Rule 506(b) vs. 506(c): Choosing the Optimal Path for Your Private Capital Raise

Key Takeaways

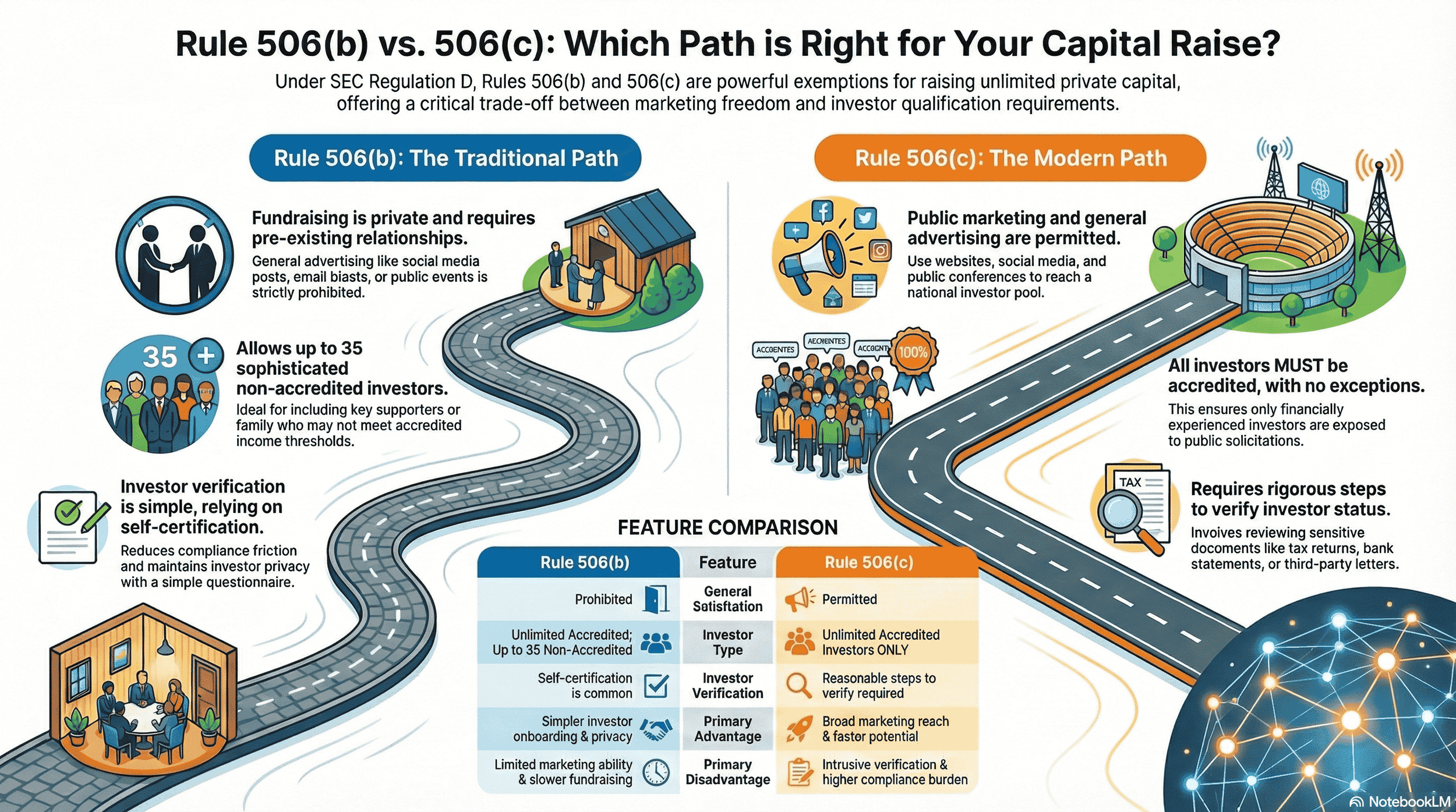

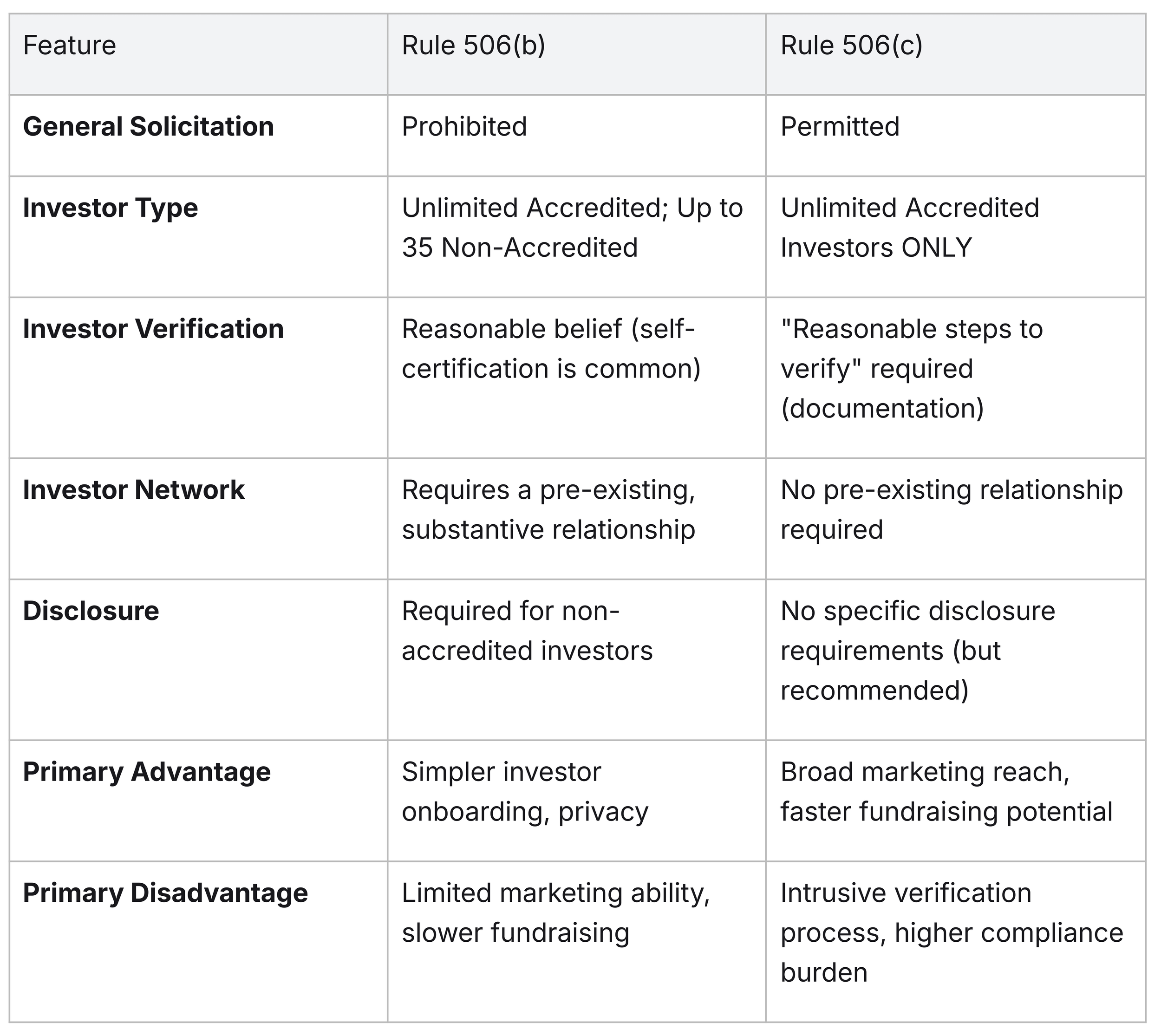

Rule 506(b) prohibits general solicitation and requires pre-existing relationships with investors, but allows up to 35 sophisticated non-accredited investors alongside unlimited accredited investors with simple self-certification.

Rule 506(c) permits public advertising and general solicitation but restricts all investors to accredited-only status and mandates rigorous third-party verification of each investor's financial qualifications.

Both rules allow unlimited capital raises and provide federal preemption over state Blue Sky registration requirements, making them the most powerful exemptions under Regulation D for private securities offerings.

The JOBS Act introduced Rule 506(c) in 2012 to modernize private fundraising by allowing issuers to leverage internet marketing, social media, and public conferences to reach broader investor pools.

Verification requirements are the critical trade-off: 506(b) relies on reasonable belief and self-certification, while 506(c) requires collecting sensitive financial documentation such as tax returns, bank statements, and credit reports or obtaining confirmation from attorneys, CPAs, or SEC-registered investment advisers.

Marketing reach versus network depth: Choose 506(b) if you have strong existing relationships and want privacy and simplicity; choose 506(c) if you need to cast a wide net, accelerate fundraising timelines, and can manage the compliance burden.

Real estate syndication and private equity funds commonly use 506(c) to access national investor pools through syndication platforms, while well-connected founders often prefer 506(b)'s streamlined process.

