Annual Investor Letter 2025

Wednesday, December 17, 2025

To the Founders, Investors, and Partners of Allied VC,

Thank you for another exceptional year of support as we celebrated Allied Venture Partners' fifth anniversary and continued to navigate one of the most dynamic and paradoxical venture markets in recent memory.

Allied embodies the best practices I've gathered as an angel investor and scout over the past twelve years. To see it mature into a disciplined investment platform while maintaining the agility that defines our approach is incredibly rewarding, especially during a year marked by unprecedented AI investment euphoria alongside persistent fundraising challenges.

As with my previous letters, I would like to cover three key topics in this update:

Syndicate Metrics, Outlook & Portfolio Construction

The Current State of Markets (Public & Private)

Looking Forward: Phase Two, Phase Three

1. Syndicate Metrics, Outlook & Portfolio Construction

Allied Venture Partners boasts a thriving community of over 3,000 members from two dozen countries, creating a powerful global network. Since 2020, we've successfully invested over $6.4 million into 24 innovative companies spanning Canada, the United States, and Australia. Furthermore, our Scout and Advisory programs have demonstrated remarkable success, creating a powerful and diverse dealflow flywheel that gives us a unique advantage.

In 2025, we reviewed over 1,700 investment opportunities throughout North America and strategically selected approximately 0.25% for investment—our most selective year yet. For reference, I've included a breakdown of our five-part dealflow funnel, designed to enhance collaboration and drive success:

I am truly grateful to all the founders, limited partners, advisors, venture scouts, and co-investors for sharing unique investment opportunities. Without your support, Allied would not be possible.

Regarding our 2025 investment progress, Allied raised and deployed $600,000, making 9 investments across 6 companies (including 4 new investments at pre-seed and seed and 5 strategic follow-on investments at seed and Series A). These investments were part of the $15 million in total funding raised by our founders across their respective rounds.

These companies include:

As outlined in our investment mandate, my goal is to consistently add four to six new companies to the Allied portfolio each year. In 2025, we added four new portfolio companies (three in the United States and one in Canada) while strategically doubling down on five of our highest-conviction positions through follow-on investments.

Regarding performance, our strategy of co-investing alongside reputable investors remains highly effective. This year, we co-invested with notable firms, including Techstars, Entrepreneur Ventures, Gaingels, Incisive Ventures, Telegram, Network VC, Team Ignite, Opensky Ventures, Etowah Capital Partners, Savyon Ventures, and numerous others.

Among our follow-on investments, we achieved notable markups of 2x, 10x, and 50x, all within 36 months or less from our initial investment—validating our conviction-driven approach to portfolio construction and our ability to identify breakout companies early. The Allied portfolio now comprises 24 companies, with aggregate combined valuations surpassing $500 million—a significant milestone as we celebrate our five-year anniversary.

