How Much Equity for Startup Advisors?

When compensating startup advisors, equity is often the go-to option due to limited cash resources. But how much equity should you offer? Here's a quick breakdown:

Standard Range: Advisors typically receive 0.1% to 1.0% equity, depending on their expertise, involvement, and your startup's stage.

Key Factors: Equity allocation depends on:

Experience: Seasoned experts or niche specialists may earn more.

Time Commitment: Advisors dedicating more hours or helping during critical periods deserve higher stakes.

Impact: Contributions like fundraising support or strategic guidance justify larger shares.

Vesting: Equity is usually tied to a 1-2 year vesting schedule with a 6-month cliff to ensure long-term engagement.

Documentation: Clear agreements outlining roles, responsibilities, and terms prevent misunderstandings, such as the FAST Agreement by Founder Institute.

Equity is a finite resource, so allocate it wisely. Reward actual contributions, not just potential, and ensure agreements are formalized to protect both parties.

How much equity should you give advisors?

Standard Equity Ranges for Advisors

When it comes to allocating equity to advisors, startups often rely on industry benchmarks to strike a balance between rewarding advisors and preserving ownership for founders and employees. While these benchmarks provide general guidance, the exact equity share can shift depending on several factors.

What Are Normal Equity Ranges?

Advisors in startups typically receive a modest equity stake. This share reflects the value they bring while maintaining the founders' and employees' majority ownership. Many startups create a specific, limited equity pool for their advisory board. In early-stage companies, this allocation tends to be more generous due to the higher risks and lower valuation. As the startup matures and its value grows, the equity granted to advisors becomes more conservative.

The goal is to align advisors' incentives with the startup's success, ensuring they are as invested in the outcome as the founders. Startups, particularly those connected to networks like Allied Venture Partners, can use these benchmarks to craft equity packages that fit their current growth stage and strategic goals.

What Affects Equity Norms

Several factors can influence how equity is allocated to advisors. Advisors with strong reputations or specialized expertise often command higher equity stakes, especially if they join during the startup's early stages. Their guidance during these formative periods is often crucial and justifies more favorable terms. On the other hand, advisors who join later, when the company is more stable and less reliant on foundational input, usually receive smaller equity shares.

These factors help founders design equity packages that attract advisors who can make the most strategic impact.

How to Determine Advisor Equity

When deciding how much equity to allocate to an advisor, it’s important to weigh their individual contributions against the needs of your startup. Not all advisors bring the same value, so their equity share should align with the impact they can deliver. The goal is to strike a balance between rewarding their expertise and preserving equity for your company’s long-term growth.

Advisor's Experience and Skills

An advisor’s professional background plays a big role in determining their equity. Seasoned industry veterans typically earn a larger stake than less experienced professionals. Why? They bring established networks, a history of success, and the ability to guide you through critical challenges.

Specialized expertise is another key factor. An advisor who has scaled businesses in your specific industry - say, a former CTO with experience building enterprise SaaS platforms - will likely bring more targeted value than someone with a broader business background. For example, a retail executive, no matter how accomplished, may not offer the same level of insight to a B2B SaaS startup.

Reputation and personal brand also matter. Advisors with strong industry credibility can open doors that might otherwise stay closed. Their association with your startup can boost your standing with investors, customers, and even potential hires. This added credibility often warrants a higher equity share, especially early on when trust and visibility are critical.

Finally, consider the advisor’s current role and influence. Active executives or serial entrepreneurs with ongoing industry connections are often more valuable than retired professionals or those between roles. Their up-to-date insights and relevant networks can provide immediate benefits to your startup.

Of course, expertise alone isn’t enough - an advisor’s level of involvement is equally important.

Time Commitment and Involvement Level

The amount of time and effort an advisor commits should directly influence their equity allocation. Most advisors contribute 2-4 hours per month through regular check-ins or strategy sessions. However, some step up during critical periods, like fundraising or product launches, and this extra involvement can justify a larger equity share.

Focused support during key milestones - such as preparing for a Series A round or negotiating a major partnership - can outweigh the total number of hours an advisor spends. For instance, an advisor who secures critical investor introductions or helps shape your go-to-market strategy may deserve more equity than one who provides occasional high-level advice.

