How to Use Storytelling in Pitch Decks

Storytelling in pitch decks helps you connect with investors on both a logical and emotional level. Investors spend an average of just 2 minutes and 12 seconds reviewing a pitch deck, so your story needs to grab attention fast. By framing your business idea as a journey - highlighting the problem, your solution, and its impact - you make your pitch more memorable and relatable.

Key Takeaways:

Start with the problem: Use a bold statement or statistic to show the issue you’re solving.

Present your solution: Clearly explain how your product or service addresses the problem.

Show impact: Use data, customer stories, or visuals to demonstrate results and potential growth.

Keep it visual: Use charts, infographics, and images to make your slides easy to understand.

Tailor for investors: Focus on what matters most - market size, team expertise, and scalability.

By combining clear data with emotional hooks, you help investors see not just the numbers but the value of your vision. The goal is to create a pitch that’s both engaging and persuasive.

How To Improve Storytelling In A Pitch Deck

Building a Story Structure for Your Pitch Deck

Crafting a pitch deck isn’t just about assembling slides - it’s about telling a story that captures your vision and gets investors on board. The best pitch decks follow a structured narrative that builds momentum, highlights solutions, and emphasizes the potential impact. And here’s the kicker: you need to hook your audience within the first 40 seconds.

Pro Tip: Think of your pitch deck like a movie trailer. Your goal is to build credibility and spark interest in the feature film, not reveal the entire story.

The 3-Part Story Framework

At the heart of any great pitch deck is a simple framework: Problem, Solution, and Impact. Think of it as positioning your startup as the hero, tackling challenges, and delivering results.

Start with the Problem: This is where you grab attention. Use a powerful statement or a striking statistic to set the stage. For example, about 21% of startups fail in their first year because they miss the mark on product-market fit or lack genuine demand [7]. Make it clear that you’re solving a real, pressing issue.

"You always want to use data to make the pain you explain irrefutable. Very few startups do that so here you can really stand out. The data that you share can either come from market reports or interviews/surveys that you've done with potential customers. Don't forget to link or explain how you discovered the findings." – Melinda Elmborg, Former VC at Daphni [8]

Present Your Solution: Once you’ve laid out the problem, introduce your solution as the perfect answer. Keep it concise - outline your unique value proposition and back it up with data, testimonials, or early results. Real-world examples can help reinforce why your solution works.

Demonstrate Impact: Finally, show what happens when your solution is implemented. Highlight the benefits, scalability, and the risks of doing nothing. This is where you connect with both the customer experience and the investor’s desire for returns.

Adding Key Business Elements to the Story

Your pitch deck isn’t just about storytelling - it’s also a snapshot of your business. To make it compelling, integrate these essential components:

Market Validation: Prove there’s a demand for what you’re offering. Use data to show that the problem you’re solving affects a wide audience. For instance, Airbnb’s 2009 pitch deck included a slide demonstrating that people were open to staying on strangers’ couches [5]. This kind of validation can make a huge difference.

Business Model and Financials: Investors want to see that your business model works. Be ready to explain your sales projections, key expenses, and how your revenue model supports your overall story. Concrete numbers reduce risk and build confidence.

Team Credentials: Investors need to believe in the people behind the idea. Share your team’s expertise and experiences, and don’t shy away from personal stories. For example, explain a moment when the problem became real for you - it makes your pitch more relatable.

Competitive Analysis: Show you understand the market and your competitors. Explain why current solutions fall short and how your approach stands out. This demonstrates strategic thinking and market awareness.

Once you’ve woven these elements into your story, it’s time to tailor it for your audience.

Tailoring Your Story for Investors

Startup investors have specific preferences - they want clear communication, scalable models, and growth potential. To resonate with them, focus on the big picture. Highlight the market size, growth opportunities, and why your solution is a game-changer.

Use metrics and examples that align with business trends. Show how your solution fits into the broader market and why the timing is perfect. Investors want to know why they should act now, so emphasize urgency and scalability.

"I want a deck that right off the bat, on the first slide, tells me what this company is about" – Ariel Poler, Entrepreneur and Angel Investor [9]

Remember to practice your pitch so you can deliver your key message in under 40 seconds. And don’t make it feel like a lecture - keep it conversational and engaging. A natural flow will keep investors hooked.

With your story and business elements in place, the next step is transforming them into clear, visually engaging slides.

