How Startup Investors Evaluate Your Competition: A Deep Dive

Key Takeaways

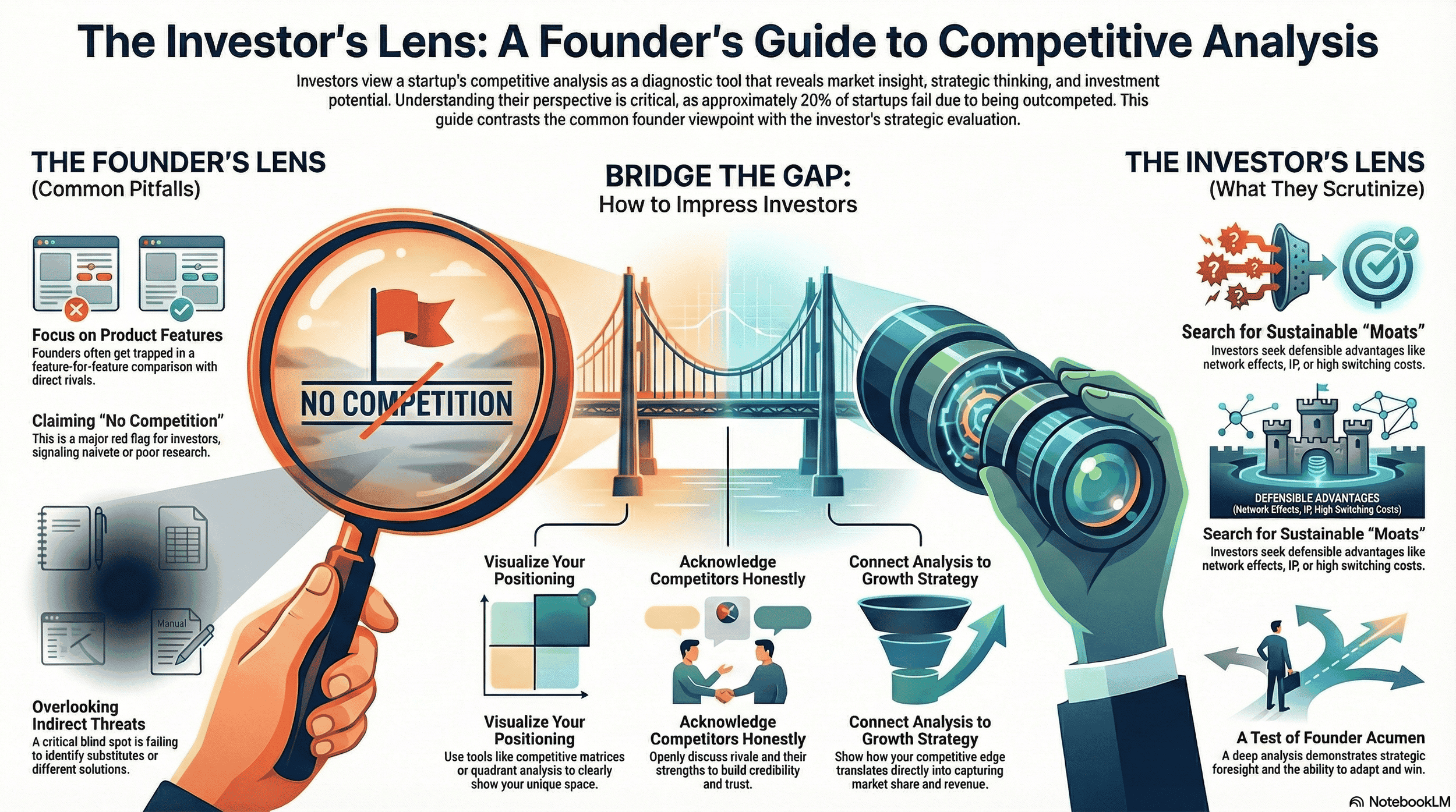

Competitive analysis is non-negotiable for startup fundraising success. Investors view your understanding of competition as a diagnostic tool that reveals market insight, strategic acumen, and investment potential. Approximately 20% of startups fail due to competition, making this analysis fundamental to securing funding.

Investors evaluate competition differently than founders. While founders focus on product features and operations, investors assess competition to de-risk their investment, validate market opportunity, gauge business defensibility, and evaluate founder capabilities for long-term scalable growth.

Identify all competitor types—not just direct rivals. Map the complete competitive spectrum including direct competitors, indirect competitors addressing the same need differently, substitute solutions, and potential future entrants. Overlooking indirect competitors or substitutes can be a critical blind spot.

Sustainable competitive moats are essential for investment attractiveness. Investors seek structural advantages like network effects, proprietary technology, strong brand loyalty, high switching costs, cost advantages, or regulatory barriers—not temporary leads that competitors can easily replicate.

Market positioning and "white space" opportunities demonstrate strategic vision. Clearly articulate your unique selling proposition, identify underserved market gaps, and explain how you'll capture and defend this territory better than existing players.

Benchmark your business model and go-to-market strategy against competitors. Investors scrutinize your customer acquisition costs, revenue streams, pricing strategy, unit economics (targeting 3:1 CAC-to-LTV ratio and 80%+ gross margins for software), and overall GTM efficiency relative to rivals.

Customer sentiment reveals differentiation opportunities. Analyze reviews on G2, Capterra, and Trustpilot, monitor social media, and track Net Promoter Scores to identify unmet pain points that your startup can address, creating meaningful competitive advantages.

Leverage both free and paid competitive intelligence tools strategically. Start with Google search, LinkedIn, social media, and customer review platforms. As you grow, consider tools like SEMrush for marketing analysis, SimilarWeb for traffic data, and platforms like Crunchbase or CB Insights for funding and market intelligence.