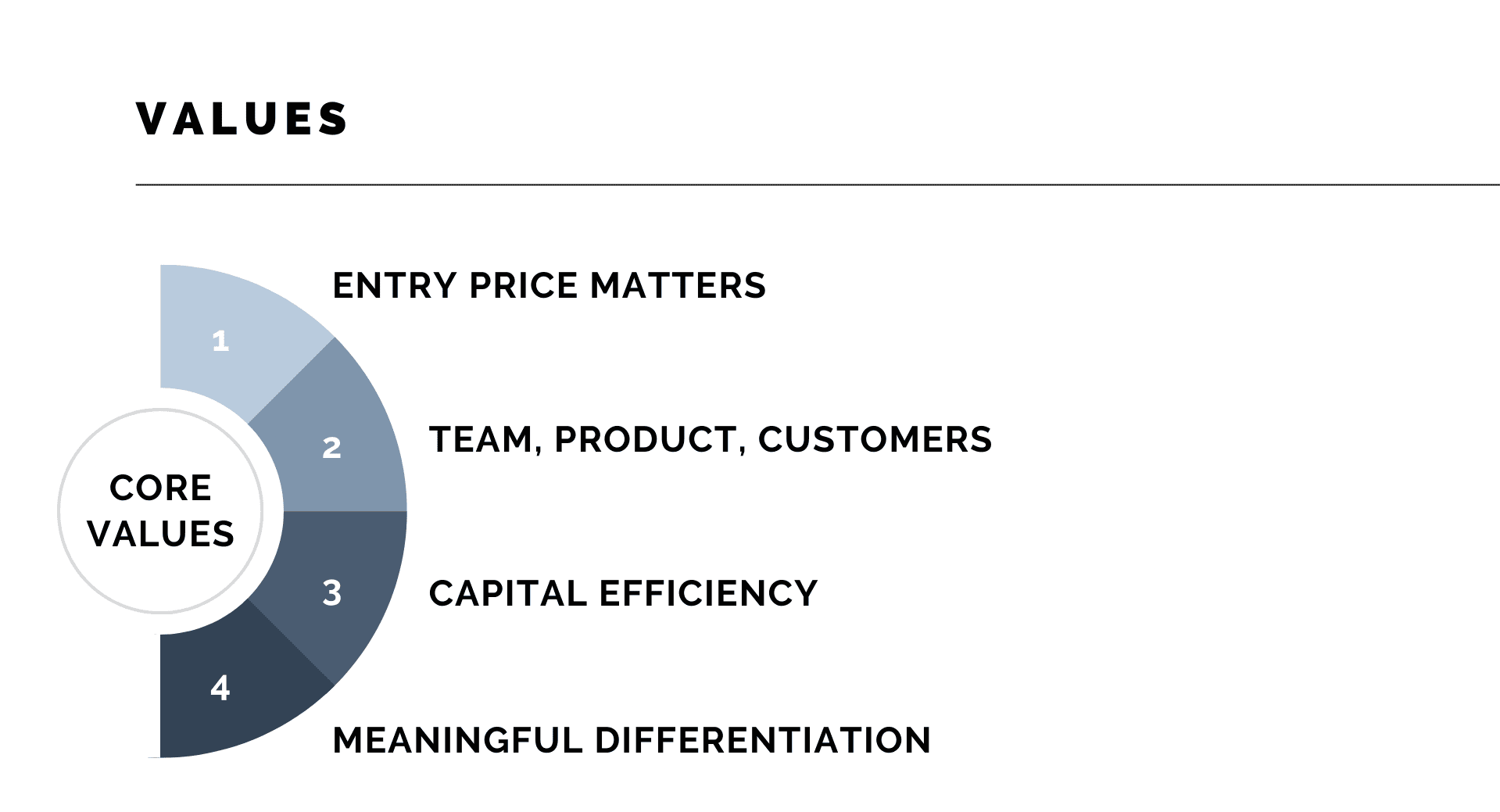

To reinforce our mandate, my objective from day one has been to operate Allied with the diligence and discipline of a top-tier VC firm while maintaining the agility of a syndicate. I firmly believe that our disciplined, thesis-driven approach, rooted in our core investment values, has proven resilient in the face of recent market volatility, and will continue to generate attractive markups for our limited partners in 2026.

Nevertheless, we are in the business of early-stage venture investing, so we will naturally experience some losses. Unfortunately, this year we had one portfolio company shut down. I deeply admire the founder's resilience and dedication as he attempted to navigate one of the most difficult global macroeconomic environments in years.

Building a company takes an incredible amount of dedication, and it's genuinely heartbreaking to realize that after investing years of hard work and devotion, one could encounter serious personal, professional, and financial turmoil if it doesn't succeed. I greatly respect any founder who takes the entrepreneurial plunge, and I truly hope to be their first phone call when they launch their next startup.

Moving forward, I remain focused on uncovering unique and overlooked opportunities while also doubling down on our top-performing companies. We have several exciting prospects in the pipeline, and I look forward to sharing more details in the weeks ahead.

2. The Current State of Markets (Public & Private)

Public Markets: A Year of Divergence

In my 2024 letter, I predicted a more subdued year for market returns amid administrative transition and interest rate uncertainty. While my forecast proved directionally correct for US markets, Canadian markets significantly outperformed expectations.

