Berkus Method vs. Other Valuation Models

Valuing early-stage startups can be tricky, especially without financial history. The Berkus Method focuses on reducing risk by evaluating five factors: idea, prototype, team, relationships, and traction. It's ideal for pre-revenue startups but relies on subjective judgment. Other methods, like the Scorecard Method, compare startups to industry benchmarks, while Comparable Company Analysis uses market data. For later-stage companies, Discounted Cash Flow (DCF) calculates future earnings potential.

Quick Overview of Valuation Models:

Berkus Method: Pre-revenue, assigns value to progress and risk reduction.

Scorecard Method: Compares startups to others in the market.

Comparable Company Analysis: Uses metrics from similar businesses.

Discounted Cash Flow (DCF): Best for mature companies with revenue.

Each method fits different stages of a startup's journey, and early-stage investors often combine these models to ensure balanced valuation assessments.

Top 7 Startup Valuation Methods - Valuation 101

What is the Berkus Method

The Berkus Method is a valuation approach specifically designed for startups that lack a detailed financial history [5]. Created by Dave Berkus in the 1990s, it was developed to address the challenge of valuing early-stage companies without relying on traditional financial projections. Instead, this method focuses on reducing risks associated with the startup's success.

Dave Berkus himself described the method as follows:

"The best way to value a startup is to give value to those elements of progress by the entrepreneur or team that reduce risk of success." [6]

Unlike conventional valuation models that depend on speculative financial forecasts, the Berkus Method emphasizes tangible progress and risk reduction, forming the foundation of its key components.

5 Core Elements of the Berkus Method

The Berkus Method evaluates startups based on five critical factors, each aimed at addressing specific risks. Each factor can contribute up to $500,000 to the startup's pre-money valuation, with a maximum total valuation of $2.5 million [5].

Sound Idea: This measures the strength of the business concept and its ability to solve a real problem or meet a market need.

Prototype: Focuses on the development of a working product or service, demonstrating technical feasibility.

Experienced Team: Assesses the expertise and track record of the founding team and key players, which can significantly impact the startup's chances of success.

Strategic Relationships: Looks at the startup's ability to establish key partnerships, secure early customers, or build valuable industry connections.

Market Traction: Evaluates early indicators of market interest, such as initial sales or positive feedback from pilot customers.

For example, TechNova Solutions, a startup offering an AI-driven project management tool, was valued using the Berkus Method. The breakdown included $400,000 for its strong business idea, $450,000 for its developed prototype, $350,000 for its team, $200,000 for strategic partnerships, and $100,000 for early sales - resulting in a total valuation of $1.5 million. This analysis highlighted areas for improvement, particularly in team development and expanding partnerships.

Pros and Cons

One of the biggest advantages of the Berkus Method is its straightforward approach, making it accessible to both founders and early-stage investors. By focusing on qualitative factors, it provides a practical framework for valuation when financial projections are unreliable or unavailable.

However, the method isn’t without its challenges. Its reliance on subjective evaluations can lead to inconsistent results, as different evaluators may assign varying values to the same factors. Additionally, the original $500,000 cap per factor, while suitable for early-stage startups, may not adequately reflect the potential of more advanced companies.

Best Use Cases for the Berkus Method

The Berkus Method is best suited for very early-stage startups, particularly those seeking angel or seed funding. It’s an excellent choice when financial data is sparse or unreliable, as it allows founders to showcase progress in reducing key risks.

Startups with innovative prototypes, strong founding teams, or promising strategic relationships stand to benefit the most from this approach. However, for companies with established revenue or those seeking later-stage funding, more detailed financial analyses are typically required.

Pro Tip: Use our free Berkus Method Calculator to estimate your startup’s pre-revenue valuation. Perfect for founders, angel investors & early-stage VCs.

Other Common Startup Valuation Methods

Beyond the Berkus Method, there are other ways to estimate the value of startups, particularly when data is limited.

Scorecard Method

The Scorecard Method, often referred to as the Bill Payne valuation method, uses comparisons to evaluate startups. Instead of assigning fixed dollar amounts, it benchmarks your startup against others in the same region, industry, and stage of development [7].

Here’s how it works: First, you determine the average pre-money valuation of comparable startups in your market. Then, your company is assessed across six key factors, each with a specific weight. The management team holds the greatest weight at 25%, followed by the size of the opportunity at 20%, and product or technology at 18%. Marketing and sales capabilities account for 15%, while the need for additional funding and other factors each carry 10% [7].

