7 Mistakes Founders Make During Series A

Key Takeaways: Avoid these 7 common mistakes during Series A funding to increase your chances of success

Unrealistic Valuations: Overpricing your company can lead to down rounds and hurt future fundraising.

Weak Unit Economics: Failing to demonstrate profitability per customer undermines investor confidence.

Poor Customer Acquisition Plans: Investors need proof of scalable, repeatable acquisition strategies.

Targeting the Wrong Investors: Pitch to investors aligned with your industry, stage, and vision.

Overcomplicated Pitch Decks: Keep it concise; 10–13 slides with clear, compelling data.

Insufficient Market Proof: Show traction, customer validation, and strong market research.

Ignoring Future Funding Impacts: Negotiate terms that support long-term growth and future rounds.

Quick Overview Table

Avoiding these pitfalls can streamline your Series A process and set your company up for sustainable growth.

We Raised a $10M Series A | Funding Mistakes

1. Setting Unrealistic Company Valuations

Overpricing your company during a Series A round is a mistake many founders make. While a high valuation might seem like a win, it can create long-term challenges that are tough to overcome.

One major issue is relying on outdated or overly optimistic data. Founders often look at selective success stories or base their valuations on hopeful projections rather than solid, up-to-date market research. This approach can lead to unrealistic expectations and ultimately harm the business.

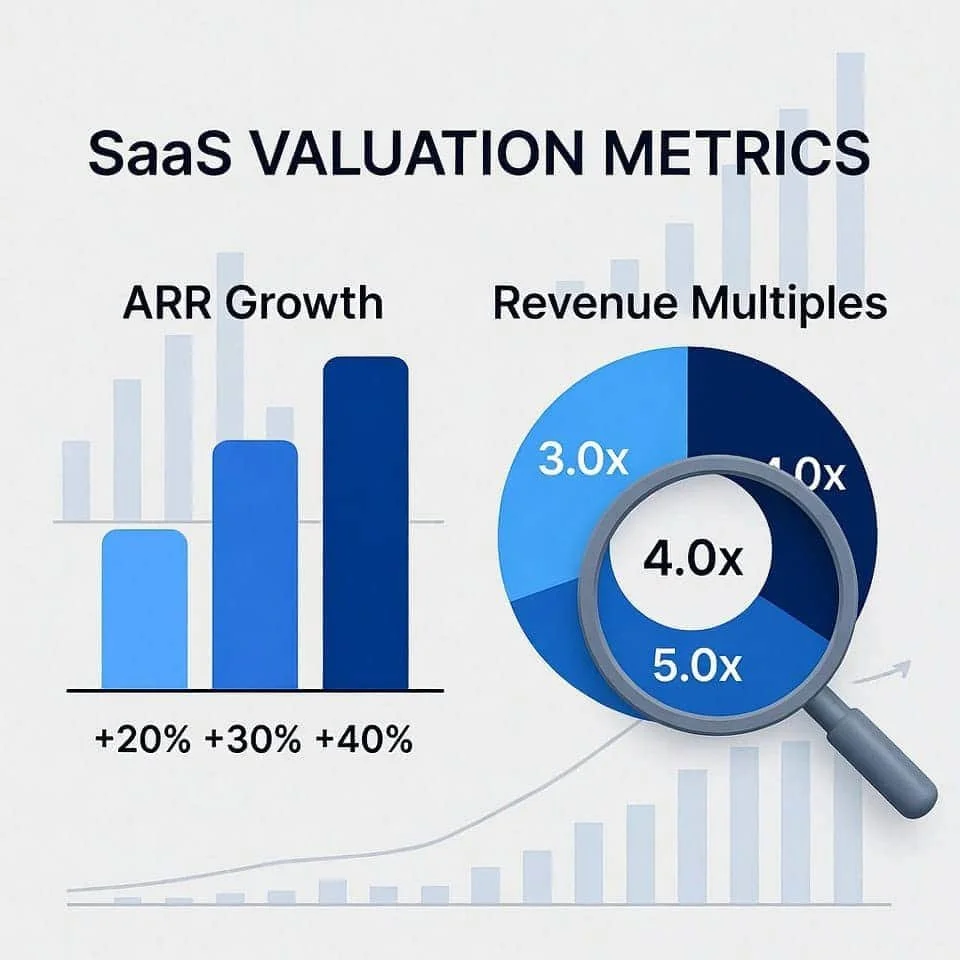

Here’s a look at typical Series A valuation ranges for 2025:

These benchmarks show how overvaluation can lead to serious consequences. Take WeWork, for example - a company that fell from a $47 billion valuation to $8.3 billion. Or Theranos, which went from being valued at $9 billion to filing for bankruptcy. Both are cautionary tales of how inflated valuations can unravel a business [3].

