What Are Investor Information Rights?

Investor information rights give investors access to a company's key data, such as financial reports, forecasts, and ownership details. These rights are typically outlined in an Investor Rights Agreement (IRA), ensuring transparency between founders and investors. Larger investors often receive more detailed updates, while smaller stakeholders get standard reports.

Key points:

Purpose: Help investors track performance and make informed decisions.

Common Reports: Quarterly financial statements, monthly cash burn updates, annual budgets, and cap table updates.

IRA Details: Specifies reporting timelines, formats, and confidentiality rules.

Benefits for Founders: Builds trust with investors and simplifies future fundraising.

Efficient reporting systems and clear expectations make these rights manageable for startups while keeping investors informed.

Startup term sheet explained by a lawyer (Investor Agreements) | Startup funding 101

Types of Information Investors Request

When investors negotiate information rights, they generally focus on three main types of data to monitor performance and guide future funding decisions. These data categories - financial details, operational forecasts, and ownership records - help ensure transparency in investor agreements. Here's a closer look at what investors typically request.

Financial Statements and Reports

Quarterly financial statements are a cornerstone of investor reporting. These include income statements, balance sheets, and cash flow statements, all prepared in standard accounting formats. The level of detail often depends on the company's stage of growth and the size of the investor's stake, with more mature companies usually providing more comprehensive reports.

For more frequent updates, companies often share monthly financial snapshots. These focus on critical metrics like revenue, expenses, cash position, and burn rate, offering investors a quicker read on the company's financial health compared to quarterly reports.

Investors also rely on variance reports, which compare actual performance to budgeted projections. These reports highlight where the company is exceeding or falling short of expectations, giving investors insights into management's ability to forecast and manage operations effectively.

Budgets, Forecasts, and Business Updates

Annual budgets and forecasts are crucial for understanding how management plans to allocate resources and achieve strategic goals. These documents, typically covering 12 to 18 months, include detailed projections for revenue, hiring, marketing expenses, and major capital investments.

Investors also keep an eye on key performance indicators (KPIs), which vary by industry. For example, software companies might focus on metrics like monthly recurring revenue, customer acquisition costs, churn rate, and gross margins. Meanwhile, manufacturing startups might prioritize production volumes, inventory turnover, and supply chain efficiency.

Business development updates provide context beyond the numbers, covering major milestones like strategic partnerships, customer wins or losses, product launches, and competitive shifts. These updates help investors gauge the company's market position and strategic direction.

Additionally, operational metrics offer a deeper look into the company's overall health. These might include employee headcount changes, customer satisfaction scores, product usage stats, or market share data, depending on the company's industry and business model.

Understanding the equity structure is equally critical, as it helps investors assess potential dilution and control dynamics.

Cap Tables and Ownership Information

Capitalization tables (cap tables) are vital for tracking ownership percentages and changes over time. These spreadsheets detail all equity holders - founders, employees, advisors, and investors - along with their respective ownership stakes.

Investors also review option pool data, which shows how much equity is reserved for employee stock options and how quickly that pool is being utilized. This information helps them anticipate dilution and evaluate the company’s approach to attracting and retaining talent.

Details about warrants and convertible securities become increasingly important as companies go through multiple funding rounds. Investors need to understand how these instruments might affect their ownership stakes.

Finally, transaction summaries document equity-related activities, such as stock options granted to new hires, advisor equity grants, or secondary market transactions. These updates ensure investors stay informed about any changes to the ownership structure.

Cap table updates are typically shared on a quarterly basis, aligning with financial reporting schedules. However, some investors with larger stakes may request real-time access to cap table management platforms or more frequent updates during periods of rapid hiring or fundraising activity.

How to Set Up Investor Information Rights

When raising funds, it’s essential to establish investor information rights from the start. This means outlining clear expectations, setting boundaries, and creating efficient systems for sharing updates.

Using an Investor Rights Agreement (IRA)

An Investor Rights Agreement (IRA) is the cornerstone document for defining how startups share information with their investors. Typically negotiated alongside the main investment terms, the IRA becomes part of the overall funding agreement.

This document spells out details like what information will be shared, in what format, and on what timeline. For instance, an IRA might require:

Monthly financial summaries delivered within 15 days of the month’s end.

Quarterly board packages sent five days before board meetings.

Annual budgets submitted by December 31st each year.

The agreement also specifies how information will be delivered, often favoring secure digital platforms. Some IRAs include provisions for emergency updates, requiring companies to notify investors within 48 hours of significant events, such as losing a major customer or facing regulatory issues.

To protect sensitive data, IRAs typically include confidentiality clauses. These ensure investors won’t share proprietary information with competitors or use it for anything beyond monitoring their investment. This is particularly important when investor groups include individuals with competing business interests.

Most IRAs also include sunset clauses, which limit the duration of information rights. For example, these rights might expire if an investor’s ownership falls below a certain percentage, the company goes public, or after a set number of years.

Once the IRA is finalized, it’s important to tailor information rights based on the size and role of each investor.