For example, let’s say ABC Ltd., a startup seeking angel investment, is valued using this method. The baseline pre-money valuation is $7 million. The company scores 140% on market opportunity, 130% on team strength, 100% on technology, 90% on sales capabilities, and 80% on competitive environment. After applying the weighted factors, the startup’s final valuation is $7.843 million [7].

The advantage of this method is its grounding in real-world funding data, making valuations more realistic. However, finding truly comparable companies can be tricky, especially for startups in niche or emerging markets. For a purely financial approach, the Comparable Company Analysis method offers another option.

Comparable Company Analysis

Comparable Company Analysis (CCA) operates on a simple principle: similar companies should have similar valuations [9]. This method evaluates financial metrics - like revenue multiples, user growth rates, or other key performance indicators - from comparable businesses and applies those benchmarks to your startup.

This approach works particularly well when there’s access to publicly available data from similar companies, especially those that are publicly traded. Instead of pinpointing a single valuation, CCA provides a range, offering flexibility during negotiations. It’s also relatively straightforward since it avoids complex financial modeling or speculative projections.

However, finding truly comparable companies can be challenging for early-stage startups with unique business models or those in emerging markets. Additionally, CCA heavily depends on market trends and investor sentiment, which can sometimes distort valuations [8]. This method is better suited for startups with established metrics, like consistent revenue or user growth, rather than pre-revenue companies [10].

For startups that need to project long-term cash flow, investors may turn to the Discounted Cash Flow method.

Discounted Cash Flow (DCF)

The Discounted Cash Flow method is a classic approach to valuation. It involves projecting a company’s future cash flows over several years and then discounting those numbers back to their present value using a rate that reflects the investment's risk [1].

For mature companies with steady revenue, DCF offers detailed, data-driven valuations. It also forces both founders and investors to think about long-term performance, market trends, and competitive positioning. It’s often considered the gold standard for valuing established businesses with predictable cash flow.

However, DCF doesn’t work well for seed-stage startups. Early-stage companies often lack consistent cash flow, and their financial projections are highly speculative. Assumptions about market adoption, competition, and execution can vary widely, making the method unreliable for startups still in their infancy [1].

For example, while a mature SaaS company with recurring revenue can use DCF to project future earnings, a startup still developing its product doesn’t have the financial data to support such calculations. As a result, DCF is typically reserved for later funding rounds when companies have clearer revenue patterns and paths to profitability.

Unlike the Berkus Method, which focuses on potential rather than financial metrics, DCF requires solid financial data that most early-stage startups simply don’t have. This explains why early-stage investors often prefer methods like the Berkus or Scorecard approaches when making initial investment decisions.