"Raising at an inflated valuation might feel good in the moment, but it can create massive problems down the road." – Kelly Mak, Principal at Workbench [2]

Overpricing doesn’t just hurt credibility; it can also lead to down rounds. These occur when a company fails to grow into its high valuation and is stuck raising funds at a lower valuation than before, signaling poor performance to the market. This makes attracting future investors significantly harder. Investors prefer companies with room to grow - not those that appear to have already reached their peak.

To avoid these pitfalls, compare your valuation to similar companies in your industry. Look at businesses with comparable revenue, growth rates, and market positions that have recently raised Series A funding. Factor in current market conditions to ensure your valuation aligns with reality.

What really matters is crafting a clear, data-driven narrative to justify your valuation. Metrics like clean financials, strong unit economics, and achievable growth projections carry far more weight than lofty ambitions. At this stage, founders typically retain around 50%+ ownership, while investors take a 15–20% equity stake [1].

The goal? A fair valuation that sets the stage for sustainable growth and smooth future funding rounds.

2. Presenting Weak Unit Economics

Failing to clearly demonstrate profitability per customer or sale (known as weak unit economics) can quickly derail a Series A deal. Gone are the days of growth at all costs. Investors want to see a business model that proves it can make money on every customer. Without this clarity, confidence in the startup's financial viability takes a hit.

Unit economics break down profitability on a per-unit basis, helping businesses understand whether they gain or lose money with each sale or customer. This concept is central to showcasing strong financial fundamentals, much like the importance of solid company valuations we’ve discussed earlier [4]. But it's not just about revenue; it’s about understanding the true cost of acquiring customers and the long-term value they bring.

The key metrics investors focus on include:

Customer Acquisition Cost (CAC): The total cost of acquiring a customer.

Lifetime Value (LTV): The revenue a customer generates over their entire relationship with the business.

CAC Payback Period: How long it takes to recoup the cost of acquiring a customer.

LTV/CAC Ratio: A measure of whether customer acquisition efforts are profitable.

"Investors use LTV/CAC to measure whether a company's short-term investments into sales and marketing are creating or destroying value for the business and determine if additional capital will help the business scale efficiently." – Blair Silverberg, co-founder and CEO of Hum Capital [6]

One common mistake founders make is underestimating the true costs in their CAC calculations. They often leave out expenses like salaries, commissions, and paid acquisition costs [6]. This oversight skews profitability projections and creates unrealistic expectations for revenue growth.

The LTV/CAC ratio is especially critical. Investors typically look for a ratio of at least 3:1 [4], meaning each customer should generate three times the cost of acquiring them. To ensure accuracy, this ratio should be calculated based on gross margin rather than revenue [6]. A ratio above 1 demonstrates the potential for scalable and efficient growth [6].

Overly optimistic revenue projections without accounting for realistic costs can quickly erode investor trust [7]. Founders must align their revenue goals with a clear understanding of their cost structures to maintain credibility [7].

"In the early stages of a business, be patient for growth and impatient for profits." – Clayton Christensen, Harvard [5]

To build investor confidence, founders should present a full breakdown of sales and marketing costs alongside a detailed analysis of costs per lead [6]. This dual approach shows a deep understanding of the business from multiple angles and sets the stage for addressing cash flow challenges.

Speaking of cash flow, startups must also outline the timing of cash inflows and outflows. Ignoring this can lead to serious financial pitfalls, especially since 42% of startups fail due to misreading market demand [8].

Another way to strengthen unit economics is by evaluating LTV data on a cohort basis [6]. This method tracks how different customer groups perform over time, providing transparency and grounding projections in real data rather than assumptions.

Ultimately, the goal is to prove that additional capital will fuel efficient scaling. Strong unit economics signal a business model that can grow profitably - exactly what Series A investors are looking for [4].

3. Lacking Proven Customer Acquisition Plans

Having strong unit economics is crucial, but scaling customer acquisition is just as important when it comes to securing Series A funding. One common pitfall for founders is failing to demonstrate a scalable and repeatable strategy for acquiring customers.

