3]

To streamline this process, organize all company information in a central location, such as a virtual data room or Google Drive [5]. Ensure you have documentation for IP ownership, up-to-date financials, and compliance records.

Carefully review investment and shareholder agreements with a qualified lawyer. As PwC advises:

Carefully go through the shareholder agreement with a lawyer that has expertise in startup fundraising, as it is critical that founders clearly understand every single clause of the agreement. [4]

Regular updates to investors, such as monthly reports, can help maintain momentum.

Pro tip: Keep a folder in your data room with all prior investor updates. As Mark Suster says, investors invest in lines, not dots. By providing prior investor updates, new investors can easily plot and connect the dots, streamlining your fundraising process.

To avoid common issues like disorganized records, inaccurate financial data, or poor communication, Canadian founders should prepare for due diligence calls early and keep legal documents readily accessible. Staying organized can help ensure this phase stays within the typical 8–12 week timeframe [5].

Each phase builds on the previous one, creating a structured and efficient path for Canadian startups to secure funding.

What Affects Fundraising Timelines

Several factors can shape how long it takes for a Canadian startup to secure funding. Knowing these variables can help founders plan better and sidestep common delays.

Investor Location and Time Zones

Geography plays a big role in fundraising, especially for Canadian startups looking to attract international investors. Time zone differences can slow communication, particularly when reaching out to hubs like Silicon Valley or London. For instance, coordinating calls between Toronto and Silicon Valley can be tricky, while startups based in Vancouver may find it easier to connect with West Coast investors. On top of that, cultural differences can make building trust a slower process.

To navigate these challenges, Canadian founders should tailor their messaging to emphasize local market strengths, regulatory benefits, and unique economic opportunities. It’s worth noting that cross-border investments are becoming more common, especially since Covid. However, geography isn’t the only factor; your industry can also heavily influence your fundraising timeline.

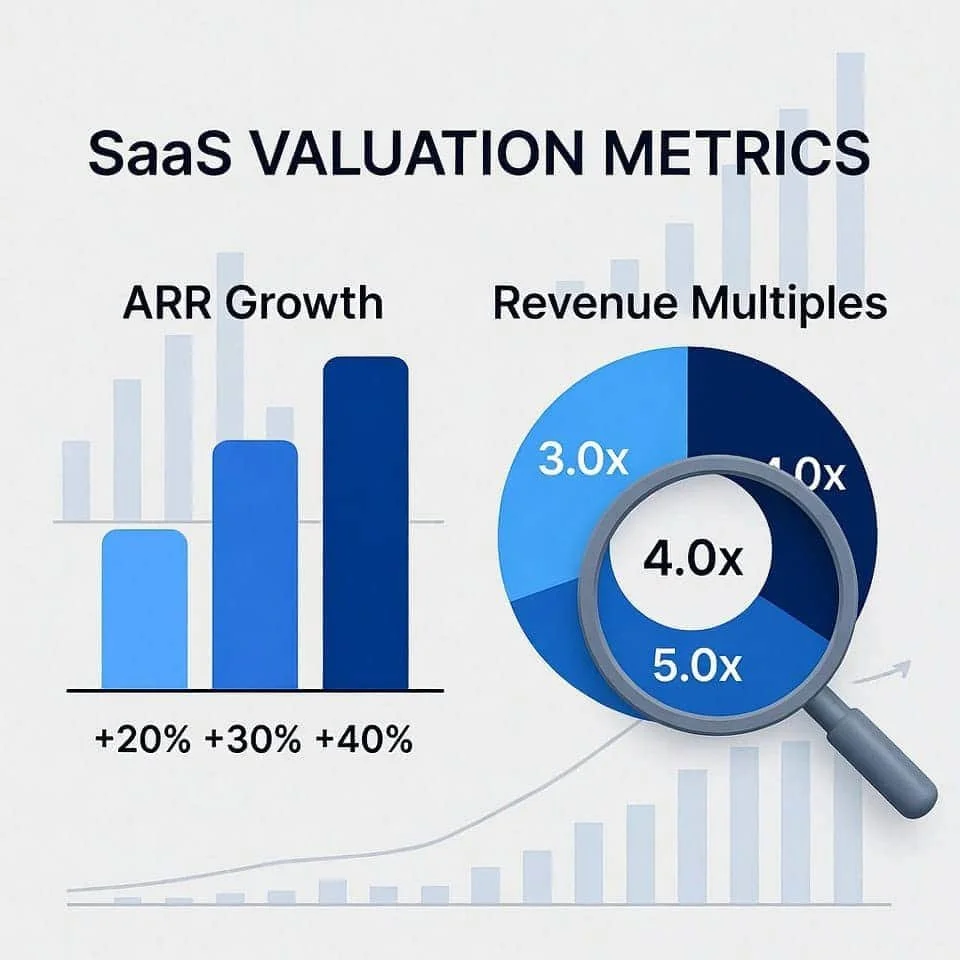

Industry-Specific Differences

The type of industry you’re in can either speed up or slow down the fundraising process. For example, deep-tech startups often face extended technical diligence, while SaaS companies may find it easier to align with investor expertise. In Canada, 67% of all venture capital raised over the past decade has come from generalist funds [1], which often favour SaaS and tech startups due to their straightforward business models.