Present competition honestly and strategically in investor pitches. Claiming "no competition" is a major red flag. Instead, acknowledge all competitors openly, clearly articulate your unique advantages, use visual aids like competitive matrices and quadrant analysis, and demonstrate how your moats translate into defensible growth.

Connect competitive analysis to growth strategy and business defensibility. Show investors a clear path from your competitive positioning to market share capture, revenue generation, and profitability. Demonstrate how you'll adapt to new entrants and fend off established players in a dynamic market environment.

Introduction: Beyond the Surface-Level View of Competition

The journey of a startup is a relentless pursuit of innovation, market capture, and ultimately, sustainable growth. While founders often pour immense energy into perfecting their product and refining their business model, a crucial element often determines the success or failure of their funding rounds: their understanding of the competition.

For investors, a startup's approach to competitive analysis is far more than a perfunctory slide in a pitch deck; it's a diagnostic tool that reveals market insight, strategic acumen, and the potential for significant investment returns. In today's dynamic and increasingly saturated market, navigating the competitive landscape effectively is not just an advantage—it's a prerequisite for securing capital. This deep dive explores the intricate ways investors scrutinize competition, what they look for, and how founders can strategically position themselves to meet these exacting expectations.

The Critical Role of Competitive Analysis in Startup Fundraising

Securing investment hinges on demonstrating a compelling opportunity and a clear path to profitability. At the heart of this demonstration lies a thorough understanding of the competitive landscape. For investors, the absence of this understanding is a significant red flag, signaling potential naivete or a lack of due diligence. Approximately 20% of startups fail because their competitors outperform them [Stripe, 2024]. This stark reality underscores why a robust competitive analysis is not an option, but a fundamental requirement. It’s the bedrock upon which investor confidence is built, influencing everything from initial interest to valuation and the ultimate decision to deploy funding. Without a clear picture of who else is vying for the same customer base and market share, investors cannot adequately assess the inherent risks and the true potential of your startup.

Pro tip: Before making an investment in any given market or industry, investors commonly engage with multiple competing companies to determine which one best positions itself as the potential breakout winner. Therefore, it's crucial to arrive well-prepared with a comprehensive grasp of the competitive landscape, as investors likely have already evaluated one or more of your competitors. A major red flag for investors is knowing more about your competitors than you do.

Why an Investor's Lens on Competition is Different (and What It Means for You)

Founders often view competition through the lens of product features, sales strategies, and operational efficiency. They are deeply immersed in the nuances of their own offering and its immediate market positioning. Investors, however, adopt a broader, more strategic perspective. Their primary concern is de-risking their investment while maximizing potential returns. This means they scrutinize your competition not just to understand who your rivals are, but to gauge the overall health and accessibility of the market, the defensibility of your business model, and your startup's capacity for long-term, scalable growth. They look for evidence of strategic foresight, an understanding of market dynamics beyond immediate wins, and a credible plan to not just survive, but thrive amidst existing and potential threats.

Pro tip: A crucial differentiator that investors look for among early-stage startups is whether the team exhibits unrelenting ambition and tenacity. Investors want to back founders who are cutthroat business builders. Success often hinges on the team that shows greater determination and is willing to overcome any obstacle to achieve their goals.

The Investor's "Why": Why Competition Dictates Investment Decisions

For investors, analyzing your competition serves several critical functions that directly influence their investment decisions. It’s a multifaceted evaluation process that touches upon risk, validation, and the fundamental potential for growth and profitability.

Risk Mitigation and Validation: The Investor's Primary Concerns

The most immediate concern for any investor is risk. The startup ecosystem is notoriously volatile, with approximately 21.5% of private sector businesses failing within their first year, and a staggering 48.4% failing within five years [U.S. Bureau of Labor Statistics, 2024]. A significant portion of these failures stem from the inability to effectively navigate market dynamics, often exacerbated by intense competition.

Investors use competitive analysis to identify potential threats, understand market saturation, and assess the likelihood of your startup being disrupted or outmaneuvered. A clear-eyed understanding of the competitive landscape, coupled with a well-defined strategy to overcome rivals, signals to investors that you have anticipated these risks and have a plan to mitigate them.

Furthermore, a strong competitive analysis validates your market opportunity. It demonstrates that you understand the needs your product addresses, the size of the addressable market, and crucially, how your startup uniquely fits into that ecosystem. If your analysis shows a clear demand and a defensible niche, it enhances the perceived viability of your business model and the potential for a successful investment.

Pro tip: Investors don't expect you to have all the answers, but they at least expect you to have thought about how you will effectively compete and win in your market, and be able to articulate this strategy to team members and stakeholders.

Gauging Market Potential and Business Defensibility for Long-Term Growth

Beyond immediate risk assessment, investors are keenly interested in the long-term viability and scalability of a startup. Competitive analysis plays a pivotal role in evaluating both market potential and business defensibility. By understanding the competitive landscape, investors can better estimate the total addressable market (TAM) and serviceable obtainable market (SOM) and assess the growth trajectory. They look for opportunities within the market that are not fully exploited by existing players, often referred to as "white space."

Equally important is business defensibility, often termed "competitive moats." Investors want to see that your startup possesses sustainable advantages—whether through proprietary technology, network effects, strong brand loyalty, or unique business model innovations—that will protect it from rivals as it grows. A startup with a strong moat is less susceptible to price wars or imitation, offering investors a more secure path to substantial returns. For instance, a startup that can clearly articulate how its product creates switching costs for customers or benefits from increasing returns as more users join is far more attractive than one with easily replicable features.

