How to Time Follow-On Investments

Timing follow-on investments is crucial for maximizing returns and minimizing risks in venture capital. Here's a quick breakdown of what you need to know as an angel investor or venture capitalist:

What Are Follow-On Investments? These are additional funding rounds after initial investments, aimed at scaling operations, expanding markets, or developing new products.

Why Timing Matters: Investing too early can waste resources, while investing too late risks losing market share to competitors. The sweet spot is when the company has product-market fit, growing demand, and strong competitive positioning.

Key Metrics to Evaluate: Revenue growth, customer acquisition cost (CAC) vs. lifetime value (LTV), churn rate, burn rate, and gross margin. These indicate financial health and scalability.

Milestones to Watch: Product-market fit, user growth, revenue diversification, and strategic partnerships signal readiness for follow-on funding.

Market Conditions: Economic cycles, interest rates, and industry-specific metrics (e.g., MRR for tech or clinical validation for healthcare) help determine the right timing.

Capital Allocation Tips: Reserve 40%-60% of your fund for follow-ons, focus on top-performing companies, and balance diversification with concentrated bets.

Portfolio Management: Stay connected with founders, participate in board meetings, and track performance metrics to identify opportunities early.

Takeaway: Timing follow-on investments requires a mix of data analysis, market awareness, and strong relationships with portfolio companies. Focus on companies with clear growth potential and align your decisions with market trends for better returns.

Mitchell Green of Leading Edge Capital: Must-Have KPIs for Growth-Stage Software Companies

Source: Venture Unlocked Podcast

Key Metrics and Milestones for Follow-On Investments

Making timely follow-on investments requires a thorough analysis of performance and clearly defined growth benchmarks.

Performance Metrics to Check Before Investing

Before committing to follow-on investments, it’s essential to evaluate a company’s key performance indicators (KPIs). These metrics provide a clear picture of its financial health and growth trajectory.

One of the most telling indicators is the revenue growth rate, which reflects how well the market is responding to the product. A steady, consistent increase in revenue signals that the company is successfully converting its offerings into sustainable income streams [5].

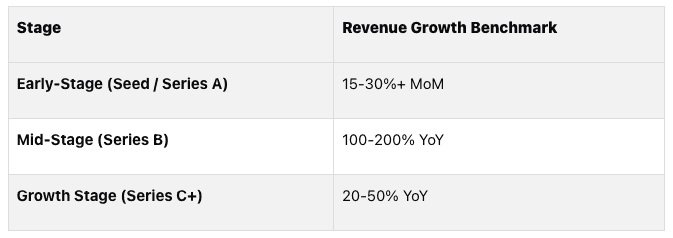

The benchmark depends on the stage of the company, sector, and prevailing market conditions, but some general guidelines have emerged from leading VC firms and industry studies.

General Revenue Growth Rate Benchmarks:

Early-Stage (Seed, Series A)

Month-over-month (MoM) revenue growth: 15%–30%+ is considered strong, especially when the company is racing to reach $1M Annual Recurring Revenue (ARR).

Mid-Stage (Series B)

Annual revenue growth: 100%–200% year-over-year (YoY) is often expected for high-performing companies.

Later-Stage (Series C and beyond)

Sustained annual revenue growth: 20%–50%+ YoY is typical for attractive follow-on investment opportunities, particularly where companies plan to IPO within a few years.

Historical growth equity data shows that companies with >20% annual revenue growth are much more likely to deliver high returns (MOIC of 2x or better) at exit.

LTV to CAC Ratio:

Another critical metric is the relationship between customer acquisition cost (CAC) and lifetime value (LTV). A low CAC compared to LTV indicates that the company acquires customers profitably and sustainably, which is a strong sign of scalability [5].

Ideally, for high-potential startups, the LTV-to-CAC ratio should be at least 3:1 or higher, meaning that for every dollar spent on acquiring a customer, the company earns three dollars in gross profit over the customer’s lifetime.

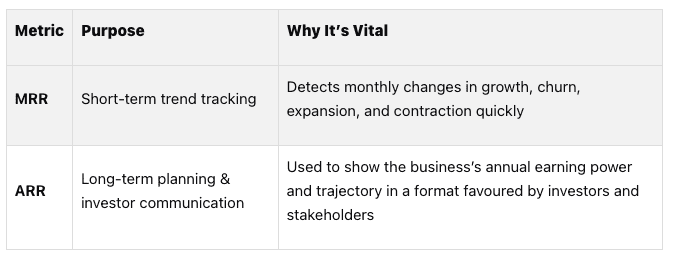

MRR and ARR Tracking:

For subscription-based businesses, monthly recurring revenue (MRR) and annual recurring revenue (ARR) are critical key indicators because they provide predictable, scalable, and transparent measures of revenue growth, operational planning, and valuation.

