How AI is Reshaping Venture Capital: Opportunities for Founders and Investors

Key Takeaways

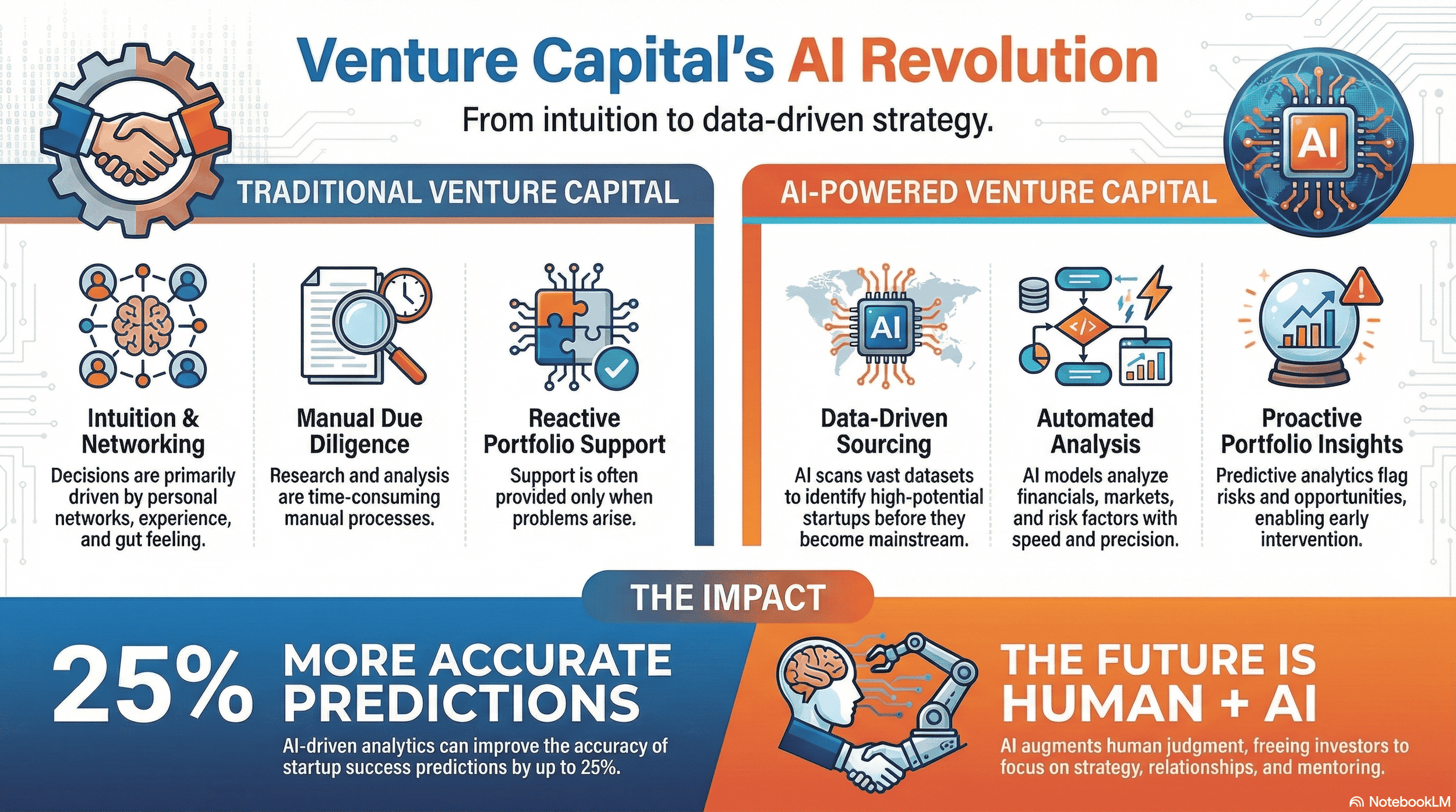

The VC industry is undergoing a fundamental transformation: AI is reshaping venture capital from an intuition-led art to a data-driven science, with 92% of VCs now using AI to optimize due diligence, manage relationships, and discover investment opportunities.

AI adoption is a strategic imperative, not optional: With the global AI market projected to grow from $189 billion in 2023 to $4.8 trillion by 2033, and 41% of the world's Top 100 most valuable private tech firms now being AI companies (up from 16% in 2022), integrating AI is essential for survival and competitive advantage.

Deal sourcing is being revolutionized: AI-powered platforms using Natural Language Processing can scan vast datasets from PitchBook, LinkedIn, Crunchbase, and regulatory filings to identify promising startups with unprecedented speed, expanding dealflow and improving the quality of initial insights.