Pro tip: Many venture investors, including those of us at Allied Venture Partners, favor investing in startups that operate in large, rapidly expanding markets. Capitalizing on the momentum of a growing market boosts a startup's chances of success and enhances the potential terminal value during a successful exit. So take a moment to consider your market: is it on the rise, declining, or stable?

Validating Founder Acumen and Strategic Foresight in a Dynamic Market

A thorough competitive analysis is also a powerful indicator of the founders' capabilities. Investors are not just investing in an idea or a product; they are investing in the team's ability to execute and adapt. When founders demonstrate a deep understanding of their competitors, their strategies, their strengths, and their weaknesses, it suggests they possess critical strategic foresight. This foresight is essential in a dynamic market where trends shift rapidly and new competitors can emerge unexpectedly.

Investors look for founders who can articulate not only the current competitive landscape but also anticipate future shifts and potential disruptions. This includes understanding how external factors, such as technological advancements or regulatory changes, might impact the competition and how your startup plans to respond. A founder who can credibly explain how they will outmaneuver rivals, adapt their business model, or continuously innovate to stay ahead reassures investors that they are backing a team capable of navigating complex challenges and seizing opportunities.

Pro tip: Beyond strategic foresight and adaptability, investors particularly value founders with domain expertise. They are especially drawn to teams building companies that tackle problems the founders have substantial experience with. A crucial question investors consider is, "Is this the most qualified team in the world to solve this problem?" Therefore, ensure you possess the necessary background.

Tool: Try the Founder-Market Fit Scorecard to see how investors would evaluate your team.

Investment Attractiveness: How Competitive Edge Drives Funding Decisions

Ultimately, a strong competitive edge is a direct driver of investment attractiveness. Investors are in the business of identifying companies with the potential for exponential growth and significant market impact. A startup that can clearly demonstrate a superior product, a more efficient business model, a stronger go-to-market strategy, or a unique value proposition that resonates deeply with customers stands out.

When you can present a compelling competitive analysis that highlights your differentiators and outlines a clear strategy for winning market share, you are presenting a more attractive investment thesis. This is particularly true in a challenging funding environment; global venture capital funding dropped approximately 40% year-over-year from $357 billion in 2022 to around $214 billion in 2023 [Growth Equity Interview Guide, 2025]. In such conditions, differentiation and a clear competitive advantage become paramount for securing funding. Investors want to back winners, and your competitive analysis is the evidence that proves you have a strategy to be one.

Deconstructing the Competitive Landscape: An Investor's Framework

Investors approach the competitive landscape with a structured framework designed to uncover deep insights. This goes beyond simply listing rival companies; it involves dissecting various facets of the competition to understand the market's dynamics, your startup's potential, and the associated risks.

Identifying All Shades of Competitors: Direct, Indirect, Substitutes, and Potential

A crucial first step for investors is to map out the entire competitive spectrum, not just the most obvious rivals. This involves identifying:

Direct Competitors: Those offering a very similar product or service to the same customer segment.

Indirect Competitors: Those addressing the same customer need but with a different type of product or service. For example, a meal kit delivery service might compete indirectly with restaurants or grocery stores.

Substitute Competitors: Those offering an alternative solution that can satisfy the same core customer need, even if it's a fundamentally different approach.

Potential/Future Competitors: Established players or emerging startups that could enter your market or develop a competing offering.

Investors understand that a startup can be blindsided by indirect competitors or substitutes that offer greater convenience, lower cost, or a novel approach that resonates with customers. Failing to identify and account for these less obvious rivals can be a critical oversight, signaling a superficial understanding of the market.

Pro tip: Spend an hour and perform a SWOT Analysis of your startup to identify competitive strengths, weaknesses, opportunities, and threats.

Analyzing Competitive Moats: The Search for Sustainable Advantage

The concept of a "moat"—a sustainable competitive advantage—is central to investor evaluation. Investors look beyond fleeting advantages like early market entry or a temporary feature lead. They seek evidence of structural barriers that make it difficult for competitors to erode your market position. These moats can manifest in various forms:

Network Effects: Where the value of the product increases as more users join (e.g., social media platforms like Facebook, marketplaces like Airbnb or Uber).

Proprietary Technology/Intellectual Property: Patents, unique algorithms, or trade secrets that are difficult to replicate (e.g., Coca-Cola, Google).

Strong Brand Loyalty and Community: A dedicated customer base that values the brand and resists switching (e.g., airlines and hotel chains).

High Switching Costs: Where it is costly or inconvenient for customers to move to a competitor (e.g., AT&T, Verizon).

Cost Advantages: Economies of scale, proprietary manufacturing processes, or unique supply chain efficiencies that allow for lower pricing (e.g., Amazon, Walmart, Costco).

Regulatory Hurdles: Licenses, permits, or compliance requirements that act as barriers to entry (e.g., pharmaceuticals companies).

Investors scrutinize how your startup is building and defending its moat. A business model that relies on continuous, costly innovation to stay ahead is less attractive than one with a deeply entrenched, sustainable advantage. Startup companies that use structured competitive analysis are up to 30 percent more likely to innovate successfully and 20 percent more likely to survive beyond year five [Qubit Capital, 2026], a testament to how a strong moat, often built through analysis, contributes to long-term survival.

Decoding Market Positioning and White Space Opportunities

Investors analyze how a startup positions itself within the broader market and identify any available "white space"—unmet customer needs or underserved segments. This involves understanding where your product sits relative to competitors on key dimensions like pricing, quality, features, and target audience. A clear, differentiated positioning strategy is vital. Investors want to see that you have a unique selling proposition (USP) that resonates with a specific customer segment and is difficult for competitors to replicate.

Furthermore, identifying and articulating white space is a strong indicator of opportunity and founder vision. It suggests that you have not only analyzed the existing competition but have also identified gaps in the market that you are uniquely positioned to fill. This could be a new feature set, a novel business model for an existing problem, or targeting a demographic previously overlooked by competitors. The ability to carve out and defend this white space is a key metric for investors assessing growth potential.