Furthermore, monitoring changes in MRR and ARR helps companies evaluate the effectiveness of sales, marketing, selling, and retention strategies over time. A sudden drop or surge can provide an early alert to underlying issues that can be addressed quickly.

Burn Rate Benchmarks:

The burn rate - or the speed at which a company spends its cash - offers insight into financial discipline. Tracking burn rate is important because it helps startups evaluate their financial health, plan operational decisions, and estimate how long they can continue operating before running out of cash.

One of the best ways to contextualize burn rate is by calculating a startup’s burn multiple, which measures how much cash is burned for each new dollar of annual recurring revenue (ARR) generated. From an investment perspective, this illustrates how effectively a company turns spending into growth, offering a clear view of operational efficiency and sustainability. The lower the burn multiple, the more efficiently the company is generating net new AAR for each dollar spent.

To learn more about burn multiple, check out our Burn Multiple Calculator.

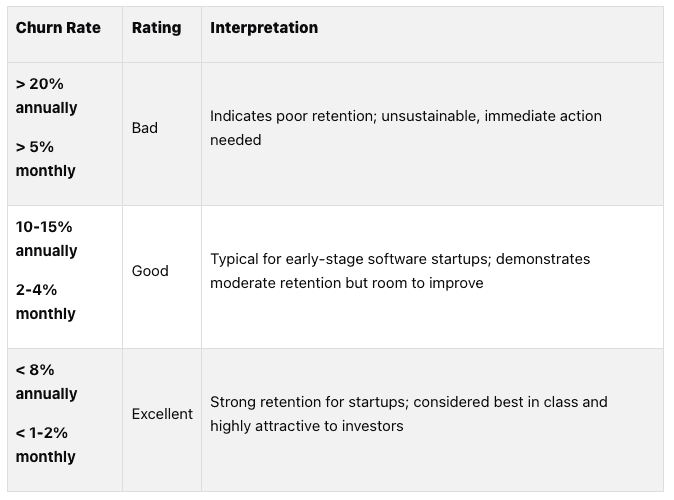

Churn Rate Benchmarks:

Churn rate is another vital measure, showing how well the company retains customers. A low churn rate typically indicates satisfied customers who perceive value in the product. In contrast, a high churn rate usually suggests issues such as poor customer satisfaction, product-market misalignment, or ineffective pricing. This forces the company to spend much more on acquiring new customers just to maintain revenue.

Churn rate varies by industry and company stage, but early-stage software companies should generally aim for a monthly churn rate below 2% and an annual churn rate below 10%.

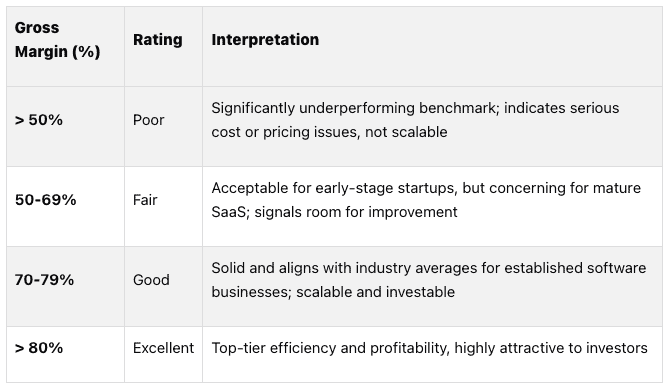

Gross Margin Benchmarks:

Finally, gross margin highlights the company’s ability to generate profit from its core operations. Specifically, it measures how efficiently a company turns revenue into profit after covering direct production costs (COGS), providing a clear indicator of core profitability, business efficiency, and pricing strategy.

From an investment perspective, higher gross margins often indicate strong financial health and the potential for scalability since the company will have more cash flow and flexibility to reinvest in growth, improve profitability, and withstand cost and market fluctuations.

High gross margins also make it easier for startups to cover operational expenses like marketing, salaries, R&D, and accelerated scaling. This makes them more attractive to investors seeking sustainable, efficient business models with strong growth potential.

Like our previous metrics, gross margin varies by industry and company stage; however, early-stage software companies should generally aim for gross margins of 80% or higher.