Due diligence becomes faster and more accurate: AI-driven financial analysis enhances predictive accuracy by up to 35%, while machine learning models can improve startup success predictions by up to 25%, freeing investment teams to focus on strategic thinking and founder assessment.

Founders must adapt their pitch strategies: Modern investors expect data-backed evidence and want to understand your AI strategy. Demonstrating how you leverage AI as a core operational advantage—not just a product feature—can be a significant differentiator in securing funding.

Portfolio management is now proactive and data-driven: AI continuously monitors key performance indicators, predicts future trends, and flags potential risks before they escalate, enabling investors to be more strategic partners and maximize returns.

The human-AI partnership is critical: Success lies not in replacing human judgment with AI, but in creating synergy between artificial and human intelligence. AI excels at data processing and pattern recognition, while humans provide irreplaceable intuition, creativity, relationship-building, and strategic foresight.

Ethical considerations demand attention: Addressing bias in AI models, ensuring data privacy and security, and maintaining critical human oversight are essential for responsible AI adoption. 86% of surveyed individuals believe AI companies should be regulated.

Continuous learning is non-negotiable: With AI talent demand increasing 81% between 2024 and 2025, both founders and investors must commit to ongoing education, experimentation with new tools, and willingness to adapt strategies to remain competitive in this rapidly evolving landscape.

Navigating Venture Capital's AI-Powered Evolution

The venture capital landscape is undergoing a seismic shift, driven by the relentless advancements in Artificial Intelligence (AI). This technological revolution is not merely augmenting existing processes; it's fundamentally re-engineering how venture capital operates, from initial deal sourcing to portfolio management and beyond. For both the founders seeking capital and the investors deploying it, understanding and adapting to this AI-powered evolution is no longer a competitive advantage, but a necessity for survival and, crucially, for thriving.

The global AI market is projected to soar from $189 billion in 2023 to $4.8 trillion by 2033, marking a 25-fold increase in just a decade. This immense growth signals a new era where AI is the primary engine of innovation and economic value creation. This article serves as a comprehensive guide, dissecting the AI-driven transformation of venture capital and providing actionable strategies for founders and investors to navigate and capitalize on this dynamic new frontier.

The Irreversible Shift: Why AI is Reshaping the Venture Ecosystem

The evolution of venture capital: from an intuition-led art to a data-driven science.

The venture capital ecosystem, long characterized by human intuition, extensive networking, and manual analysis, is being irrevocably reshaped by the capabilities of Artificial Intelligence. This transformation is not a gradual evolution but a fundamental paradigm shift driven by several key factors.

Firstly, the sheer volume of data generated by startups, markets, and economic indicators has surpassed human capacity for comprehensive analysis. AI, particularly machine learning (ML) and Natural Language Processing (NLP), can process and derive insights from these vast datasets at speeds and scales previously unimaginable.

Secondly, the competitive pressure among Venture Capital Firms is intensifying. Those that adopt AI gain a significant edge in identifying promising opportunities, conducting more thorough due diligence, and providing enhanced support to their portfolio companies. This technological leap enables a move from reactive decision-making to proactive, data-informed strategies.

Furthermore, the increasing sophistication of AI technologies themselves, such as generative AI and advanced AI models, is opening up entirely new avenues for innovation within the VC lifecycle. It’s becoming clear that AI is not just another tool; it’s becoming the underlying operating system for how venture capital operates. This shift means that firms and founders who do not integrate AI into their core strategies risk becoming obsolete. The impact is already visible: 78% of organizations now use AI in at least one business function, up from 55% in 2023, showcasing a rapid increase in AI adoption across various industries. This widespread adoption underscores the urgency for both investors and founders to align with the AI-driven future.

Who This Guide is For: Equipping Founders and Investors to Thrive

This guide is meticulously crafted for two primary audiences who are at the forefront of this AI-driven revolution in venture capital: founders and investors.

For Investors (Venture Capitalists, Limited Partners, Angel Investors): If you are managing a Venture Capital Firm, deploying capital, or seeking to enhance your investment strategies, this guide will equip you with the knowledge and frameworks necessary to harness AI. We will explore how AI can revolutionize your deal sourcing, streamline due diligence, optimize portfolio management, and fundamentally reshape your investment thesis and team structures. You will learn how to leverage AI-powered platforms and sophisticated AI models to gain a competitive edge in identifying and nurturing the next generation of successful startups.