Pro tip: Typically, the most successful companies and lucrative investment opportunities initially appear obvious only to a select few, yet remain largely overlooked or misunderstood by outsiders unfamiliar with the core issues. As a case in point, over 100 investors initially passed on the seed rounds of now-giants Uber and Airbnb. Therefore, if you've identified a promising niche with substantial potential, brace yourself for numerous rejections from investors.

Benchmarking Go-to-Market & Business Model Strategies

The effectiveness of a startup's go-to-market (GTM) strategy and its underlying business model are heavily benchmarked against competitors. Investors examine:

Sales Channels and Marketing Strategies: How do you acquire customers? Are your sales funnels efficient? How does your marketing spend compare to rivals in terms of cost per acquisition (CAC)?

Revenue Streams and Pricing: What are your revenue sources? How does your pricing strategy align with the perceived value of your product and the pricing of your competitors? Is your pricing sustainable and scalable?

Unit Economics: Investors meticulously analyze the profitability of each unit sold or service delivered, comparing it against industry benchmarks and competitor performance. This includes gross margins, customer lifetime value (CLTV), and retention rates. Benchmark metrics for early-stage software companies include a 3:1 CAC-to-LTV ratio, 80%+ gross margins, and monthly churn below 2%.

A business model that appears fundamentally flawed or significantly less efficient than those of competitors will raise serious concerns. Conversely, a GTM strategy that demonstrates a unique ability to reach and convert customers cost-effectively, or a business model with superior unit economics, can significantly boost investor confidence.

Pro tip: One major red flag for early-stage investors is when a company plans to allocate a significant portion of its capital to marketing and advertising. Instead, early-stage companies should prioritize developing a sustainable customer acquisition flywheel that promotes organic growth. Only after establishing this repeatable mechanism and minimizing churn should a company consider increasing its acquisition efforts through paid marketing.

Understanding Customer Sentiment and Pain Points to Inform Differentiation

Investors look beyond your internal assessment of your product and delve into how customers perceive your startup and its competitors. This involves understanding customer sentiment through reviews, social media discussions, Net Promoter Scores (NPS), and churn rates. The objective is to identify unmet customer pain points that your startup can effectively address, thereby creating differentiation.

If customers are consistently expressing frustration with a particular aspect of a competitor's offering—be it usability, support, or missing features—and your startup can provide a superior solution, this represents a significant opportunity. Conversely, if your product is perceived similarly to competitors or fails to address key pain points, it signals a lack of differentiation and a struggle for market share. Investors are drawn to startups that demonstrate a deep, empathetic understanding of customer needs and can translate that understanding into a compelling value proposition that fosters loyalty.

Pro tip: Begin gathering customer reviews and feedback from day one. Ask customers to share their experiences on platforms such as G2, Trustpilot, Capterra, and Google. Favorable online reviews serve as a gold mine resource for launching your organic growth flywheel.

Assessing Product Offerings and Innovation Pipeline Against Rivals

The core of any startup is its product. Investors will rigorously assess your product offerings not just in isolation, but in direct comparison to your competitors. This involves evaluating:

Feature Set: How do your features stack up against those of your rivals? Are you offering something truly novel, or are you playing catch-up?

Product Roadmap: What is your plan for future development? How will you continue to innovate and stay ahead of the curve? Investors look for a forward-thinking roadmap that addresses evolving customer needs and anticipated competitive moves.

Technical Debt and Scalability: Is your product built on a robust and scalable architecture? Can it handle significant growth in user numbers and data?

The pace of innovation is critical. In rapidly evolving industries, such as those driven by AI (where AI startups raise capital earlier and faster than non-AI peers [SG Analytics, 2026]), investors expect startups to not only have a strong current offering but also a clear strategy for continuous improvement and disruption. A startup that demonstrates a proactive approach to R&D and a proven ability to out-innovate competitors is significantly more attractive for investment.

Pro tip: Before each investor pitch, share a demo of your product. Engaging with the product firsthand is the most effective way to comprehend its value and optimize the impact of your meeting.

Evaluating Pricing Strategies and Revenue Models within the Competitive Environment

Pricing and revenue models are direct reflections of a startup's understanding of market value and its competitive positioning. Investors meticulously examine how a startup prices its product or service relative to its competitors and the perceived value it delivers.

Value-Based Pricing: Does your pricing reflect the true value your product provides to the customer, rather than simply being a reaction to competitor pricing?

Competitive Pricing: How do your prices compare? Are you positioned as a premium, mid-tier, or budget option?

Revenue Model Viability: Whether it's subscription, freemium, one-time purchase, or a hybrid model, investors assess if the chosen revenue model is sustainable, scalable, and aligned with the market and competitive realities.

A startup that prices too low might signal a lack of confidence in its value proposition or an unsustainable race to the bottom, potentially leading to cash flow problems [PlanPros' AI, 2026]. Conversely, excessively high pricing without clear justification will deter customers and invite competition. Investors seek pricing strategies that balance market penetration, profitability, and long-term business model sustainability.

Pro tip: As an early-stage startup, investors understand that your long-term pricing strategy may not be fully developed. However, they expect you to clearly explain why you selected your current pricing model and how you plan to adjust to evolving market conditions, such as transitioning from a value-based approach to a volume-driven strategy.

The Investor's Toolkit: Unearthing Competitive Intelligence

Investors employ a diverse set of tools and methodologies to gather competitive intelligence. This isn't guesswork; it's a systematic process of data collection and analysis designed to build a comprehensive picture of the competitive landscape.