On the other hand, industries like life sciences and biotech typically require longer timelines. These sectors demand thorough reviews of regulatory compliance, clinical data, and intellectual property. Jenny Fielding, GP at Everywhere Ventures, explains:

"It's no longer unusual to raise for 24-30 months of runway. Investors want to fortify companies so they can survive volatility." [6]

This increased level of scrutiny means founders must demonstrate solid fundamentals, regardless of their industry. Having the right documentation and a clear strategy becomes even more critical in these cases.

Document Preparation and Compliance

Well-organized documentation can make or break your fundraising timeline. Canadian startups must comply with key regulations, including the Charities Accounting Act, Charitable Gifts Act, Competition Act, Income Tax Act, and the Personal Information Protection and Electronic Documents Act (PIPEDA), which governs how donor and investor information is handled.

Having prepared agreements, up-to-date financial statements, and neatly organized intellectual property records can keep the process moving smoothly. On the flip side, scrambling to put these documents together at the last minute can lead to major delays. Brian Hollins from Collide Capital highlights the importance of being prepared:

"You need to show you can execute on milestones quarter over quarter. Investors are looking for teams that can achieve repeatable results in a less forgiving fundraising environment." [6]

This is especially critical in today’s environment. In 2023, Canadian venture capital funding dropped by 76% compared to the previous year [1], leading to heightened scrutiny from investors. By investing time in thorough document preparation and ensuring compliance, startups can keep the momentum going during key negotiations.

How to Speed Up Fundraising

For Canadian founders looking to raise funds, preparation is key - but speed matters too. By using the right tools, running efficient processes, and keeping communication sharp, founders can significantly shorten their fundraising timelines.

Using Syndication Platforms

Syndication platforms simplify the fundraising process by grouping multiple investors into a single entry on the cap table. This not only reduces administrative headaches but also opens the door to a wider network of potential supporters.

For example, at Allied, our special Purpose Vehicle (SPV) model connects Canadian startups with over 2,000 angels and VCs globally. By pooling investors into a single syndicate, we’ve helped startups close funding rounds in as little as one week.

Another example, back in 2014, Zach Coelius organized a $100,000 syndicate on AngelList to support Cruise Automation during their $12.5 million Series A round. Fast forward, Cruise Automation was acquired by GM for CA$1 billion, showcasing how syndication can simplify fundraising while delivering big results.

Running Processes in Parallel

One way to cut down fundraising time is by tackling multiple tasks at once instead of handling them one by one. This approach avoids unnecessary delays and builds momentum.

A proven strategy is to schedule introductory calls with investors within a concentrated 1–2 week window. This creates a sense of urgency and encourages competitive dynamics. For instance, a Grand Ventures portfolio company managed to secure five term sheets in just one week, followed by four more in ten days. This allowed them to negotiate from a position of strength and choose their ideal lead investor.

To make this work, founders must be well-prepared to run a tight-knit process. This includes setting up data rooms, completing legal reviews, refining pitch decks, and engaging their Board of Directors, all at the same time. As Abraham Lincoln famously said:

Give me six hours to chop down a tree, and I will spend the first four sharpening the axe. [8]

The same principle applies here - investing time upfront to organize materials and qualify investors can make the active fundraising phase much smoother and faster.

Maintaining Investor Communication

Clear and consistent communication is a game-changer during fundraising. Startups that regularly update their investors are 45% more likely to secure follow-on funding. Plus, those with strong communication strategies during a raise are 60% more likely to hit their funding targets [11].

The trick is to keep communications frequent but concise. Many successful founders send one-page email updates to share progress and milestones with their network [9]. These updates help build trust and keep the company top-of-mind for investors.

Transparency is critical, especially when challenges arise. Brendan Fitzgerald, a seasoned entrepreneur, emphasizes:

You don't want investors finding out that your company is doing badly on social media. You have to keep communication constant, and the corollary to that is you always have to be accessible, within reason. [10]

Using technology can take communication to the next level. CRM tools can help track investor interactions, personalize outreach, and measure engagement. Startups that tailor their communications see a 35% boost in investor interest, and those incorporating multimedia content (such as graphs and charts) report 77% higher engagement compared to text-only updates [11].