For Founders (Startup Entrepreneurs, CEOs, Founders): If you are building a startup and seeking to launch, scale, and secure funding, this guide is your essential playbook for navigating the AI-augmented funding landscape. We will delve into how AI influences investor evaluation, how to craft an AI-accelerated pitch that resonates with modern VCs, and strategies for identifying and engaging AI-forward investors. Furthermore, you will discover how to leverage AI-enabled support from your investors and utilize AI technologies to accelerate your own startup's growth.

Regardless of your role, the core message is clear: embracing AI is paramount to not just participating, but thriving in the future of venture capital.

Beyond Efficiency: The Strategic Imperative of AI Adoption

While the immediate benefits of AI adoption in venture capital often revolve around enhanced efficiency and cost reduction, its true significance lies in its role as a strategic imperative. In today's hyper-competitive market, relying solely on traditional methods is no longer sustainable. AI moves beyond automating mundane tasks; it transforms core decision-making processes, unlocks new strategic insights, and enables a level of precision previously unattainable.

For Venture Capital Firms, adopting AI is about gaining a strategic advantage. It allows for deeper market analysis, more accurate risk assessment, and the identification of nascent trends before they become mainstream. This proactive approach can lead to higher returns and a more robust portfolio.

Moreover, AI can help in democratizing access to information and analysis, leveling the playing field to some extent. The rapid growth of AI companies further exemplifies this imperative; 41% of the world's Top 100 most valuable private tech firms are now AI companies, up from 16% in 2022. This indicates that AI is not just a sector of investment but a fundamental driver of value across the entire tech landscape.

For founders, understanding the strategic imperative means recognizing that investors are increasingly looking for companies that can leverage AI effectively, both in their product and operations. Demonstrating AI proficiency can be a significant differentiator, signaling innovation, scalability, and a forward-thinking approach. Ignoring AI means potentially missing out on critical funding opportunities and falling behind competitors who are already embracing its transformative power. The strategic imperative is to view AI not as an optional upgrade, but as a foundational element for future success.

The Fundamental Transformation: AI as the New Operating System for VC

The integration of Artificial Intelligence into venture capital signifies a fundamental transformation, moving it beyond a series of discrete tools to become the new operating system for the entire ecosystem. This means AI is not just automating specific tasks; it's weaving itself into the fabric of every stage of the investment lifecycle, influencing how deals are found, analyzed, executed, and managed.

From Intuition to Intelligence: The Evolution of Venture Capital

Historically, venture capital relied heavily on the intuition, experience, and personal networks of investors. While these human elements remain invaluable, the sheer scale and complexity of modern markets demand a more data-driven approach. AI introduces a layer of quantitative intelligence that augments, rather than replaces, human judgment.

Machine learning models can sift through millions of data points—market trends, financial indicators, competitive landscapes, and even sentiment analysis from news and social media—to identify patterns and predict outcomes with greater accuracy. This evolution from intuition-based decision-making to intelligence-augmented decision-making allows investors to make more informed choices, identify opportunities that might otherwise be missed, and mitigate risks more effectively. The ability of AI to process vast amounts of data provides a more objective lens, complementing the subjective insights derived from human experience.

The Power of Predictive Analytics and Generative AI

At the heart of AI's transformative power in venture capital are its capabilities in predictive analytics and generative AI. Predictive analytics, powered by machine learning, allows investors to forecast potential success rates of startups, market trajectory, and potential risks. By analyzing historical data and identifying complex correlations, AI models can provide probabilities for various outcomes, enabling more strategic capital allocation.

For instance, according to recent PWC research, industries more exposed to AI have 3x higher growth in revenue per employee since 2022, indicating AI's impact on productivity and value creation. Furthermore, according to PitchBook data, AI-driven predictive analytics can improve the accuracy of startup success predictions by up to 25%.

Generative AI, on the other hand, introduces a new dimension of creation and simulation. It can assist in crafting compelling pitch decks (e.g. NotebookLM), generating detailed market research summaries (e.g., Grok DeepSearch), and even simulating various business scenarios to stress-test investment theses (e.g., Claude Artifacts or custom-built Replit apps). This capability not only enhances the efficiency of content creation for both investors and founders but also opens up novel ways to explore investment opportunities and potential future challenges. The synergy between predictive analytics and generative AI offers a powerful toolkit for navigating the uncertainties of the startup world.

For Investors: Crafting a Winning Strategy in the AI-Augmented Era

The advent of AI is fundamentally reshaping the investment strategies and operational frameworks for venture capital firms. To thrive in this new era, investors must proactively integrate AI across their entire investment lifecycle, from identifying promising startups to nurturing their growth and maximizing returns.