Note: Hardware, CPG, and other industries generally have much lower gross margins than software.

As Nicolas Sauvage, President of TDK Ventures, explains:

"To secure follow-on funding will require: 1) Demonstrating strong performance and (over)achieving the milestones you had set in the previous round 2) Having built trusted relationships with your investors with open communication" [4]

While these metrics provide a snapshot of the current financial state, milestones reflect the company’s potential for future growth.

Milestones That Show Growth Potential

Certain milestones, like product-market fit and user growth, serve as strong indicators of a company’s readiness for follow-on investment. These achievements highlight progress toward long-term sustainability and market leadership.

Product-market fit is a cornerstone milestone for early-stage businesses. Signs of achieving this include rapid user growth, high engagement, and significant organic customer acquisition. When customers actively seek out and recommend a product, it’s clear there’s strong demand.

The user growth rate is another vital signal of market traction. Consistently high growth rates suggest the company is tapping into a scalable market opportunity.

Metrics like engagement and retention rates reveal how well a product meets user needs over time. High engagement and strong retention suggest that the product has become integral to its users’ lives or businesses.

Milestones related to revenue diversification are also important. Reducing reliance on a single revenue stream or key customer lowers risk and enhances growth potential.

Additionally, key partnerships and strategic alliances can open doors to new markets, distribution channels, or technological advancements. These partnerships validate the company’s value proposition and can provide a competitive edge.

For instance, HealthWave secured milestone-based funding in stages, covering phases like market research, prototype development, pilot testing, and scaling sales [6].

Achieving these milestones is crucial, but setting measurable goals ensures the company stays on track and aligns with its strategic vision.

Setting Measurable Goals for Portfolio Companies

Clear and measurable goals are essential for tracking a company’s progress and determining its readiness for additional funding. Goals should be specific, actionable, and tied to the company’s long-term growth strategy.

The SMART framework is a practical tool for goal-setting: objectives should be Specific, Measurable, Achievable, Realistic, and Time-based [7]. This approach ensures clarity and allows performance to be evaluated objectively.

Revenue targets should account for market size, customer acquisition capabilities, and past performance. Similarly, customer acquisition goals should focus on both quantity and quality to encourage sustainable growth. Product development milestones should address market demands and be defined by clear technical and user benchmarks.

Operational efficiency is another area to monitor. For example, many venture capital firms have a monthly review system in place to track key performance indicators across their portfolio companies. If a company’s user growth begins to falter, early detection allows the firm to work with the company and address the issue proactively.

As David Vogel, a Solar Energy Mentor, advises:

"Regularly monitor KPIs and adjust strategies promptly. This helps you make informed decisions and swoop in with divine interventions if a portfolio company starts to stray. Continuous monitoring ensures your goals stay relevant and offers a chance for recalibration when needed" [8]

Given that only 48% of startups progress from Seed to Series A funding [4], setting and monitoring the right milestones is crucial. As Naimul Abd, CEO of SweBAN, points out:

"Investors are looking for evidence that your business can scale" [4]

Market Conditions and Timing Triggers

External market forces play a major role in deciding when to allocate follow-on capital. Keeping an eye on these conditions helps investors make smarter decisions that align with broader economic trends and industry shifts.

How Market Trends Affect Investment Timing

Market trends can either open doors or create hurdles for follow-on investment strategies. Economic cycles often follow a predictable rhythm. Early in the cycle, conditions are typically more favorable for follow-on investments as businesses benefit from improving economies and rising consumer spending. The mid-cycle, which usually lasts about three years, offers steady growth opportunities, making it an ideal period for strategic follow-on investments [9].

Market volatility also plays a key role. When markets are turbulent, defensive follow-on strategies are often used to safeguard existing investments. On the other hand, stable markets encourage offensive strategies aimed at growth and expansion [14]. These signals from the market can help investors adjust their tactics to align with the shifting economic landscape.

For example, in the first quarter of 2024, global venture capital investments rose by 16% compared to the previous quarter, reaching $89 billion across 4,600 deals [2]. This growth highlights how improving market conditions can spark increased follow-on investment activity.

Adjusting to Economic and Industry Changes

Economic shifts can also push investors to recalibrate their follow-on strategies. Factors like interest rates, inflation, and currency fluctuations affect how different asset classes perform [10]. For instance, when central banks hike interest rates, growth-focused companies often face higher borrowing costs, making follow-on capital critical for sustaining operations and scaling.

