Side Letters vs. Standard LP Agreements

In venture capital, Limited Partnership Agreements (LPAs) and side letters define the relationship between investors and funds. LPAs set standardized terms for all investors, ensuring consistency and fairness. Side letters, however, provide tailored terms for individual investors, addressing specific needs like regulatory compliance, tax considerations, or enhanced reporting.

Key Points:

LPAs: Uniform agreements covering fund governance, fees, profit distribution, and legal safeguards.

Side Letters: Custom agreements for select investors, offering flexibility but adding administrative and legal complexity.

Comparison:

LPAs ensure simplicity and transparency.

Side letters attract larger investors by meeting unique requirements, but may create operational challenges.

A balanced approach - using LPAs for standardization and side letters for flexibility - is crucial for effective fund management.

How VC works | Limited partnerships & management companies | VC 101

Standard Limited Partnership Agreement Features

Standard Limited Partnership Agreements are the backbone of venture capital fund operations, laying out the rules that all investors must follow. These agreements create a consistent framework that simplifies fund management while ensuring all parties are treated equitably.

Structure and Key Provisions

The structure of a standard Limited Partnership Agreement (LPA) revolves around several key elements that govern how the fund operates:

Capital Contributions: These define each limited partner's commitment and the schedule for capital calls. Typically, fund managers can request funds over a 3-5 year investment period, with limited partners receiving 10–30 days' notice for each call.

Management Fees: Generally set at 2% of committed capital per year (later calculated on the remaining portfolio value), these fees cover operational costs and align the interests of fund managers with those of investors.

Profit Distribution: Profit-sharing follows a waterfall model. Limited partners (LPs) first recover their invested capital before general partners (GPs) collect a 20% carried interest on profits (exceeding any pre-negotiated preferred return hurdle).

Governance Provisions: These outline voting rights, advisory committee roles, and reporting obligations. LPs typically receive quarterly performance updates, and major decisions - such as strategy changes or term extensions - require majority approval.

Exit Terms: These detail how the fund will wind down, including the distribution of proceeds from portfolio companies and the timeline for final liquidation. Most funds operate for 10 years, with the option for multiple one-year extensions to allow portfolio companies to reach maturity.

These provisions ensure that all investors are treated the same, creating a streamlined and fair operational framework.

Uniform Terms Across Investors

One of the core principles of standard LPAs is uniformity. All limited partners, regardless of their investment size, operate under the same terms. Whether an investor commits $1 million or $50 million, they receive the same management fee structure, carried interest terms, and governance rights, proportionate to their investment.

This uniformity eliminates the need for multiple fee structures or varying reporting requirements, which simplifies fund administration. Fund managers can focus on managing the portfolio rather than juggling different contractual obligations. It also helps avoid potential legal disputes over perceived preferential treatment.

Moreover, information rights are consistent for all investors, ensuring equal access to fund performance data, updates on portfolio companies, and strategic decisions. This transparency builds trust while reducing administrative complexity for fund managers.

Legal and Regulatory Framework

In addition to operational consistency, standard LPAs include robust legal safeguards to protect both fund managers and investors. These agreements address key legal and regulatory concerns:

Conflict-of-Interest Policies: LPAs require general partners to disclose any conflicts and secure approvals before engaging in transactions that may personally benefit them.

Regulatory Compliance: Provisions ensure adherence to securities laws, including verifying investor accreditation and providing clear disclosures about investment risks. Mutual representations and warranties offer legal recourse for non-compliance.

Fiduciary Duties: These clauses define the fund manager's responsibility to act in the best interests of limited partners while limiting their liability exposure, striking a balance between accountability and operational flexibility.

Indemnification Provisions: Fund managers are protected from lawsuits arising from routine business activities, provided they act within their authority and avoid gross negligence. This protection encourages thoughtful risk-taking while maintaining accountability.

Side Letters: Custom Terms and Flexibility

Standard Limited Partnership Agreements (LPAs) ensure consistency across all investors, but side letters introduce a way for fund managers to address individual investor needs without altering the core agreement. These supplementary contracts allow funds to attract larger commitments and cater to unique requirements that don’t fit within the standard framework. By balancing uniformity with adaptability, side letters address the evolving demands of today’s venture capital landscape.

Essentially, side letters add tailored provisions for specific investors while leaving the main LPA intact. This approach helps fund managers operate efficiently while meeting specialized investor needs. Let’s explore some common scenarios where these customized terms are particularly useful.

