Investing in Vint

The following excerpt is from Allied’s original deal memo to investors. To review investment opportunities in full, please consider joining the syndicate at Allied.vc/join

In recent years, demand for alternative assets has grown exponentially among investors seeking diversification and increased alpha. Furthermore, while much of the attention has focused on emerging asset classes such as cryptocurrency and NFTs, other alternatives, like art, antiquities and fine wine, have been a common component of high-net-worth portfolios for decades.

However, what has changed in recent years is the commercialization and democratization of access to these alternative assets, making them far more accessible to a much larger number of people, thanks to relaxed regulations coupled with the rapid evolution of financial technology.

As a result of these converging market forces, we believe the why now timing is optimal for asymmetric demand and adoption as a growing wave of investors seek to include alternative assets as a fundamental component of portfolios.

Enter Vint

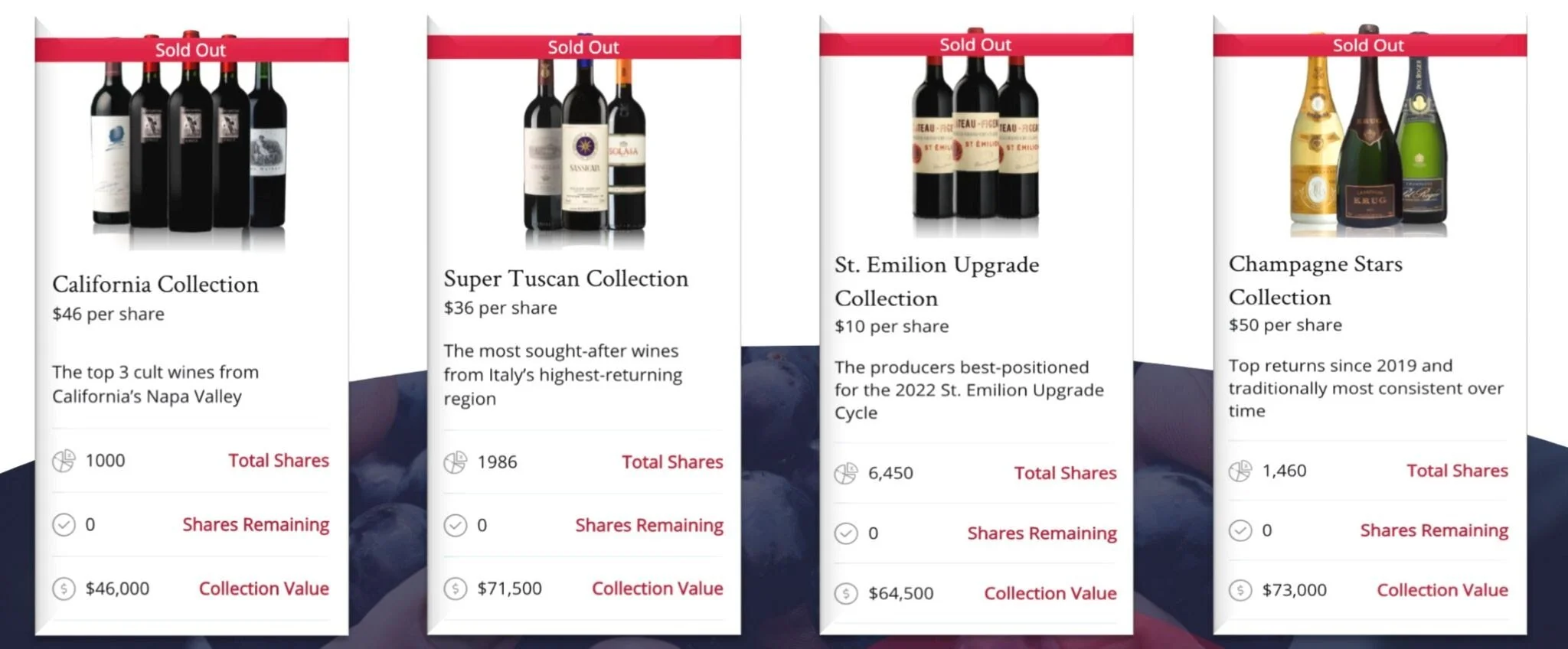

Vint is a financial platform that allows investors to buy shares in collections of fine wine, spirits, and other similar offerings.

Sourced by an investment committee of Certified Sommeliers & Master’s of Wine, in combination with their proprietary data sets and fundamental pricing analysis, Vint selects high-value collections of wine from across Europe and North America, which they believe have a high probability of appreciating in value over the ensuing 3-7 years.

Each wine collection is set up as an individual LLC and is qualified by the SEC as a Regulation A+ offering. Once approved, investors can purchase shares in the collection through the Vint platform, giving them ownership in the LLC, which owns the underlying bottles.

