Angel Syndicates: Collaborative Funding Explained

Angel syndicates are reshaping early-stage startup funding by pooling resources from multiple investors to back promising ventures. Here's what you need to know:

What They Are: Groups of investors collaborate under a lead investor to fund startups, mainly in tech and software sectors.

How They Work: Lead investors find deals, conduct due diligence, and manage investments via a single entity (SPV). Members contribute smaller amounts (as low as $1,000), spreading risk while gaining access to curated opportunities.

Why They Matter: Syndicates simplify fundraising for startups and lower barriers for investors. Founders get funding and expertise without managing multiple individual investors, while investors enjoy reduced effort and diversified portfolios.

While syndicates offer streamlined processes and mentorship, they come with risks like illiquidity and limited control for investors. Success depends on choosing experienced syndicate leads and clear communication.

Understanding Angel Syndicates: A Guide for Investors

How Angel Syndicates Work

Angel syndicates operate using a structured approach, with clear roles, processes, and legal frameworks that connect startups with funding opportunities.

Key Players in an Angel Syndicate

At the heart of any angel syndicate is the lead investor. This individual takes on the critical responsibility of identifying potential opportunities, performing evaluations, and managing communication between startups and syndicate members. They also carry out the majority of the due diligence, ensuring the viability of the investment.

The syndicate members are individual investors who decide which deals to join. Unlike traditional venture capital funds where decisions are centralized, syndicate members maintain the freedom to evaluate deals independently and invest based on their preferences.

Startup founders seeking funding interact with the syndicate through the lead investor. This setup allows founders to present their business to multiple investors at once, avoiding the need for numerous individual meetings. For startups, this means accessing larger funding rounds with less administrative hassle.

This structure benefits both sides: founders streamline their fundraising efforts, while investors gain access to curated opportunities they might not find on their own. With clearly defined roles, the process moves efficiently from deal sourcing to closing.

The Investment Process

The journey from identifying a startup to closing the deal unfolds in several stages:

Deal sourcing: The lead investor identifies promising startups through networks, industry connections, or direct applications from founders.

Due diligence: The lead investor conducts a thorough review, examining financial statements, references, and the startup’s team, market, and technology.

Investment memos: Once a potential deal is identified, the lead prepares a detailed memo outlining the startup’s business model, market potential, financial projections, and investment terms. Syndicate members use this to assess whether they want to invest.

Member contributions: Syndicate members typically invest amounts ranging from $1,000 to $25,000, which collectively add up to a median deal size of $100,000 or more.

Closing the deal: Investments are consolidated through a Special Purpose Vehicle (SPV). This structure simplifies the startup’s cap table by pooling all syndicate investments into a single entity, while also offering legal protections for everyone involved.

This structured process makes it easier for startups to secure early-stage funding while providing a seamless experience for investors.

Legal and Financial Structures

The legal and financial frameworks of angel syndicates are designed to ensure smooth collaboration and compliance.

A key component is the use of Special Purpose Vehicles (SPVs), which are often set up as Limited Liability Companies (LLCs) under U.S. law. This structure offers both flexibility and tax benefits for investors and startups.

Each SPV operates under a Limited Partnership Agreement (LPA), which outlines critical details like member rights, investment terms, profit distribution, and exit strategies. This document also sets the rules for decision-making and how returns will be shared when the startup exits via acquisition or public offering.

To raise funds, angel syndicates rely on Regulation D exemptions - specifically 506(b) or 506(c) - which allow them to raise capital from accredited investors without registering with the SEC. This approach keeps compliance manageable while ensuring adequate investor protections.

Key documents for each SPV include operating agreements, subscription forms, investment memos, and annual tax documents like K-1 forms. The lead investor oversees these legal and administrative tasks, ensuring everything is in order.

For startups, the SPV structure is particularly advantageous. Instead of managing relationships with dozens of individual investors, founders work primarily with the lead investor, who represents the syndicate. This streamlined cap table is especially helpful during later funding rounds, making it easier to coordinate with existing investors.

Additionally, startup founders can leverage the collective network and experience of each individual angel within an SPV structure, gaining access to a diverse pool of expertise and valuable connections that can accelerate their company’s growth.