Creating Slides for Visual Storytelling

Turn your story into slides that grab attention in seconds. Every visual element should serve a purpose - after all, people remember 80% of what they see compared to just 20% of what they read[11]. Visuals are also 43% more persuasive than text alone, and about 70% of venture capitalists prefer visuals over lengthy text[10]. Here’s how to design visuals that enhance your pitch and drive your narrative forward.

Using High-Quality Visuals and Infographics

Think of your slides as a visual conversation. Use professional, relevant images, like product photos, customer interactions, or behind-the-scenes moments, to establish trust and authenticity.

Data visualizations are your secret weapon. Instead of cramming revenue growth into bullet points, try bar graphs or line charts to make trends jump off the page. For more complex information, like market size, infographics can break data into manageable pieces. Take Uber’s pitch deck as an example: it used maps, charts, and graphs to visually explain market expansion and growth potential, making the data easy to grasp at a glance.

When creating infographics, focus on relevance, not flashiness. Every visual should directly support your story - if it doesn’t, leave it out. Stick with consistent styles and templates, and ensure your visuals are large enough to read easily. Since investors often spend just 10 seconds per slide, [12], your visuals need to communicate their message instantly.

Maintaining Visual Clarity and Consistency

Consistency in design is just as important as the quality of your visuals. A cohesive look builds trust, which is crucial when asking for funding. Stick to two or three main colors, ideally those that align with your brand, to create a polished and professional feel.

For text, keep it simple: use a minimum font size of 30 points and limit yourself to two typefaces for readability. Follow the 6-6 Rule: no more than six bullet points per slide, with six words per point, to keep your slides clean and to the point.

If you’re pitching to U.S. or Canadian investors, pay attention to formatting details. Use dollar signs for currency ($), the MM/DD/YYYY format for dates, and commas for thousand separators. These small adjustments show you’ve tailored your presentation to your audience.

Don’t underestimate the power of white space. Instead of filling every corner of a slide, use empty areas to draw attention to your content and avoid overwhelming viewers. Focus on one main idea per slide, and if you have multiple points to cover, spread them across several slides.

Examples of Before-and-After Scenarios

Visual storytelling is a great way to highlight transformation. Before-and-after visuals are especially effective for showing the impact of your product or service. Start with a chaotic or inefficient "before" state, then contrast it with a clear, improved "after" state that demonstrates the difference your solution makes. Pair these visuals with customer testimonials or measurable results - like cost savings or efficiency improvements - presented in clear graphs or charts to make the impact undeniable.

Subtle animations can also add a layer of engagement when used sparingly[10]. For example, use animations to reveal data step-by-step or to show how a process improves over time. Just be sure they’re understated and enhance your message rather than distract from it.

Ultimately, every visual element should strengthen your core narrative, transforming your pitch deck into a compelling and memorable presentation tool.

Combining Data and Emotion in Your Story

Clear visuals may set the stage for your pitch, but blending data with emotion is what truly captivates investors. The most compelling pitch decks don’t force a choice between the two; they weave them together into a story that grabs both the logical and emotional sides of an investor’s decision-making process.

Think of data as the sturdy framework and emotion as the spark that brings your story to life. Even the most analytical investors are influenced by emotion, whether they’re poring over spreadsheets or dissecting market projections [14]. The trick is to use data to reinforce your narrative, creating a balanced approach that highlights the metrics investors care about most.

Adding Data-Driven Insights

Start by focusing on the metrics that matter most to early-stage investors. Market size, revenue growth, and user traction should take center stage. These numbers aren’t just statistics - they’re proof points that validate your business’s potential [13].

Take BenchSci as an example. When they raised $40M in funding, they didn’t just talk about their technology. They highlighted a single, powerful metric: 500 lab sign-ups. This number showed investors that their platform was already gaining traction with real scientists, signaling market demand and adoption [13].

When presenting financial data, format it in a way that’s easy for investors to digest. Use dollar signs ($) and add commas for thousands (e.g., $1,250,000 instead of $1250000). Be specific about timeframes - investors want to see momentum over clearly defined periods.

Connecting with Investors Through Emotional Hooks

While precise data builds trust, emotional hooks are what make your pitch memorable. Numbers establish credibility, but stories create a connection that inspires investors to join your journey. Consider how Facebook, in its early days, raised over $2.3B by emphasizing how the platform transformed global communication [1]. This wasn’t just about technology; it was about the profound impact on people’s lives.