Including non-accredited investors triggers extensive disclosure requirements under 506(b) similar to registered offerings, and may complicate future institutional funding rounds seeking clean cap tables.

Both rules require Form D filing within 15 days of the first sale, compliance with anti-fraud provisions, bad actor disqualification checks, and adherence to state notice filing requirements.

Strategic decision factors include: the strength of your existing network, fundraising timeline urgency, tolerance for compliance complexity, ability to include sophisticated but non-accredited supporters, and future financing plans.

Third-party verification services can streamline the 506(c) compliance process but add costs, while the prohibition on general solicitation under 506(b) may significantly limit your ability to reach sufficient capital from your immediate network alone.

The optimal path aligns with your specific circumstances: neither rule is universally superior, and the choice should be based on a thorough self-assessment of your resources, investor base, timeline, and long-term growth strategy.

Navigating the Landscape of Private Capital Raises

Raising private capital is a pivotal moment for any growing enterprise, but the path is paved with complex regulatory decisions. For companies issuing securities, choosing the right fundraising exemption under the Securities and Exchange Commission (SEC) rules is not just a matter of compliance; it's a strategic choice that can define the speed, scope, and success of your capital raise. The decision often boils down to two powerful, yet distinct, options within Regulation D: Rule 506(b) and Rule 506(c).

The Importance of Strategic Fundraising

Navigating the fundraising landscape requires more than just a compelling business plan. While the global private capital market presents immense opportunities, it has also become more competitive. In a challenging environment where total capital raised across Buyout, Growth, and Venture funds has seen significant declines, a well-defined strategy is paramount. The choice between 506(b) and 506(c) directly impacts who you can raise from, how you can market your offering, and the compliance burdens you must undertake. This decision sets the foundation for your company's growth trajectory and future financing rounds.

Overview of Regulation D and its Role in Private Securities Offerings

The Securities Act of 1933 mandates that every offer and sale of securities must be registered with the SEC unless an exemption applies. This registration process is expensive and time-consuming, making it impractical for most early-stage companies and private funds. This is where Regulation D comes in. It provides several exemptions from these registration requirements, creating a safe harbor for issuers conducting private securities offerings. Despite recent fluctuations, Regulation D remains the dominant exemption framework, with tens of thousands of filings annually. Within this framework, Rule 506 is the most widely used provision.

Understanding the Foundation: Rule 506 within Regulation D

Rule 506 serves as the bedrock for most significant private capital raises in the United States. It offers a clear path for companies to raise an unlimited amount of capital from an unlimited number of accredited investors without undergoing the full SEC registration process. Its power lies in its flexibility and federal preemption, which simplifies state-level compliance.

The Securities Act of 1933 and Exempt Offerings

The Securities Act of 1933, enacted in the wake of the 1929 stock market crash, was designed to ensure transparency and protect investors. Its core principle is full and fair disclosure. However, Congress recognized that not all securities offerings require the same level of public scrutiny. The Act itself provides for "exempt offerings," which are transactions that do not need to be registered because of the nature of the security or the transaction itself. Regulation D, and specifically Rule 506, provides the most common and practical "safe harbors" for these exempt private placements, allowing businesses to access capital markets efficiently.

Why Rule 506 is a Cornerstone for Raising Capital

Rule 506 is the go-to exemption for several key reasons. First, it allows issuers to raise an unlimited amount of capital, making it suitable for everything from a small seed round to a large real estate development project. Second, it preempts state "Blue Sky" laws. This means that if you comply with Rule 506, you generally only need to file a notice with the states where you sell securities, rather than undergoing a substantive review and registration process in each state. This federal preemption dramatically reduces the complexity and cost of multi-state fundraising, making Rule 506 an indispensable tool for issuers.

Rule 506(b): The Traditional Private Placement Approach

Rule 506(b) has long been the default standard for private placements. It is built on the principle of fundraising through established networks and pre-existing relationships. This approach prioritizes investor protection by strictly limiting how an offering can be communicated to the public.

Key Characteristics and Limitations

The defining characteristic of a Rule 506(b) offering is the absolute prohibition of "general solicitation" and "general advertising." This means issuers cannot use public-facing methods to market their securities. Prohibited activities include advertising on television or radio, publishing articles or notices in newspapers or magazines, and using unrestricted websites, email blasts, or social media posts to attract investors. Communication is restricted to individuals and entities with whom the issuer has a pre-existing, substantive relationship, effectively limiting the pool of potential investors to the company's direct network.