After the investment is finalized, the lead investor keeps syndicate members informed with regular updates on the startup’s progress, financial performance, and any major developments. This ongoing communication ensures transparency and helps maintain a strong relationship between the startup and its investors, making the entire funding process more efficient for everyone involved.

Benefits of Angel Syndicates

Angel syndicates bring value to both investors and founders by simplifying the early-stage funding process. By fostering collaboration, these groups make investing and fundraising more efficient and accessible. Let’s break down the advantages for each side.

Benefits for Investors

Angel syndicates offer a range of perks that make investing in startups more appealing and manageable:

Curated deal flow: Syndicate members gain access to startups that have already been vetted by lead investors. This eliminates the challenge of finding high-quality opportunities on their own.

Portfolio diversification: Instead of committing $25,000 to a single startup, investors can spread that amount across 10-25 companies by contributing smaller amounts, like $1,000 or $2,500 per deal. This reduces risk while keeping the potential for big returns.

Less due diligence work: Lead investors handle the heavy lifting, including financial analysis, market research, and team evaluations. They share their findings through detailed investment memos, saving syndicate members significant time and effort.

Learning opportunities: New investors can sharpen their skills by studying deal memos, joining discussions, and observing how seasoned lead investors make decisions.

Lower investment minimums: Traditional angel deals often require $10,000-$50,000 per investment, but syndicates allow participation starting at $1,000, making it easier for more people to get involved.

Benefits for Founders

Founders also benefit significantly from the syndicate model, addressing many of the common challenges they face during fundraising:

Streamlined fundraising: Instead of pitching to multiple individual investors, founders present their business to the syndicate once, saving valuable time.

Access to larger funding rounds: Syndicate members pool their resources, making it easier for startups to hit funding targets. For example, raising $250,000 becomes more achievable when 50-100 members contribute $2,500-$5,000 each.

Simplified cap table management: By working with a single lead investor representing the syndicate, founders avoid the complexity of managing dozens of individual investors. This also simplifies coordination during future funding rounds.

Credibility boost: Being backed by a respected syndicate lead can signal quality to other investors, customers, and partners, opening doors that might otherwise remain closed.

Ongoing mentorship: Beyond funding, syndicate leads and members often provide strategic advice, industry connections, and operational support.

Faster decision-making: Unlike traditional venture capital firms that can take months to finalize investments, angel syndicates often close deals within 2-4 weeks, provided founders have their documentation ready.

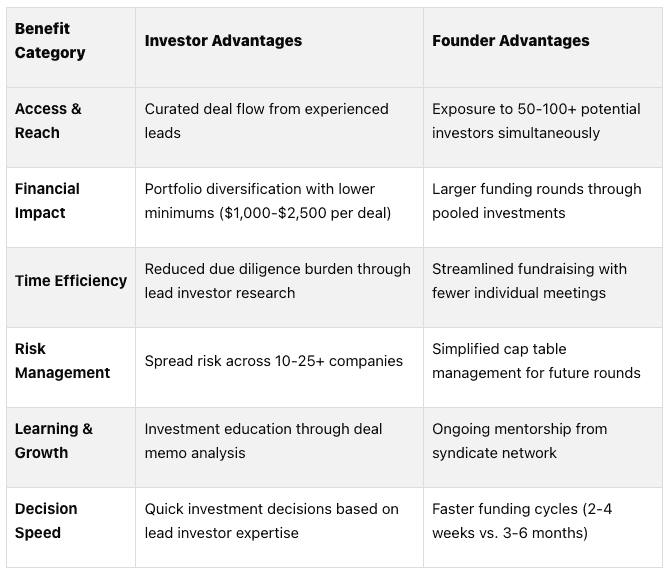

Comparison Table: Investor vs. Founder Benefits

Here’s a quick look at how the benefits stack up for both investors and founders:

Angel syndicates solve traditional pain points in early-stage investing. Investors enjoy access to better opportunities with less effort, while founders can raise funds more efficiently and gain valuable support. This collaborative model is quickly becoming a favored approach in the U.S. and Canadian startup ecosystem.

Risks and Challenges of Angel Syndicates

Angel syndicates come with their share of risks and challenges, and it's important for both investors and founders to weigh these carefully. While the advantages of angel syndicates are appealing, understanding the potential downsides is key to making informed decisions. Below, we'll break down the risks for both investors and founders.