Revolutionizing Deal Sourcing and Discovery

The traditional methods of deal sourcing— Relying on established networks, attending industry events, and manual outreach—are being significantly augmented, and in some cases, redefined by AI. AI-powered platforms and sophisticated AI models are now capable of scanning vast datasets from sources like PitchBook, LinkedIn, Crunchbase, and regulatory filings to identify potential investment opportunities with unprecedented speed and precision.

Natural Language Processing (NLP) plays a crucial role here, enabling AI to analyze company descriptions, news articles, patent filings, and even social media sentiment to identify emerging trends, innovative technologies, and promising startups that might otherwise fly under the radar.

This AI-driven approach to deal flow not only expands the breadth of opportunities an investor can explore but also deepens the quality of initial insights, allowing for a more targeted and efficient approach to deal sourcing. Firms that master this AI-augmented deal sourcing can gain a significant competitive advantage by accessing high-quality deal flow before their peers.

For example, at Allied Venture Partners, we leverage weekly Grok and Gemini Deep Research reports as a core pillar of our proactive deal sourcing and market discovery process. These AI-powered summaries scan and highlight the latest developments in AI and tech—pulling together startup funding announcements, emerging market trends, key hires, product launches, and competitive shifts across our target verticals in early-stage software and technology.

This routine intelligence feed, run every Monday morning, surfaces 10–20 high-signal opportunities per week that might otherwise slip past traditional channels, enabling us to initiate outreach to founders earlier in their cycles and build relationships before they hit the broader market. By systematizing this AI-driven horizon scanning, we’ve increased our pipeline velocity by roughly 25% year-over-year while maintaining focus on Canadian and US-based companies in our core thesis areas.

Streamlining Due Diligence and Investment Analysis

Once potential investments are identified, AI continues to play a pivotal role in streamlining the often-intensive process of due diligence and investment analysis. AI-powered platforms can automate the aggregation and analysis of critical data, including financial statements, market research, competitive landscapes, and management team backgrounds. Machine learning models can identify anomalies, assess financial health, and predict potential risks with a higher degree of accuracy than manual methods alone.

For instance, according to PitchBook, AI-driven financial analysis can enhance predictive accuracy by up to 35%. NLP techniques are invaluable for dissecting complex investment memos, legal documents, and customer feedback, extracting key insights and flagging potential red flags. This automation frees up valuable time for investment teams, allowing them to focus on higher-level strategic thinking, founder assessment, and complex negotiation. Moreover, per PitchBook data, ninety-two percent of VCs are now using AI in their firms to optimize due diligence, manage relationships, and discover new investment opportunities. This widespread adoption highlights AI's critical role in enhancing the rigor and efficiency of the investment decision-making process.

For example, at Allied Venture Partners, our perspective on AI in venture is grounded in day-to-day practice. In addition to traditional deal-sourcing methods—tapping established networks, attending industry events, and running targeted outbound—we now integrate Grok DeepSearch reports into every high-potential opportunity that enters our funnel. For each of these deals, a DeepSearch report is run before the very first founder intro call, which means the investment team arrives with a synthesized view of the company’s market, competition, technical claims, and public footprint already in hand.

This AI-augmented workflow has effectively turned what used to be several hours of fragmented manual research into a standardized, front-loaded diligence layer that sharpens our questions, compresses timelines, and improves the quality of the conversations we have with founders from the very first meeting.

Optimizing Portfolio Management and Value Creation

The impact of AI extends beyond initial investment into the ongoing management and value creation for portfolio companies. AI-powered platforms can continuously monitor key performance indicators (KPIs) for each investment, providing real-time insights into growth, financial health, and potential challenges. Machine learning algorithms can predict future performance trends, identify areas where a startup might need additional support, or flag potential risks that could impact valuation. This allows investors to intervene proactively, offering strategic guidance or connecting companies with relevant resources before minor issues escalate.

Furthermore, AI can assist in identifying opportunities for synergies between portfolio companies or within broader market segments, thereby enhancing overall portfolio value or enhance investor returns by managing portfolio risk more effectively. At Allied Venture Partners, portfolio management and value creation rely on rigorous KPI tracking for each portfolio company, benchmarked against industry comparables to spot risks early. This data-driven approach flags potential issues before they escalate, while directly informing follow-on investment decisions by quantifying a company’s growth trajectory relative to peers.

Per our investment thesis, we prioritize valuations tied to hard metrics; if a portfolio company fails to hit the velocity needed to emerge as a category leader, we proactively reassess exercising our pro rata rights. This data-driven approach to portfolio management enables us to be more strategic partners, driving growth and maximizing returns for our Limited Partners.