Major Investor Thresholds and Qualifying Investors

Investor rights are often tiered, with larger investors receiving more detailed updates than those with smaller stakes.

Major Investor status typically applies to those who own 5% to 10% of the company or have invested between $250,000 and $1 million, depending on the company’s stage and funding round size. These investors usually receive comprehensive updates, such as detailed financial statements, board materials, and strategic overviews.

Lead investors, regardless of their ownership percentage, often negotiate additional rights. These might include direct access to the management team, participation in strategic planning sessions, or advance notice of major decisions. Their active involvement in guiding the company justifies these enhanced privileges.

In cases where multiple investors pool their resources, aggregate holdings are often considered. This means the combined ownership of related parties determines their rights, rather than evaluating each individual stake.

Once the IRA and thresholds are in place, founders should focus on efficient reporting practices to meet their obligations.

Best Practices for Founders

Here are some practical steps for founders to manage investor information rights effectively:

Work with experienced legal counsel. Securities attorneys familiar with venture funding can help founders navigate standard terms and flag potential issues during negotiations.

Set clear boundaries. While transparency is important, overly broad information rights can overwhelm founders. Negotiate limits on report frequency, detail, and response times to keep the process manageable.

Standardize reporting. Use templates for monthly updates, quarterly reports, and annual summaries to ensure consistency and save time. Regular reporting also helps founders stay on top of their business performance.

Budget for reporting costs. Investor reporting often involves additional expenses, such as hiring staff, upgrading accounting software, or using third-party services. Include these costs in your fundraising plans.

Leverage investor relations platforms. Tools that automate reporting, manage document libraries, and track engagement can significantly reduce the manual workload for founders.

Communicate proactively. If challenges or delays arise, let investors know ahead of time. Most investors appreciate transparency and are more likely to be flexible when they’re kept in the loop.

Reassess information rights as you grow. As your company matures and your investor base expands, you may need to adjust reporting requirements to ensure they remain practical and beneficial for everyone involved.

Pros and Cons of Investor Information Rights

Once you've established investor information rights, it's important to weigh their potential benefits against their challenges. These rights can be a double-edged sword, offering clear advantages while also presenting some hurdles.

Benefits and Drawbacks Comparison

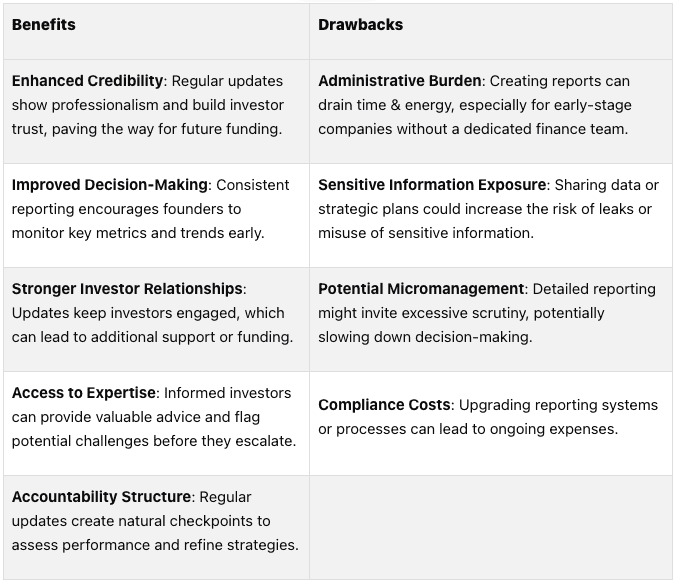

The effects of investor information rights often depend on your company's growth stage, available resources, and the dynamics of your investor relationships. Here's a side-by-side look at the upsides and downsides:

This comparison underscores the need for a thoughtful approach to managing transparency within your business.

Striking the right balance between openness and operational efficiency is essential. Many startups discover that the benefits of investor information rights outweigh the challenges once they streamline their reporting processes. Transparent communication not only strengthens investor relationships but also positions founders to receive timely feedback and strategic advice.

For founders, viewing reporting as a chance to highlight achievements and gather valuable input often leads to better results. As companies grow and delegate these tasks, the process becomes smoother and more efficient. These practices not only make reporting less of a burden but also ensure that transparency enhances both investor trust and company performance.

Allied Venture Partners' Approach to Information Rights

At Allied VC, we have designed a streamlined approach to investor information rights, aiming to reduce the administrative load on founders while ensuring transparency for investors.

Straightforward Reporting Processes

Early-stage startups often lack the resources for complex financial reporting, and Allied understands this challenge firsthand. Instead of overwhelming founders, we focus on setting clear and manageable reporting expectations through monthly or quarterly email updates. These requirements emphasize key performance indicators and major business updates, steering clear of exhaustive financial documentation.

This approach is particularly beneficial for startups by keeping reporting focused and realistic, while also ensuring consistency without burdening startup founders with additional admin work. Founders can stay transparent while channeling their energy into core activities like product development and growing their customer base. This balance not only minimizes unnecessary effort but also creates room for expert guidance if a founder has a specific investor ask, thus helping our portfolio companies grow more effectively.

