VC Milestones By Funding Stage

In venture capital, milestones are the measurable goals startups must achieve to secure funding and grow. Each funding stage - Pre-seed, Seed, and Series A - has unique expectations:

Pre-seed: Focus on validating ideas, building a minimum viable product (MVP), and forming a strong team. Typical funding ranges from $250,000 to $1 million, with valuations between $2 million and $5 million.

Seed: Prove product-market fit, gain early traction, and refine the product. Funding typically ranges from $1 million to $4 million, with valuations between $5 million and $15 million.

Series A: Demonstrate scalable revenue, strong financial metrics, and market growth. Funding ranges from $5 million to $15 million, with valuations between $15 million and $50 million.

Less than 15% of seed-funded startups secure Series A funding, underscoring the importance of meeting these milestones. Each stage builds upon the previous one, with investors seeking clear evidence of progress, market demand, and a clear growth path.

The 7 Stages of Venture Capital Every Startup Needs to Know

1. Pre-seed Stage

The Pre-seed stage is where startups begin transforming raw ideas into tangible products. For venture capital investors, this phase is all about betting on potential rather than proven outcomes.

Early progress during this stage not only validates the startup's vision but also sets the stage for future funding rounds.

Key Milestones

At the pre-seed stage, the focus is on validation and early execution - not revenue. Startups need to assemble a strong founding team with a mix of technical expertise, leadership, and a deep understanding of their market [4]. Investors are drawn to founders who can clearly articulate their vision and demonstrate the ability to execute it.

A critical milestone is validating the problem. Startups must show there’s a real market need through customer research or pilot partnerships [4]. It’s not about having a large user base yet; it’s about proving that the problem matters and that there’s demand for a solution.

Building a functional prototype or MVP (Minimum Viable Product) is another major step. This early version of the product demonstrates how it works and hints at its potential value. Investors expect startups to have a clear MVP strategy and a well-defined development timeline [4][6]. Startups at this stage are often considered “pre-product, but have something to show" [7].

Other milestones include conducting thorough market research to understand the target audience and competition, forming a capable team with complementary skills, and ensuring legal groundwork - like incorporating the company and securing partnership agreements. Founders should also outline an initial roadmap for customer acquisition, retention, and future revenue growth [4].

Take Notion, for example. Before becoming a productivity software giant, it started as a small pre-seed-funded idea. The team operated out of a modest apartment, refining early concepts and testing what worked. Their early backers didn’t focus on immediate traction; instead, they believed in the team’s technical skills and vision [4].

These milestones create a foundation for securing the funding needed to move forward.

Funding Amounts

Pre-seed funding amounts can vary widely depending on your industry and location. For example, North American pre-seed rounds typically range from $250,000 to $1 million, and in rare cases, can be as much as $5 million [9].

In 2024, pre-seed investments in the U.S. totaled $4 billion. However, quarterly figures show a decline: $1.2 billion in Q2, $965 million in Q3, and $716 million in Q4. Smaller deals are becoming more common; in Q4 2024, nearly 44% of pre-seed rounds were under $250,000, compared to 30% in Q4 2023 [10].

Typically, pre-seed funds are designed to last 12–18 months, giving startups the runway they need to hit key milestones before seeking additional funding. The exact amount raised depends on factors like the industry, location, business potential, and the strength of the team/pitch [9].

Investor Types

Pre-seed investors come from a variety of backgrounds. Many startups initially turn to friends and family, who provide funding based on personal trust rather than industry expertise. While this support is invaluable for getting started, it often lacks strategic guidance.

Angel investors, often experienced entrepreneurs themselves, play a crucial role by offering both capital and mentorship. As Silicon Valley super angel Jason Calacanis famously said:

"Your job as an angel investor is to block out the haters, doubters, and small thinkers, because if you think small you'll be small. I’d rather see my founders fail at a big goal than succeed at a small one." [2].

Angel syndicates, like us at Allied Venture Partners, are also gaining traction, where groups of investors pool resources through Special Purpose Vehicles (SPVs). With a global network of angels and VCs from the software and technology industry, Allied offers not just funding but also mentorship and connections to help our portfolio startups succeed.

Accelerators and incubators can also provide structured support, mentorship, and sometimes funding in exchange for equity - an especially helpful option for first-time founders [11].

Finally, some venture capital firms, especially micro-VCs, may also participate in pre-seed rounds – often investing through convertible notes or SAFE agreements.