Building an AI-First Investment Thesis and Team

To fully capitalize on the AI revolution, Venture Capital Firms must embed AI into their core investment thesis and organizational structure. This involves developing a clear strategy for how AI technologies will be leveraged across the firm, from identifying thematic investment areas in AI itself to understanding how AI impacts every sector. It also necessitates building an AI-first team, which means not only hiring individuals with strong AI expertise but also up-skilling existing team members.

The talent shortage index of AI skills job postings increased by 81% between 2024 and 2025, highlighting the increasing gap between demand and supply of AI talent (source: Robert Walters Plc). This emphasizes the strategic importance of talent acquisition and development in AI. An AI-first investment thesis ensures that the firm is strategically positioned to identify and invest in companies that are leading the AI revolution, while an AI-first team ensures the firm has the in-house capabilities to leverage AI for its own success.

For Founders: Capitalizing on the AI-Driven Funding Landscape

For founders, the rise of AI in venture capital presents both new challenges and significant opportunities. Understanding how investors are using AI and adapting your own strategies is crucial for securing funding and accelerating startup growth in this evolving landscape.

Mastering the AI-Accelerated Pitch and Fundraising Process

The traditional pitch has evolved. Investors armed with AI tools are more data-driven and analytical in their evaluation. This means founders need to go beyond compelling narratives and present robust, data-backed evidence of their startup's potential. Your pitch deck and accompanying materials should highlight how your startup leverages AI, not just as a product feature, but as a core part of your operational strategy. Clearly articulating your AI technologies, AI models, and data advantage can significantly impress AI-savvy investors.

For example, at Allied Venture Partners, we make it a standard question in every pitch call to ask: “What’s your AI strategy, and how are you deploying it to unlock maximum growth potential?” Even non-AI-native companies catch our attention when they wield AI as a force multiplier to transform their economics—dramatically expanding gross margins, top-line revenue, and bottom-line profitability. We’ve encountered dozens of bootstrapped startups that scaled to $500K+ ARR in under 12 months with teams of fewer than five people, exemplifying the scrappy capital efficiency that defines the breakout early-stage winners we love to back.

The fundraising process itself is also accelerating, with AI-powered platforms assisting investors in narrowing down candidates. Founders must therefore ensure their initial pitch and company profile are optimized for AI analysis, utilizing keywords and metrics that align with investor AI criteria. The ability to launch with a clear AI advantage can set you apart from the competition.

Identifying and Engaging AI-Forward Investors

Not all investors are at the same stage of AI adoption. To maximize your chances of success, it’s essential to identify and engage with investors who are actively leveraging AI in their strategies. Research firms that are known for their AI investments, have AI experts on their team, or publicly discuss their use of AI in deal sourcing and analysis.

Platforms like Crunchbase and PitchBook can provide insights into investor portfolios and investment theses. When approaching these AI-forward investors, tailor your pitch to highlight aspects of your business that align with their AI focus. Demonstrating an understanding of how AI can drive your specific market and business model will signal that you are a founder who understands the current venture capital landscape and is poised for future success. This strategic engagement can lead to more productive conversations and a higher likelihood of securing investment from partners who can truly add value.

Pro tip: Try SaaStr's free VC Matchmaking and VC Research tools to explore and get matched with hundreds of VCs in your industry and geo.

Maximizing AI-Enabled Portfolio Support and Growth

Beyond funding, AI can also be a powerful tool for growth and support within your startup's lifecycle, often facilitated by your investors. Many VC firms are now offering AI-powered tools and data analytics platforms to their portfolio companies. As a founder, actively seek out and leverage these resources. This could include AI tools for market analysis, customer segmentation, operational efficiency, or even predictive maintenance.

Furthermore, transparently communicating your startup’s AI-driven progress and leveraging AI technologies to enhance your own product development and business operations can provide investors with valuable data points, reinforcing confidence in your growth trajectory. By embracing AI in your operations and actively engaging with AI-enabled support from your investors, you can accelerate your startup’s development, enhance its competitiveness, and build a more resilient and scalable business.

The Human-AI Partnership: Where Intuition Meets Intelligence

While the transformative power of AI in venture capital is undeniable, it is crucial to recognize that the future does not lie in the complete automation of human roles, but in a powerful synergy between human intelligence and artificial intelligence. The most successful ventures, and the firms that back them, will be those that master this symbiotic relationship.

Beyond Automation: The Irreplaceable Value of Human Judgment and Creativity

AI excels at processing data, identifying patterns, and executing tasks with unparalleled speed and accuracy. However, it currently lacks the nuanced understanding, emotional intelligence, and creative spark that are fundamental to venture capital. The ability to assess founder conviction, discern market vision beyond current data, and build deep, trusting relationships remains firmly within the human domain.