Investor Qualification Standards

Rule 506(b) offers a degree of flexibility in its investor base. An issuer can sell securities to an unlimited number of "accredited investors." The SEC defines an accredited investor based on specific income, net worth, or professional criteria. Critically, Rule 506(b) also permits up to 35 non-accredited investors to participate in the offering. However, these non-accredited investors must be "sophisticated"—meaning they must have sufficient knowledge and experience in financial and business matters to be capable of evaluating the merits and risks of the prospective investment. If any non-accredited investors are included, the issuer must provide them with disclosure documents that are similar in substance to what would be required in a registered public offering.

Advantages of 506(b) for Issuers

The primary advantage of Rule 506(b) lies in its reduced compliance friction regarding investor qualification. While issuers must have a reasonable belief that an investor is accredited, they can generally rely on a self-certification questionnaire from the investor. There is no mandatory verification process required for accredited investors, which simplifies the subscription process and maintains investor privacy. The ability to include a limited number of sophisticated non-accredited investors can also be beneficial for founders looking to bring in capital from trusted colleagues, family, or friends who may not meet the accredited threshold.

Disadvantages of 506(b)

The most significant drawback of 506(b) is the strict ban on general solicitation. This severely limits an issuer's ability to reach new investors beyond their immediate network. Building a sufficient pool of capital can be slow and challenging if the founders do not have an extensive, high-net-worth network. Furthermore, the inclusion of non-accredited investors triggers extensive disclosure requirements, which can be costly and time-consuming to prepare. This complication can also deter future venture capital or institutional investors, who often prefer a "clean" cap table consisting solely of accredited investors.

Rule 506(c): Embracing General Solicitation and Public Marketing

Introduced as part of the Jumpstart Our Business Startups Act (JOBS) of 2012, Rule 506(c) represents a modernization of private fundraising rules. It acknowledges the power of the internet and modern communication by permitting public advertising of securities offerings, but it does so with a critical trade-off: stricter investor qualification requirements.

Key Characteristics and Opportunities

Under Rule 506(c), the fundraising world opens up. Issuers are permitted to engage in general solicitation to find investors. This means they can advertise their offering on their website, use social media platforms like LinkedIn and Twitter, speak at public conferences, run online ad campaigns, and generally publicize their need for capital. This ability to cast a wider net can dramatically accelerate the fundraising process and provide access to a much larger and more diverse pool of potential investors, which is especially valuable for issuers in sectors like real estate or technology who may not have a pre-existing network of wealthy contacts.

Strict Investor Qualification: Accredited Investors ONLY

The flexibility to advertise comes with a significant and non-negotiable condition: under Rule 506(c), every single investor must be an accredited investor. There is no allowance for non-accredited investors, sophisticated or otherwise. This bright-line rule ensures that only those individuals and entities deemed by the SEC to have the financial capacity to withstand the risk of loss are exposed to these publicly marketed private offerings. This is a critical distinction, as the pool of potential investors is limited to the approximately 12.6% of the U.S. population that qualifies as accredited.

Crucial Gap Fill: The Verification Process for 506(c) (Practical Deep Dive)

The most significant operational burden of Rule 506(c) is the requirement that issuers take "reasonable steps to verify" that all purchasers are accredited investors. A simple self-certification questionnaire is not sufficient. The SEC has provided a non-exclusive, principles-based list of methods that are deemed to satisfy this verification requirement.

Practically, this verification process involves collecting and reviewing sensitive financial documentation from potential investors. Common methods include:

Income Verification: Reviewing an investor’s Internal Revenue Service forms (such as a W-2, Form 1099, or K-1) or filed tax returns for the two most recent years and obtaining a written representation that the investor has a reasonable expectation of reaching the required income level in the current year.

Net Worth Verification: Reviewing recent bank statements, brokerage statements, other statements of securities holdings, and certificates of deposit to ascertain assets. To verify liabilities, a recent consumer credit report from a nationwide reporting agency is typically used. The issuer must also get a written representation from the investor that all liabilities necessary to make a net worth determination have been disclosed.

Third-Party Confirmation: Obtaining written confirmation from a registered broker-dealer, an SEC-registered investment adviser, a licensed attorney, or a certified public accountant stating that such person or firm has taken reasonable steps to verify the investor’s accredited status within the prior three months.

Professional Status: Verifying an investor holds certain professional certifications or licenses in good standing (e.g., Series 7, 65, or 82 licenses).

This verification process can be intrusive for investors and administratively burdensome for issuers. Many companies opt to use third-party verification services, like AngelList, that specialize in this compliance task to streamline the process and reduce liability.