Leveraging Public Data and Professional Networks

The most accessible intelligence comes from publicly available sources. Investors meticulously scour:

Company Websites and Public Filings: Annual reports, SEC filings (for public companies), and product pages reveal strategy, financials, and offerings.

News Articles and Press Releases: These provide insights into product launches, funding rounds, partnerships, and strategic shifts.

Industry Conferences and Trade Shows: These events offer opportunities to observe competitors' presentations, product demos, and network with industry insiders.

Professional Networks: Investors often tap into their extensive networks of founders, executives, and industry experts for firsthand insights and candid opinions on competitors. Discussions on platforms like LinkedIn can also reveal team movements, hiring trends, and strategic directions.

A keen investor can piece together a substantial amount of information from these sources, often spotting subtle trends or potential vulnerabilities that a less experienced observer might miss.

Pro tip: Leverage tools like Gemini or Grok deep research to conduct a comprehensive competitive assessment and SWOT analysis for your startup. This approach will help you pinpoint competitive gaps and enhance your readiness for investor meetings, knowing that investors are conducting similar research reports.

Diving into Market Research Reports and Industry Analysis

For a broader market perspective, investors rely on syndicated market research reports from firms like Gartner, Forrester, Carta, Crunchbase, Pitchbook, or Statista. These reports provide:

Market Sizing and Growth Forecasts: Quantifying the opportunity and its trajectory.

Industry Trends and Dynamics: Identifying macro-level shifts impacting the competitive landscape.

Competitor Benchmarking: Often providing comparative analysis of key players' market share, strategies, and performance.

While these reports can be expensive, they offer valuable context and data points that complement more granular company-specific research. They help investors understand the overall health of the market and where your startup fits within established industry narratives.

Pro tip: In most cases, it's not practical or necessary for an early-stage startup to invest in costly research reports or Pitchbook subscriptions. Instead, prioritize leveraging free public data and your own proprietary datasets from talking to customers.

Advanced Tools for Deeper Insight and Validation

Beyond basic data collection, investors utilize specialized tools to gain deeper competitive intelligence:

Competitive Intelligence Platforms: Services like SimilarWeb, Crayon, and Owler provide data on website traffic, customer acquisition channels, pricing intelligence, and competitor news aggregation.

Customer Review Aggregators: Platforms like G2, Capterra, and Trustpilot offer a wealth of qualitative data on customer sentiment, feature requests, and pain points associated with various products.

Social Listening Tools: Monitoring social media for brand mentions, customer feedback, and sentiment analysis related to your startup and its competitors.

SEO and Analytics Tools: Tools like SEMrush or Ahrefs can reveal competitors' online marketing strategies, keyword targets, and content performance, offering insights into their GTM efforts.

These tools allow investors to move beyond surface-level observations to quantitative analysis, validation of claims, and identification of subtle shifts in the competitive landscape that might signal emerging threats or opportunities.

Beyond Data: Qualitative Signals Investors Value (e.g., brand reputation, market understanding)

While data is king, investors also place significant weight on qualitative signals that are harder to quantify but crucial for assessing long-term potential. These include:

Brand Reputation and Perception: How is your startup perceived by customers, partners, and the industry? A strong, positive brand can be a powerful moat.

Founder's Deep Market Understanding: Do the founders demonstrate an intuitive grasp of market nuances, customer psychology, and the competitive ecosystem that goes beyond data points? This often comes through in their communication and strategic articulation.

Team's Experience and Adaptability: Does the team have a track record of navigating competitive markets or overcoming challenges? Their resilience and strategic thinking are invaluable.

Thought Leadership: Does the startup or its founders contribute to industry discourse, demonstrating vision and influencing the market narrative?

These qualitative factors, often discerned through interviews, networking, and observing the startup's overall presence, can heavily influence an investor's decision, especially when the quantitative data is inconclusive or similar among competitors.

Pro tip: Keep your LinkedIn and Crunchbase profiles updated for both personal and company information, as these platforms are among the first that investors check when evaluating your startup. Share essential milestones, team news, customer growth, and other significant achievements. Additionally, start a monthly investor update newsletter to distribute industry insights, showcase thought leadership, and ensure your company remains prominent in the minds of potential investors. A monthly newsletter can be a simple as an email list with a few bullet points.

Mastering the Investor Pitch: Presenting Your Competitive Edge

The culmination of your competitive analysis is its presentation to investors. This is where you translate your research and strategy into a compelling narrative that inspires confidence and secures funding. Approximately only 0.05% of startups secure venture capital funding [Digital Silk, 2025], making a clear and persuasive presentation essential.

Crafting a Compelling Competitive Narrative: Risks, Opportunities, and Your Unique Value Proposition (USPs)

Your pitch deck's competitive slide (or slides) should tell a story, not just present data.

Honesty and Transparency: Acknowledge your competitors openly. Investors value honesty. Claiming to have no competition is a major red flag, suggesting a lack of research or an inflated view of your opportunity.

Clear Articulation of USPs: Emphasize what makes your startup unique. For each competitor, highlight how your product, business model, or value proposition is superior or distinct.

Risk and Opportunity Framing: Frame your competitive analysis not just as a threat, but as a validation of the market and an illustration of the opportunities you are poised to capture. Discuss how you will mitigate identified risks.

Focus on "Why You Win": The narrative should clearly explain why your startup is best positioned to succeed in this competitive landscape.

Investors want to know you understand your market—inside and out. Incorporating competitor analysis into your investor decks shows that you’ve done your homework.

Visualizing Your Place: Strategic Matrices, Quadrant Analysis, and Market Share

Visual aids are powerful tools for conveying complex competitive information efficiently.

Competitive Matrices: These can compare your startup and key competitors across critical features, pricing, target audiences, or benefits.