Investors want to see clear evidence that your approach to customer acquisition can consistently deliver results on a larger scale. Michael Skok, Co-founding Partner at Underscore VC, emphasizes this point:

"One of the biggest red flags at the Series A round is having outlier customers. Outlier customers suggest that you don't have repeatability, and haven't yet honed your minimum viable segment" [11].

This means early customer successes must show potential for predictable scaling. In other words, you need a well-defined and repeatable acquisition framework in place.

Take Mable, for example. This B2B eCommerce platform secured $8.5 million in Series A funding by focusing on two critical areas: product-market fit and cost-efficient customer acquisition [11]. They tracked their progress with key metrics like active customer growth, retention rates, CAC, and cohort analysis - providing the data investors needed to see.

It’s also worth noting that acquisition strategies aren’t static. As Steli Efti, Co-founder and CEO of Close, explains:

"Your customer acquisition strategy should evolve over time. What you do to persuade your 1,000th customer to buy will probably not be the same thing that persuaded your 10th customer to buy" [9].

To gain investor confidence, focus on metrics that matter: lower your CAC, increase lifetime value (LTV), and reduce churn [13]. Steer clear of relying on outlier customers by refining your minimum viable segment and showing that your growth strategy is not only effective but also repeatable. Without this proof, investors may view scaling your business as too risky.

4. Targeting the Wrong Investors

Once you've nailed down your customer acquisition strategy, the next big step for a successful Series A is finding the right investors. One of the biggest mistakes founders make is pitching to investors who aren't a good fit. This scattershot approach wastes valuable time and energy - resources that could be better spent building relationships with investors who truly align with your industry, growth stage, and vision.

Investors have specific criteria they look for when evaluating deals. Skipping the research phase often leads to mismatches, like pitching a biotech-focused investor when you're running a consumer hardware startup or reaching out to firms that have already backed your competitors.

Angel investor Erik Huberman highlights the importance of preparation:

"Sending a cold deck without researching my investment criteria demonstrates a lack of intention with who they take money from" [18].

Taking the time to thoroughly research an investor's thesis, portfolio, and typical deal size can make all the difference. Nancy Pfund, managing partner at DBL Partners, underscores this point:

"I want to get answers as to why should I invest in this company over all the other opportunities I have" [15].

Your pitch needs to answer that question clearly. Think of investor research as building a customer database. Use tools like an investor CRM to track key details such as their preferred industries, past investments, and deal sizes [16]. This targeted approach works hand-in-hand with the strong financial metrics and growth plans you've already developed, helping you focus on investors who are genuinely aligned with your business.

There are also red flags to watch for that signal misalignment. These include investors overly fixated on valuation early on, showing poor preparation during meetings, or repeatedly asking for redundant information without moving toward a decision [17]. If you're struggling to get junior partners to introduce you to general partners, it might mean your deal doesn't align with the firm's criteria [17].

Start your investor research at least six months before you plan to fundraise. Platforms like Crunchbase and LinkedIn are great for identifying active investors. From there, focus on building authentic relationships by clearly explaining why your company fits their focus [14]. This groundwork not only improves your chances of securing funding but also sets the tone for smoother negotiations and future rounds.

5. Creating Overly Complex Pitch Decks

Once you've identified the right investors, the next step is presenting your company in a way that grabs attention without overwhelming them. A common mistake founders make is overloading their pitch decks with every technical detail imaginable. This approach often backfires, as complexity can derail the pitch and lose investors' interest.

Here's the reality: investors spend an average of just 3 minutes and 44 seconds per pitch deck[20]. You have about 10 seconds to hook their attention[22]. And with venture capital firms now reviewing over 2,000 pitches annually - more than double the number they saw in 2015[22] - your deck needs to stand out for the right reasons. Consider this: successful startups like Airbnb, Buffer, and Mixpanel secured millions in funding with pitch decks containing just 10 to 13 slides. On the other hand, failed startups often use an average of 27 slides, which frequently leads to rejection[22].

So, what do investors actually want? According to Janelle Tam, YC's Series A Program Manager, your deck should highlight your company's potential and explain how funding will accelerate growth. Skip the technical deep dives. As Kevin Hale from Y Combinator explains:

"Investors invest in teams not slides. Your slides should make your ideas more clear. Don't let your slides distract investors from what you're saying out loud. You want them to be impressed by you. Not your slides."[23]

Instead of overwhelming details, focus on the basics. Your pitch deck should clearly outline:

The amount of funding you're requesting

How you'll use the funds

The traction you expect within 18–24 months

Use simple visuals and limit technical explanations. For example, include just a few screenshots of your product rather than a full technical breakdown[24]. Start by drafting your narrative in 10–15 concise bullet points, then build your deck around these points. Each bullet can become a slide, with a clear title and supporting data. Keep text to 75 words per slide or 50 words for slides with visuals[19][20].