AI can provide data-driven insights to inform decisions, but it cannot replicate the gut feeling that a visionary founder is onto something revolutionary, nor the creative problem-solving required to navigate unforeseen market shifts. The winning firms in this new landscape won’t be the ones that replace people with bots, but those that use AI to scale what humans do best: pattern recognition, intuition, and judgment. Relationship building, founder empathy, and strategic thinking still matter deeply.

The Evolution of Roles: How AI Elevates Founders and Investors

The integration of AI reshapes, rather than eliminates, the roles of founders and investors. For investors, AI automates many of the time-consuming, data-intensive tasks, such as initial screening, data aggregation for due diligence, and portfolio monitoring. This frees them to focus on higher-value activities: strategic advisory, deep market understanding, founder coaching, and complex deal structuring.

Similarly, founders can leverage AI to streamline operations, enhance product development, and gain deeper market insights. This allows them to dedicate more energy to strategic vision, team building, and customer engagement. The human element in venture capital, therefore, shifts from performing repetitive analytical tasks to excelling in areas where human creativity, critical thinking, strategic foresight, and interpersonal skills are paramount. AI becomes a powerful co-pilot, amplifying human capabilities and enabling both founders and investors to operate at a higher strategic level.

Navigating the New Frontier: Challenges, Ethics, and Responsible AI

As AI becomes more deeply embedded in venture capital, it brings forth a new set of challenges and ethical considerations that founders and investors must navigate responsibly. Proactive awareness and mitigation strategies are essential for long-term success and for fostering a trustworthy ecosystem.

Addressing Bias and Ensuring Fairness in AI Models

AI models are trained on data, and if that data reflects historical biases—whether related to gender, race, geography, or other factors—the AI can perpetuate and even amplify those inequities. In venture capital, this could manifest as AI models inadvertently favoring certain types of founders or startups over others, leading to a lack of diversity and missed opportunities.

Venture Capital Firms must actively work to identify and mitigate bias in the AI models and data they employ. This involves using diverse datasets, implementing fairness metrics, and conducting regular audits of AI outputs.

Founders, too, should be aware of how their company’s data might be interpreted and be prepared to articulate how they promote fairness and inclusion within their own organizations. Ultimately, 86% of those surveyed believe AI companies should be regulated, underscoring the public demand for responsible AI development.

Data Privacy, Security, and Regulatory Scrutiny

The increased reliance on data for AI-driven decision-making raises significant concerns around data privacy and security. Venture capital firms handle sensitive proprietary information from both their investors and their portfolio companies. Startups often share their most valuable intellectual property and customer data. Ensuring robust data security protocols and compliance with evolving data privacy regulations (such as GDPR or CCPA) is paramount.

As AI technologies become more sophisticated, regulatory bodies are increasingly scrutinizing their application, particularly concerning data usage and algorithmic transparency. Both founders and investors must stay informed about these evolving legal and regulatory landscapes to ensure compliance and avoid costly penalties or reputational damage.

The Risk of Over-Reliance: Maintaining Critical Thinking and Human Oversight

While AI offers immense analytical power, there is a significant risk of over-reliance, leading to a decline in critical thinking and human oversight. The "black box" nature of some complex AI models can make it difficult to understand why a particular decision or recommendation was made. This lack of transparency can be problematic, especially in high-stakes investment decisions. Investors and founders must maintain a healthy skepticism, using AI as a powerful analytical tool rather than an infallible oracle.

Human judgment, intuition, and domain expertise are crucial for validating AI outputs, challenging assumptions, and making nuanced decisions that go beyond algorithmic calculations. A strong preference for retaining human decision control over AI-generated processes is becoming a hallmark of responsible AI adoption. This balance ensures that AI augments, rather than dictates, the strategic direction of venture capital.

The Future Outlook: Pioneering the Next Era of Venture Capital

The integration of AI is not a static phenomenon; it is an ongoing evolutionary process that promises to redefine the venture capital landscape in profound ways. Looking ahead, several trends are poised to shape the future, creating new opportunities and demanding continuous adaptation from all stakeholders.

Emerging Trends: Hyper-Specialization, Algorithmically Driven Portfolios, and Mega VC Funds

We are witnessing the rise of hyper-specialization within venture capital, with an increasing number of Venture Capital Firms focusing on niche areas of AI or on sectors profoundly impacted by AI. This allows firms to develop deep expertise and build strong networks within specialized ecosystems.