Risks for Investors

Investing through angel syndicates isn’t without its challenges. Here are some key risks that investors should keep in mind:

Illiquidity is a significant hurdle. Unlike public stocks or bonds, angel investments tie up funds for 7–10 years, often with no guarantee of an exit[1]. Until a liquidity event like an acquisition or IPO occurs, investors can’t access their capital, making patience and long-term commitment essential.

Deal selection is another major risk. Even though syndicate leads perform due diligence, startup failure rates remain high. Investors depend heavily on the lead's expertise, but even seasoned leads can make mistakes, resulting in backing ventures that fail or underperform.

Carry fees cut into profits. Syndicate leads typically take a 20% carried interest fee on any profits. For example, if an investment returns 5×, the carry fee reduces the investor's net profits by 20%.

Limited control is a concern. Unlike direct angel investments, where investors might have a say in business decisions or even a board seat, syndicate members usually have minimal influence over the startup's direction.

Risks for Founders

Founders working with angel syndicates face their own set of challenges. Here’s what they need to consider:

Diverging investor expectations can create distractions. Syndicate members might have conflicting opinions on growth strategies, exit timing, or levels of involvement. Balancing these differing viewpoints can pull founders away from focusing on their business.

Managing communication becomes more critical. When working with an angel syndicate, it becomes especially important for startup founders to provide regular monthly or quarterly updates to keep all syndicate members informed and engaged. This added administrative workload can detract from day-to-day operations.

Reduced individual engagement may limit strategic value. While syndicate leads often provide mentorship and connections, individual members typically have less involvement compared to traditional angel investors. This could mean fewer introductions, less guidance, and limited access to valuable networks.

Comparison Table: Investor vs. Founder Risks

The risks associated with angel syndicates affect investors and founders differently. Here's a side-by-side look:

Both investors and founders need to approach angel syndicates with full transparency. For investors, understanding their risk tolerance and liquidity needs is critical. Founders, on the other hand, must evaluate whether the benefits of raising funds through syndicates outweigh the potential challenges of managing a larger, more diverse group of backers. Success often hinges on choosing experienced syndicate leads, maintaining clear communication, and setting realistic expectations from the start.

Case Study: Allied Venture Partners' Angel Syndicate Model

To get a better sense of how angel syndicates operate in real life, let’s examine our own firsthand experience at Allied Venture Partners. Our angel investor network serves as an excellent example of how collaborative funding can work effectively. Our approach highlights how syndicates can simplify the investment process while offering meaningful support to early-stage startups.

Overview of Allied Venture Partners

Allied Venture Partners is an angel investor network with a robust community of over 2,000 angels and venture capitalists (VCs) from over two dozen countries globally. This extensive network creates a strong syndicate structure capable of quickly mobilizing funds for promising startups.

Focused on Pre-seed, Seed, and Series A funding rounds, Allied’s syndicate model stands out by offering founders a zero-cost entry point and access to a vast pool of experienced investors. Our syndicate operates on a deal-by-deal basis, allowing individual investors to decide which opportunities align with their interests and investment goals.

One of the key benefits for startups is the ability to pitch and apply without any upfront fees. This removes a common hurdle that often blocks early-stage companies from accessing angel funding, making the process more approachable and efficient for founders.

How Allied’s Investment Process Works

Allied VC is known for our efficiency, completing funding rounds in under four weeks. This speed is critical for startups that need to act quickly to seize market opportunities or meet important milestones.

The process begins with deal sourcing and an initial screening phase. During this stage, Allied's team identifies startups that meet our investment criteria. Once a startup passes this review, we move on to a structured diligence process where founders share their data room, including financial models and accompanying documents. Once a startup passes due diligence, our team prepares a deal memo to share with the syndicate network. At this point, individual angels and VCs within the network decide whether to participate in the deal.

To simplify things for founders, Allied uses Special Purpose Vehicles (SPVs) via AngelList to structure investments. Instead of having a long list of individual investors on their cap table, startup founders deal with a single entity that represents the entire syndicate. This approach not only streamlines the cap table but also makes the process more manageable for founders.

By leveraging AngelList as our proven backoffice platform to handle SPV management and legal processes, we can focus on sourcing deals and managing investor relations instead of getting bogged down in administrative tasks.