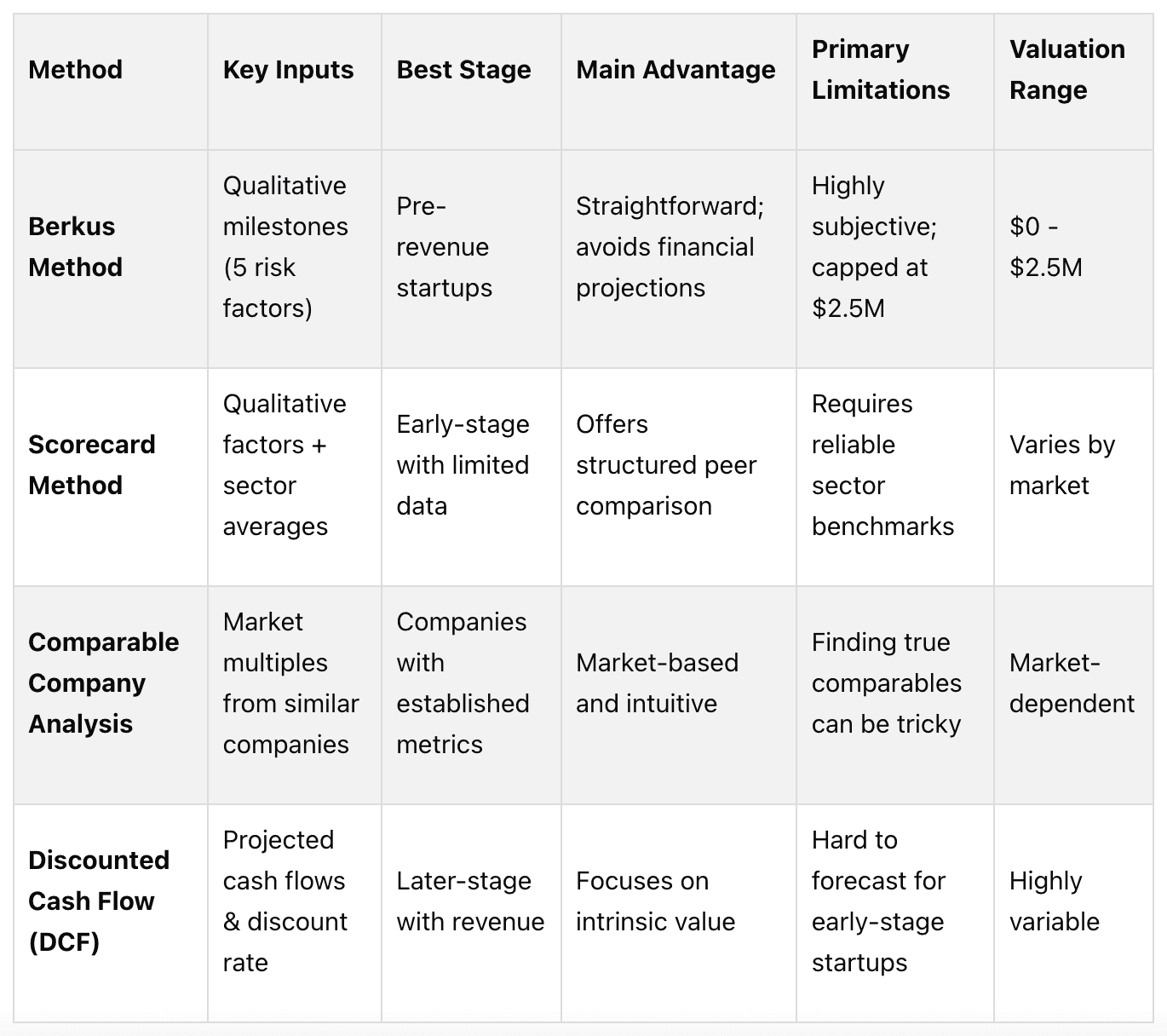

Direct Comparison of Valuation Methods

Determining the right valuation method for a startup is no small feat, especially given the uncertainties surrounding early-stage data. Each approach comes with its own set of inputs, assumptions, and challenges.

The Berkus Method assigns monetary values to specific risk-reducing milestones, while the Scorecard Method uses a weighted comparison against an "ideal" company. On the other hand, Comparable Company Analysis relies on valuation multiples from similar businesses, and the Discounted Cash Flow (DCF) method calculates present value based on projected future cash flows [11].

As Dave Berkus himself put it:

"Pre-revenue, I do not trust projections, even discounted projections" [12]

This statement highlights his preference for focusing on qualitative milestones rather than speculative financial forecasts. The comparison table below outlines the key aspects of these four valuation methods.

Comparison Table

Each method serves different purposes depending on the stage and data available. The Berkus Method, for instance, is perfect for pre-revenue startups, relying solely on qualitative milestones. The Scorecard Method adds a layer of comparison by incorporating sector averages, making it suitable for early-stage ventures. For companies with established metrics, Comparable Company Analysis provides market-driven insights, while DCF is best suited for later-stage businesses with predictable revenue streams.

Subjectivity also plays a role. The Berkus and Scorecard methods lean heavily on investor judgment, while Comparable Company Analysis and DCF depend on assumptions about market conditions and future growth.

To address the complexities of valuation, investors often combine these methods to create a more balanced and thorough assessment.

How to Pick the Right Valuation Method

Choosing the right valuation method depends largely on your startup's stage and the kind of data you have at your disposal.

Key Decision Factors

Company maturity plays a big role in determining the best approach. If your startup is pre-revenue, qualitative methods like the Berkus or Scorecard Method are better suited. As your business starts generating steady revenue, quantitative techniques such as Discounted Cash Flow (DCF) or Comparable Company Analysis become more practical [13].

Jason Mendelson, Founding Partner at the Foundry Group, sums it up well:

"At the very earliest stage of any new venture, it's all about hope and not metrics" [3].

Available financial data is another critical factor. Without reliable revenue figures, using DCF analysis isn't feasible. On the other hand, sticking with qualitative methods like the Berkus Method when you have solid revenue data could lead to an undervaluation of your progress.

Funding stage also matters. For pre-seed rounds, qualitative techniques are typically sufficient. By the time you're raising a Series A round, it's worth incorporating quantitative methods into your valuation process.