Quadrant Analysis: Plotting competitors on axes representing key market dimensions (e.g., innovation vs. market share, price vs. quality) can vividly illustrate your unique positioning and any "white space" you occupy.

Market Share Visualizations: Presenting current and projected market share, showing how you plan to capture it from competitors.

These visuals should be clear, easy to understand at a glance, and directly support your narrative about differentiation and opportunity. They help investors quickly grasp your startup's place in the market and your strategic intent.

Pro tip: Use free tools like NotebookLM to create slide decks, infographics, and other visuals.

Addressing Investor Red Flags and Highlighting Green Flags in Your Analysis

A strong competitive analysis proactively addresses potential investor concerns and highlights what instills confidence.

Red Flags Investors Look For:

Ignoring or Downplaying Competition: Suggests a lack of understanding or honesty.

Overestimating Unique Value: Claiming to be the "only" solution without clear evidence.

Lack of Defensible Moats: Relying on easily replicable advantages.

Weak Go-to-Market Strategy: A plan that cannot effectively compete for customers.

Misunderstanding Customer Needs: Creating products nobody wants or needs.

Green Flags Investors Look For:

Deep, Honest Analysis: Acknowledging all types of competitors and their strengths.

Clear, Differentiated USPs: Explaining what makes you truly better or different.

Sustainable Competitive Moats: Demonstrating long-term defensibility.

Credible Go-to-Market Plan: A realistic strategy for acquiring customers.

Founder's Strategic Insight: Evidence of foresight and adaptability.

Customer-Centricity: Demonstrating a profound understanding of customer pain points.

Pro tip: Maintain a dynamic FAQ document in your data room, updating it with investor questions or concerns after each meeting. This approach saves you time from answering the same questions and streamlines the investor diligence process.

Demonstrating Business Defensibility and Growth Strategies

Ultimately, your competitive analysis must serve as a springboard for showcasing business defensibility and robust growth strategies. Investors want to know that your startup isn't just a fleeting idea but a scalable enterprise that can withstand competitive pressures and achieve significant scale.

Explain how your competitive advantage translates into tangible growth levers. If you have a strong network effect, how will that accelerate user acquisition? If you possess proprietary technology, how will that lead to higher margins or new product lines? Investors are looking for a clear line of sight from your competitive positioning to your ability to capture market share, generate substantial revenue, and achieve profitability.

Your growth strategy should be informed by your understanding of the competitive landscape. How will you adapt to potential new entrants? How will you fend off attacks from established players? A confident, data-backed narrative that demonstrates your preparedness to navigate these challenges is crucial for securing investment. This proactive approach to competition and growth planning is what transforms a promising idea into a compelling investment opportunity.

Summary: Elevate Your Narrative, Secure Your Funding

In the highly competitive arena of startup funding, a superficial understanding of your competition is a critical vulnerability. Investors approach competitive analysis with a singular focus: to de-risk their investment and identify ventures with the highest potential for exceptional returns. They scrutinize your grasp of the market, the defensibility of your business model, the strength of your product, and your team’s strategic acumen, all through the lens of the existing and potential competition.

By moving beyond a simple listing of rivals to a deep, analytical framework—identifying all shades of competitors, dissecting competitive moats, decoding market positioning, benchmarking strategies, and understanding customer sentiment—you can construct a powerful narrative. This narrative, supported by robust research and presented visually, demonstrates your foresight and preparedness.

The ability to clearly articulate your unique value proposition, proactively address investor concerns, and showcase a credible growth strategy built on sustainable competitive advantages is paramount. In an environment where only about 1 in 2,000 startups secure venture capital funding [Digital Silk, 2025], mastering how investors evaluate your competition is not just beneficial; it is essential for elevating your pitch, building investor confidence, and ultimately, securing the funding necessary to bring your startup vision to fruition.

Frequently Asked Questions

Getting Started with Competitive Analysis

How do I start conducting a competitor analysis for my startup?

To start your competitor analysis, begin by identifying all types of competitors—direct, indirect, substitutes, and potential future rivals. Use free resources like Google search, company websites, and social media platforms to gather initial information. Create a competitor matrix to organize your findings across key dimensions like features, pricing, target market, and marketing strategies. Tools like SEMrush can help you analyze competitors' digital presence and content marketing approaches. The key is to be thorough and honest in your assessment, as investors will likely have already evaluated your competitors and expect you to demonstrate comprehensive market understanding.

What competitive analysis template should startup founders use when preparing for investor pitches?

An effective competitive analysis template for startup fundraising should include several components: a competitor matrix comparing key features and positioning, a SWOT analysis identifying your strengths and weaknesses relative to competitors, market segmentation showing your target customers, and a visual representation (like quadrant analysis) showing your unique positioning. Include data on competitor pricing, marketing strategies, customer experience ratings from platforms like G2 or Trustpilot, and growth metrics where available. Many venture capitalists appreciate seeing frameworks like Porter's Five Forces or PESTEL Analysis to demonstrate strategic thinking about the market environment.

How often should I update my competitor analysis during the startup fundraising process?

Update your competitor analysis continuously throughout your fundraising journey. Markets evolve rapidly, and VC funds expect you to have current competitive intelligence. Before each investor meeting, refresh your analysis using tools like SEMrush for digital marketing data, check social media for recent announcements, and review platforms like Crunchbase or CB Insights for funding news and traction data. Markets can shift significantly even during a funding round, and venture capitalists value founders who demonstrate real-time market understanding and adaptability to changing market trends.

Understanding Competitive Advantages and Market Positioning

What competitive advantages do investors value most in early-stage startups?