Advantages of 506(c) for Issuers

The primary advantage of 506(c) is the freedom to market an offering publicly. This can lead to a faster and more efficient fundraising process, opening doors to investors nationwide that would have been impossible to reach under 506(b). For businesses with a compelling story that resonates with a broad audience, 506(c) provides the tools to build momentum and attract capital at scale. It also enforces a clean cap table of only accredited investors, which can be more appealing to future institutional funding sources. Despite its benefits, it is worth noting that 506(c) offerings still represent a small fraction of the capital raised compared to 506(b) offerings, suggesting issuers still favor the traditional path's simplicity.

Disadvantages of 506(c)

The verification burden is the most substantial disadvantage. It adds a layer of friction to the investment process, can deter privacy-conscious investors, and increases administrative costs and potential legal risks if not performed correctly (source: Proskauer Rose LLP). The absolute prohibition on non-accredited investors also means that founders cannot accept investments from supporters who don't meet the strict financial thresholds, even if they are sophisticated and believe strongly in the venture.

Side-by-Side Comparison: 506(b) vs. 506(c) at a Glance

Choosing between these two rules requires a clear understanding of their fundamental trade-offs. At its core, the decision is a balance between marketing freedom and investor eligibility and verification requirements.

Key Differentiators Table

Strategic Decision Navigator: Choosing Your Optimal Path

The choice between 506(b) and 506(c) is not merely a legal checkbox; it's a strategic business decision. The optimal path depends entirely on your company's specific circumstances, resources, and goals.

Self-Assessment Questions for Issuers

Before committing to a path, founders and fund managers should ask themselves the following questions:

What does our existing network look like? Do we have deep relationships with a sufficient number of accredited investors to fund our round without public marketing? If yes, 506(b) may be more efficient.

How quickly do we need to raise capital? If speed is critical and our network is limited, the broad reach of 506(c) might be necessary to fill the round in a timely manner.

Do we have key supporters who are not accredited? If including strategic, non-accredited investors (like early employees, supporters, or key advisors) is important, 506(b) is your only option.

What is our marketing capacity? Are we prepared to launch a public marketing campaign? Do we have the resources and expertise to manage it effectively and compliantly?

What is our tolerance for compliance friction? Are we prepared to manage the administrative burden of verifying every investor's accredited status for a 506(c) offering?

What are our future fundraising plans? Will having non-accredited investors on our cap table from a 506(b) raise create complications for a future institutional or VC round?

Cost-Benefit Analysis: Beyond Basic Pros and Cons

The decision requires weighing the direct and indirect costs against the potential benefits.

Rule 506(b) Costs: The opportunity cost of not reaching a wider investor pool can be immense. Fundraising may take longer, potentially delaying key business milestones. If non-accredited investors are included, the legal costs of preparing required disclosures can be significant.

Rule 506(b) Benefits: Lower upfront legal and administrative costs for investor verification. Greater investor privacy and a smoother, less intrusive subscription process for your network.

Rule 506(c) Costs: Higher administrative costs associated with the verification process (whether done in-house or via a third-party service). Increased legal scrutiny to ensure all marketing materials comply with anti-fraud rules.

Rule 506(c) Benefits: Access to a vastly larger pool of capital. The potential to build brand awareness and market validation through a public fundraising campaign. A faster path to a fully subscribed round.

Real-World Scenarios and Use Cases

Scenario 1: The Well-Connected Tech Startup. A startup founded by experienced entrepreneurs with a deep network of angel investors and venture capitalists. They can likely fund their entire seed round through direct outreach to their contacts.

Optimal Path: Rule 506(b). The simplicity and privacy of 506(b) are ideal. There is no need for public marketing, and the investor onboarding process is streamlined.

Scenario 2: The Real Estate Syndicator. A real estate developer is raising capital for a large multi-family apartment project. They have some local investors but need to raise $10 million and want to tap into a national investor base.

Optimal Path: Rule 506(c). The ability to advertise the deal on syndication platforms, through email newsletters, and at industry events is crucial to attracting enough capital from accredited investors nationwide.

Scenario 3: The Consumer Product Company. A company with a popular product wants to raise a community round from its passionate customer base. Many of these customers may be sophisticated but not accredited.

Optimal Path: Rule 506(b). This allows them to accept up to 35 non-accredited customers while still raising the bulk of the capital from accredited investors in their network.

Essential Compliance and Regulatory Considerations for Both 506(b) and 506(c)

Regardless of the path chosen, issuers must adhere to several overarching securities regulations. These are not optional and are critical to conducting a lawful capital raise.

Filing Form D with the SEC

For both 506(b) and 506(c) offerings, the issuer must file a notice called Form D with the SEC. Form D is a brief notice that includes basic information about the company, its management, and the offering itself. It must be filed electronically through the SEC's EDGAR system no later than 15 calendar days after the first sale of securities in the offering.