US and Canadian stock markets both posted strong gains through late 2025, though with notably different drivers. The S&P/TSX Composite gained 26.8% year-to-date as of mid-December, substantially outperforming the S&P 500's 16.9% and NASDAQ's 21.4% returns. This Canadian edge stemmed from rallies in materials, financials, and energy sectors amid commodity strength and resilient bank earnings. Meanwhile, US markets showed heavy concentration in tech and AI leaders, with the S&P 500 and NASDAQ delivering solid but narrower advances despite reaching record highs earlier in the year.

Regarding interest rates, I agree with the Bank of Canada's recent decision to pause interest rate cuts, and I am very pleased with their ability to maintain low inflation near 2%. However, the story in the US is quite different, and I am wary of the US Fed cutting interest rates while employment remains near historic lows and inflation trends back up to 3%—well above the Fed's 2% target. Time will tell if this decision was politically motivated or economically justified.

Looking ahead to 2026, I remain cautiously optimistic. I still believe we are in the early innings of the new AI supercycle, and that we are drastically underserved given the total compute we will need. However, I won't be surprised if we see a market pullback as investors reassess sky-high AI valuations and PE multiples, likely taking some risk off the table in public markets.

Private Markets: What I’m Seeing

My 2024 prediction about an AI bubble in first-generation application-layer startups proved prescient—though I underestimated the magnitude of valuation disconnects that would emerge.

Throughout 2025, we witnessed the venture market operate as two fundamentally separate ecosystems: AI-native startups commanding premium valuations regardless of traction, versus everything else facing normalized (or compressed) valuations despite solid fundamentals.

The AI Valuation Paradox

The numbers tell a striking story. According to CB Insights data, AI-native startups commanded a 21% premium over non-AI counterparts at the seed stage. However, the real extremes appeared in individual deal dynamics.

For instance, we reviewed one AI startup fresh from a top-tier accelerator that oversubscribed a $3.5 million seed round at a $35 million post-money valuation—a 140x implied revenue multiple—for a product that Google already offers for free. With sub-$20k MRR and what appeared to be an inferior product, this deal exemplified a broader challenge facing our industry.

In another example, I met a San Francisco-based startup that oversubscribed a $2.5 million pre-seed round at a $25 million valuation with no product or revenue. Meanwhile, a non-SF startup struggled to raise $500k at $5 million—despite having a working prototype, six beta customers, $10k MRR growing 20% month-over-month, and a team with 10+ years of deep domain expertise.

Simply put, geography and narrative carried the day over fundamentals.

The 2021-2022 Vintage Continues to Haunt

My expectation for increased operational efficiency through AI adoption materialized across our portfolio—companies like GroWrk, Tiliter, and Fonbnk demonstrated this thesis beautifully. However, another prediction from 2024 also came to pass: the downstream consequences of 2021's undisciplined capital deployment.

Throughout 2025, we encountered numerous companies with genuinely attractive fundamentals, only to discover that their cap tables had become their greatest liability. Consider one recent example: a B2B SaaS company generating $2 million ARR with 90% gross margins and 10% monthly growth—metrics that would typically command immediate attention.

The team sought to raise $3 million at $35 million post-money, yet this company remained uninvestable, trapped by a $20 million pre-money valuation overhang from 2021 when they raised over $5 million in SAFEs while generating just $60k ARR.

This SAFE overhang and structural mismatch reflect the immense downstream consequences of undisciplined capital deployment during the bubble years. Founders who accepted overly large rounds at inflated valuations while still searching for product-market fit now face an impossible choice: accept a significant down round or remain frozen in fundraising limbo.

The Rolling SAFE Trap

Another concerning trend emerged in 2025: the proliferation of rolling SAFEs that create perpetual fundraising cycles. I met one founder raising $2 million on a rolling SAFE with $1.5 million in "commitments"—but that capital had trickled in (and been spent) over the past 12 months. The company's actual cash position? Just $150k with three months of runway remaining.

This scenario became increasingly common, trapping founders in perpetual fundraising mode, unable to focus entirely on what matters most—talking to customers and building products. Each new check becomes a temporary bridge rather than strategic capital.