Investors prioritize sustainable competitive advantages or "moats" that are difficult for competitors to replicate. The most valued advantages include strong network effects (where value increases with more users), proprietary technology or intellectual property, high switching costs that lock in customers, and significant cost advantages through economies of scale or unique distribution networks. Investors also value team expertise and domain knowledge—they want to back founders who are uniquely qualified to solve specific problems. During your trial period in the market, demonstrating that these advantages are actually working (through customer retention, pricing power, or market reach) significantly strengthens your position with investors.

How do I identify market gaps and position my startup in white space?

Identifying market gaps requires deep customer research and thorough competitor analysis. Start by examining customer reviews on platforms like G2, Capterra, Trustpilot, and even Glassdoor to understand where competitors are falling short. Use social media listening and direct customer conversations to uncover unmet needs. Analyze content gaps in competitor marketing to see which customer segments or use cases aren't being addressed. Look at market segmentation—are there demographics or industries being overlooked? Tools like SEMrush can reveal content competitors aren't creating. The most successful startups often identify opportunities that seem obvious to insiders but are misunderstood by the broader market, as demonstrated by companies like Uber and Airbnb, which faced numerous rejections before finding investors who understood their vision.

How can I use competitor analysis to inform my product development roadmap?

Competitor analysis should directly shape your product development priorities. Map competitor features in a competitor matrix and identify where they're strong and where gaps exist. Analyze customer experience feedback across review platforms to understand which features customers actually value versus marketing claims. Use competitive intelligence from sources like peer-reviewed academic journals for technical innovations, and platforms like CB Insights for product launch patterns. However, avoid simply copying competitor features—instead, use this analysis to identify opportunities for differentiation and innovation. Investors want to see a forward-thinking roadmap that anticipates market trends and demonstrates how you'll maintain competitive advantages as the market evolves.

Tools and Resources for Competitive Intelligence

What free and paid tools should I use for gathering competitive intelligence?

Start with free resources: Google search for basic company information, LinkedIn for team movements and thought leadership, social media for brand sentiment, and government databases for regulatory filings and industry data. For deeper analysis, consider investing in tools as you grow: SEMrush or Ahrefs for SEO and content marketing analysis, SimilarWeb for website traffic data, G2 and Capterra for customer reviews and ratings, and Crunchbase for funding and traction data. AI-powered platforms like Gemini can conduct comprehensive competitor research reports. For market context, access syndicated reports from Gartner, Forrester, or Statista, though these can be expensive for early-stage startups. Many platforms offer a free trial period—use these strategically before investor meetings.

How can I use SEMrush and similar tools to understand competitor marketing strategies?

SEMrush provides valuable insights into competitor marketing strategies by revealing their organic and paid search keywords, content marketing performance, backlink profiles, and advertising copy. Use it to identify which keywords drive traffic to competitor sites, understand their content gaps you can exploit, and benchmark your digital presence against theirs. Analyze their most successful content to understand what resonates with your shared target audience. SEMrush can also reveal their advertising spend patterns and messaging. Combine this data with social media analytics and customer review platforms to build a complete picture of how competitors acquire and retain customers—critical information for demonstrating to venture capitalists that you have a superior go-to-market strategy.

Should I invest in expensive market research reports and data subscriptions as an early-stage startup?

Generally, early-stage startup founders should prioritize free public data and proprietary insights from customer conversations over expensive subscriptions to Pitchbook or premium research reports. Your limited capital is better spent on product development and customer acquisition. However, selectively accessing market data through free trials or one-time report purchases can be valuable before major investor pitches. Focus on building your own competitive intelligence through direct market engagement, social media monitoring, Google search, and free platforms like Crunchbase. As you progress toward Series A and beyond, when VC funds expect more sophisticated market analysis, investing in professional tools becomes more justified.

Strategic Frameworks and Analysis Methods

How do I apply Porter's Five Forces to my competitive analysis for investors?

Porter's Five Forces helps investors understand the structural attractiveness of your market. Analyze:

Threat of new entrants—what barriers protect your market position?

Bargaining power of suppliers—how dependent are you on key partners or distribution networks?

Bargaining power of buyers—how price-sensitive is your customer base?

Threat of substitutes—what alternative solutions could customers choose?

Competitive rivalry—how intense is competition among existing players?

Present this framework in investor pitches to demonstrate strategic market understanding. Connect each force to your competitive advantages and explain how your business model addresses these dynamics. This analysis shows venture capitalists you understand not just current competitors, but the entire market environment that will impact your growth trajectory.

What is blue ocean strategy and should I use it in my competitive positioning?

Blue ocean strategy involves creating new market space where competition is irrelevant rather than competing in existing "red ocean" markets. While intellectually appealing, be cautious about presenting a pure blue ocean approach to investors. Most successful startups actually compete in established markets with proven market demand, then differentiate through superior execution or innovation. Venture capitalists are often skeptical of claims that you have "no competition"—it usually signals either inadequate market analysis or insufficient market demand. Instead, acknowledge the existing market context, identify specific market gaps your competitors haven't addressed, and explain how you'll capture share from existing solutions while expanding the overall market. This balanced approach demonstrates both market understanding and growth potential.

Should I include PESTEL Analysis in my investor presentation?

PESTEL Analysis (Political, Economic, Social, Technological, Environmental, Legal factors) can strengthen your pitch by demonstrating comprehensive market understanding, but use it strategically rather than overwhelming investors with frameworks. It's particularly valuable when external factors significantly impact your market—for example, regulatory changes, technological disruptions, or economic trends that create opportunities or threats. Venture capitalists appreciate founders who anticipate how macro trends will affect the competitive landscape. However, keep it concise and directly connected to your competitive positioning and growth strategy. Don't let framework analysis overshadow the compelling narrative about why your startup will win in the market.