The length of the advisor’s engagement also matters. Advisors who commit to multi-year relationships are often more invested in your company’s success and can provide continuity as your startup grows. Short-term advisors, while valuable in certain situations, usually receive smaller equity stakes.

Value and Impact on the Startup

To ensure fair compensation, it’s essential to evaluate the tangible impact an advisor can have on your business. Whether they’re helping with fundraising, customer acquisition, technical leadership, or operational challenges, their contributions should align with your startup’s needs and growth stage.

The timing of their involvement is also critical. Advisors who join during the pre-seed or seed stages often have a more profound influence on your company’s direction. Their guidance during these formative periods can lay the groundwork for long-term success, which often justifies a higher equity allocation - even if the company’s valuation is lower at the time.

For startups connected to investor networks like Allied Ventures, advisors who strengthen relationships within these ecosystems can be particularly valuable. Their ability to enhance your visibility and credibility with top-tier investors or strategic partners can accelerate your growth and open doors to new opportunities.

How to Structure Advisor Equity

Structuring advisor equity is a key step in ensuring long-term engagement and aligning incentives. Once you've determined the equity percentage for your advisor, it's essential to design the grant in a way that protects your startup while keeping the advisor motivated and accountable. This involves setting clear terms, using vesting schedules, and choosing the right equity type.

Using Vesting Schedules and Milestones

Vesting schedules are an effective way to ensure advisors earn their equity over time. Unlike the typical four-year vesting period used for employees, advisors often follow a shorter timeline - usually one to two years. This strikes a balance between sustained engagement and flexibility.

A common setup includes a six-month cliff, meaning advisors must stay involved for at least six months before earning any equity. After the cliff, equity vests monthly. For example, if an advisor is granted 0.5% equity on a two-year vesting schedule with a six-month cliff, they would earn 0.125% at the cliff and approximately 0.021% each month thereafter.

To further align incentives, you can tie portions of equity to specific achievements, such as securing partnerships or hitting fundraising goals. Accelerated vesting can also be included for exceptional contributions. However, avoid making milestones overly rigid - advisors are there for strategic guidance, not day-to-day execution.

In addition to vesting schedules, ensure all terms are solidified through clear legal agreements, like the FAST Agreement from Founder Institute.

Writing Clear Advisory Agreements

A well-drafted advisory agreement is essential for avoiding misunderstandings later. It should clearly outline the advisor's responsibilities, equity terms, and other key details.

Define the advisor's role with specific commitments rather than vague descriptions. For instance, instead of saying "provide strategic advice", specify tasks like "attend monthly board meetings", "conduct quarterly business reviews", or "make two key introductions per quarter."

Include detailed equity terms, such as the percentage granted, vesting schedule, exercise price (if using options), and any performance milestones. Address scenarios where the advisor becomes inactive or steps down, often by including a clause that allows the company to buy back unvested shares.

Other standard provisions include confidentiality and non-compete clauses. While non-compete terms should remain reasonable - since advisors often work with multiple companies - they should still protect sensitive information. Termination clauses are also important, outlining how either party can end the relationship. This could cover situations like the advisor joining a competitor, failing to meet commitments, or mutual agreement to part ways.

Advisory Shares vs. Stock Options

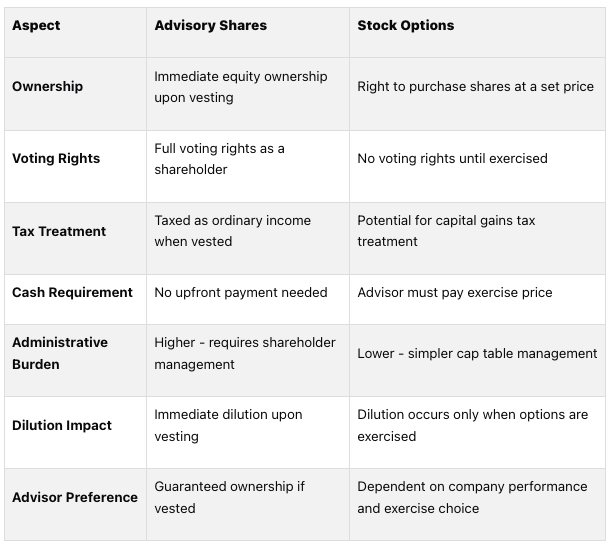

Deciding between advisory shares and stock options can significantly impact the advisor's ownership experience and your company's cap table. Each option has its own pros and cons, depending on your startup's stage and the advisor's preferences.

