How Non-Dilutive Funding Helps Early-Stage Startups

Non-dilutive funding gives startups access to capital without giving up ownership. It includes options like government grants, tax incentives, venture debt, and revenue-based financing. This approach helps founders maintain control, stabilize valuations, and extend their financial runway.

Key Takeaways:

Ownership Retention: Founders keep full equity.

Funding Types: Includes grants, tax credits, loans, and revenue-based financing.

Accessibility: Easier to secure than traditional VC funding.

Challenges: Smaller funding amounts, time-consuming applications, and limited strategic support.

For startups, combining non-dilutive funding with equity financing can reduce dilution, improve credibility, and support growth. Timing is critical - secure funds when cash flow is strong to negotiate better terms.

How to Access Non-Dilutive Funding

Types of Non-Dilutive Funding in the US and Canada

Startups across North America have access to a variety of non-dilutive funding options. These funding methods allow founders to choose strategies that align with their business needs and growth stages.

Government Grants and Tax Incentives

Government programs are some of the most appealing sources of non-dilutive funding, designed to encourage innovation and business development.

In the United States, programs like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) are key players, offering up to $2 million in seed funding for eligible startups [1].

Canada also provides a strong lineup of funding opportunities. The Industrial Research Assistance Program (IRAP) supports tech companies with funding and advisory services. Meanwhile, the Scientific Research and Experimental Development (SR&ED) tax credit program allocates $4.5 billion annually in tax incentives [5]. On a regional level, initiatives like the Ontario Innovation Tax Credit and the Alberta Innovates Voucher Program cater to specific provincial priorities [4].

For example, Opencare, a digital healthcare platform, leveraged government grants to enhance its technology and expand its reach across Canadian cities [4]. Similarly, EcoSense Technologies, an environmental startup in Vancouver, secured funding through the Clean Growth Hub to develop sustainable waste management solutions [4].

Revenue-Based Financing and Venture Debt

For startups generating consistent revenue, revenue-based financing offers an alternative to equity funding. This model provides upfront capital in exchange for a percentage of future revenues, making it particularly suitable for businesses like software-as-a-service (SaaS) companies with predictable income streams [1].

Another option is venture debt, which is designed for startups that have already raised venture capital. It allows them to extend their runway without giving up additional equity. For instance, Toronto-based fintech company Clearco combined government loans with venture capital to build its financing platform for e-commerce businesses [4]. Venture debt often includes warrants or equity-related incentives, but it results in less dilution compared to traditional equity rounds.

Pro Tip: The ideal time to raise venture debt is immediately after an equity financing round. Debt lenders prefer to support startups that are well funded with at least 12 to 18 months of runway in the bank.

Eligibility and Application Processes

Once the right funding option is identified, startups need to focus on meeting eligibility requirements and navigating the application process. Most government programs require applicants to be incorporated entities and meet minimum revenue thresholds [7]. Other criteria may depend on factors like industry focus, geographic location, and how well the business aligns with the program’s goals [6].

"It's about matching the grantor's values with your startup's objectives." – Thuy Cusato, Vice President, Startup Banking at J.P. Morgan [8]

Applications typically require detailed documentation, such as business plans, financial statements, incorporation records, and risk assessments. For instance, the San Francisco Accessibility Grant supports small businesses by funding accessibility improvements [9].

Application timelines vary widely - some grants follow annual cycles, while others accept applications year-round. Tools like the Business Benefits Finder can help Canadian startups identify tailored funding opportunities. Additionally, Innovation Advisors are available to assist with applications, ensuring startups stay on track.

After receiving funding, businesses should be prepared for ongoing reporting requirements, which may include monthly or quarterly updates and annual reports for several years [10].

For revenue-based financing and venture debt, the focus shifts to financial performance and revenue predictability. Lenders typically review detailed financial projections, investor references, and specific plans for how the funds will be used.

While the due diligence process resembles traditional lending, it places greater emphasis on the company’s growth potential and market opportunities.

Benefits and Drawbacks of Non-Dilutive Funding

When deciding on funding strategies, it's important to weigh the pros and cons. Non-dilutive funding comes with some clear advantages, but it also presents challenges that founders should carefully evaluate.