The choice of pre-seed investors can have a lasting impact, shaping a startup’s trajectory and its ability to secure future funding rounds. Picking the right partners early on is a crucial step toward long-term success.

2. Seed Stage

After the pre-seed phase, which focuses on validating ideas, the seed stage shifts gears toward building traction and proving market demand. This is where startups move from conceptual validation to showcasing real-world progress. Seed funding typically involves refining the product, acquiring early customers, and establishing a presence in the market - marking the first major capital injection for many startups [12].

At this stage, investors expect more than just a strong team and an ambitious vision. They’re looking for evidence that the startup can execute its plans and demonstrate growth potential. This phase is all about setting the foundation for scaling up and achieving tangible milestones.

Key Milestones

The seed stage is all about proving traction and preparing for growth. While the pre-seed phase establishes whether an idea is viable, seed funding focuses on deeper market engagement and validation [14].

One of the most critical milestones is customer validation. Investors want to see that the startup has identified a real demand for its product or service and has begun to attract actual customers. This involves moving beyond theoretical research to real-world customer interactions, pilot programs, or even early sales. Startups must show they understand their audience’s needs and have a solution people are willing to pay for.

Another key focus is refining the MVP (minimum viable product). At this stage, it’s no longer about proving the product works - it’s about making it better and scalable. The goal is to present a polished product that clearly communicates its value.

Financial performance also takes center stage. Startups need to demonstrate commercial viability through strong margins, efficient customer acquisition, and controlled burn rates [13][20]. While financial projections don’t need to be as detailed as in later stages, they should outline a clear path to monetization.

As Jeff Farrington, fractional CFO and former venture capitalist, explains:

"Everything before Series A is considered more risky, and financial projections matter less because they're not yet reliable enough... With tightening market conditions, seed companies are now typically required to show some proof of revenue." [21]

Take Dropbox, for example. When it secured $1.2 million in seed funding from Sequoia Capital in September 2007, it had already moved past proving the concept of file syncing. Dropbox demonstrated early user adoption and scalability, showing how it could attract millions of users [12]. Similarly, Uber raised $1.25 million in seed funding from First Round Capital in October 2010 after proving its ride-hailing concept in limited markets. The company had actual drivers, real customers, and data to back its claims of demand [12].

Funding Amounts

Seed funding amounts have grown considerably over the years. In the U.S., the median seed round size in 2024 was $2.5 million, with most rounds ranging between $1 million and $4 million [17]. However, the specific amount often depends on the startup’s industry and needs, with funding ranging from $500,000 to $5 million [15].

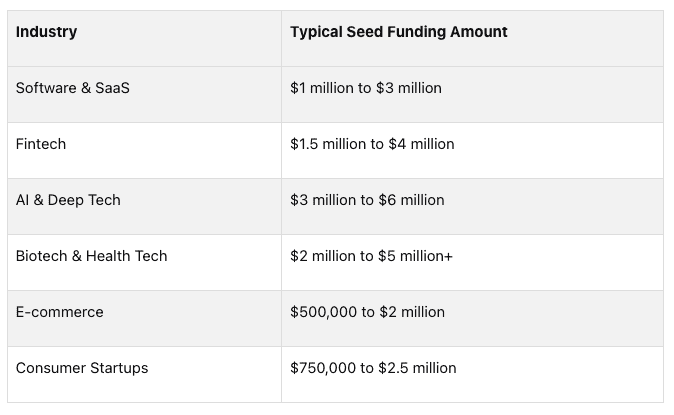

Different industries have distinct funding requirements. For instance:

Fintech startups typically raise $1.5 million to $4 million.

AI and deep tech companies often secure $3 million to $6 million.

Biotech and health tech startups require $2 million to $5 million or more due to longer development cycles.

E-commerce startups usually raise smaller amounts, between $500,000 and $2 million [16].

Geography also plays a role. In California, the median seed round in 2024 was $3.2 million with a median valuation of $17 million, while startups in Florida raised a median of $1.5 million with valuations around $13.6 million [17].

The funding landscape in 2024 saw mixed trends. Seed-stage funding hit $3.9 billion in Q2, an 8% increase from Q1 [12]. However, the median funds raised by U.S. startups in the first half of the year were only $1.3 million [13], highlighting the wide variation in round sizes.

Investor Types

Seed funding attracts a more diverse and experienced group of investors compared to pre-seed rounds. While friends and family may still participate, the main players at this stage are angel investors, early-stage venture capital firms, and specialized seed funds [19].

