Investing in SHARE

The following excerpt is from Allied’s original deal memo to investors. To review investment opportunities in full, please consider joining the syndicate at Allied.vc/join

The American housing market is the largest asset class globally, valued at more than $36T, while the single-family rental (SFR) portion of this market is valued at approximately $2.3T.

However, while real estate and rental properties have been a fundamental holding among investor portfolios for generations, most people are still prevented from participating in the asset class due to the high costs and lengthy sales cycles.

With software and technology development, we believe we are now at a critical inflection point where more people can begin participating in the SFR asset class thanks to lower fees and the disruption of traditional gatekeepers.

Therefore, when we met Andrew and discovered his team's mission to enable a completely digital way to build a portfolio of fully managed, cash-flowing rental homes, we were instantly attracted to the sheer size of the opportunity.

Enter SHARE

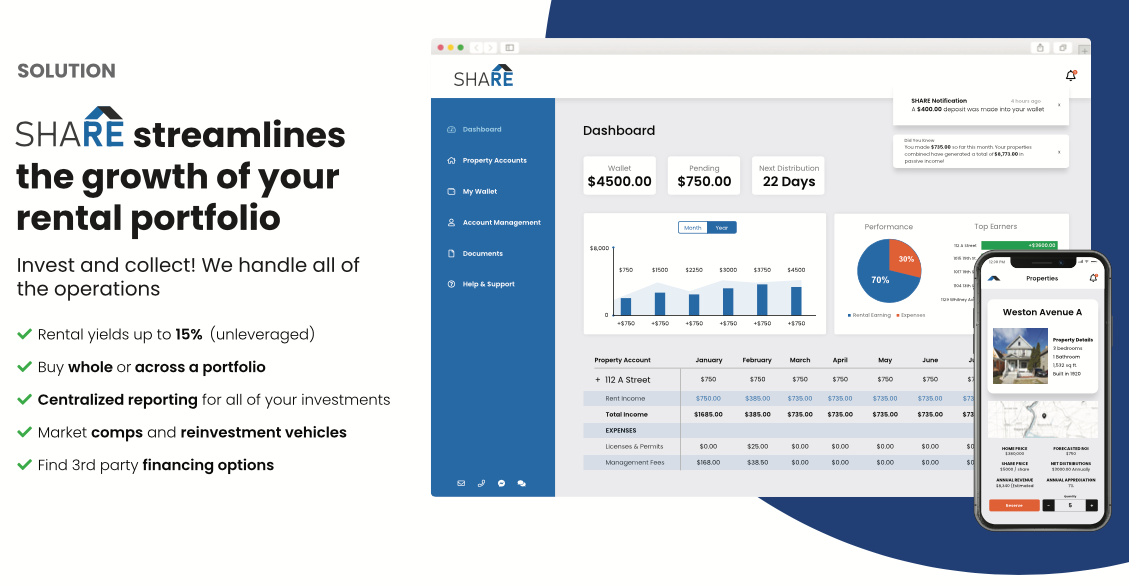

SHARE’s platform marketplace enables anyone to invest and buy an interest in single-family rental homes across the US in less than 48 hours.

By lowering the barrier to entry and providing a turnkey solution into real estate investing, SHARE allows investors to spread their capital across a portfolio of SFRs.

SHARE's unique ownership structure allows investors to enjoy the immediate benefits of being a hands-free landlord, with all the upside of predictable, consistent cash flow, yet without the time-consuming responsibilities of managing property and tenants.

How it works:

Browse through SHARE's fully-vetted online marketplace of properties.

Select the properties of interest and how many shares you wish to buy.

SHARE handles all aspects of the purchase, including ownership and closing documentation.

Using the SHARE platform, the historical process time of 5-6 months to find, inspect, prep, and rent a property is reduced to less than 48 hours. Once closed, investors receive quarterly cash/rental distributions along with any other benefits (i.e. expense write-offs, tax breaks, appreciation & depreciation) directly through their SHARE account.

Why we are thrilled to support Andrew and the team at SHARE

Here at Allied, we love opportunities where software and market forces converge to disrupt and enable access into large, rapidly expanding and antiquated target markets.

Led by a team of previously-exited venture-backed founders with more than 20+ years of combined real estate investing expertise, and having previously built a $500M ARR digital commerce business, the team at SHARE is incredibly well-positioned to capitalize on these converging market forces.

1) Converging market forces within a multi-trillion dollar asset class

Firstly, since the 2008 global financial crisis, there has been a housing shortage in the US due to a significant drop in housing starts, followed by a prolonged recovery over the past 14-years.

Source: Trading Economics

Although the apartment and condominium markets were quicker to recover, the construction of single-family homes has been running at the slowest pace since 1995. Coupled with a spike in demand from people seeking larger living spaces due to the global pandemic, this gap between supply and demand has widened over the past 2-years, pushing prices higher and pricing out many would-be first-time buyers.

As a result, we now have an estimated shortage of more than 5M homes across the US, and this problem is anticipated to worsen due to supply chain disruptions.

Second, due to dwindling supply and growing demand, single-family rents have grown at the fastest rate in more than 16 years, up 11.5% YoY in Q4'21.

Source: National Single-Family Rent Index YoY Percentage Change by Price Tier

Since demand outpaces supply, competition for SFRs has increased, driving up rents and accelerating home prices.

Third, millennials with children––who represent approximately 50% of all would-be homebuyers in the US––are more likely to rent than older generations (source: Pew Research Center).

We believe the desire among millennials to rent results from rising home prices, increased lending rates (as inflation moves higher), and a preference for flexibility.

When we combine these critical market forces, including the growing gap between supply and demand, increased borrowing costs, and a desire to rent, we consider single-family rentals a very attractive option for investors seeking long-term capital appreciation and cash flow.

2) Founding team with deep domain expertise and the ability to execute

The team at SHARE are a diverse group of technical individuals with expertise in e-commerce, marketplaces, operations and real estate, including a prior successful exit backed by Tier-1 investors.

Co-Founder and CEO Andrew Kim has worked in the e-commerce and marketing industries for the past 15 years. His previous video commerce startup was backed by tier-1 investors Greycroft and Accel before getting acquired after just 14 months.

Following the acquisition, Andrew moved back to Toronto where he was offered the role of Head of Digital Operations at Loblaws––one of Canada's largest retailers with a $33B market cap. In just 4 years, Andrew grew his division from $0 to $500M ARR. Andrew has also spent the past 8+ years successfully investing in real estate across North America.

Rounding out the core team is Senior Software Engineer and Head of Engineering Brandon Sam Soon and Head of Revenue Carmen Da Silva, bringing over a decade of experience across software development, estate planning, and real estate investing.

Andrew has also attracted a talented group of investors and advisors that includes the CEO of Side (a $2.5B real estate technology company backed by 8VC, Coatue and Tiger Global); the CEO of Kijiji & eBay Canada; and the founder of an international SFR investment and management company with more than 1.5k homes under management.

These are the types of talented and proven entrepreneurs we love backing, and for these reasons, we believe the SHARE team are the absolute best people to build this.

Certain information contained in this post has been obtained from third-party sources, including from portfolio companies of Allied Venture Partners. While taken from sources believed to be reliable, AlliedVP has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; AlliedVP has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by AlliedVP. (An offering to invest in an AlliedVP fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by AlliedVP, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.