Customer success stories are a powerful way to tap into emotion. Instead of simply stating that your product improves efficiency, share a real example. Show how a customer struggled before finding your solution, the transformation they experienced, and the measurable results they achieved.

Personal founder stories can also leave a lasting impression. Starting your pitch with a personal anecdote tied to your business vision helps investors see the human behind the numbers [13]. It makes your mission relatable and underscores your passion and determination.

"Nir helped me move beyond presenting data to crafting a compelling narrative that integrates my 'why' with my professional credentials. Whether in a brief or extended format, I now have the tools to present our mission with clarity, confidence, and impact." – Founder, Launch Lab X

This emotional element is crucial, especially when you consider that pitch decks with focused messaging are 30% more likely to secure investor meetings [13]. Focused messaging means tying your data to a larger narrative that resonates with investors on both a logical and emotional level.

Comparison of Storytelling Techniques

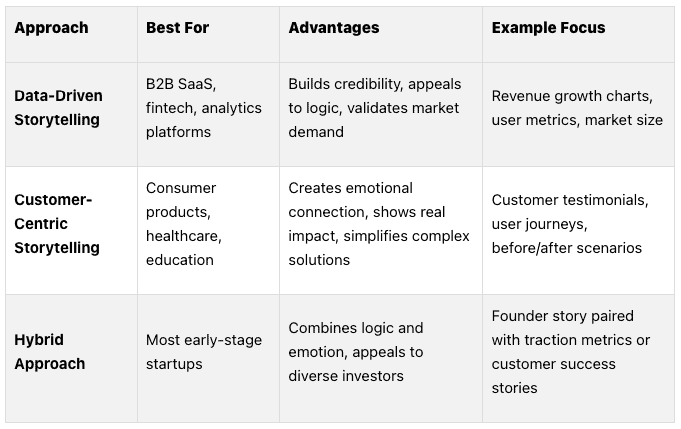

The right mix of data and emotion depends on your startup’s focus and the type of investors you’re pitching to. Here’s a quick breakdown of different storytelling approaches:

The hybrid approach often works best, as it combines the strengths of both data and emotion. A great example is DocSend, which increased their viewer retention rates from 17.5% to 65.4% by focusing on clarity and narrative structure [13]. They didn’t abandon their data; instead, they integrated it into a story that was easier to follow and more engaging.

And here’s a key takeaway: focused messaging boosts persuasiveness by 43% [1]. Choose a storytelling method that aligns with your startup’s strengths and your audience’s priorities. Every data point should support your story, and every emotional hook should have the weight of evidence behind it.

Adjusting Your Story for Investor Engagement

Using a structured storytelling framework, you can refine your approach to capture investors' attention at every stage. The key lies in tailoring your narrative to align with their priorities and the specific funding stage of your business. Investors focus on different factors depending on where you are in the fundraising journey.

"Startup fundraising isn't just about numbers and projections; it's about connecting with your potential investors on a level that resonates with their beliefs, interests, and emotions" – Teresa Fric, Startup Advisor and Angel Investor [15]

Understanding Investor Priorities

In the U.S., investors typically look for four main things: market opportunity, a strong founding team, product-market fit, and a clear mission. They want evidence that your product solves a genuine problem in a growing, sizable market [16]. A strong founding team matters just as much - they’re looking for people with diverse skills, deep industry knowledge, and a proven ability to execute [17].

Equally important is demonstrating product-market fit and scalability. You need to show that your business model can grow without costs ballooning at the same rate. This reassures investors that your company is built for sustainable growth.

"At this stage of the startup, the investors are looking for the right people: they want to see the next Steve Jobs, Elon Musk, or Mike Cannon-Brookes. They want to see vision and charisma" – Ryo Umezawa, Venture Partner at Antler [18]

Be upfront about any challenges you’ve faced. Framing setbacks as opportunities for growth shows resilience and builds trust. With these priorities in mind, you can adjust your story to meet the expectations of each funding stage.

Modifying for Fundraising Stages

Your pitch should evolve as you progress through funding rounds:

Pre-seed: Highlight your vision and the potential of your idea. Focus on the problem you’re solving and introduce your concept or early MVP. Back this up with high-level market size estimates and early validation signals.

Seed: Showcase your early traction and product-market fit. Share customer success stories and validation that proves users genuinely need and want your solution.

Series A: Focus on execution, scalability, and market capture. Use user behavior insights, detailed market segmentation, and key growth metrics to ground your story in data.