Angel investors at the seed stage often bring both capital and industry expertise. Unlike pre-seed angels, who may invest based on personal relationships, these investors conduct more rigorous due diligence and typically contribute $2 million to $3 million per round [18].

Early-stage venture capital firms and micro-funds are also key players. In 2023, over 400 new micro-funds launched globally, focusing on providing hands-on support and leveraging deep industry connections. Many of these funds specialize in areas like climate tech, deep tech, or crypto [22].

Seed investors aim for high returns, often targeting a 100× return on their investment [20]. They look for startups that can scale and solve real problems in innovative ways. As Oliver Hammond, Partner at Fuel Ventures, puts it:

"With seed funding, I would expect the company to have a live product in market that people are willing to pay for." [20]

In addition to financial potential, investors value founders who demonstrate passion, expertise, and resilience. The median U.S. seed-stage valuation reached $13 million in 2023 - more than double the $6 million median in 2015 [22] - reflecting the growing competition and interest in this stage.

The seed stage is where startups transition from potential to proof. Investors expect more than just a compelling vision; they want to see early signs of product-market fit and a clear path to growth. This phase sets the groundwork for scaling and securing the next funding round.

3. Series A Stage

The Series A stage is where startups shift gears from showcasing potential to proving performance. It’s a critical juncture, as fewer than 15% of seed-funded startups make it to this stage [25]. This underscores the higher bar and rigorous evaluation that Series A funding demands.

Key Milestones

To secure Series A funding, startups need to present clear, measurable evidence across several areas: team capability, product viability, market traction, and operational execution [23]. At this stage, it’s all about demonstrating a proven revenue model and scalable operations.

One of the most critical milestones is achieving product-market fit. This means showing a strong market demand and delivering a solution that customers actively use - and are willing to pay for.

Financial metrics like Annual Contract Value (ACV), Customer Lifetime Value (LTV), and Customer Acquisition Cost (CAC) take center stage. Additionally, startups must have a solid operational infrastructure, complete with established systems, processes, and a capable core team to drive growth. Strong market positioning and competitive advantages also help companies stand out.

Take Slack as an example: before its Series A, the company demonstrated impressive user engagement and low churn rates, signaling strong customer retention and market demand [4].

These milestones are crucial for securing larger funding amounts and withstanding the rigorous scrutiny that comes with Series A investments.

Funding Amounts

Series A funding amounts have held strong despite market swings. As of January 2025, the average Series A round raised $16.6 million, with a median of $7.9 million in Q1 2025 [1][24]. Most rounds fall in the $5 million to $15 million range, with investors typically taking 15–30% equity [4]. Valuations at this stage often range between $10 million and $30 million, though standout companies can reach valuations as high as $50 million [2][1]. This is a significant leap from earlier stages, where seed funding typically ranges from $500,000 to $2 million and pre-seed funding averages $500,000 or less [25][3].

Investor Types

The investor landscape evolves significantly at the Series A stage, with venture capital firms taking the lead. These firms bring not only capital but also strategic expertise and extensive networks. Typically, a lead investor, or "anchor", sets the terms and handles the primary due diligence process [1].

Series A investors often secure board seats and play an active role in business decisions. Their due diligence process is thorough, covering financial projections, market analysis, competitive positioning, and operational readiness. The goal is to ensure the company has the foundation and scalability needed for growth.

Advantages and Challenges

As startups progress through funding stages, each phase brings its own set of benefits and hurdles. Navigating these trade-offs effectively is crucial for startups aiming to grow strategically. Let’s break down the advantages and challenges at the pre-seed, seed, and Series A stages.

In the pre-seed stage, funding serves as a lifeline for early ideas. It allows founders to build their teams, develop prototypes, and test market needs. However, the capital at this stage is modest - often just a few hundred thousand dollars - and typically comes from personal networks like friends and family. While helpful, these sources often lack the strategic expertise needed to accelerate growth [3].

At the seed stage, the average funding jumps to around $2 million. This capital boost helps startups refine their products, expand their teams, and dive deeper into market research. But with this stage comes added pressure. Startups need to show real market traction and meet the rising expectations of investors [12].

The Series A stage brings even more resources, with average funding reaching $12 million [5]. Startups at this level focus on scaling - whether that’s launching new products, entering new markets, or building a strong operational framework. The flip side? Investors demand more. A proven product-market fit, a solid team, and a clear plan for 3–5× growth within 12–18 months are non-negotiable [3].