Preemption of State Registration (Blue Sky Laws)

A major benefit of Rule 506 is that it provides federal preemption over state securities registration requirements. This means issuers do not have to go through the costly process of registering the offering in every state where they have an investor. However, states can still require issuers to file a notice (typically a copy of the federal Form D) and pay a filing fee.

Anti-Fraud Provisions of Securities Laws (Securities Act of 1933)

Exemption from registration is not an exemption from the anti-fraud provisions of federal securities laws. All information provided to investors, whether in a private placement memorandum or in marketing materials, must be truthful and complete. Issuers can be held liable for any material misstatements or omissions made in connection with the sale of securities.

The "Bad Actor" Disqualification Rule

Rule 506 includes "bad actor" disqualification provisions. An offering is ineligible for a Rule 506 exemption if the issuer or other "covered persons" (such as directors, executive officers, or major shareholders) have had a relevant criminal conviction, regulatory or court order, or other disqualifying event. Issuers must take reasonable care to conduct a factual inquiry to ensure none of their covered persons are bad actors.

Proper Disclosure Documents (Private Placement Memorandums or Offering Circulars)

While Rule 506(c) and 506(b) offerings to only accredited investors do not have specific line-item disclosure requirements, it is a universal best practice to provide investors with a comprehensive disclosure document, often called a Private Placement Memorandum (PPM). A PPM details the terms of the offering, describes the business and its risks, and provides financial information, allowing investors to make an informed decision and protecting the issuer from future liability.

Summary: The Difference Between 506b vs. 506c

The choice between Rules 506(b) and Rule 506(c) is a foundational strategic decision in any private fundraising effort. Rule 506(b) offers a time-tested, private path for issuers with strong, pre-existing investor networks, prioritizing simplicity and confidentiality over broad reach. In contrast, Rule 506(c) provides a powerful modern tool for issuers who need to cast a wide net, allowing public advertising in exchange for a stricter, accredited-only investor base and a rigorous verification process.

To make the right choice, issuers must conduct a thorough self-assessment of their network, timeline, resources, and long-term goals. Consider the nature of your business and your ideal investor profile. Are you building on existing relationships, or do you need to create new ones from scratch? Is the privacy of your investors paramount, or is the speed of fundraising the top priority?

Ultimately, the optimal path is the one that aligns with your specific fundraising strategy and operational capabilities. By carefully weighing the trade-offs and understanding the deep compliance responsibilities inherent in both options, you can select the regulatory framework that best positions your company for a successful capital raise and future growth. Consulting with experienced legal counsel is not just recommended; it is an essential step in navigating this complex but rewarding landscape.

Frequently Asked Questions: 506(b) vs. 506(c)

General Understanding

What is the main difference between Rule 506b and Rule 506c for raising capital?

The fundamental difference lies in marketing freedom versus investor qualification requirements. Rule 506(b) prohibits general solicitation but allows up to 35 sophisticated non-accredited investors alongside unlimited accredited investors. Rule 506(c), introduced under the JOBS Act, permits public advertising and general solicitation but requires all investors to be accredited and mandates third-party verification of each investor's accredited investor status. This distinction significantly impacts your fundraising capabilities and the investor pool you can access.

Can I use crowdfunding instead of Rule 506 offerings?

Yes, crowdfunding is an alternative under the exempt offering framework. Regulation crowdfunding (RegCF) allows companies to raise up to $5 million annually from both accredited and non-accredited investors through SEC-registered crowdfunding platforms. Unlike Rule 506 offerings, Regulation Crowdfunding requires financial statements and allows investing by the general public with individual investment limits based on income and net worth. However, crowdfunding platforms charge fees and the process involves more public disclosure than private syndications under Rule 506.

How does Regulation A differ from Rule 506 for capital raising?

Regulation A is sometimes called "mini-IPO" crowdfunding and allows companies to raise up to $75 million annually (source: SEC). Unlike Rule 506 offerings that create restricted securities, Regulation A can result in freely tradable securities and permits general solicitation. However, Regulation A requires audited financial statements, SEC qualification of the offering circular, and ongoing reporting obligations. Rule 506 offerings are generally faster and less expensive for raising capital, making them more suitable for most private equity funds and private real-estate offerings.

Investor Qualification and Verification

What are the investor qualification standards under each rule?