Benefits of Non-Dilutive Funding

One of the biggest perks of non-dilutive funding is that it allows founders to maintain full ownership of their company. This means they can make strategic decisions independently, without external pressure to scale quickly or pivot prematurely. It also provides flexibility to grow at a pace that aligns with the company’s goals.

Receiving a government grant or similar award can act as a stamp of approval. This kind of third-party validation can enhance credibility with customers, partners, and even potential investors. And since grants don’t require repayment, they’re a cost-effective way to secure funding compared to giving up equity.

But these benefits don’t come without a few trade-offs.

Limitations of Non-Dilutive Funding

While non-dilutive funding has its strengths, there are some notable downsides. For starters, the amount of capital available through these channels is often smaller than what’s typically raised in venture capital rounds. Competition is another hurdle - many startups compete for a limited pool of grants and awards.

The process of securing non-dilutive funding can also be a major time drain. It often requires extensive research, filling out multiple applications, and waiting through lengthy approval processes. All of this can pull valuable attention away from running the business.

Furthermore, debt-based options, like loans, come with their own risks. Startups may need to guarantee repayment, and failing to meet those terms can lead to financial penalties and increased risks for the business [11].

Another drawback is the lack of strategic support. Unlike equity-based funding, which often includes mentorship, industry connections, and operational guidance from investors, non-dilutive options don’t usually come with these extras. Additionally, some grants or loans may impose restrictions on how the funds can be used, limiting a startup’s operational flexibility [13].

Understanding these trade-offs is key to making informed decisions about funding.

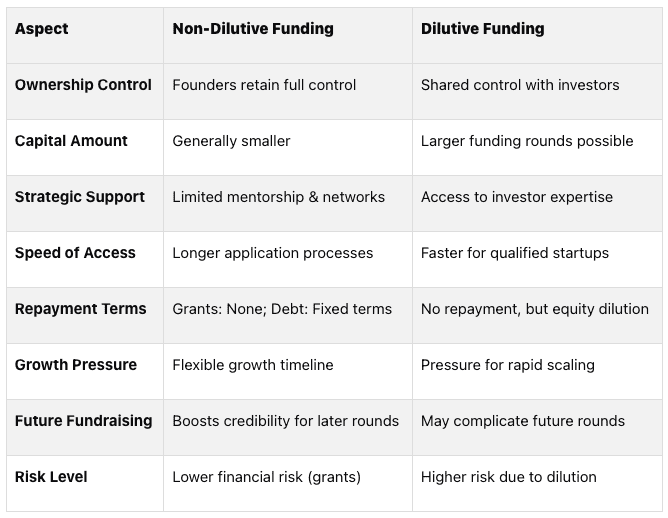

Comparison Table: Non-Dilutive vs. Dilutive Funding

Here’s a quick breakdown of how non-dilutive funding stacks up against traditional equity-based funding:

This comparison highlights that the choice between non-dilutive and dilutive funding depends on factors like your startup’s stage, financial needs, and long-term goals.

For example, nearly 32% of Swiss startups rely on loans or bank financing [11], and in 2018, 40% of private credit managers were lending to businesses with EBITDAs under $25 million [2]. These trends show that non-dilutive funding is becoming more accessible, especially for smaller businesses. However, founders must carefully balance the trade-offs between speed, control, and financial risk when choosing a funding path.

How to Add Non-Dilutive Funding to Your Fundraising Plan

Now that we've covered the perks of non-dilutive funding, let's dive into how you can seamlessly integrate it into your overall fundraising strategy. Combining non-dilutive funding with equity rounds can help you retain control while fueling growth.

Finding the Right Non-Dilutive Funding Sources

There are several non-dilutive funding options to explore, including government grants, debt financing, revenue-based financing, tax credits, and even reward-based crowdfunding [15]. Each option has its own eligibility criteria, application steps, and funding timelines, so thorough research is essential.

Your startup's stage and industry will heavily influence which funding sources make sense. For example, early-stage companies working on groundbreaking technologies might qualify for Small Business Innovation Research (SBIR) grants. Meanwhile, startups with steady revenue streams may find revenue-based financing or venture debt more suitable. Align your funding choices with your business's current phase and future goals.

Unfortunately, many founders miss out on these opportunities simply because they aren't aware of them. The truth is, non-dilutive funding options have expanded significantly, especially for startups tackling big challenges. Take Mimetas, for instance. They secured SBIR funding alongside a grant from a local university, which allowed them to kick off therapeutic RNA research and plan for an FDA application [2].