LP Liquidity Constraints Created Downstream Volatility

My 2024 concern about late-stage liquidity proved partially correct. While I anticipated IPO market improvements that didn't fully materialize—particularly as tariff uncertainties caused multiple companies to pause their IPO plans—a more insidious problem emerged: LP liquidity constraints affecting committed capital.

Throughout 2025, we witnessed multiple instances of VC funds reneging on term sheets or abruptly pivoting deployment strategies after failing to call capital from their own investors. For founders, the lesson became unforgiving: verbal commitments mean nothing until the wire hits the bank.

The Secondary Market Feeding Frenzy

The AI boom created an intoxicating cocktail of rapid wealth creation and rampant speculation. As companies like Cursor and Perplexity scaled past $100 million ARR with multi-billion dollar valuations in mere months, the secondary market became a feeding frenzy for opportunistic brokers peddling multi-layered SPVs to unsuspecting investors.

These are often not direct equity purchases. Instead, SPVs invest in other SPVs, creating a Russian nesting doll-like structure of fees and intermediaries. Primary investors charge 2% management fees plus 20% carry to brokers, who layer on their own fees and success kickbacks before selling to end investors. By the time this fee cascade reaches the LP, true ownership percentages become opaque while 100% of the risk remains concentrated at the bottom.

Meanwhile, some brokers pre-sell allocations they don't yet have, promising future share transfers from employees who may lack company approval to sell. This represents classic bubble behavior—FOMO masquerading as sophisticated investing.

The Infrastructure Thesis Holds

Despite these challenges, my 2024 conviction about infrastructure-layer investments over application-layer plays proved sound. The market bifurcation I predicted—where true defensibility requires platform strategies rather than standalone applications—accelerated throughout 2025.

The consensus among founders and investors alike is that applications alone no longer provide sufficient moats as software development becomes more accessible through AI tools. True defensibility now requires creating full-stack ecosystems that enable consumers and enterprises to build upon—the core of our investment thesis since day one.

Market Opportunity Amid Chaos

While the AI frenzy and 2021 vintage challenges created substantial market dysfunction, they also reinforced my 2024 assertion that we're living through one of the most attractive periods for early-stage technology investing in 15 years.

High-quality founders solving genuine problems with proven customers and revenue—who strategically incorporate AI to enhance unit economics and growth efficiency—remain significantly undervalued relative to their AI-first counterparts. This valuation arbitrage presents compelling opportunities for disciplined capital allocators willing to look beyond the loudest narratives in the room.

As the market inevitably separates signal from noise through consolidation, I believe our infrastructure-focused, fundamentals-driven approach positions us to capture value others have overlooked while chasing hype. I am very optimistic and excited for the year ahead.

3) Looking Forward: Phase Two, Phase Three

Reflecting on Five Years

This October, Allied Venture Partners celebrated its five-year anniversary—a milestone that prompted reflection on an unlikely journey that began during one of the most uncertain periods in modern history.

As I look back to when I launched Allied in October 2020, we were in the height of the global pandemic, and there was considerable uncertainty about launching a new venture firm. Initially, I had developed the business plan for Allied as part of an MBA capstone project, but thought I would first work at a large VC firm for several years before eventually breaking out and launching my own.

However, with the uncertainty of the global pandemic, no venture firm was hiring, and many venture firms had stopped deploying capital. By October, I reached a point where I decided to go to market and see what would happen.

Now here we are, five years later, having successfully raised and deployed over $6.4 million across 24 portfolio companies spanning three countries. As a former startup founder and national-level athlete, I've always been confident betting on myself, but there was considerable uncertainty nonetheless.

Once again, I couldn't have done it without the help of my venture partners, limited partners, and the amazing founders who've allowed us to support their vision. I look forward to the next five years of growing the Allied Venture Partners platform.

Phase Two: Canadian Integration Continues

I created Allied to enhance capital access for startups in Western Canada while providing local investors with opportunities to invest in high-growth startups from established VC markets. This dual approach supports innovation in our local region and connects investors with the potential for significant returns they would not otherwise have access to.