Common Use Cases for Side Letters

Side letters often come into play when institutional investors - such as pension funds, sovereign wealth funds, or large endowments - bring significant capital and require terms aligned with their internal policies or regulatory frameworks.

Co-investment rights: Large investors may negotiate the option to invest directly alongside the fund in specific portfolio companies. These direct investments often come without additional management fees or carried interest, giving investors greater exposure to promising opportunities while lowering their overall fee burden.

Tax accommodations: Tax-exempt entities like pension funds may request assurances that the fund won’t engage in activities generating unrelated business taxable income (UBTI). Similarly, foreign investors may require specific structuring to avoid unfavorable tax outcomes in their home countries.

Regulatory compliance: Some investors, such as insurance companies, operate under strict regulatory frameworks. They may need additional reporting or specific investment restrictions that don’t apply to other limited partners.

Enhanced information rights: Investors contributing significant capital may negotiate for extra reporting, early warnings about potential issues, or access to detailed portfolio company information.

These provisions demonstrate how side letters can address diverse investor priorities while maintaining the fund’s overall structure.

Benefits of Side Letters

The most obvious benefit of side letters is their ability to secure larger commitments from institutional investors who might otherwise walk away due to rigid standard terms.

Another advantage is confidentiality - side letter terms remain private between the fund manager and the specific investor. This privacy allows fund managers to accommodate special requests without drawing attention to them. Additionally, side letters offer operational flexibility, enabling managers to address unique situations without renegotiating the LPA with all investors.

Side letters also serve as a tool for competitive differentiation. By showing a willingness to adapt to institutional investors’ specific needs, fund managers can stand out during fundraising efforts, potentially winning commitments over less accommodating competitors.

Finally, side letters can help with risk management. For example, they might include provisions like enhanced governance rights or additional key person clauses, offering large investors extra reassurance without imposing these terms on the entire investor base.

Drawbacks and Limitations

Despite their advantages, side letters come with challenges that fund managers must navigate carefully.

Administrative complexity: Each side letter introduces unique tracking, compliance, and reporting requirements. Managing multiple sets of terms increases operational costs and the risk of errors.

Legal challenges: As the number of side letters grows, so does the potential for conflicting or overlapping provisions. Ensuring that these terms align with the main LPA requires thorough legal reviews, which can drive up costs.

Concerns over preferential treatment: Even though side letter terms are confidential, smaller investors may suspect that larger commitments receive better treatment. This can strain relationships, especially if smaller investors feel overlooked. To address this, some investors negotiate "most favored nation" clauses, ensuring they receive the best terms offered to others.

Disclosure requirements: In some jurisdictions, regulatory frameworks mandate the disclosure of side letter terms, either to all investors or to regulatory bodies. Such requirements can undermine the confidentiality that makes side letters appealing.

Inconsistent obligations: If some investors have enhanced reporting rights or other privileges, fund managers must juggle multiple reporting streams. This increases the risk of errors, such as inadvertently sharing confidential information with the wrong parties.

Precedent-setting: Granting specific terms to one investor can set expectations for future negotiations. Over time, this can erode the standardization that makes fund management efficient, complicating future fundraising efforts.

While side letters are a powerful tool for accommodating investor needs, they require careful handling to avoid operational and legal pitfalls. Balancing these benefits and challenges is key to leveraging side letters effectively.

Direct Comparison: Side Letters vs Standard LP Agreements

Understanding the contrast between side letters and standard LP Agreements (LPAs) is key to making informed decisions. Although both documents define the relationship between general partners (GPs) and limited partners (LPs), they serve different roles and complement each other within venture capital fund structures.

Key Differences

The primary distinction lies in scope and applicability. Standard LP Agreements establish a unified set of terms for all investors, creating a consistent foundation. In contrast, side letters are tailored agreements that apply to specific investors, reflecting negotiated terms or special arrangements.

Flexibility and confidentiality also set them apart. Standard LPAs ensure uniformity and transparency across all investors, while side letters allow for personalized terms that remain confidential, addressing unique investor needs without altering the core agreement.

Legal complexity further differentiates the two. Standard LPAs rely on established templates and legal precedents, making them simpler to manage. Side letters, on the other hand, introduce complexity by requiring careful drafting to avoid conflicts with the main agreement or other side letters.

These differences significantly influence daily operations and legal oversight, as explored below.

Impact on Operations and Legal Requirements

Standard LPAs simplify fund operations by providing a consistent framework for decision-making and reporting. Side letters, however, introduce additional tracking requirements. Fund managers must monitor multiple reporting channels and ensure compliance with specific obligations outlined in these customized agreements, which can increase administrative costs and risks.