Presenting Competition to Investors

What are the biggest red flags investors look for in how startups present their competitor analysis?

The most critical red flag is claiming you have no competitors—this signals inadequate research or market understanding. Other major concerns include: knowing less about your competitors than the investors do (they've likely already evaluated your rivals), focusing only on product features while ignoring business model or go-to-market differences, underestimating indirect competitors or substitutes, lacking defensible competitive advantages beyond "we're first" or "we're better," and having no clear strategy for how you'll win market share. Investors also worry when startups can't articulate customer experience differences or demonstrate deep market understanding. During startup fundraising, approximately 20% of failures stem from being outcompeted, so superficial competitor analysis suggests vulnerability.

How should I visualize competitive positioning in my pitch deck using a competitor matrix?

An effective competitor matrix should be visual, easy to grasp quickly, and support your differentiation narrative. Create a table comparing your startup against 3-5 key competitors across the most important dimensions—typically features, pricing, target market, customer experience ratings, and your key differentiators. Use checkmarks, ratings, or brief descriptors rather than lengthy text. Consider complementing the matrix with quadrant analysis, plotting competitors on two key axes (such as price vs. features, or innovation vs. market reach) to visually highlight the white space you occupy. Include data sources where possible—reference customer ratings from G2, market data from CB Insights, or pricing from competitor websites. This demonstrates thorough competitive intelligence while making your unique positioning immediately clear to venture capitalists.

How can I demonstrate competitive advantages without appearing overconfident or dismissive of strong competitors?

Balance confidence with intellectual honesty. Acknowledge competitor strengths explicitly—this shows market understanding and strategic thinking. Then clearly articulate your specific competitive advantages with supporting evidence: customer testimonials, retention rates, superior unit economics, traction data, or proprietary technology. Frame advantages in terms of customer value and market gaps you're addressing rather than just claiming superiority. Share how your team expertise uniquely positions you to execute on your vision. Investors value founders who respect their competition while demonstrating a credible path to winning market share. This approach—"Competitor X does Y well, but we uniquely solve Z problem through our ABC advantage"—resonates much better than dismissiveness.

Market Analysis and Growth Strategy

How do I connect my competitor analysis to demonstrating market demand and growth potential?

Link your competitive analysis directly to market opportunity by showing how competitor traction validates market demand while their limitations create your opportunity. Present market data showing growth trends, reference competitor funding rounds or valuations as demand indicators, and use customer experience feedback to demonstrate unmet needs driving market expansion. Connect specific market gaps you've identified to quantifiable opportunities—customer segments, geographic markets, or use cases competitors aren't serving effectively. Show how your competitive advantages enable you to capture this demand more effectively. Include growth metrics and traction data that prove you're already succeeding. Venture capitalists invest in growing markets, so your competitor analysis should illuminate both the overall market potential and your specific path to capturing significant share.

What market trends should I highlight when discussing competition with VC funds?

Focus on market trends that create opportunities for your startup while potentially disrupting established competitors. This might include: technological shifts (like AI adoption) that favor your approach, regulatory changes creating new requirements or opportunities, demographic or behavioral changes affecting customer preferences, economic trends influencing buying patterns, or distribution channel evolution (like direct-to-consumer models). Reference market analysis from credible sources like peer-reviewed academic journals, government databases, or industry reports. Explain how you're positioned to capitalize on these trends better than competitors due to your business model, technology, team expertise, or market segmentation strategy. Investors want to back companies riding positive momentum, so connecting your competitive positioning to favorable market trends strengthens your startup fundraising narrative.

How do I address potential market expansion opportunities in my competitive analysis?

When discussing market expansion with investors, demonstrate that you've analyzed how competitors have grown (or failed to grow) into adjacent markets. Identify geographic, customer segment, or product line expansion opportunities that competitors haven't effectively pursued. Explain why you're better positioned for this expansion—perhaps through your technology platform, distribution networks, brand positioning, or team expertise. However, be realistic: investors typically prefer founders who can dominate their initial market before expanding. Present expansion as a future opportunity enabled by strong competitive advantages in your core market rather than as an immediate strategy. Use your competitor analysis to show you understand the risks and requirements of expansion, including how the competitive landscape might differ in new markets.

Ongoing Competitive Intelligence

How do I maintain competitive intelligence throughout my startup's growth beyond initial fundraising?

Build ongoing competitive intelligence into your operations from the start. Establish regular monitoring using tools like Google Alerts for competitor news, social media listening for brand mentions and customer sentiment, and SEMrush for tracking digital marketing changes. Review customer experience feedback continuously on platforms like G2, Capterra, and Trustpilot. Attend industry conferences to observe competitor positioning and build your network. Create a shared repository where your team documents competitor moves, customer feedback, and market shifts. Include competitive updates in your monthly investor newsletter. As you scale, consider designating someone to own competitive intelligence or investing in dedicated competitive intelligence platforms. This ongoing vigilance helps you adapt your product development, marketing strategies, and overall strategy while demonstrating to current and future venture capitalists that you maintain strong market understanding as conditions evolve.

Should I monitor competitor content marketing and social media strategies, and how?

Absolutely monitor competitor content marketing and social media—these reveal their positioning, target customers, and go-to-market priorities. Use SEMrush to analyze their content performance, identify content gaps in their strategy, and understand which topics drive engagement. Follow competitors on all relevant social media platforms to track their messaging, product launches, and customer interactions. Analyze content competitors to see who else is attracting your target audience's attention. Look for patterns in their customer experience communications and how they address complaints or concerns. Tools like BuzzSumo can show which content resonates most with shared audiences. However, use this intelligence to inform your own differentiated strategy rather than simply copying competitors. Investors value startups that have unique voices and content marketing approaches that reflect their specific competitive advantages and market positioning.