Concurrently, there is a growing interest in algorithmically driven portfolio construction and management, where AI plays an even more central role in identifying, selecting, and managing investments based on predefined criteria and predictive models. On the other end of the spectrum, mega VC funds are leveraging AI at scale to gain an edge in a highly competitive deal market, deploying significant capital with the support of advanced analytical capabilities. These trends indicate a future where AI adoption will vary in its intensity and application, creating diverse strategic pathways for investors.

Democratizing Access: How AI Could Expand the Venture Ecosystem and Support Diverse Founders

While concerns about bias are valid, AI also holds the potential to democratize access within the venture capital ecosystem. By automating aspects of deal sourcing and initial analysis, AI can potentially level the playing field, allowing investors to discover promising startups beyond their traditional networks. This could lead to greater opportunities for founders from underrepresented backgrounds or geographic locations. Furthermore, AI-powered tools could provide more accessible and affordable resources for startups seeking to scale, regardless of their funding levels. The challenge lies in ensuring that the development and deployment of these AI tools are done equitably, consciously addressing potential biases to foster a truly inclusive venture ecosystem.

The Urgency of Adaptation: Thriving Through Continuous Learning and Innovation

The pace of AI development is relentless, meaning that continuous learning and adaptation are no longer optional but essential for survival and success. Both founders and investors must remain agile, committed to understanding new AI technologies, and willing to iterate on their strategies. This requires a culture of innovation, a willingness to experiment with new tools and approaches, and a commitment to ongoing professional development. The talent shortage in AI skills underscores this need; companies must invest in training and upskilling their workforce to stay relevant. Those who proactively embrace AI, understand its implications, and integrate it thoughtfully into their operations and investment strategies will be best positioned to thrive in the new frontier of venture capital.

Summary: Your Blueprint for Success in AI's New Frontier

The venture capital world is in the midst of a profound transformation, driven by the pervasive influence of Artificial Intelligence. This shift from traditional, intuition-led methodologies to data-driven, AI-augmented strategies is fundamentally reshaping how deals are sourced, analyzed, and managed. For founders and investors alike, navigating this new frontier successfully requires not just an understanding of AI's capabilities, but a proactive commitment to integration and adaptation. The global AI market's explosive growth and the increasing reliance on AI across industries signal that this is not a fleeting trend but a foundational evolution.

Recap of Key Strategies for Founders and Investors

For investors, thriving in this AI-augmented era means revolutionizing deal sourcing through AI-powered platforms and advanced AI models, streamlining due diligence with sophisticated analytics and NLP, and optimizing portfolio management through continuous, data-driven insights. Building an AI-first investment thesis and team is critical for long-term strategic advantage.

For founders, success hinges on mastering the AI-accelerated pitch, clearly articulating their AI advantage, identifying and engaging with AI-forward investors, and leveraging AI-enabled support from their VC partners to drive startup growth.

Crucially, both parties must recognize the enduring importance of the human-AI partnership. AI amplifies human capabilities, automating tasks and providing invaluable data, but it cannot replace the strategic foresight, creative problem-solving, and relationship-building that define successful venture capital. Addressing the ethical challenges of bias, ensuring data privacy, and maintaining critical human oversight are vital for responsible and sustainable growth. The future of venture capital lies in this intelligent synergy, where human intuition meets AI-driven intelligence.

The path forward demands continuous learning, a commitment to innovation, and a willingness to adapt. By embracing AI as a strategic imperative, founders and investors can not only survive but truly thrive, pioneering the next era of venture capital and driving significant value creation in the process. Your blueprint for success lies in leveraging AI to enhance your strengths, make smarter decisions, and build a more resilient and innovative future for startups and the investment ecosystem.

Frequently Asked Questions

How is AI fundamentally changing the VC industry today?

The VC industry is experiencing a paradigm shift from intuition-based decision-making to data-driven strategies powered by AI. Today, 92% of VCs use AI in their firms to optimize due diligence, manage relationships, and discover investment opportunities. AI assistants and large language models now process vast amounts of market data from sources like PitchBook, LinkedIn, and Crunchbase at unprecedented speeds. Leading firms like Sequoia Capital, Andreessen Horowitz, Khosla Ventures, and Battery Ventures are integrating AI across their entire investment lifecycle—from dealflow management to portfolio optimization. This transformation enables firms to analyze proprietary data, generate financial projections with up to 35% better accuracy, and identify promising startups before they reach mainstream attention.

What specific AI tools and platforms are venture capital firms using for deal sourcing?