Advisory shares are ideal for early-stage startups looking to foster a sense of ownership and engagement. Advisors can receive voting rights and an immediate stake in the company, though this does require more administrative effort and results in immediate dilution.

Stock options, on the other hand, are often easier to manage, particularly as a company grows. They don’t dilute existing shareholders until exercised, and they naturally filter committed advisors - those who believe in the company’s potential are more likely to exercise their options.

For early-stage startups, the exercise price for options is typically set at fair market value, which can be as low as $0.001 per share. This keeps the financial barrier low while still requiring advisors to actively decide to become shareholders.

Some startups blend both approaches, offering a small number of immediate shares to create a sense of ownership, paired with stock options tied to performance or continued involvement. This hybrid model combines the benefits of immediate equity with performance-based incentives, making it a flexible option for engaging advisors effectively.

Common Mistakes in Advisor Equity Allocation

Founders often stumble when it comes to allocating equity to advisors, and these errors can lead to mismatched expectations that slow growth. By understanding these common pitfalls, you can avoid them and create stronger, more productive relationships with your advisors.

Giving Too Much Equity or the Wrong Amount

One of the biggest mistakes founders make is offering too much equity to advisors, especially in the early stages of their startup. When you're just starting out, it's easy to let desperation cloud your judgment, leading to overly generous equity packages. But this can wreak havoc on your cap table and make future fundraising more challenging.

Typically, advisor equity falls within the 0.1% to 2.0% range. Offering more than this without a compelling reason can raise red flags with downstream investors, signaling inexperience. It also limits your ability to bring on new employees or advisors later.

Another issue is misaligning equity with actual contributions. For example, allocating significant equity to a well-known CEO who provides minimal input can be a poor decision compared to rewarding an advisor who’s actively helping with introductions or offering critical strategic guidance.

It's also crucial to differentiate between advisor roles. A technical advisor working on product development may deserve a larger equity share than a general business advisor, especially if your startup operates in a complex, technical field. Similarly, advisors who join at riskier stages, like pre-seed, often warrant more equity than those who come on board after Series A, when the company is more stable.

Front-loading equity grants is another trap to avoid. If you allocate a large portion of your advisor equity (say, 3%) in the first year, you might find yourself struggling to attract new advisors with the expertise you’ll need as your company grows. Savvy founders reserve equity for future rounds and adapt allocations based on evolving needs.

On the flip side, some founders are so cautious about equity that they undervalue key early advisors. Someone who helps you sidestep a major strategic blunder or connects you with the investors who fund your seed round may deserve more than the standard equity range.

These missteps become even more problematic when combined with poor documentation.

Poor Documentation and Communication

One of the riskiest mistakes founders make is relying on informal handshake agreements. Many advisor relationships start casually - maybe over coffee or at an industry event - and equity discussions often remain verbal. But without a written agreement, misunderstandings are almost inevitable. A founder might remember offering 0.25% equity, while the advisor recalls 0.5%. These discrepancies can lead to costly legal disputes that drain both time and resources.

Another common problem is vague role definitions. Agreements that simply state "provide strategic advice" leave too much room for interpretation. Without clear expectations, advisors may believe they’re contributing more than they actually are, or founders might expect more involvement than the advisor is prepared to give.

Failing to communicate with existing stakeholders - like co-founders, employees, or investors - can also create tension. For instance, surprising your co-founder with news that you’ve allocated 1.5% equity to advisors without prior discussion can lead to trust issues and internal conflict.

Equally important is explaining equity terms clearly to advisors. Complex vesting schedules, cliff periods, and performance milestones need to be spelled out. An advisor who doesn’t understand that their equity vests monthly after a six-month cliff might feel frustrated when they don’t see immediate ownership.

Neglecting regular check-ins can also sour relationships. Advisory roles aren’t a "set it and forget it" deal - they require ongoing management. Ignored or underutilized advisors may lose interest, while those who exceed expectations might warrant additional equity or recognition.