Most notably, thanks to Vint’s unique SEC qualification, accredited and non-accredited investors can participate through the Vint platform with average share prices of less than $50, and with each investment being IRA eligible – something its competitors do not have. The wine collection is then stored in Vint’s fully licensed, insured and professionally managed wine storage facility.

After 3-7 years, once the Vint investment committee has determined the collection has reached optimal value, the collection is sold and gains are distributed to participating investors.

Led by a team with deep domain expertise, including a financial co-founder, technical co-founder, product designer, Certified Sommelier and Masters of Wine, this impressive team has shown the unwavering ability to execute while maintaining capital efficiency.

Why we are thrilled to support Nick and the team at Vint

When it comes to startups, we know timing followed by team & execution are the two largest predictors of success (source: IdeaLab). As a result, these factors have been baked into our investment thesis from day one, and we are constantly on the lookout for superior teams at the convergence of multi-billion dollar market opportunities.

As it pertains to timing, it goes without saying that investor appetite for alternative assets is one of the most in-demand and rapidly expanding asset classes; facilitated by ongoing advancements in financial technology which provide greater transparency and accessibility to a much wider group of investors.

Regarding team & execution, Vint’s proven ability to continuously execute and achieve milestones is some of what we consider to be the most impressive we’ve seen from any early-stage company in recent years.

For example, at the end of 2020, Vint had yet to launch their product, acquire customers or raise money from institutional investors. Vint has since:

succeeded through an intensive 8-month SEC qualification process,

built and launched a fully functional & scalable investment platform,

attracted thousands of investors to the platform,

signed strategic partnerships agreements with AltoIRA and Vincent (among others),

onboarded their first institutional hedge fund, and;

has continued to surpass every monthly and quarterly milestone the team has set out to achieve.

All with a team of only four people and having never raised institutional capital.

Therefore, we were thrilled when we met the exceptional team at Vint and were given the opportunity to support their innovative mission to democratize access to such a rapidly expanding market.

1) Timing: Increasing Demand + Rapid Technological Adoption = Massive Market Opportunityy

As highlighted above, Fintech is one of the fastest-growing technology sectors worldwide, with innovation occurring across every vertical of the industry.

Among these fintech verticals, two of the most rapidly expanding include Digital Capital Raising and WealthTech. Specifically, the ability to raise capital from investors through a digital online platform while providing investors with unprecedented access to new asset classes outside of the traditional banking model.

While cryptocurrency and NFTs have received much of the spotlight in recent years, we continue to see massive growth and adoption across a growing list of alternative assets, such as art (Masterworks), vintage automobiles & collectibles (Rally), venture capital (AngelList, Republic), real estate (Yieldstreet), and others.

Moreover, this significant growth is expected to continue across all alternative asset classes thanks to an ever-improving regulatory environment coupled with technological innovation; resulting in greater transparency, credibility, and expansion of the overall market (i.e. the loosening of accreditation rules).

As such, the global alternative asset market is projected to expand by 60% to more than $17T by 2025, with the global wine market representing more than $400B of this trend (expanding to nearly $700B over the same time period).

Source: Grand View Research

Furthermore, while wine investing has long been viewed as a hobby among the wealthy, it’s surprising to learn that fine wine has outperformed the S&P 500 over the past 20-years, up 270% vs. 259%, respectively (source: Liv Ex).