From a legal standpoint, standard LPAs offer a clearer liability structure since all investors adhere to the same terms. Side letters, however, can create legal challenges, such as potential conflicts between differing investor rights or ensuring compliance with securities regulations.

Transparency is another area where these approaches differ. Standard LP Agreements promote openness by granting all investors equal access to information and rights. Side letters, however, can limit transparency, particularly when some investors receive preferential terms or enhanced information rights that others are unaware of.

Regulatory compliance adds another layer of complexity. In some jurisdictions, side letter terms must be disclosed to regulators or even other investors. This requirement can undermine the confidentiality that makes side letters appealing, forcing fund managers to carefully navigate these rules to avoid compliance issues.

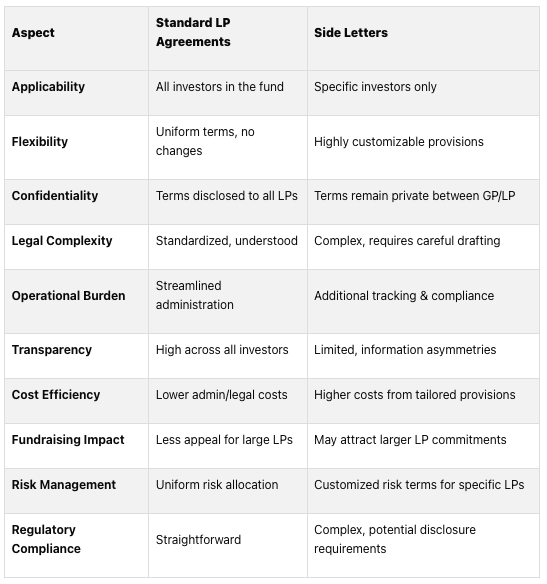

The table below summarizes these operational and legal distinctions:

Comparison Table

This comparison highlights the trade-off between standardization and customization. Both approaches have their strengths: standard LP Agreements provide efficiency and transparency, while side letters offer the flexibility needed to meet the demands of specific investors. Many funds successfully combine the two, using standard LPAs to maintain order while leveraging side letters to attract significant commitments from key investors with unique requirements.

Next, we’ll explore practical tips for fund managers and LPs navigating these agreements.

Practical Guidance for Fund Managers and LPs

Navigating LP agreements and side letters can feel like walking a tightrope. Fund managers must address legal challenges while meeting the varying demands of investors, and LPs need to know when and how to push for tailored terms.

Best Practices for Fund Managers

Start with a solid foundation: Draft a comprehensive standard LP agreement that covers the majority of investor needs. This minimizes the need for lengthy side letter negotiations.

Clarify policies upfront: Decide which terms are negotiable, outline eligibility criteria, and prepare standardized language for common requests before you begin fundraising.

Keep meticulous records: Use specialized software to track side letter commitments and ensure all customized terms are met on time.

Tier your negotiations: Tailor your approach based on the size of an investor’s commitment and their strategic importance, but avoid creating an overwhelming number of unique agreements.

Bring in legal experts early: Work with attorneys who specialize in fund formation to draft templates and pinpoint potential conflicts before they arise.

By following these steps, fund managers can build a framework that supports effective risk management and reduces operational headaches.

Risk Management and Mitigation

To manage risks effectively, it’s crucial to establish strict protocols for handling side letter agreements. Use secure communication channels and designate specific team members to oversee these arrangements. Sensitive data should be stored in separate, secure repositories.

Stay on top of regulatory compliance, particularly U.S. SEC rules, which may require disclosure of certain side letter terms. Partner with compliance professionals to ensure you understand your obligations and have appropriate systems in place for disclosure.

Scalability is another key consideration. Set internal limits on the number of unique side letter arrangements to maintain a balance between flexibility and administrative efficiency. Many fund managers cap customization to avoid operational strain.

Prepare for potential conflicts by developing contingency plans. Include clear dispute resolution mechanisms and escalation protocols to address issues that could arise when side letter obligations clash with broader fund operations.

Allied Venture Partners Approach

Allied Venture Partners offers a great example of how to balance standardization with flexibility. Operating across Canada and the United States, and supported by a network of over 2,000 angels and VCs, we’ve streamlined our processes to meet diverse investor needs while maintaining administrative efficiency.

Our SPV-based investment structure is particularly noteworthy. By creating separate legal entities for each investment opportunity, we address customization needs without complicating the overall firm structure. This approach simplifies traditional side letter challenges.