Historical events also offer lessons on timing. During the COVID-19 pandemic, global stock markets plunged 34% after the WHO declared it a pandemic. However, by August 2020, markets rebounded thanks to fiscal and monetary policies [10]. Companies that secured timely follow-on funding during the downturn were better positioned to thrive during the recovery.

Industry-specific metrics further refine timing decisions. Technology startups, for instance, often rely on Monthly Recurring Revenue (MRR) to gauge predictable income from subscriptions. Strong MRR growth and critical inflection points can signal the right moment for follow-on investments to ramp up customer acquisition.

Healthcare startups, on the other hand, depend on clinical validation, such as patient outcomes or trial results. Positive milestones in these areas often trigger follow-on rounds to fund regulatory approvals and market entry.

Similarly, renewable energy startups monitor the Levelized Cost of Energy (LCOE), which measures the lifetime cost of generating electricity. Improvements in LCOE often indicate technological advancements that justify additional investment.

In the milestone-based financing structure of venture capital and angel investing, the availability of downstream funding—meaning clear interest from Series A and Series B investors—significantly influences investment decisions by early-stage (seed) investors.

For instance, Seed investors are more inclined to commit capital when they know that larger, later-stage funds are actively looking to invest, as this lowers the risk that a promising startup will struggle to secure the next round of financing—a challenge often referred to as "financing risk."

Given these variables, regular portfolio reviews become essential to stay ahead.

Regular Portfolio Reviews for Better Decisions

Frequent portfolio reviews enable investors to pinpoint the optimal timing for follow-on investments and respond promptly to changing market conditions, often preempting rounds in top-performing companies.

Effective monitoring involves tracking both company-specific metrics and broader market indicators. For instance, keeping an eye on central bank policies can help investors anticipate rate changes and their impact on funding and valuations [11]. As we observed during the COVID-19 pandemic, when interest rates fell to nearly zero, this triggered a large inflow of capital into private markets. However, as the US Federal Reserve began raising rates in March 2022, we saw a sharp outflow.

Concurrently, delays in capital deployment during temporary downturns can lead to missed opportunities. Research shows that missing just a handful of the market's best days can drastically reduce long-term returns [14]. The same principle applies to follow-on investments in private markets, where timing is everything.

Investors must also ensure that any additional capital deployed yields a clear and acceptable return on investment (ROI) relative to the opportunity cost of allocating that capital elsewhere. This involves analyzing market conditions, the competitive landscape, and the target company’s performance [12]. Aligning these factors with broader economic trends helps validate follow-on decisions.

As Mark Twain famously said, "History doesn't repeat itself, but it often rhymes" [14]. Learning from past patterns while staying flexible for the present is the cornerstone of successful follow-on investment timing.

Capital Allocation for Follow-On Investments

How you allocate follow-on capital can be the difference between a thriving investment strategy and one that struggles to deliver returns. Smart capital allocation is what sets top-tier venture investors apart from the rest.

Best Practices for Allocating Follow-On Capital

In venture capital, a good rule of thumb is to reserve 40%-60% of funds for follow-on investments [16]. This ensures you have enough capital to support top-performing portfolio companies through multiple funding rounds without scrambling for additional resources.

When writing an initial seed check, think of it like buying a long-dated out-of-the-money call option that gives you a seat at the table and the chance to track the company over time. If the founders follow through on their plans and reach (or exceed) their milestones, it becomes much easier to write a larger check in subsequent rounds.

Pro-rata is also an important factor when writing the initial seed check. For example, at Allied Ventures, we negotiate pro-rata rights on all first-time investments to ensure our limited partners can participate in future rounds.

Furthermore, to stay ahead, regularly update your portfolio tracking with company performance, market trends, and potential exits. This continuous adjustment helps you identify breakout winners even before they raise their next round. If you have a good relationship with the founder, they might allow you to invest additional capital before a significant mark-up in the next round.

Valuation also plays a significant role in determining whether to invest in a follow-on financing. For example, assume you initially invested at a $5 million post-money valuation when the company was generating $250,000 in annual revenue. Now, the company is raising at a $20 million post-money valuation, but only generating $500,000 in annual revenue. The valuation has grown four times, while revenue has only doubled. Ideally, traction and KPIs should grow faster or at least keep pace with valuation. Otherwise, the company risks failing to grow into such an ambitious valuation, which could lead to a future bridge or down round.