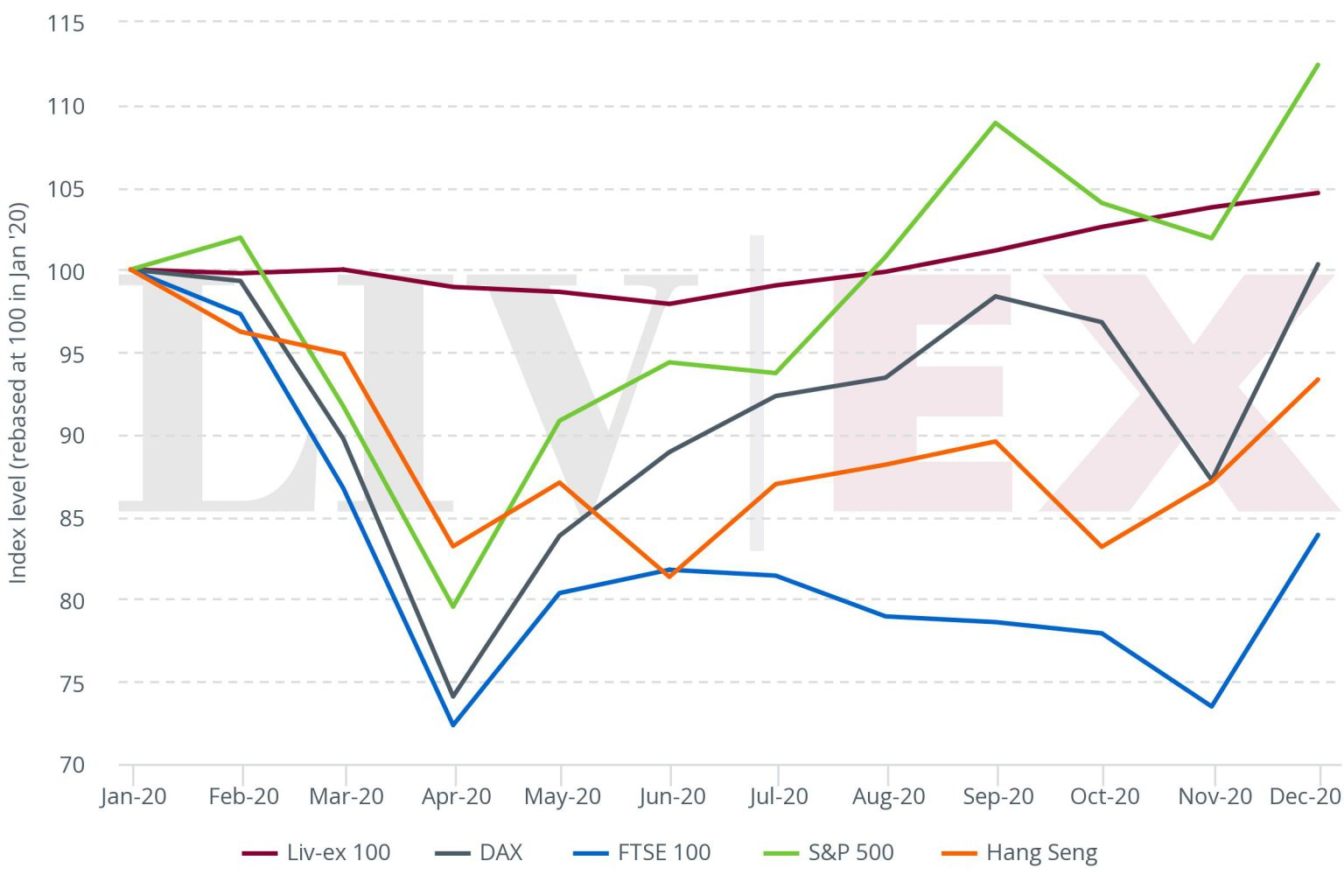

Most interestingly, fine wine has proven to be a very attractive portfolio diversification strategy, providing considerable stability and insulation against public market volatility.

For example, during the 2008 financial crisis, the S&P 500 fell nearly 40%, yet the Liv-ex 1000 Fine Wine Index fell less than 1%. Most recently, in March 2020, the S&P 500 fell more than 23% due to the global pandemic, while the Liv-ex 1000 fell just 4%.

Source: Liv Ex

Wealthy investors have been using fine wine for decades as a means of portfolio diversification, increased alpha, and protection from stock market volatility. Now, thanks to improvements in technology coupled with increasing demand for alternative assets, Vint is strategically positioned to ride this wave by commercializing and democratizing access to this high-value asset class.

2) Team: Proven Ability to Execute & Deep Domaine Expertise

As highlighted, the founding team at Vint is incredibly well-rounded, with strong domain expertise and highly complementary skill sets.

Aside from their financial, technical, product and marketing acumen (i.e. ex-Capital One & Vayner Media), the team has surrounded themselves with an investment committee comprised of Certified Sommeliers along with numerous Master’s of Wine – the highest level of wine qualification, of which there are only 419 members globally.

Most notably, every time the team has faced a challenge or roadblock (such as SEC qualification, generating repeatable & scalable revenue, and finding investors), they have surpassed expectations, showing exceptional grit, resilience, leadership and the ability to execute.

In fact, after flying to New York to pitch a prospective lead investor, Vint Co-Founder & CEO Nick King was interrupted mid-pitch by the building’s fire alarm. As everyone vacated the building and all seemed lost, Nick continued his pitch for the next 45-minutes on a New York City sidewalk, ultimately closing the deal and landing their lead investor.

Without hesitation, Nick and the team are the types of talented, resilient and driven entrepreneurs we love backing.

IN SUMMARY, we are investing based on the team’s proven ability to execute its mission and continue capturing marketshare within the rapidly expanding alternative asset market.

***

Certain information contained in this post has been obtained from third-party sources, including from portfolio companies of Allied Venture Partners. While taken from sources believed to be reliable, AlliedVP has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; AlliedVP has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by AlliedVP. (An offering to invest in an AlliedVP fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by AlliedVP, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.