Camila Noordeloos, Venture Capital Manager at Grand Ventures, sums it up well:

Fundraising is hard, but a strong plan can make it more manageable - and much more successful. Leverage your network, keep your Board engaged, and stay disciplined. [8]

On average, fundraising rounds take three to six months, but with the right strategies, some founders can close in just two months [9]. By combining syndication platforms, parallel processes, and effective communication, Canadian startups can not only speed up their fundraising but also build lasting relationships with investors along the way.

Planning Your Fundraising Timeline

Creating a practical fundraising timeline takes careful thought and preparation. For many Canadian startups, this process usually stretches over three to six months.

Start by exploring non-dilutive funding options like grants, tax incentives, or low-interest loans before seeking venture capital. As Laith Shukri, Director of Early Stage Banking at RBCx, points out:

There is no right or wrong when it comes to financing your startup, but you need to be strategic about it because the impact is long lasting. Choices you make today are going to impact tomorrow. [12]

This approach helps you secure funding without immediately giving up equity in your company.

Building relationships early on is another key step. Regular monthly or quarterly updates to potential investors can help establish trust and familiarity. Daniel Powell, Co-founder of Spark Biomedical, shared his experience:

What I should have done is introduced myself to every VC possible over the course of a year, put them on a mailing list, given them regular updates every quarter, become familiar like an everyday brand that they're watching. [14]

Developing these connections over time creates a strong foundation for future funding opportunities.

Canadian founders face some unique hurdles, particularly a slower-moving investment landscape. Corey Ellis, Chief Executive of The Growcer Inc, explains:

Because Canada is a smaller market, the Canadian investor scene is just much, much slower moving, and as an entrepreneur, time is really the currency. It's less about money and it's more about speed of execution. [15]

This highlights the importance of carefully planning your timeline to account for these challenges.

When preparing to approach investors, tailor your documentation - financials, business plans, and fund allocation - to meet the specific needs of your target audience. Research potential investors to ensure their interests align with your goals, and avoid reaching out to those who have already backed your competitors.

Another important factor is the age of the venture capital fund. As Laith Shukri advises, understanding where a fund stands in its lifecycle can help you determine whether they have the capacity to invest [12].

Plan for a runway of 18 to 24 months from your funding round. This gives you enough time to achieve key milestones and prepare for your next round of funding. Fundraising is time-intensive, so integrating it into your broader strategy is essential to keep your business moving forward.

Finally, set realistic expectations for the Canadian market. Start small, focusing on initial rounds from friends, family, and angel investors under founder-friendly terms (like a standard YC SAFE). Use this phase to build traction before approaching larger institutional investors [16]. This step-by-step approach is often more achievable than aiming for a large Series A without demonstrating market validation. By taking it one phase at a time, you can position your startup for steady and sustainable growth.

FAQs

How can Canadian startups navigate challenges in a slower investment landscape when fundraising?

Canadian startups can navigate a slower investment climate by focusing on a few smart strategies. One of the most important steps is building strong relationships with investors (before you need them). Attend networking events, industry meetups, and pitch competitions to boost your startup's visibility and earn trust within the investor community.

Another valuable resource is government funding programs, such as the Scientific Research and Experimental Development (SR&ED) tax incentive. These programs not only provide additional financial support but also enhance your credibility when presenting to potential investors.

It's also crucial to refine your pitch and business model. Highlight your startup’s value proposition, market potential, and growth plans in a clear and compelling way to stand out in the crowd. By combining these approaches, Canadian startups can improve their chances of thriving, even in a tough fundraising landscape.

How can Canadian startup founders handle time zone differences and remote investors during fundraising?

Tackle time zone hurdles and build strong relationships with remote investors by using smart communication strategies and the right tech tools. A good starting point is scheduling meetings at times that work well for both parties, keeping both your local time zone and your investors' in mind. Consistently sharing updates and scheduling regular check-ins can also go a long way in maintaining clear communication and keeping investors engaged during the fundraising journey.

Tools like video conferencing platforms and shared document systems can make collaboration smoother and help close the distance between you and your investors. By staying proactive, organized, and adaptable, you can effectively manage time zone differences and create meaningful connections with investors, no matter how far apart you are.

What key documents and compliance steps should Canadian startups focus on to streamline due diligence and close their funding rounds?

To make due diligence seamless and keep the closing phase on track, focus on organizing key documents and ensuring compliance with regulations. Begin by preparing current financial statements, including balance sheets, income statements, and cash flow statements for the past three months or quarters (depending on the age of your company). Equally important is keeping all legal documents in order, such as incorporation papers, bylaws, contracts, and agreements.

Take stock of your intellectual property assets, including patents, trademarks, copyrights, and any related IP assignment agreements. Double-check that you're meeting industry-specific regulations and that your tax filings align with Canada Revenue Agency (CRA) standards. Additionally, compile all employee agreements, like contracts, NDAs, and non-compete clauses, and ensure your operational documents, such as customer and supplier contracts, are properly organized. These steps can enhance investor trust and help speed up your fundraising journey.