Helping Founders and Investors Work Smarter

At Allied, we encourage founders to maximize communication with our network of seasoned entrepreneurs and technology investors. This diverse network of over 2,000 angel investors offers guidance on everything from customer introductions to recruiting support, sales, marketing, follow-on funding, and more.

For investors, this approach means receiving clear, well-structured updates that make it easier to evaluate opportunities and make informed decisions. By educating founders and aligning investor expectations, we strive to create a more seamless and productive information-sharing environment across the Allied network.

Transparency Through Technology

At Allied, we take transparency and efficiency to the next level by leveraging technology for investor relations. We exclusively use the AngelList platform for all investor-related activities, eliminating the confusion of juggling multiple communication channels and systems.

AngelList provides tools for regular updates, annual tax forms like IRA Form K-1, and personalized dashboards for performance tracking. This not only simplifies administrative tasks for founders but also gives investors a clear and accessible view of their investments. As a global leader in SPV and back-office fund administration, AngelList’s infrastructure supports Allied in maintaining transparency without adding extra work for startups.

Beyond AngelList, Allied enhances transparency through podcasts and videos, monthly LP newsletters, and annual investor letters, ensuring our network stays informed. We’ve even introduced Ask Allied, an AI-powered VC assistant, which answers investor questions quickly, adding yet another layer of accessible communication.

Let’s Recap (Conclusion)

Key Takeaways for Founders and Investors

Investor information rights are essential for fostering open, trust-based relationships between startups and their investors. These rights empower investors to stay informed, monitor progress, and provide the guidance startups need to navigate challenges and achieve growth.

For founders, transparent reporting is a powerful tool to strengthen investor relationships. By clearly sharing relevant updates (even if it’s an informal monthly email), startups not only build trust but also open doors to valuable advice from seasoned investors. Striking the right balance is crucial - reporting should provide the transparency investors require without overwhelming early-stage teams. The goal is to set clear and achievable reporting expectations that work for both sides.

For investors, these rights are critical in tracking a startup’s progress, evaluating performance, and making informed decisions about future funding or exit opportunities. Access to key company data enables investors to offer strategic advice and collaborate effectively with founders, ensuring alignment on goals and priorities.

This balanced approach is reflected in the practices championed at Allied VC, which emphasize streamlined reporting focused on key performance indicators and major company updates. By simplifying reporting processes through technology and clear communication, startups can reduce administrative burdens while maintaining the transparency that drives successful venture capital partnerships.

FAQs

How can startups stay transparent with investors without creating too much administrative work?

Startups can simplify their operations and stay transparent by using automated tools to handle data collection and reporting. These tools cut down on manual work, reduce errors, and make it easier to share accurate updates with investors.

By concentrating on essential financial metrics like revenue, expenses, runway, and cash flow, founders can give investors the information they need without getting bogged down in unnecessary reporting. Keeping financial records tidy and periodically reviewing reporting methods can further enhance communication and ensure everything runs smoothly.

What key metrics should smaller investors track to stay informed about their early-stage investments?

Smaller investors can keep a close eye on their investments by tracking a handful of key metrics that offer a clear picture of a startup's performance. Here are some of the most important ones to watch:

Customer Acquisition Cost (CAC): This tells you how much the company spends to bring in a new customer. Lower CAC generally means more efficient spending.

Customer Lifetime Value (CLV or LTV): This represents the total revenue a business expects to earn from a single customer throughout their relationship. Ideally, LTV should significantly exceed CAC for a sustainable business model.

Churn Rate: This is the percentage of customers who stop using the product or service within a certain time frame. A high churn rate can signal trouble retaining customers.

Revenue Growth: Metrics like Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) help track income trends and indicate whether the business is scaling effectively.

Burn Rate & Runway: This shows how quickly the company is using up its cash reserves. A high burn rate might mean the company needs to raise more funds soon or risk running out of runway.

Gross Margin: This percentage reveals how much revenue is left after covering the direct costs of goods or services. Higher margins of 70% or more often indicate a healthier business.

By keeping tabs on these metrics, investors can get a reliable sense of how their investments are doing without needing constant updates.

What is the role of confidentiality clauses in Investor Rights Agreements, and what risks arise if they’re not enforced?

Confidentiality clauses in Investor Rights Agreements play a crucial role in safeguarding a company’s sensitive information. This includes protecting trade secrets, financial details, and strategic plans from being disclosed or misused without proper authorization. These measures are vital for preserving the company’s competitive edge and ensuring smooth operations.

When these clauses aren’t enforced effectively, the company becomes vulnerable to information leaks. Such breaches can lead to serious consequences like losing a competitive position, damaging the company’s reputation, and even facing legal challenges. Upholding these clauses is not just about compliance - it’s about minimizing risks and maintaining a strong, trustworthy relationship between the company and its investors.