Modern VC firms leverage a combination of AI-powered investment platforms and tools for enhanced deal sourcing. Many firms now use weekly AI research reports from tools like Grok DeepSearch and Gemini to scan emerging market trends, funding announcements, and competitive shifts. Platforms like AngelList provide AI-enhanced access to startup dealflow, while firms integrate data from Crunchbase and PitchBook for comprehensive market mapping. AI agents and generative artificial intelligence (gen AI) tools assist in competitor landscape mapping and analyzing founder-market fit. These technologies enable firms to systematically surface 10-20 high-signal opportunities per week that might otherwise be missed through traditional networking alone.

How should founders adapt their pitch for AI-savvy investors?

Founders must go beyond compelling narratives and present robust, data-backed evidence of their potential. Leading firms, like Allied VC, now make it standard practice during founder calls to ask: "What's your AI strategy, and how are you deploying it to unlock maximum growth potential?" Your pitch should clearly articulate how you leverage AI—not just as a product feature, but as a core operational strategy. Highlight your use of AI assistants, large language models, or other AI technologies that drive capital efficiency. Firms like Pioneer Fund and Soma Capital are particularly interested in AI-native startups that demonstrate exceptional economics—such as scaling to $500K+ ARR in under 12 months with fewer than five people. Optimize your company profile with keywords and metrics that align with AI analysis criteria used by investment platforms.

What role do AI agents play in venture capital due diligence?

AI agents are revolutionizing the due diligence process by automating data aggregation and analysis of financial statements, market data, competitive landscapes, and management backgrounds. These systems use Natural Language Processing to dissect complex investment memos, legal documents, and customer feedback, extracting key insights and flagging potential red flags. At the conception of every high-potential deal, many firms now run AI-powered research reports before the first founder call, arriving with a synthesized view of the company's market position, competition, and technical claims. This AI-augmented workflow compresses what used to take several hours of manual research into a standardized, front-loaded diligence layer, improving both the speed and quality of investment analysis.

How is generative artificial intelligence impacting portfolio management?

Generative artificial intelligence and gen AI tools are transforming portfolio management from reactive to proactive value creation. AI-powered platforms continuously monitor key performance indicators for each portfolio company, providing real-time insights into growth, financial health, and potential challenges. Machine learning algorithms predict future performance trends and identify areas where startups might need support before minor issues escalate. This data infrastructure enables investors to make more informed follow-on investment decisions, benchmark companies against industry comparables, and identify synergies between portfolio companies. The result is more strategic partnership between investors and founders, with AI handling the analytical heavy lifting while humans focus on relationship-building and strategic guidance.

What are the biggest challenges and ethical considerations in AI-driven venture capital?

The primary challenges include addressing bias in AI models, ensuring data privacy and security, and avoiding over-reliance on algorithmic outputs. AI models trained on historical data can perpetuate biases related to gender, race, or geography, potentially favoring certain types of founders unfairly. Venture capital firms must implement fairness metrics, use diverse datasets, and conduct regular audits of AI outputs. The handling of proprietary data from investors and portfolio companies requires robust security protocols and compliance with regulations like GDPR. Additionally, 86% of surveyed individuals believe AI companies should be regulated. The "black box" nature of complex models makes maintaining human oversight critical—AI should augment rather than replace human judgment in assessing founder-market fit, market vision, and strategic decisions.

How can AI democratize access and support diverse founders in venture building?

AI has the potential to level the playing field in venture building by enabling discovery of promising startups beyond traditional networks. Automated deal sourcing and analysis can help investors identify talented founders from underrepresented backgrounds or non-traditional geographic locations. AI-powered market mapping and competitor landscape mapping tools can provide more accessible and affordable resources for startups seeking to scale, regardless of their initial funding levels. However, realizing this potential requires conscious effort to address biases in training data and ensure equitable development and deployment of AI tools. The challenge for the VC industry is to harness AI's democratizing potential while actively working to create a truly inclusive venture ecosystem.

What's the future outlook for AI in venture capital over the next decade?

The venture capital landscape will continue evolving with several key trends: hyper-specialization in AI-focused niches, algorithmically driven portfolio construction, and mega funds leveraging AI at massive scale. The global AI market's projected growth from $189 billion in 2023 to $4.8 trillion by 2033 signals that AI will remain the primary engine of innovation and value creation. The talent shortage in AI skills—with an 81% increase in job postings between 2024 and 2025—underscores the urgency of continuous adaptation. Success will require ongoing investment in data infrastructure, comfort with new investment platforms, and a commitment to the human-AI partnership where intuition meets intelligence. Firms and founders who proactively integrate AI into their core strategies while maintaining human oversight will be best positioned to thrive in this new frontier.