Rule 506b permits unlimited accredited investors plus up to 35 non-accredited but sophisticated investors who must demonstrate sufficient financial knowledge. Rule 506c strictly limits the investor pool to accredited investors only. The U.S. Securities and Exchange Commission defines accredited investor status based on meeting income thresholds ($200,000 individually or $300,000 jointly for two years), net worth requirement (over $1 million excluding primary residence), or holding certain professional certification requirements like Series 7, Series 65, or Series 82 licenses (source: SEC).

What does the verification process look like for Rule 506(c)?

Rule 506(c) requires issuers to take "reasonable steps to verify" accredited status, which goes far beyond self-certification. Common methods include reviewing IRS tax returns or W-2 forms for income verification, examining bank and brokerage statements along with credit reports for net worth verification, or obtaining confirmation from an SEC-registered investment adviser, attorney, or CPA. Many fund managers use third-party verification services, like AngelList, to streamline this process and ensure compliance with internal compliance protocols, though this adds cost to the fundraise.

Can I accept investments from family members who aren't accredited?

Only under Rule 506(b). This rule allows up to 35 sophisticated non-accredited investors, making it ideal when you want to include trusted supporters, family, or key advisors in your capital raising efforts. However, including non-accredited investors triggers extensive disclosure requirements similar to registered offerings. Rule 506(c) prohibits all non-accredited investors, regardless of their sophistication or relationship to the company.

Marketing and Solicitation

What counts as "general solicitation" that's prohibited under 506(b)?

General solicitation includes any public advertising, such as:

Social media posts

Email blasts to people outside your existing network

Website advertisements accessible to the general public

Speaking about your offering at public conferences

Traditional media advertising

Rule 506(b) restricts you to contacting individuals with whom you have a pre-existing, substantive relationship. This limitation significantly affects your fundraising capabilities compared to 506(c), which permits all forms of public marketing for your fundraise.

How can Rule 506(c) help with real estate syndication?

Rule 506(c) is particularly powerful for syndication deals in multifamily investing and private real-estate offerings. Real estate syndicators can advertise deals on crowdfunding platforms, send newsletters to broad investor lists, and speak at industry conferences to attract capital from accredited investors nationwide. This is especially valuable for Delaware Statutory Trust (DST) offerings, REITs, and 1031 exchanges where sponsors need to reach investors beyond their immediate network. The ability to publicly market private syndications dramatically expands the potential investor pool.

Can I use both 506(b) and 506(c) for different fundraising rounds?

Yes, general partners and fund managers often use different rules for different fundraises. You might use Rule 506(b) for an initial friends-and-family round where you have strong relationships and want to include some sophisticated non-accredited investors, then switch to Rule 506(c) for a larger institutional round where public marketing can accelerate investment funding. However, you cannot mix the rules within a single integrated offering.

Compliance and Regulatory Requirements

What SEC regulation requirements apply to both 506b and 506c?

Both rules require filing Form D with the SEC through the EDGAR database within 15 days of the first securities sale. Issuers must:

Comply with anti-fraud provisions regardless of exemption status

Maintain accurate records

Conduct bad actor disqualification checks on covered persons; and typically

File Blue Sky filings (notice filings) with states where investors reside

The anti-fraud rules apply to all offering materials, so comprehensive disclosure through a Private Placement Memorandum is considered best practice even when not strictly required by SEC regulation.

What is the bad actor disqualification rule?

The bad actor disqualification provisions prevent companies from using Rule 506 if certain "covered persons" (founders, directors, executive officers, promoters, or 20%+ shareholders) have relevant criminal convictions, regulatory sanctions, or court orders. This rule protects the investor pool by ensuring those with serious securities law violations cannot access these exemptions. Issuers must conduct reasonable factual inquiries before each fundraise to verify no disqualifying events exist.

Do I need to provide financial statements in a Rule 506 offering?

It depends. Rule 506(b) requires providing financial statements and extensive disclosure documents to any non-accredited investors, with the level of detail similar to registered offerings. For 506(c) offerings with only accredited investors, there's no specific financial statement requirement, though providing comprehensive financial information in a Private Placement Memorandum is strongly recommended for both legal protection and attracting sophisticated investors in alternative investments like private equity.

How does FINRA involvement differ between the two rules?

FINRA-registered broker-dealers often help with capital raising under both rules, particularly for larger fundraises or complex private syndications. For Rule 506(c), FINRA member firms can provide verification services since registered broker-dealers are among the qualified third-party verifiers. The broker-dealer compensation must be disclosed, and using FINRA members can add credibility to your fundraise while ensuring compliance with internal compliance protocols and investor protection standards.

Strategic Considerations

Which rule is better for alternative investments like digital assets?