Here’s a quick comparison between effective and overly complex pitch decks:

Ariel Poler, entrepreneur and angel investor, stresses the importance of clarity from the very first slide:

"I want a deck that right off the bat, on the first slide, tells me what this company is about... That starts with a good impression. From then on, I know what I am looking for."[21]

Your goal is to spark interest, not to explain every detail. Use clear visuals and compelling storytelling to engage investors. Practice your pitch, refine your deck based on feedback, and prioritize clarity over flashy design. As Karin Klein from Bloomberg Beta puts it:

"Simplicity is helpful and shows a clarity of vision and the ability to sell."[21]

This simplicity sets the stage for the next step: proving your market potential. Let's dive into that next.

6. Showing Insufficient Market Proof

Once you've streamlined your pitch deck, the next challenge is proving that your product or service is something customers genuinely want. Investors aren't swayed by appeal alone - they expect hard evidence of market demand. This proof transforms your pitch from just an idea into a convincing growth story.

It's a tough reality: nearly 90% of startups fail due to poor judgment of market demand, targeting the wrong audience, or lacking insight into competitors[26]. Without strong market proof, your Series A funding chances can quickly fall apart.

So, what counts as reliable market proof? Investors usually look for three main types of evidence: customer validation, traction metrics, and thorough market research[25]. Together, these elements paint a clear picture of how well your product fits the market.

Customer Validation

Customer validation goes deeper than a few glowing testimonials. Take the example of PulseHealth, a health tech startup that secured Series A funding in 2024. They showcased customer success stories alongside supportive testimonials, offering clear evidence of product-market fit. This strategy boosted investor confidence and highlighted the real-world value of their product[25].

Traction Metrics

Traction metrics are the numbers that back up your claims. For instance, XYZ Analytics - a data analytics company - proved its market potential in 2024 by achieving a 300% increase in sign-ups within three months of launch. They also maintained a 90% monthly retention rate and reported consistent month-over-month revenue growth of 20%[25]. These figures demonstrated not just customer interest but also engagement and long-term retention.

For Series A rounds, investors often expect benchmarks like $2 million in annual recurring revenue (ARR), 3x year-over-year growth, and a burn multiple under 1.5x[28]. However, the key metrics vary depending on your business model. SaaS companies, for example, should highlight customer lifetime value and churn rates, while marketplace businesses are judged on their ability to grow gross merchandise value (GMV). E-commerce startups, on the other hand, are often evaluated based on conversion rates - i.e., how effectively they turn browsers into buyers[27].

Comprehensive Market Research

Beyond metrics, solid market research strengthens your case. It shows you understand your industry and competitors. MedConnect Solutions, a telehealth startup, incorporated detailed market analysis into its 2024 pitch deck. This included insights on rising demand, a competitive landscape map, and trends in technology adoption - all of which underscored the market need for their solution[25].

Another example comes from a fintech startup that surveyed freelancers to refine its product focus. This pivot helped them raise $4.5 million and triple their user base in just 12 months.

Charles Hudson from his blog Venture Reflections puts it well:

"There is no magic number, in terms of revenue or KPIs, that will unlock a Series A round by itself. Metrics are just one of many inputs that go into the decision."[29]

7. Ignoring Future Funding Needs in Deal Terms

Many founders fail to consider how the terms they agree to in their Series A funding can impact future fundraising efforts. This oversight can lead to costly complications and unfavorable conditions down the road. Let’s break down how these decisions today can shape your company’s financial future.

The time between funding rounds often stretches longer than anticipated. Data from Carta shows that startups take an average of 18 months to move from seed funding to Series A. From there, it typically takes another 10–18 months to reach Series B and 27 months to get to Series C[30]. With venture capitalists rejecting 95% of their incoming deal flow[31], founders need to avoid saddling themselves with terms that could scare off future investors.

How Current Terms Affect Future Rounds

The terms you agree to in your Series A funding lay the groundwork for all subsequent rounds. Just as strong business metrics are crucial, structuring your deal to support long-term growth is equally important. A cautionary tale is the experience of founders Christina Wallace and Alex Nelson, who raised $1 million in 2011. When they pursued Series A funding later, they faced rejection from VCs who felt their growth didn’t meet expectations, ultimately forcing them to shut down[33].