Furthermore, by using AngelList for SPV formation and management, we can create customized side letters for limited partners, such as modified carried interest agreements, adjusted setup fees, and carry share agreements for LPs and VC Scouts. This approach ensures common investor concerns are addressed in our standard agreements, while maintaining flexibility for larger commitments through our extensive network.

Conclusion: Choosing Between Standardization and Customization

Deciding between standard LP agreements and side letters comes down to finding the right balance between operational efficiency and meeting investor expectations. Fund managers must weigh the benefits of streamlined processes against the desire to accommodate specific investor needs. Meanwhile, limited partners should consider whether customized terms are worth the additional complexity.

Standard LP agreements are ideal for funds managing a large number of investors with similar risk profiles and goals. These agreements simplify operations and keep legal costs in check. On the other hand, side letters are often necessary when working with institutional investors, sovereign wealth funds, or other sophisticated LPs that have unique, non-negotiable requirements. While side letters can help secure larger commitments and address regulatory demands, they also introduce extra administrative challenges.

To navigate these differences effectively, having clear guidelines is critical. Identify which terms are open to negotiation, establish minimum commitment thresholds for side letter eligibility, and prepare standardized language for frequently requested terms. This approach helps keep fundraising on track while still allowing for flexibility where it's most needed.

For example, Allied Ventures uses SPV-based structures to strike a balance between standardization and investor flexibility. By employing separate investment vehicles, we cater to diverse investor needs without adding unnecessary complexity.

Technology is a key enabler in managing both approaches. Fund administration software can simplify the tracking of side letter obligations, automate compliance reporting, and ensure all customized terms are met on time. Without the right tools, even a small number of side letters can create operational headaches that outweigh their advantages.

Ultimately, the choice depends on your fund’s scale and the type of investors you’re working with. Standardized LP agreements work best for smaller, more uniform investor groups, while side letters are essential for securing commitments from institutional investors, despite the added complexity. The goal is to create a framework that aligns with your investment strategy while keeping operations manageable.

FAQs

What are the advantages and disadvantages of using side letters in venture capital agreements?

Side letters in venture capital agreements offer a way to tailor terms for individual investors. These agreements might include adjustments for specific reporting requirements, customized fee arrangements, or unique governance rights. By accommodating these preferences, funds can appeal to a wider pool of investors.

That said, side letters aren't without their drawbacks. They can lead to imbalances among investors, especially if certain terms disproportionately benefit specific parties, which might spark disagreements. Additionally, if the terms in side letters conflict with the main limited partnership agreement, it can create governance issues and slow down decision-making. To avoid such complications, drafting side letters with precision and ensuring they align with the core agreement is crucial.

What are the key differences between side letters and standard limited partnership agreements, and how do they affect transparency and efficiency in venture capital funds?

When it comes to structuring agreements in investment funds, side letters and standard LP agreements serve different purposes and cater to distinct needs.

Side letters are tailored agreements that provide specific investors with unique terms. These might include perks like fee reductions, customized reporting, or additional rights. While this flexibility can be appealing, it comes with a downside: less transparency. Other investors in the fund might not be aware of these special arrangements, which could lead to misunderstandings. On top of that, juggling multiple side letters can become an administrative headache, potentially complicating the fund's operations.

On the flip side, standard LP agreements offer a one-size-fits-all approach. These agreements apply equally to all investors, ensuring consistency and promoting transparency. They also simplify fund management since there’s no need to handle individualized terms. However, this uniformity can be a drawback for investors looking for more personalized arrangements.

Fund managers often find themselves walking a fine line - balancing the need to cater to individual investor preferences through side letters while maintaining the simplicity and clarity provided by standard LP agreements. Both approaches come with their own set of advantages and challenges, and the right choice often depends on the fund's goals and investor expectations.

How can fund managers effectively manage the use of standard LP agreements and side letters while minimizing legal and administrative challenges?

Fund managers can handle standard LP agreements and side letters more efficiently by sticking to clear, consistent practices. For instance, drafting side letters with precise, well-thought-out language ensures they align with the main agreement and avoid conflicts with the fund's governance structure. This approach not only enhances clarity but also helps prevent misunderstandings or disputes down the line.

Relying on standardized templates for side letters and maintaining thorough records of all agreements can significantly ease administrative burdens. These methods simplify processes, reduce legal risks, and ensure compliance with regulatory requirements. By adopting these strategies, fund managers can create a smoother experience for all parties involved.