Market conditions and investor expectations add yet another layer of complexity. In highly competitive funding environments, investors may insist on seeing multiple valuation methods to ensure accuracy and credibility [13].

The bottom line: your valuation approach should align with your startup’s stage, available data, and funding goals. These factors form the foundation of the valuation process used by Allied Venture Partners.

How Allied Venture Partners Uses Valuation Models

At Allied VC, we take a tailored approach to valuation, adapting methods to fit the unique challenges faced by early-stage startups. As a firm specializing in pre-seed, seed, and Series A investments across North America, we recognize the difficulties of valuing companies with limited financial history.

For pre-revenue startups, Allied relies on qualitative tools like the Berkus Method. When assessing seed-stage startups, we blend multiple approaches to create a more rounded view. For example, we might use the Berkus Method to set a baseline valuation and then cross-check it with comparable company analysis, leveraging our extensive network of North American tech startups. This combination helps validate assumptions while accounting for both the startup’s potential and current market conditions.

With access to a network of over 2,000 global angels and VCs, Allied can tap into valuable market insights. For instance, when evaluating a fintech startup, we can benchmark valuations using recent investment data from similar companies within our network.

For Series A rounds, Allied incorporates more quantitative models while still considering qualitative factors like the strength of the team, market opportunity, and execution capability. Our approach reflects the understanding that early-stage valuation is as much about judgment as it is about numbers [2]. By blending theoretical models with real-world insights, Allied ensures that valuations are grounded in both logic and market realities.

Lets Recap

The Berkus Method serves as a straightforward and practical tool for early-stage tech startups that lack extensive financial data. By prioritizing risk reduction over speculative projections, it becomes especially useful for pre-revenue companies. This approach lays the groundwork for selecting the right valuation methods as a startup progresses.

The secret to effective valuations lies in choosing methods that align with a startup's stage of development. For early-stage companies, qualitative models like the Berkus Method work well. As startups grow and establish revenue streams, quantitative techniques, like discounted cash flow analysis or comparable company analysis, can complement these models.

At Allied Ventures, we aim to exemplify this balance by tailoring valuation strategies to the unique challenges faced by early-stage startups. Our approach combines qualitative assessments for pre-revenue companies with a blend of quantitative methods for more mature companies. This strategy reflects how professional investors mix theoretical models with practical market insights.

Ultimately, aligning valuation methods with a startup's stage and the quality of available data is essential. Whether you're a founder gearing up for your first funding round or an investor evaluating your first angel investment, understanding these valuation approaches equips you to make smarter decisions in the ever-changing landscape of startup investing.

FAQs

What’s the difference between the Berkus Method and the Scorecard Method for valuing early-stage startups?

The Berkus Method focuses on estimating a startup's value by assigning up to $500,000 to various qualitative factors, such as the strength of the idea, the quality of the founding team, and the potential of the market. This method is especially helpful for pre-revenue startups that don’t yet have financial data to analyze.

Meanwhile, the Scorecard Method takes a comparative approach. It evaluates a startup against others in the same industry, considering elements like market size, team experience, and the stage of the product. This method is better suited for startups that have gained some traction and can show measurable progress.

To sum it up, the Berkus Method is perfect for gauging qualitative risks in very early-stage startups, while the Scorecard Method offers a more data-focused valuation for companies with some activity in the market.

Why is the Berkus Method often better suited than Discounted Cash Flow (DCF) for valuing pre-revenue startups?

The Berkus Method is a practical choice for valuing pre-revenue startups because it focuses on qualitative factors like the strength of the founding team, the potential of the market, and the development progress of a prototype. This approach works well for early-stage companies that lack financial data or consistent cash flow projections.

On the other hand, the Discounted Cash Flow (DCF) method depends heavily on projecting future revenue and profits - something that early-stage startups often can't provide with accuracy. For startups without revenue, the Berkus Method offers a more grounded way to evaluate their potential.

What are the limitations of the Berkus Method for valuing startups?

The Berkus Method is a popular tool for evaluating early-stage startups, thanks to its straightforward approach. However, it does come with a few drawbacks. Since it leans heavily on qualitative factors like the strength of the team or the concept itself, it can lack precision when applied to startups that already have measurable revenue or more mature business models.

This simplicity can sometimes gloss over the complexities of a business, leaving out critical financial metrics or unique risks - elements that are essential for accurately assessing companies with innovative ideas or those scaling at a fast pace.

For startups that already have steady revenue or more developed operations, valuation methods that factor in detailed financial data might offer a clearer and more accurate picture.