Pro Tip: When weighing your options, think about your company’s specific needs and long-term goals. A software startup scaling its marketing efforts will have vastly different requirements than a hardware business ramping up manufacturing.

Once you've identified the right funding sources, timing becomes critical.

Timing Non-Dilutive and Equity-Based Funding

Timing is everything when it comes to fundraising. The golden rule? Raise money when your cash flow is strong - this puts you in a position to negotiate better terms [16]. That means seeking funds when you’re flush with cash from a recent VC round or when your business is generating solid revenue and you’re ready to scale.

Non-dilutive funding can also help stabilize your company’s valuation during market volatility. This is particularly useful during downturns when equity valuations may take a hit. By using non-dilutive capital, you can maintain a steady valuation before or between equity rounds.

A strategic approach often involves using different funding types for different purposes. For example, VC funding is ideal for high-risk activities like product development, market entry, R&D, or team expansion. On the other hand, non-dilutive funding works well for scaling proven models - like fulfilling large hardware orders, boosting manufacturing capacity, or driving sales and growth initiatives [16].

"What you're trying to do is make some kind of tradeoff of future revenue – whether that's percentage points on your recurring revenue or interest, or whatever it might be – to put more money in your pocket today." - Bryce DelGrande, Vice President at Fidelity Private Shares [17]

Non-dilutive funding also buys you time, allowing you to approach equity fundraising more strategically. With this financial cushion, you can take your time selecting investors and negotiating better equity terms [18].

Application Tips and Using Awards to Attract More Investment

Once you’ve identified and timed your funding sources, it’s time to focus on the application process. Preparing for non-dilutive funding requires the same level of diligence as pitching to VCs [17]. Make sure your financials, business model, and growth projections are polished and ready to present.

Craft a strong business case that clearly explains why your company deserves funding [15]. This isn’t just about describing your product - it’s about showing the market opportunity, your competitive edge, and how your growth plan aligns with the funder’s goals.

Tailor your application to each funder. For instance, a government grant focused on job creation will require different messaging than a revenue-based financing provider looking for steady cash flows [15]. Research each funder’s priorities to make your pitch as relevant as possible.

Work with non-dilutive financing partners who understand your industry [17]. These partners are more likely to offer favorable terms and faster decisions because they’re familiar with your business model and the challenges you face.

Once you’ve secured non-dilutive funding, use it strategically to boost your future fundraising efforts. Grants and awards act as third-party validation, showing equity investors that others believe in your business’s potential. This credibility can make a big difference when negotiating equity deals.

"The best time to look at venture debt resources is often when you don't need it. It can be an accelerant for your existing traction and success." - Bryce DelGrande, Vice President at Fidelity Private Shares [17]

Finally, streamline your due diligence process. Having a complete data room with standardized documents, financial reports, and metrics ready to go will help you move quickly when new funding opportunities arise.

Skip the Research

Get Instant Answers to Your Startup and VC Questions

Chat with Ask Allied, the AI-powered VC assistant trained on Allied Venture Partners’ corpus of website content, newsletters, podcasts, investment memos, and more. Get instant answers and insights about startup fundraising, venture capital, angel investing, and more.

How Allied Venture Partners Supports Early-Stage Startups

Pairing non-dilutive funding with the right venture partners can significantly boost a startup's growth. While non-dilutive funding provides essential capital without requiring equity, combining it with expert backing can help founders scale faster and more effectively.

Let’s break down how Allied’s funding, mentorship, and streamlined processes can help early-stage startups thrive.

Funding and Mentorship for Startups

At Allied, we provide a strong support system that enhances non-dilutive funding strategies by connecting founders with a broad network of experts who offer strategic advice on product development, scaling, and entering new markets.

By leveraging the Allied syndicate network and connecting founders with experienced entrepreneurs, operators, and venture capitalists who provide hands-on advice, this guidance ensures that startups not only secure funding but also develop the tools and strategies needed for growth. Founders gain insights into everything from refining their products to navigating new markets - an invaluable complement to the benefits of non-dilutive funding.

Simplified Fundraising Through Allied

Raising funds can be a logistical headache, but Allied simplifies the process. By consolidating angels into a single cap table entry through Special Purpose Vehicles (SPVs), we reduce administrative burdens and allow founders to focus on building their business. Instead of juggling multiple investor relationships, startups deal with a single point of contact while still benefiting from an expansive network.