Support That Goes Beyond Capital

Allied doesn’t just stop at providing funding; we also deliver valuable resources to help startups grow. Our network offers strategic mentorship and networking opportunities, which can make a significant difference for early-stage companies. With over 2,000 experienced investors and entrepreneurs in our community, founders gain access to a wealth of knowledge across various industries and business functions.

In addition to mentorship, Allied provides operational guidance and key introductions that can help startups scale. This might include connecting founders with potential partners or helping them find critical hires to accelerate growth. The size and diversity of our network mean that founders can often find expertise tailored to their unique challenges.

We also take a long-term approach to investing, offering opportunities for follow-on funding as startups grow. This continuity allows founders to maintain relationships with investors who are already familiar with their business and have supported them from the beginning.

Support doesn’t end after the initial investment. At Allied, we provide ongoing mentorship, with members of our network sharing insights on product development, go-to-market strategies, team building, and even preparing for future fundraising rounds. This hands-on approach helps address a common concern about syndicate investing - that founders might miss out on personalized attention compared to traditional angel investors.

Conclusion

Angel syndicates are reshaping the way early-stage funding works by aligning the needs of startups with the resources of investors. This collaborative approach tackles key challenges in startup financing by pooling capital, sharing knowledge, and simplifying the investment process.

For investors, syndicates offer access to carefully vetted opportunities and allow for risk diversification through smaller, more manageable commitments. This makes angel investing more approachable than ever. On the other hand, founders benefit from a one-stop solution that delivers both funding and mentorship. Syndicates operate with speed, and tools like SPVs help streamline cap table management, cutting down on administrative hassles. This efficiency underscores the cooperative spirit that runs throughout the syndicate model.

A standout example of this model in action is what we’ve built at Allied Venture Partners. With a network of over 2,000 angels and VCs, we’ve proven that scaling up doesn’t have to come at the expense of personalized support or meaningful mentorship.

That said, success with angel syndicates hinges on choosing the right collaborators. Investors should prioritize syndicates with strong leadership, transparent practices, and a proven ability to source high-quality deals. Founders, meanwhile, should focus not only on the financial backing but also on the mentorship and long-term support offered by the network.

As the startup world continues to grow and change, angel syndicates are positioned to play an even bigger role in bridging the gap between innovation and funding. By addressing inefficiencies in traditional angel investing while maintaining a personal, hands-on approach, they offer a powerful solution for early-stage companies seeking both capital and guidance.

FAQs

How do angel syndicates differ from venture capital firms in terms of investor involvement?

Angel syndicates and venture capital firms operate in distinct ways when it comes to supporting startups. Venture capital firms usually back companies with larger investments and play a hands-on role in shaping their direction. They often use formal governance structures, like board seats, to actively influence key decisions and steer the company’s strategy.

Angel syndicates, on the other hand, take a more laid-back approach. A lead angel typically handles the deal, while individual investors remain less involved in the startup’s daily operations or strategic planning. This setup makes it easier for angel investors to back early-stage companies without the deeper time and effort commitment that venture capital often requires.

How can investors evaluate the credibility and expertise of a lead investor in an angel syndicate?

To assess the reliability and expertise of a lead investor in an angel syndicate, start by examining their track record. Look into their history of successful investments, paying attention to how past deals performed and whether they led to profitable exits. This can give you a clear sense of their ability to spot and nurture winning opportunities.

Also, consider their industry experience and network. An investor with deep knowledge of the sector and strong connections can play a key role in identifying high-potential startups and providing valuable support along the way.

Finally, reach out for references from other investors or founders who’ve collaborated with them. This step can help you gauge their integrity, leadership qualities, and overall reputation. Doing your homework ensures you partner with a lead investor who is not only experienced but also dependable and well-suited to guide the syndicate effectively.

How can startup founders effectively communicate and set expectations with syndicate investors?

To build strong relationships and set expectations with syndicate investors, prioritize clear, consistent, and open communication right from the beginning. Regularly share updates on progress, financial performance, and any significant developments to keep investors engaged and well-informed. Promptly addressing their questions or concerns helps establish trust and confidence.

It’s also important to outline roles and expectations early in the process. Define how and when updates will be provided to avoid any confusion. Leveraging tools like investor dashboards or automated email updates can simplify communication and ensure everyone is aligned. Effective communication strengthens relationships and increases the chances of continued support from your syndicate investors.