Summary: Mastering Storytelling in Pitch Decks

Storytelling has the power to turn bland slides into engaging narratives that stick with your audience. The difference between a pitch that gets overlooked and one that secures funding often lies in how effectively you weave your story into every slide and interaction. This final section pulls together your strategic narrative with actionable steps to elevate your pitch.

"Telling an exciting and compelling story is...how you raise money, hire talent, manage crises, sell your product, and build your partner ecosystem. From my experience, a great story is the difference between success and failure." - Liran Belenzon, CEO of BenchSci [3]

Key Takeaways

Here are some essential lessons from proven storytelling techniques:

Structure keeps your audience hooked. Answer three core questions: Why care? Why believe? Why join? [3]. A narrative built around these questions creates a natural flow that keeps investors engaged from start to finish.

Visuals amplify your story. Use visuals and customer testimonials to reinforce your message. Instead of treating slides as standalone elements, think of your pitch as a collection of 2-5 slide story arcs that build momentum [6].

Authenticity trumps perfection. Let your passion shine. Share the personal moment or experience that made the problem you're solving feel real to you. This emotional "why" should set the tone for your pitch.

Timing is everything. Start strong and get to the heart of your story quickly. Open with action, create immediate tension, and practice narrating the story behind your slides smoothly, so you're leading the presentation - not your slides [6].

"A well-crafted story acts as a Trojan Horse, helping you bypass these defenses and communicate your value proposition effectively." - Lyn Graft, Storytelling for Entrepreneurs [4]

Next Steps for Founders

To refine your pitch and make your storytelling even more impactful, consider these steps:

Experiment with different storytelling styles. Write stories of varied lengths and genres [24]. Focus on vivid details and emotional shifts to make your narrative come alive. Use action verbs and practice delivering dialogue naturally [24].

Get honest feedback. Share your pitch with trusted friends, mentors, or critique groups to identify areas for improvement [24]. Practice explaining your vision, problem, solution, and business model conversationally - if you can't tell your story without slides, it needs more work.

Leverage our resources at Allied VC.

Our guides and articles on fundraising, cap tables, and valuations, along with our Allied Angels podcast, provide practical advice on what resonates with investors. Our tools repository is also regularly updated with various tools and calculators to help in building, funding, and evaluating startups. Finally, check out Ask Allied, the new AI-powered VC assistant trained on our full collection of website content, newsletters, podcasts, investment memos, and more.

Prioritize emotional connection over raw data. Use data to back up your story, not replace it. The goal is to help investors feel the problem and see how your solution creates meaningful change.

Founders who can seamlessly blend their vision with a compelling narrative and supporting data will find storytelling to be their most powerful tool - not just in pitching but in every aspect of building their company.

FAQs

How can I balance storytelling and data to create an engaging pitch deck for investors?

To put together a compelling pitch deck, mix storytelling with solid data insights. Begin by weaving a narrative that showcases your startup's mission, the problem you're addressing, and the difference your solution can make. This approach builds an emotional connection, making it easier for investors to align with your vision.

Back up your story with quantitative data points that highlight your business’s potential - think market size, projected growth, and financial metrics. Use visuals like charts and graphs to simplify complex details, making the information easier to grasp. By pairing an engaging story with reliable data, you’ll appeal to both the emotions and logic of investors, boosting your chances of winning their support.

How can I adapt my pitch deck for different fundraising stages, like Pre-seed or Series A?

To fine-tune your pitch deck for different fundraising stages, align your focus with what investors care about most at each phase.

At the Pre-seed stage, spotlight the problem you're tackling, your innovative solution, and the expertise of your founding team. Keep the deck short, visually appealing, and engaging. Use storytelling to make your vision resonate and leave a lasting impression.

By the time you reach Series A, the emphasis should shift to results. Showcase your traction, proven business model, and key growth metrics. Make it clear how your business is ready to scale, fits the market, and is primed for expansion. Craft your pitch to meet the specific priorities of Series A investors, ensuring it aligns with their expectations for this stage of funding.

What are the best visual elements to use for storytelling in a pitch deck?

When creating a pitch deck, visuals play a crucial role in telling your story effectively. Use high-quality images, custom graphics, and infographics to simplify complex concepts and make your message clear. Consistent design choices - like a unified color palette, readable fonts, and intuitive icons - help create a polished and cohesive loo