Speed is another advantage. Allied’s funding process typically takes four weeks or less, which helps startups seize market opportunities without losing momentum. Additionally, our Venture Advisory Program connects entrepreneurs and investors, broadening deal flow and creating networking opportunities that can open new doors for founders. This streamlined system works in harmony with the structured application processes of non-dilutive funding, and can even open doors to new sources of non-dilutive capital.

Combining Non-Dilutive Funding with Allied's Support

Beyond advice, Allied can facilitate introductions to non-dilutive funding opportunities such as grants and tax credits. These connections can save months of effort, helping startups build relationships faster. Moreover, having Allied’s endorsement adds credibility to applications for non-dilutive funding, giving founders an edge when pursuing grants or other financial opportunities.

This validation strengthens a well-rounded fundraising strategy that integrates multiple funding types effectively.

Let’s Recap

Non-dilutive funding offers early-stage startups a way to grow without giving up equity. By tapping into options like government grants, tax incentives, and revenue-based financing, founders can fuel product development, validate their market, and scale - all while keeping control of their company’s direction and future potential.

The real power lies in combining non-dilutive funding with equity-based funding. This mix allows startups to extend their financial runway, reduce equity dilution, and hit key milestones that make them more appealing to investors. Using non-dilutive funds to achieve meaningful traction can open doors to larger equity investments down the line.

Timing is everything. Securing non-dilutive funding early helps validate the product and market fit, while equity funding becomes more relevant when scaling requires significant capital. This approach not only minimizes dilution but also maximizes valuation - key for founders aiming to maintain ownership as their businesses grow. Having a well-thought-out funding strategy makes it easier to attract experienced mentors who can guide the journey.

To make the most of these opportunities, startups should actively research non-dilutive funding options, review eligibility requirements, and put together strong applications. Partnering with experienced networks like Allied Ventures adds another layer of strategic support, combining expert guidance with access to equity funding. This integrated approach can help startups build a sustainable capital structure, achieve long-term growth, and stay on the path to success.

FAQs

How can startups effectively combine non-dilutive funding with equity-based funding?

Startups can effectively combine non-dilutive funding and equity-based funding by carefully planning the timing of their financing efforts. For instance, tapping into non-dilutive options like government grants, tax credits, or revenue-based financing early in the process can help extend cash flow and boost the company’s valuation before engaging equity investors.

Another smart tactic is using hybrid instruments such as convertible notes or SAFE agreements. These provide quick access to capital without causing immediate dilution, while offering the flexibility to convert into equity later. This approach not only aligns the goals of founders and investors but also keeps options open. By blending these methods, startups can maintain greater control, secure better valuations, and minimize financial risks as they grow.

What steps can startups take to increase their chances of securing non-dilutive funding?

To boost their chances of securing non-dilutive funding, startups need to focus on preparing their application materials with care. This means having all the essentials in order - detailed financial records, accurate revenue projections, and a well-thought-out business plan that clearly explains how the funds will be used to fuel growth.

It’s also important to understand the various types of non-dilutive funding available. Options like grants, tax credits, loans, and revenue-based financing each have unique criteria, so identifying which aligns best with your startup’s needs is key. Tailoring your applications to match the specific requirements of each funding source can make a significant difference.

On top of that, building connections with government agencies, industry groups, and mentors can offer valuable guidance during the process.

What’s the difference between revenue-based financing and venture debt, and how can startups choose the right option?

Revenue-based financing (RBF) and venture debt are two non-dilutive funding options, but they cater to different business needs and operate differently.

RBF involves receiving capital in return for a percentage of future revenue. Since repayments are tied directly to income, they fluctuate based on how much the company earns. This makes RBF a flexible choice, especially for startups in their early growth stages that want to avoid the pressure of fixed payments and prefer a repayment structure that adapts to their revenue.

Venture debt, by contrast, is a traditional loan that requires regular interest and principal payments. These loans are typically secured by assets or future revenue, making them a better fit for businesses with stable, predictable cash flow that can manage fixed repayment schedules without issue.

When deciding between the two, think about your startup’s revenue consistency, cash flow situation, and where you are in your growth journey. RBF offers flexibility, while venture debt works better for companies prepared to handle steady repayments.