Throughout 2025, Phase Two continued as planned. We successfully added another Canadian company to our portfolio, maintaining our commitment to integrate 1-2 Canadian opportunities each year. Given that our primary focus encompasses both Canada and the US, it's natural that most of our dealflow originates from a US market ten times larger than Canada. Nevertheless, I remain committed to this geographic balance and have several promising Canadian opportunities in our pipeline for 2026.

Phase Three: The Long-Term Vision Remains Unchanged

My long-term vision for Allied as a venture firm remains clear and unwavering: a series of early-stage venture funds that strategically co-invest alongside the syndicate, empowering us to support companies at various stages while building meaningful ownership in our top-performing companies throughout follow-on rounds.

However, as I've shared in previous letters, successfully raising and launching a new VC fund is extraordinarily time-consuming—averaging 18-24 months compared to the 3-5 months it takes founders to close a round. To execute this properly while maintaining our investment standards, I would need to secure a general partner to help divide responsibilities.

Until the right partner materializes—someone who shares our values, understands our thesis, and can help elevate the platform—the syndicate model remains the most efficient and effective way to achieve my core objectives:

Support great founders

Continue deploying capital

Return many multiples to LPs

The 2025-2026 vintage continues to present exceptional opportunities for disciplined early-stage investors. Given the persistent valuation arbitrage between AI hype and fundamental-driven companies, combined with the structural challenges facing undisciplined 2021-vintage companies, I believe pausing syndicate activities to raise a VC fund would mean missing one of the most compelling investment environments we've seen in decades.

Ultimately, my responsibility is to our founders and limited partners—and the syndicate structure allows me to fulfill that mission without compromise.

What's Next for 2026

Looking ahead, my focus remains consistent with the disciplined approach that has served us well over the past five years.

Investment Pacing & Portfolio Construction

My goal remains to add 4-6 new companies to the Allied portfolio each year while strategically participating in follow-on opportunities among our existing portfolio companies. This measured pace allows us to:

Maintain our rigorous 3-6 week diligence process

Remain mindful of vintage diversification

Preserve capacity to support founders when they need it most

Avoid spreading ourselves too thin across too many companies

I believe in focus and discipline regarding portfolio construction—quality over quantity, conviction over consensus. As we've demonstrated throughout 2025, our ability to achieve notable markups of 2x, 10x, and 50x within 36 months validates our approach of finding unique opportunities others have overlooked, then doubling down as they break out.

Market Positioning for 2026

As AI valuations continue to diverge from fundamentals and the venture market operates as two separate ecosystems, our strategy becomes increasingly clear:

Focus on infrastructure and platform plays rather than application-layer tools

Back founders with deep domain expertise, solving validated problems with proven customers

Maintain disciplined entry prices and ownership targets regardless of market froth

Support companies strategically incorporating AI to enhance growth and margins

Continue building meaningful ownership positions in our top-performing companies

The market will inevitably consolidate. Companies building genuine moats through proprietary data, network effects, and platform strategies will emerge as category leaders. Our job is to identify and support these companies early, then help them navigate the journey to becoming foundational businesses in their respective markets.

The Path Ahead

As we enter our sixth year, I'm more excited than ever about the opportunities ahead. The combination of normalized valuations outside the AI bubble, increased operational efficiency enabling capital-efficient growth, and high-quality founders solving real problems creates an exceptionally compelling environment for early-stage technology investors.

I remain committed to operating Allied with the diligence and discipline of a top-tier VC firm while maintaining the agility and flexibility that makes us attractive to both founders and investors. This balanced approach—thesis-driven yet opportunistic, concentrated yet diversified, patient yet decisive—will continue to guide our investment decisions in 2026 and beyond.

We have several exciting prospects in our pipeline, and I look forward to sharing more details with you in the weeks and months ahead.

************

Thank you, Founders, Investors, and Partners, for your continued trust and support throughout 2025. As we celebrate five years of Allied Venture Partners, I'm deeply grateful for the community we've built and optimistic about the opportunities ahead.

Please feel free to connect with me on LinkedIn, X, or by email. I'm always happy to discuss startups, fundraising, and everything in between.

Sincerely,

--

Matt Wilson

Founder & Managing Director | Allied Venture Partners