"I learned that who you take capital from matters. Understanding their motivations and pressures matters, because it will affect what advice they give and what pressures they then exert on you." – Christina Wallace, Entrepreneur and Investor, Harvard Business School [33]

The Danger of Overvaluation

Chasing inflated valuations may seem appealing in the short term, but it can lead to unrealistic expectations in future rounds. Favorable terms for investors - like liquidation preferences, anti-dilution clauses, and protective provisions - can pile up over multiple funding rounds. This accumulation often erodes founder control and limits financial upside.

Terms That Can Cause Trouble Later

Some deal terms, if not carefully managed, can create roadblocks for future fundraising. For example:

Board composition changes: Gradual shifts in board control can leave founders with less decision-making power.

Anti-dilution protection: If a future round happens at a lower valuation, founders may face penalties.

Protective provisions: Investor veto rights on major decisions can restrict operational flexibility.

Smarter Strategies for Negotiating Terms

Before signing a deal, founders should seek at least two independent offers from venture capitalists[33]. This strategy not only provides leverage but also gives a better sense of market norms. Additionally, working with legal counsel experienced in venture capital transactions is essential for navigating the complexities of term sheets[32].

"One of the largest mistakes that founders make is accepting a deal from investors whose expectations don't match their business model. If your vision for growth doesn't align with your investor's expectations and you fail to meet high return goals, your VC can cut off your funding." – Shikhar Ghosh, Entrepreneur and Investor, Harvard Business School [33]

Focus on negotiating straightforward terms in your Series A. Overly complex structures with multiple investor classes and preferences can create headaches later. If possible, plan your total capital needs upfront and raise a larger initial round with favorable terms. This reduces the likelihood of needing multiple rounds that might introduce restrictive clauses[34].

Every term sheet sets a precedent for future funding rounds[35]. A small concession today can snowball into a significant issue later. Always consider not just the immediate implications of a term but also its potential impact on future growth and eventual exit opportunities. Negotiating Series A terms with a long-term perspective is essential for ensuring your company’s success.

Practical Tips for Avoiding Series A Pitfalls

Navigating Series A funding successfully requires thoughtful preparation and strategic execution. To sidestep common challenges, consider these actionable tips:

Start Building Investor Relationships Early

It’s never too soon to connect with potential investors. Begin these conversations months before your Series A round.

"Metrics are going to start to matter in the A round and they'll count in the B and C rounds even more" [36]

Jason Mendelson, Founding Partner at the Foundry Group, highlights how important it is to focus on metrics early. Use platforms like AngelList and Crunchbase to research investors who regularly fund companies in your industry. The goal isn’t just securing the highest valuation - it’s finding investors who understand your market and align with your long-term vision.

Base Your Valuation on Market Data

When setting your valuation, rely on solid market data rather than just your immediate funding needs. For instance, seed valuations for U.S. startups in 2019 ranged from $4–11 million [37], while the average Series A round in January 2025 raised $16.6 million [38]. If your metrics aren’t where they need to be, consider using convertible notes or SAFEs to delay formal valuation until you’re on firmer ground.

Build Compelling Traction Metrics

Traction is your proof of market demand. Naval Ravikant defines it as quantitative evidence of interest [39]. For Series A investors, this means moving beyond surface-level metrics. Startups with clear retention and profitability figures tend to raise 25% more in funding compared to peers [39]. Focus on a key metric, like Monthly Recurring Revenue (MRR) for SaaS or Gross Merchandise Value (GMV) for marketplaces, to showcase momentum. Strong examples include 1,500 paying customers, 12% month-over-month revenue growth, and a churn rate below 3% [39]. Metrics like organic acquisition rates and repeat purchases also highlight product–market fit.

Demonstrate Capital Efficiency

Investors increasingly favor companies that grow efficiently over those burning through cash for rapid expansion. A business that achieves milestones with less capital often looks more appealing than a larger competitor with higher spending [41]. Highlight financials that show how you’ve made the most of your resources. A solid lifetime value to customer acquisition cost (LTV:CAC) ratio of at least 3:1 is a strong benchmark [40].

Research and Target the Right Investors

Finding the right investors is just as important as securing funding. Focus on those whose check sizes and investment theses align with your business. Warm introductions through mutual connections can open doors, and asking thoughtful questions early can help establish a balanced relationship [11].