Take some time to also review the company’s preference stack and debt. For example, if the current valuation is $50 million post-money and the company has already raised $30 million in capital and debt, it shows the management team is very capital inefficient, and investors could be wiped out by creditors if things go poorly. The goal of venture capital is to build the largest company while burning the least amount of capital, so look for companies where the total amount of capital plus debt is less than 50% of the current valuation (the lower, the better).

Lastly, co-investor signal is worth considering in follow-on decisions. For instance, is a reputable venture firm coming in to price the round with new outside capital, or is the investment being marked up by existing investors? Preferably, a new investor is joining the cap table and investing fresh capital into the company, thereby providing the company with additional market validation.

Once you've nailed down your allocation practices, the next big challenge is finding the right balance between diversification and concentration.

Balancing Diversification and Portfolio Focus

One of the toughest decisions in follow-on allocation is navigating the trade-off between spreading risk and focusing on potential winners. Data shows that in top-performing funds, 90% of returns often come from just 20% of investments [19]. While diversification helps mitigate losses, concentrated bets on the right companies drive the majority of returns.

"Good ideas and good products are a dime a dozen. Good execution and good management - in a word, good people - are rare. …It's the execution that's really the important thing and you need really good people for that. Good people can change directions, but there are very, very few truly great people who can execute properly. …The biggest problem in starting high-tech businesses is the shortage of superior managers. There is too much money chasing too few good managers." – Arthur Rock [19]

A balanced portfolio might include both early-stage companies with high growth potential and more mature businesses with established models [18]. This mix allows you to capture the upside of emerging opportunities while maintaining some stability.

Another key consideration is how many companies you can actively and effectively support [18]. Spreading capital too thin often leads to missed chances to maximize returns from your strongest performers.

Focusing on sectors where you have expertise can also make a big difference [17]. When you understand an industry well, you’re better equipped to make informed follow-on decisions and provide meaningful support to your portfolio companies.

Lastly, every investment should have the potential to deliver significant, venture-scale returns. This is especially critical for follow-on investments, where you’re doubling down on existing positions instead of diversifying into new ones.

Comparing Follow-On Allocation Strategies

Different strategies come with their own pros and cons. Here’s a quick breakdown of some common approaches:

The "Percentage of the Fund Strategy" keeps things simple by allocating a fixed percentage of the fund for follow-on investments [16]. While easy to implement, this method might limit the ability to make larger initial investments to secure pro-rata rights [16].

The "What's Left Strategy" allocates initial investments based on targeted ownership and company count, leaving the remaining capital for follow-on rounds [16]. This approach ensures targeted ownership early on but might result in less capital for follow-ons [16].

Opportunistic strategies offer flexibility to adapt to market changes and seize unexpected opportunities [1]. However, they require quick decision-making and can sometimes lack consistency, leading to mixed results [1].

"We made our biggest losses from moves not made. So, we also explicitly review opportunity cost mistakes." – Boston Consulting Group M&A Report 2023 [15]

This quote highlights the importance of not just focusing on where to allocate follow-on capital but also recognizing the cost of missed opportunities. Ensuring you have enough reserves for your top performers can make all the difference.

At Allied VC, the collective insights gained from reviewing over 2,000 investment opportunities each year play a crucial role in guiding our allocation decisions. This data-driven approach helps identify which companies deserve additional backing relative to their peers, ensuring greater odds of capturing the right opportunities at the right time.

Communication and Portfolio Management

Effective communication and active portfolio management are key components of successful follow-on investment strategies. By systematically tracking progress, investors can spot opportunities early and address potential challenges before they escalate.

Staying in Touch with Founders

Maintaining regular contact with founders is vital for assessing performance and uncovering growth opportunities [21][22]. This isn't just about quarterly check-ins - it's about fostering a relationship built on trust and openness from the very beginning. When founders feel comfortable sharing both their wins and struggles, investors gain the clarity needed to make informed follow-on decisions. This transparency also helps in identifying issues early and resolving them quickly.

"When you speak, you only repeat what you already know. And when you listen, you have the chance to learn something new." - Dalai Lama [20]

Asking thoughtful, proactive questions can reveal risks or opportunities that might otherwise stay hidden. For example, at Allied, regular updates and communication with LPs strengthen relationships and provide founders with a wealth of perspectives and expertise to navigate complex growth challenges.

Key Takeaways

Summary of Timing Strategies

To master the art of follow-on investment timing, investors need to blend quantitative metrics, qualitative milestones, and a sharp sense of market trends. The most successful investors don’t rely on just one indicator - they build a thorough framework that evaluates company performance while keeping an eye on the broader economic landscape.