The current investment landscape reflects a growing focus on profitability. Following the global pandemic in 2020, venture capital funding dropped to $76 billion in Q1 2024, marking the lowest level in nearly five years [29]. Meanwhile, the venture funding landscape has been slow to recover, highlighting the importance of scalable business models, sound financial planning, and strong, committed teams [27][28].

"Investors often invest in the team as much as the idea. Having a committed and experienced team can go a long way in instilling confidence in potential investors." – Mert Onay, Founding Member, Bunch Capital [28]

Timing is everything when it comes to fundraising. Founders typically need six to eight months to secure capital while meeting the milestones required for each stage [27]. From validating initial concepts to scaling operations, every phase demands a customized approach.

For startups ready to scale, our team at Allied offers the funding, mentorship, and expertise to help turn big ideas into tangible success.

Lets Recap

Raising funds for a startup is a milestone-based journey where each stage (pre-seed, seed, or Series A) builds upon the achievements of the previous one. Early on, the focus is on validating your idea, gaining traction, and proving that your revenue model can scale.

Understanding these stages and their milestones is critical. Consider this: only 20–30% of seeded companies manage to secure Series A funding [30]. On top of that, 82% of small businesses fail due to cash flow problems [32], and 29% of startups cite lack of capital as the reason for their failure [31]. These numbers highlight just how crucial it is to approach fundraising with a solid plan.

Strategic fundraising does more than just bring in money - it helps establish credibility, attracts the right investors, and sets the stage for growth. To succeed, founders need to align their fundraising efforts with key milestones and a clear roadmap for scaling. Investors today are looking for startups that show a clear path to profitability, have experienced leadership, and can demonstrate real traction before they’re willing to commit.

Each stage of funding serves a distinct purpose. By aligning your business goals with what investors are looking for, you can secure the capital needed to build long-term value. Organizations like Allied VC are here to support early-stage tech companies in navigating these critical milestones.

FAQs

What are the main differences in investor expectations and startup milestones across pre-seed, seed, and Series A funding stages?

At the pre-seed stage, investors are primarily interested in seeing if your idea has legs. This means having a working prototype and showing that your solution addresses a clear problem. Early market research that highlights potential demand can also make a big difference at this stage.

When you move to the seed stage, the spotlight shifts to proving product-market fit. To win over investors, you'll need to show signs of traction - whether that's an initial user base, early revenue, or strong engagement metrics. The goal here is to demonstrate that your product is solving a real problem for your intended audience.

By the time you reach the Series A stage, it’s all about scalability. Investors want to see steady revenue growth, a clear business model, and a roadmap for expansion. To secure funding, you'll need to back up your plans with strong metrics and a strategy for scaling your operations effectively.

Why do fewer than 15% of seed-funded startups successfully raise Series A funding, and how can they improve their chances?

Fewer than 15% of seed-funded startups manage to secure Series A funding. The hurdles? They often stem from issues like not gaining enough traction, having gaps in the team, or failing to clearly establish product-market fit. At this stage, investors are looking for startups that show real growth, scalability, and a clear plan for long-term success.

So, how can startups improve their odds? Here are three key areas to focus on:

Prove product-market fit: Make it clear that your product solves a real problem and is gaining traction with a growing base of happy users.

Build a strong team: Investors want to see a team that's not just skilled but also fully committed to turning your vision into reality.

Show measurable traction: Highlight metrics that matter - revenue growth, user acquisition rates, or market adoption - to prove your startup is on the right track.

By zeroing in on these aspects, startups can build investor confidence and increase their chances of landing that crucial Series A.

How do pre-seed investors influence a startup's ability to raise future funding?

The investors you bring on board during the pre-seed stage can play a crucial role in shaping your startup’s future. Experienced, well-regarded investors don’t just provide funding - they also boost your company’s credibility, making it more appealing to future backers. Plus, your cap table (i.e., the breakdown of ownership in your company) can significantly influence how attractive your startup appears to potential investors down the line.

But it’s not just about the money. The best pre-seed investors often come with a wealth of insights, connections, and strategic advice. These resources can be game-changers as you prepare for critical funding rounds like Seed and Series A. Picking the right partners early doesn’t just help you secure funding - it lays the groundwork for sustainable growth and builds trust with future investors.