Both rules can work for digital assets and alternative investments, but the choice depends on your strategy. Rule 506(c) is often preferred for digital asset offerings because the investor base is geographically dispersed, public marketing through crypto-focused platforms is valuable, and maintaining a clean cap table of only accredited investors is important for secondary markets liquidity. However, the verification burden and regulatory scrutiny around digital assets make working with experienced Crowdfunding lawyers essential.

Should startups use Rule 506(b) or explore Rule 504 instead?

Rule 504 allows raising up to $10 million in a 12-month period and permits general solicitation in some states, but it doesn't provide the same federal Blue Sky preemption as Rule 506. For most startups raising significant capital, Rule 506b or 506c offers better scalability and simpler multi-state compliance. Rule 504 might work for smaller local fundraises, but the $10 million cap and state-by-state analysis make it less attractive than the unlimited capital raising potential of Rule 506.

How do these rules compare to Section 4(a)(2) private placements?

Section 4(a)(2) is the statutory exemption for private placements, while Rule 506 provides a "safe harbor" under that section along with Rules 502(a) requirements. Using Rule 506b or 506c gives you clear regulatory guidance and federal preemption. Relying solely on Section 4(a)(2) without the safe harbor creates uncertainty and potential state registration issues. Most issuers choose Rule 506 for its clarity and the protection of an established exempt offering framework.

What if I need to test investor interest before committing to a fundraising path?

Many issuers use an investing quiz or preliminary conversations to gauge market interest. Under Rule 506(b), you must be careful that such outreach only goes to pre-existing relationships, not the general public. Rule 506(c) allows you to publicly gauge interest through webinars, social media, or information sessions before formally launching your fundraise. Some fund managers use "testing the waters" communications permitted under recent SEC rule changes to assess demand while maintaining flexibility in their capital raising approach.

How does the minimum investment amount factor into the Rule 506 decision?

The minimum investment amount is set by the issuer and can range from a few thousand dollars to several million, depending on your strategy. Rule 506b might support lower minimums since you're targeting your known network and potentially sophisticated non-accredited investors. Rule 506c fundraises often set higher minimums because the verification process creates administrative costs per investor, and the ability to market broadly means you can be more selective about your investor pool composition.

Practical Implementation

What resources do I need for a successful Rule 506(c) fundraise?

A successful 506(c) fundraise requires:

Marketing materials compliant with anti-fraud rules

A system for collecting and verifying investor documentation

Secure data handling for sensitive financial information

Legal counsel experienced in securities law; and

Often, a third-party verification service

Many issuers also use investor management software and may engage crowdfunding platforms that specialize in private placements. The investment in these fundraising capabilities pays off through access to a much larger investor pool.

Should private equity funds use 506b or 506c?

Most private equity funds traditionally use Rule 506b because general partners typically have strong networks of institutional investors and high-net-worth individuals. The privacy of the 506b process and simpler onboarding appeal to sophisticated investors. However, emerging fund managers without established networks increasingly turn to Rule 506c to build their investor base through industry conferences, LinkedIn outreach, and syndication platforms. The choice depends on your existing relationships and timeline for raising capital.

How can I prepare for either path?

Start by conducting a network analysis to assess if you have sufficient pre-existing relationships for 506b, develop a comprehensive Private Placement Memorandum with proper risk disclosures, establish internal compliance protocols for investor verification if considering 506c, create a subscription agreement and questionnaires, organize your capitalization table structure, and consult with both crowdfunding lawyers and securities counsel. Having these foundations ready allows you to move quickly once you've determined the optimal path for your specific investment funding needs.

Disclaimer: This article is provided for general informational and educational purposes only and does not constitute legal, financial, investment, tax, or professional advice of any kind. Allied Venture Partners LLC makes no representations or warranties regarding the accuracy, completeness, or currentness of this information, which is subject to change without notice. To the fullest extent permitted by law, Allied Venture Partners LLC, its affiliates, officers, directors, employees, and agents expressly disclaim all liability for any direct, indirect, incidental, consequential, special, or punitive damages arising from your use of or reliance on this content, including but not limited to any securities offerings, capital raises, regulatory compliance issues, enforcement actions, financial losses, or business damages. Securities laws are complex, fact-specific, and vary by jurisdiction. You are solely responsible for ensuring compliance with all applicable federal and state securities laws and should consult with qualified legal counsel, financial advisors, and tax professionals licensed in your jurisdiction before making any decisions or taking any actions based on this information. By accessing or using this article, you acknowledge that you have read and understood this disclaimer, assume all risks associated with your use of this information, and agree to indemnify and hold harmless Allied Venture Partners LLC from any claims arising from your use of this content.