Validate Market Demand Beyond Revenue

If your revenue numbers aren’t yet significant, look for other ways to prove demand. This could include user engagement metrics, waitlists, strategic partnerships, or letters of intent. For example, guiding potential customers through the purchasing process - like signing up for a waitlist or making a small deposit - can provide concrete evidence of interest [41]. Additionally, creating high-quality content can boost website traffic and position your company as an industry thought leader.

Conclusion: 7 Series A Funding Mistakes Founders Must Avoid

Looking back at the seven major missteps, it’s evident that success in a Series A round boils down to thoughtful strategy and preparation. From overestimating valuations to overlooking future funding needs, avoiding these traps requires careful planning and a clear understanding of your goals.

Approach fundraising with diligence and seek out investors who genuinely align with your vision. This creates partnerships that last well beyond the initial check. As Andy Budd puts it:

"Fundraising is tough, but with the right strategy, it doesn't have to be a slog. By avoiding these common mistakes, you'll not only improve your chances of success but also streamline the process and drive sustainable growth." – Andy Budd, Investor, SXSW [16]

Doug Levin also highlights the importance of shared goals:

"Alignment is a critical - but often underestimated - driver of startup success. It refers to the consistent understanding, prioritization, and execution of goals across founders, team members, investors, and even early customers." – Doug Levin, Investor and Executive Fellow, Harvard Business School [43]

Clear communication and realistic expectations reflect strong leadership - qualities that investors respect. By showing you’re not just chasing funding but building a long-term vision, you demonstrate the type of foresight that attracts meaningful partnerships. This approach doesn’t just make your pitch more compelling; it sets the stage for growth that lasts.

From setting achievable valuations to fostering transparency, every step you take toward avoiding these common errors strengthens your funding journey. The best founders strike a balance: they’re ambitious about their vision but grounded in their current realities. They understand that securing Series A funding isn’t the finish line - it’s the start of a much longer path requiring trust, collaboration, and steady growth.

"Funding is not just about the capital you receive; it's about investing in a vision that turns potential into progress." – House of Bull Ventures [42]

Frequently Asked Questions (FAQ)

How can founders determine the right valuation for their company during a Series A round?

Determining the right valuation for your company during a Series A round takes a mix of solid research, careful analysis, and smart planning. One widely used method is comparable company analysis. This involves looking at the valuations of similar businesses in your industry to set a baseline that reflects current market conditions. It’s a practical way to ensure your expectations are in line with what’s happening in the market.

Another option is the backsolve method, which works particularly well if you’ve recently raised funds. This approach calculates your company’s valuation based on the price of the last round, with a premium that aligns with KPI growth.

Beyond these methods, paying close attention to key metrics like revenue growth, market pull, and product velocity can play a big role in shaping how investors view your value.

Ultimately, determining valuation is part art and part science, combined with a market that will offer what it thinks the company is worth.

How can I effectively showcase strong unit economics to attract Series A investors?

To grab the attention of Series A investors and highlight strong unit economics, focus on presenting data that’s both clear and engaging. Key metrics to emphasize include Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV). A solid LTV/CAC ratio - ideally above 3:1 - will signal a healthy return on investment. Additionally, showcase improvements in gross margins and operational efficiency over time to illustrate your business's scalability and long-term viability.

In your pitch deck, use visuals like charts and graphs to make trends and projections easy to grasp at a glance. Be upfront about any potential risks and walk investors through your strategies for addressing them. This transparency not only builds trust but also highlights your preparedness to scale successfully.

Why is it important to find investors who align with your startup's vision and industry, and how can founders identify them?

Finding the right investors for your startup is about more than just securing funding - it's about finding partners who share your vision and can actively contribute to your success. The right investors bring more than money to the table. They offer valuable expertise, open doors to key connections, and provide strategic guidance that can help your business grow. On the flip side, working with investors who don't align with your goals can lead to misaligned priorities and even slow down your progress.

To connect with the right investors, start by focusing on those with experience in your industry or a proven interest in your business model. Dive into their portfolios to see if their previous investments align with your startup's mission. Attend industry events, talk to other founders, and use your network to facilitate introductions - personal connections often pave the way for meaningful partnerships. By targeting investors who share your values and understand your space, you can build a relationship that not only supports your immediate needs but also helps drive long-term growth.

Series A Fast Facts from Allied VC Research:

95% of VC deal flow gets rejected

Successful pitch decks average 10-13 slides vs 27 for failed startups

Investors spend only 3 minutes 44 seconds per deck

Target LTV/CAC ratio: minimum 3:1

Average Series A in 2025: $16.6M at $47.9M valuation (skewed higher by AI vs non-AI companies)