Another critical mistake is failing to document changes in an advisor’s role. As your startup evolves, advisors may take on new responsibilities. For example, an advisor initially focused on product strategy might start making valuable customer introductions. These shifts should be formally documented through amendments to the original agreement, not left to verbal agreements.

Lastly, poor record-keeping can create headaches during due diligence. Keeping detailed records of advisor contributions - like meetings attended, introductions made, or strategic advice offered - helps justify equity decisions to potential investors. It also makes it easier to evaluate whether an advisor is meeting expectations.

And let’s not forget the importance of addressing underperformance. If an advisor isn’t delivering or has gone inactive, it’s crucial to have an honest conversation. Tackling these issues head-on protects your equity pool and ensures fairness for other advisors who are actively contributing.

Summary: Finding the Right Balance

Deciding how much equity to allocate to startup advisors is no small task. While the standard range of 0.1% to 2.0% offers a helpful benchmark, the final decision should hinge on the advisor’s expertise, the time they’ll invest, and the tangible value they bring to your company’s growth.

Equity, after all, is a finite resource. Every fraction you allocate has an impact on your ability to secure funding and maintain control of your business. The goal is to align equity distribution with actual contributions, not just potential promises or impressive credentials.

To keep these relationships productive, clarity is essential. Clearly defined roles, written agreements, and performance-based vesting schedules protect both you and your advisors from unnecessary conflicts or misunderstandings. Regularly revisiting these agreements ensures that your advisors remain aligned with your company’s evolving needs.

Beyond individual advisors, tapping into broader support networks can amplify your startup’s potential. For example, at Allied, we connect portfolio companies with our network of angels and VCs, offering funding, mentorship, and operational guidance. Combining external networks with a well-thought-out equity plan creates a solid foundation for success.

The most successful founders treat advisor equity allocation as an ongoing strategy. They consistently evaluate the performance of their advisors and adjust equity terms as needed. By striking the right balance - offering enough equity to attract top-tier advisors without depleting your resources - you can build a strong advisory team that drives your startup forward while safeguarding your long-term vision.

FAQs

How do I decide how much equity to offer a startup advisor based on their contributions?

Determining how much equity to offer a startup advisor hinges on their expertise, involvement, and the value they bring to your business. Advisors who contribute strategic insights, open doors to key industry connections, or dedicate a significant amount of time to your startup generally deserve a larger equity share.

In most cases, advisor equity ranges between 0.1% and 2%, with the exact amount depending on factors like the advisor's role, the maturity of your startup, and typical industry practices. For early-stage startups, equity can be a smart alternative to cash compensation, helping you attract top-tier advisors without straining your budget. Just make sure to outline the advisor's responsibilities and expected contributions in a formal agreement to keep everyone on the same page.

What are the risks of giving too much or too little equity to startup advisors, and how can founders strike the right balance?

Finding the right balance when offering equity to startup advisors is crucial. Giving away too much equity can dilute the founders' control, create conflicts of interest, and even lead to issues if an advisor starts working with competitors. On the flip side, offering too little might make advisors feel undervalued, which could hurt their motivation and the quality of their input.

To navigate this, founders should weigh factors like the advisor's expertise, the level of their involvement, and the unique value they bring to the table. Staying aligned with industry standards and clearly outlining the advisor's role can help maintain a healthy balance, fostering a productive and rewarding partnership for both sides.

How do vesting schedules and advisory agreements ensure fair equity allocation for startup advisors?

When it comes to startups and their advisors, vesting schedules play a crucial role in ensuring equity is distributed fairly over time. Instead of granting shares upfront, vesting schedules allow equity to be earned gradually - typically over several years. A common feature is the one-year cliff, which requires advisors to stay on board for at least a year before earning any shares. This setup ensures advisors remain committed and aligned with the startup's long-term success.

To complement vesting schedules, advisory agreements come into play. These agreements spell out the terms in detail, covering vesting conditions, advisor responsibilities, and even potential acceleration clauses. By doing so, they protect the startup’s cap table from unearned equity while giving advisors a clear understanding of their role. This clarity fosters trust and accountability, creating a stronger partnership between the startup and its advisors.