Performance metrics provide the backbone for these decisions, while operational milestones offer proof that a company is successfully executing its strategy. For a deeper dive into these metrics and milestones, refer to the earlier sections.

Market conditions also play a pivotal role. With rising interest rates and market volatility, many investors have shifted to more cautious strategies. This often means prioritizing support for existing portfolio companies over chasing aggressive growth opportunities [12].

Striking the right balance between growth-focused follow-on investments and defensive moves to stabilize underperformers is critical. Venture capitalists typically allocate between 40% and 60% of their funds to follow-on investments, making this balance essential for overall portfolio success.

These principles form the foundation for the key actions investors can take to make smarter follow-on decisions.

Final Advice for Investors

Create a reliable framework to evaluate every follow-on opportunity. It’s vital to ensure that any additional capital invested delivers a clear and acceptable return on investment. Avoid the trap of "throwing good money after bad" by defining what makes a follow-on investment worthwhile before you're faced with the decision.

A solid framework will guide you in making confident, emotionless, and actionable investment choices that are consistent over time.

Stay closely connected to your portfolio companies. Regular communication is essential for tracking performance and spotting opportunities early. Pair this with real-time monitoring of market trends to respond quickly to shifting conditions.

Be adaptable, but stick to your core principles. Markets can change in an instant, and successful investors know how to pivot while staying grounded in their investment thesis. As James Heath from dara5 puts it:

"This will be the year of the hyper-specialist VC. Where conviction is hard to come by, and FOMO isn't driving investment decisions, specialists who know how to pick in this market will shine" [27].

Focus on the power law of venture returns. Research consistently shows that in a portfolio of 200 startups, the top 15 deliver most of the returns. This highlights the importance of concentrating follow-on investments in your highest-performing companies rather than spreading capital too thin across the board.

Finally, keep refining your follow-on strategy as new data and insights emerge. The best investors evolve their timing strategies to reflect market shifts and company progress. By staying flexible yet grounded in your core investment principles, you'll be better equipped to maximize returns and minimize risks in your follow-on decisions.

FAQs

What are common mistakes investors make when timing follow-on investments, and how can they avoid them?

Investors sometimes stumble when deciding on follow-on investments, often swayed by fundraising buzz or external hype. This can lead to pouring too much money into certain rounds without properly evaluating the company's actual potential. On the flip side, some delay these investments due to unclear strategies or misreading a company's progress, which can mean missing out on promising opportunities or jumping in too late.

To steer clear of these missteps, having a solid follow-on strategy is essential. Prioritize key milestones, performance metrics, and market conditions over emotional or momentum-driven influences. A disciplined approach helps ensure your decisions are well-informed and align with your broader investment objectives.

How do economic trends and market fluctuations affect the timing of follow-on investments?

Economic trends and market shifts significantly influence the timing of follow-on investments. When the economy slows down or markets tighten, investors often pull back, and the pool of available capital shrinks. This can drive company valuations lower, creating opportunities for more favorable investment terms. However, it also introduces the risk of liquidity issues and the availability of follow-on financing, which could complicate financial stability.

On the other hand, during periods of economic expansion, valuations tend to rise, reflecting increased market activity. But with that growth often comes greater volatility and uncertainty. To navigate these ups and downs, it's essential to keep a close eye on critical factors like economic indicators, company achievements, and broader market trends. A solid understanding of these dynamics allows you to time your follow-on investments more strategically, aiming to boost returns while keeping risks in check.

How can investors balance diversification with focusing on high-performing companies for follow-on investments?

Investors can strike the right balance between spreading risk and focusing on high-growth opportunities by adopting a well-thought-out, data-informed approach. Spreading investments across various industries, business stages, and regions helps minimize risk, while channeling follow-on funding into a few standout companies enables investors to aim for higher returns.

When deciding where to allocate follow-on investments, consider critical elements such as a company's progress toward milestones, market trends, and growth indicators. Look for businesses that show strong results, the potential to scale, and alignment with your broader investment strategy. By blending diversification with targeted focus, investors can effectively manage risks while positioning themselves to seize promising opportunities.

Disclaimer:

This guide is provided for informational purposes only and should not be interpreted as financial or investment advice. Developing a follow-on investment strategy is a strategic approach to filtering investment opportunities, but it does not guarantee success or financial returns. Angel investing is inherently high-risk, and readers should consider their own financial situation, conduct thorough due diligence, and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss.