Startup Pitch Deck Checklist: 12 Must-Have Slides

Your pitch deck is your startup's first impression with investors, and you only have 2–5 minutes to grab their attention. Here's a quick checklist of the 12 essential slides every pitch deck needs to tell a clear, compelling story:

Title Slide: Introduce your company name, logo, tagline, and contact details. Make it clean and professional.

Problem Statement: Define the real-world problem you're solving with data and customer pain points.

Solution Overview: Show how your product or service addresses the problem effectively.

Why Now: Explain market trends, timing, and why this is the perfect moment for your idea.

Market Opportunity: Highlight the size of your Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

Product Architecture: Demonstrate how your product works and its scalability.

Revenue Model: Outline how you make money, including pricing strategies and revenue streams.

Go-To-Market Strategy: Share your plan for acquiring and retaining customers, including key marketing channels.

Competitive Landscape: Show how you stand out with a 2x2 matrix or other comparisons.

Traction: Provide evidence of progress (e.g., user growth, revenue, partnerships).

Financial Projections: Present realistic revenue, expenses, and growth forecasts.

Team: Highlight the experience and skills of your team and advisors.

Quick Tip: Investors want clarity and focus. Use visuals like headlines, charts, graphs, and timelines to make your data easy to digest. Keep your slides simple and concise.

This checklist ensures your pitch deck covers everything an investor needs to see, from the problem you're solving to your financial plan and team. Ready to build yours? Let’s dive into the details.

Which Slides Should Be in a Pitch Deck?

1. Title Slide: Make a Strong First Impression

You have just 7 seconds to grab an investor's attention [1]. That’s why your title slide needs to immediately convey who you are. This first impression is crucial - it establishes your brand’s credibility and sets the stage for your pitch.

Every element on this slide matters. From the placement of your logo to the choice of fonts, everything should reflect professionalism. Since investors sift through countless pitch decks, your title slide must stand out while maintaining a clean, polished look.

Company Information

Make your company name and logo the focal point of the slide. If you have a tagline that clearly defines what your business does, include it. For example, Airbnb’s title slide features their logo, company name, and the tagline: “Book rooms with locals, rather than hotels” [2]. In just a glance, it communicates the essence of their business.

Add concise contact information such as your name, title, email, phone number, and the presentation date [1]. Opt for high-resolution visuals that are directly relevant to your business. Avoid generic stock photos - they can dilute the uniqueness of your brand.

Once you’ve established your brand identity, move on to presenting your value proposition.

Clear Value Proposition

Your value proposition is the hook that makes investors want to know more. In 8-12 words, summarize what your business does and why it matters [2]. Think of it as the headline that draws them into the rest of your pitch - not the full story, just the teaser.

For instance, companies like Testlify and MergerAI use concise, impactful value propositions to address real-world problems [3]. A strong value statement sets the stage for discussing the problem you’re solving in the next slide.

2. Problem Statement: Define the Opportunity

Explain why your startup exists. This is your chance to connect with investors by presenting a real problem that impacts people’s lives. By outlining the problem clearly, you highlight the market opportunity your solution aims to address. Dive into the specific customer pain points that make this issue real and pressing.

Customer Pain Points

Start by sharing a story that shows how this problem disrupts people’s daily lives. Real-life examples make the issue relatable and highlight its impact.

Customer pain points are the specific frustrations or obstacles people face that create inefficiencies or dissatisfaction [4]. Identifying these pain points is critical to designing a solution that truly matters.

Take, for instance, the experience of BlackBerry Storm users. They dealt with unresponsive touchscreens and glitchy software, leading to widespread frustration, high return rates, and long-term damage to BlackBerry’s reputation [7]. Similarly, Ticketmaster customers frequently encounter hidden fees and unexpected charges during checkout, leaving them feeling misled and annoyed [7].

By making these pain points personal and specific, you emphasize the urgency of finding a solution. To strengthen your argument, back up these examples with data that validates the problem.

Market Gap and Supporting Data

After establishing an emotional connection, reinforce your claims with solid data. Numbers provide credibility and help illustrate the size of the market opportunity.

Consider this: 42% of startups fail because they create products that nobody wants [5][6]. This highlights how crucial it is to address real problems that people experience. Additionally, startups that ignore customer feedback are 86% more likely to fail [5].

As Aytekin Tank, Founder and CEO of Jotform, aptly states:

"Solving pain points isn't just a path to business success - it's the foundation." [9]

Recognizing these gaps helps set the stage for your solution. History shows that identifying and addressing market gaps can lead to massive success. In the early 2000s, Blockbuster ignored customer frustrations with physical store locations and late fees. Netflix stepped in with a solution centered on convenience and fair pricing, which ultimately led to Blockbuster’s decline [8][4].

Use reliable sources like industry reports, surveys, and market research to quantify the problem’s scope. Combining insights from customer interviews and competitor analysis demonstrates a thorough understanding of the issue and the market dynamics.

Ground your findings in real customer behavior. As Julia Austin from Harvard Business School explains:

"While gut feel or personal experience with a problem can be a strong signal there is a problem to solve, without proper product discovery work you won't truly know if you have a winning solution." [9]

3. Solution Overview: Your Product's Value

Explain how your product bridges the market gap and provides meaningful value to users.

As Stéphane Nasser puts it:

"The product slide is your opportunity to showcase what you've built and how it works." [11]

Focus on how your product enhances user experiences in measurable ways. Instead of overwhelming investors with a laundry list of features, emphasize the benefits and outcomes your product delivers.

Product Demonstration

Demonstrate your product using mockups, screenshots, or interactive examples. This approach makes it easier for investors to grasp its functionality and the user experience it provides.

Take inspiration from companies that have nailed their product demos. Dropbox, for instance, tackled the challenge of explaining cloud storage - a relatively new concept at the time - by showcasing seamless file synchronization. This simple yet effective demo quickly conveyed the product's value. Similarly, Slack used its demo to highlight an intuitive interface, smooth app integrations, and powerful search capabilities, making it stand out in a crowded market. Oculus Rift took a different route, wowing audiences with an immersive demo that showcased the potential of virtual reality, which eventually led to its acquisition by Facebook. [12]

Use real-world scenarios to show how your product addresses specific problems. For example, a demo could illustrate how users interact with your app or software. For service-based solutions, visuals and icons can help explain abstract concepts.

Once you've demonstrated your product in action, transition to discussing the standout features that drive its value.

Key Features and Benefits

Zero in on 2–3 standout features that set your product apart. Features explain what your product is, while benefits highlight what it does for users. As Ben Worsley explains:

"Features refer to the physical characteristics of a product or service, whereas benefits are the results that customers receive when using it." [10]

Show how your product improves lives or outpaces competitors. Unique features can grab investors’ attention, enhance customer satisfaction, and give you an edge in the market.

Whenever possible, back up your claims with numbers. Demonstrating measurable improvements - like increased efficiency, cost reductions, or higher user satisfaction - builds credibility and helps investors see the tangible value your product brings.

4. Why Now: Market Timing and Trends

Timing can make or break a startup. Your "Why Now" slide needs to show why the market is primed for your solution. This is where you prove that current conditions create the perfect opportunity for your idea to take off. Experts suggest startups are no longer just following trends - they’re setting them[13].

Market Dynamics

Focus on the forces reshaping your industry. Changes in regulations, advances in technology, and shifts in consumer behavior are opening doors that weren’t there before.

Artificial Intelligence is reshaping industries. The global AI market is projected to grow at a staggering 30% annually from 2024 to 2030[13]. GitHub's Copilot, for example, now writes 40% of the code in files where it’s used[14]. Startups leveraging AI are positioned for rapid adoption.

Decentralized finance is redefining financial services. The DeFi market is expected to grow by nearly 11% annually between 2024 and 2029[13]. With consumers demanding more control over their finances, startups offering blockchain-based payment systems, lending platforms, or investment tools have a golden opportunity.

Supply chain disruptions are forcing innovation. From geopolitical tensions to climate-related events, companies are rethinking logistics and manufacturing. Startups focusing on AI-driven logistics, localized manufacturing, or blockchain-based supply chain tracking are addressing urgent needs.

Consumer expectations have evolved. People now want hyper-personalized, ethical, and sustainable experiences. The subscription economy is estimated to be worth $3 trillion, with 86% of U.S. consumers subscribing to services[15]. Meanwhile, social commerce sales are expected to hit nearly $3 trillion by 2026[16]. Startups delivering personalized, on-demand solutions are meeting these expectations head-on.

Sustainability is no longer optional. The global climate tech market is projected to grow at about 25% annually through 2033[13]. Consumers are showing their priorities: they’re willing to pay nearly 10% more for sustainable products, and 30% have stopped supporting brands over ethical concerns[15]. Environmental responsibility is becoming a clear competitive edge.

These trends are creating fertile ground for startups to thrive. Let’s take a look at how recent events have accelerated this momentum.

Historical Context

The past few years have seen transformative shifts across industries, many of which have accelerated due to external pressures.

Healthcare has embraced rapid digital transformation. In early 2021, T-Mobile’s 5G rollout at a Miami hospital allowed healthcare providers to access data-intensive records from anywhere[14]. The pandemic fast-tracked the adoption of health tech, creating ongoing demand for innovative solutions.

Hybrid work is reshaping industries. A global shortage of IT skills could cost businesses $5.5 trillion in lost revenue by 2026[17]. Startups addressing workforce challenges with talent marketplaces, collaboration tools, or fractional employment solutions are well-positioned to capitalize on this shift.

AI adoption is hitting its stride. In 2025, Camping World’s AI system boosted customer engagement by 40% and reduced call wait times to just 33 seconds[14]. Syntegra, on the other hand, uses AI to generate synthetic patient data that’s statistically as accurate as real data[14]. These examples show how AI is moving from experimental to essential.

Consumer behavior has permanently shifted. In 2022, Duolingo’s metaverse debut in the Duolingo Game Hub attracted over 9 million visits in just a few weeks, with users spending a collective 41 million minutes on the platform[14]. This highlights the growing appetite for innovative digital experiences.

These examples underscore the importance of acting now. The market conditions and consumer behaviors shaping today’s landscape won’t wait forever.

5. Market Opportunity: Total Addressable Market

Your market opportunity slide needs to highlight the revenue potential of your startup. This is where you show the scale of the opportunity you're chasing. To make it clear, break down your market potential into TAM, SAM, and SOM, laying out your approach step by step.

"Our objective always was to build big companies. If you don't attack a big market, it's highly unlikely you're ever going to build a big company." – Don Valentine (Sequoia Capital) [20]

This is your chance to prove you've done the research - demonstrating not only the size of the opportunity but also how you plan to execute within it.

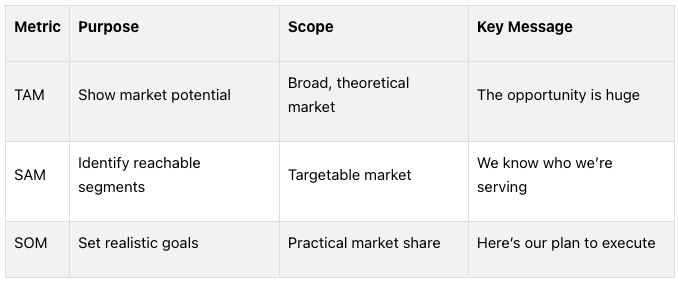

TAM vs. SAM vs. SOM

Breaking your market into these three layers helps investors understand the big picture while seeing how you plan to tackle it.

Total Addressable Market (TAM): This is the largest possible revenue opportunity if you captured 100% of the market. For example, Airbnb calculated its TAM to be $3.4 trillion, which included $1.8 trillion for short-term stays, $210 billion for longer-term stays, and $1.4 trillion for experiences [18].

Serviceable Available Market (SAM): This narrows the focus to the portion of the market you can realistically target based on your business model and geographic reach. Airbnb estimated their SAM at $1.5 trillion [18].

Serviceable Obtainable Market (SOM): This is the slice of the SAM you realistically expect to capture in the next 3 to 5 years, reflecting your go-to-market strategy and goals.

How to Calculate TAM

There are three main methods to calculate TAM:

Top-down: Start with broad industry data and narrow it to your specific target segment – less accurate.

Bottom-up: Use real customer data and insights. For instance, in 2023, a London-based graduate recruitment agency sent newsletters to local universities and received 25,000 sign-ups. With a fixed fee of $130 per recruited individual (converted from £100), they estimated a total revenue opportunity of $3,250,000 [19].

Value theory: Estimate the value your product or service creates and how much of that value you can capture.

"The most successful companies make the core progression - to first dominate a specific niche and then scale to adjacent markets - a part of their founding narrative." – Peter Thiel, Zero to One [18]

Your SAM should reflect insights into your target audience, including their buying behaviors and market trends. SOM, on the other hand, must connect directly to your customer acquisition strategies, conversion rates, and key growth milestones.

Charts and Graphs

Visuals are essential for communicating market data quickly and effectively. Research shows that visuals are processed 60,000 times faster than text, making them critical for your pitch [22]. Choose the right type of chart to back up your narrative:

Area charts: Great for showing the size and segmentation of your TAM. Openfin used this method to highlight the scale of their opportunity.

Bar graphs: Perfect for comparing market sizes over time. Front’s pitch deck combined a bar graph to show quarterly revenue growth with a line overlay for market penetration.

Line graphs: Useful for illustrating trends, such as Coinbase’s use of a line graph to show rapid platform signups.

Stacked charts: Ideal for breaking down revenue by customer segments, as seen in Mattermark’s example.

Pie charts: Best for showing market share distribution when kept simple. Atomwise used a pie chart to depict the diversification of its projects across different applications [21].

Keep your visuals clean, on-brand, and focused on the most critical data points. Use bold colors or callout boxes to emphasize key insights. These visuals should seamlessly complement the data and strategy you’ve laid out.

"I don't know how to write a business plan, but I know how to read them. You start at the back, and if the numbers are big, we look at the front." – Tom Perkins (Kleiner Perkins) [20]

Before finalizing this section, get feedback from peers, mentors, or industry experts. Their input can help sharpen your analysis and ensure your projections are both credible and impactful. Investors have seen countless market opportunity slides - yours needs to stand out by showing real understanding, not just flashy numbers.

6. Product Architecture: How Your Solution Works

Your product architecture slide should clearly showcase that you've built a system capable of scaling as your business grows. Skip the heavy technical jargon - focus instead on demonstrating that your system is designed to handle growth and withstand competitive pressures.

Investors are particularly interested in whether your technology can grow without breaking. For instance, 78% of startups that experienced rapid growth identified architecture limitations as their primary technical hurdle [26]. Poor planning in this area can quickly become a bottleneck, so it's crucial to address it upfront.

Technical Overview

Your technology stack forms the backbone of your product. It’s the combination of software, frameworks, and tools that make everything run [24]. Break this down into digestible pieces so investors can easily follow along.

Start with the big picture: describe the front-end, back-end, database, and cloud services [23][24]. Share why you chose each component. For example, you might explain opting for PostgreSQL over MongoDB because it supports complex queries, or adopting a microservices architecture for its scalability.

"Much like a great UI is designed for optimal user experience, a great API is designed for optimal consumer experience." - Uri Sarid, CTO of Mulesoft [25]

Highlight how your system handles growth. For instance, explain how you scale by adding servers during traffic surges or efficiently processing larger data volumes. This matters because 82% of developers consider scalability a key factor in API design [27].

Real-world examples help. One e-commerce client transitioned a 2TB database to a sharded architecture in just six weeks with zero downtime, enabling them to handle 30,000 queries per second [26]. Another SaaS client cut infrastructure costs by 42% after migrating to Kubernetes, boosting resource utilization from 30% to 78% [26].

Reliability is just as critical. With 94% of enterprises experiencing downtime due to infrastructure failures in 2023 [26], investors will want to know you’ve got safeguards like monitoring systems, automated deployments, and backup plans. Share specific performance metrics, such as API response times or uptime percentages, to reinforce the reliability of your system.

Once you’ve established that your technology is scalable and reliable, shift focus to what makes it stand out.

Proprietary Elements

What sets your technology apart? This is where you highlight the unique and defensible aspects of your system - your secret sauce.

If you have patents, trade secrets, or unique algorithms, this is the time to showcase them. These proprietary elements can provide a significant competitive edge. Keep in mind that 90% of startups fail, often because they’re outpaced technologically [30].

Take inspiration from companies like Apple, whose iPhone patents helped secure market leadership, or Amazon, which reduced operating costs through innovations like warehouse robots and delivery drones [29]. Qualcomm’s success, built on technology licensing, is another great example.

Your proprietary elements might include:

Unique algorithms that process data more efficiently or accurately.

Custom integrations that connect systems in a way competitors can’t easily replicate.

Specialized databases tailored to your specific needs.

Machine learning models trained on exclusive datasets.

Explain the business impact of these innovations. Do they lower costs, boost performance, or create barriers that make it harder for competitors to enter your space? Whenever possible, back these claims with numbers.

Finally, ensure your intellectual property is well-documented. Keep detailed records of your development process and invention timeline. When working with outside partners, use non-disclosure agreements [29]. These actions not only protect your innovations but also show investors you understand their value.

Your goal here is to demonstrate that your system is scalable, dependable, and uniquely positioned to give you a competitive edge - all without overwhelming your audience with excessive technical details.

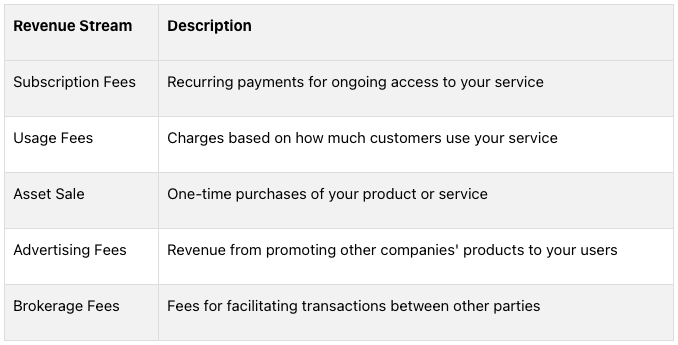

7. Revenue Model: How You Generate Income

This section is all about showing how you turn your product's value into a reliable income stream. Your revenue slide needs to clearly demonstrate how your business can grow and diversify its income sources. Investors want to see that you grasp the distinction between a broader revenue model and individual revenue streams. As Alex Genadinik puts it:

"A revenue model is the strategy of managing a company's revenue streams and the resources required for each revenue stream" [33].

This means your slide should reflect strategic thinking, showing how your pricing approach supports a scalable revenue model.

The most successful companies don't rely on just one source of income. Take Amazon, for example - they generate revenue through e-commerce, Amazon Web Services (AWS), and subscription services like Amazon Prime [32]. Similarly, Microsoft earns through productivity tools (like Microsoft Office and LinkedIn), cloud services (Azure), and personal computing (Windows licenses and gaming) [32]. This kind of diversification not only boosts growth but also reduces financial risks.

Monetization Strategy

Your monetization strategy should align with how customers interact with your product. With the rapid evolution of technology, pricing models are shifting. Usage-based pricing now accounts for 20% of SaaS companies, and 77% of the largest software companies have adopted some form of it [38][39].

When deciding on a pricing model, think about how your product delivers value. For AI-powered tools, hybrid pricing - combining fixed fees with usage-based elements - has become popular. Many companies now offer AI credits or paywalls that provide basic access, with extra usage billed separately [35].

Examples of hybrid models include Dollar Shave Club, which primarily relies on subscriptions but also sells products individually through their e-commerce store [31]. Duolingo, on the other hand, generates revenue from ads in its free app while offering a paid subscription option [31]. These approaches allow for multiple revenue streams, giving businesses flexibility and stability.

If you're building a mobile-first product, consider this: in-app purchases make up 48.2% of mobile app earnings, compared to 14% from ad revenue and 37.8% from paid app downloads [37]. These numbers can help shape your strategy.

Your pricing should reflect the value your product offers, not just your costs. As Oliver Banks wisely points out:

"Only one company can be the cheapest - everyone else in that race is a loser" [36].

Adopt value-based pricing that highlights the benefits your product brings to customers.

Here are some common types of revenue streams you might consider:

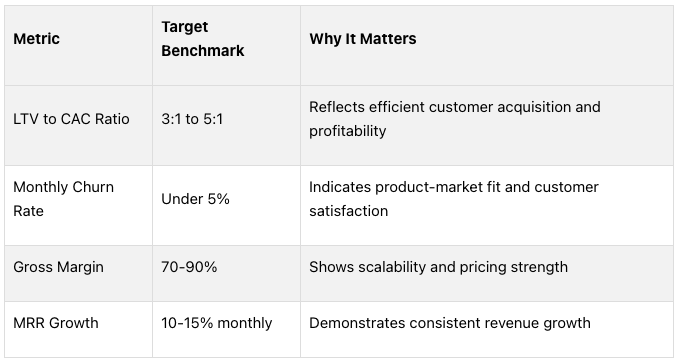

Financial Metrics

Investors are looking for metrics that prove your revenue model is both healthy and scalable. For example, they often want to see a lifetime value (LTV) to customer acquisition cost (CAC) ratio of at least 3:1 or 5:1 [40]. This means the value you gain from a customer should be three to five times higher than the cost of acquiring them.

For SaaS startups, monthly recurring revenue (MRR) growth of 10–15% or more is excellent in the early stages [40]. Investors also expect to see monthly churn rates under 5% and gross margins between 70–90% or higher [40]. Aiming for a customer lifetime of 36–48 months is another key benchmark [40].

If your numbers fall short, don't hide them. Instead, explain your plan to improve. For instance, 23% of startups have achieved accelerated growth through subscription-based monetization [34]. If subscriptions are part of your strategy, emphasize how they contribute to predictable revenue and customer retention.

To convince investors of your scalability, include key performance indicators like MRR, annual recurring revenue (ARR), CAC, and LTV. These metrics show how effectively you convert investment into sustainable growth.

Also, break down your unit economics. Highlight the cost to serve each customer, your gross profit per customer, and how these figures improve as your business scales. It's worth noting that 64% of Forbes' next billion-dollar startups use usage-based pricing, which naturally grows alongside customer success [39].

Finally, address seasonality in your revenue model. Explain how you manage cash flow during slower periods and how you maximize opportunities during peak seasons. Your financial projections should reflect an understanding of market dynamics, showing how your revenue model adapts to different customer segments and scales across varying conditions. This level of detail reassures investors that you're prepared to tackle the challenges of growth.

8. Go-To-Market Strategy: Customer Acquisition Plan

Once you've outlined your product and the market opportunity, it's time to dive into how you'll turn interest into paying customers. Your go-to-market strategy is where you show investors that you’ve got more than just a great idea - you’ve got a clear, actionable plan to get your product into the hands of your target audience. This part of your pitch should reflect a deep understanding of your market and how you’ll reach it effectively.

Startups that succeed often choose their marketing channels carefully. They focus on strategies that align with their goals, audience, and budget. A multi-channel approach is particularly effective, as it helps you reach more people while avoiding over-reliance on a single method [41][44]. These decisions form the backbone of a strong customer acquisition strategy.

As Rachel Whitehead, VP of Marketing at ChartMogul, puts it:

"Growth happens when your marketing and sales efforts focus on the same ideal customer profile (ICP), using strategies from both teams to attract and convert the best customers for the business" [45].

This alignment between marketing and sales is key to building a cohesive and effective acquisition plan.

Sales and Marketing Channels

It’s essential to focus on the channels where your target customers are already spending their time and making purchasing decisions. Commonly used channels for startups include content marketing, email marketing, SEO, social media marketing, and paid advertising [44].

SEO and email marketing stand out for their high return on investment. For instance, 97% of people use search engines to discover businesses [41], and in 2022, 61% of marketers prioritized improving SEO to boost their online presence [44]. Email marketing, meanwhile, delivers an average ROI of $36 for every $1 spent [44], making it one of the most cost-effective tools for both acquiring and retaining customers.

Paid advertising, such as display and retargeting ads, can improve conversions by as much as 70%, according to B2B marketing agency, Markivis. However, these channels require careful management to ensure they remain profitable.

Pro tip: Early-stage investors want to see that your company has market pull before you start investing in paid advertising (i.e., customers are demanding your solution because it addresses a significant and urgent pain point). A pitch deck that shows the Use of Funds, where the majority will be spent on Facebook or Google ads, is a big red flag for investors.

Your choice of channels should also depend on whether you’re targeting B2B or B2C customers. For example, B2B companies often focus on LinkedIn, direct sales, and industry publications. On the other hand, B2C businesses might lean more on social media, influencer partnerships, and consumer-focused advertising [source: Forbes].

Here’s how to approach channel selection strategically:

Define your ideal customer profile (ICP). Use real market research to build detailed personas, rather than relying on assumptions [41][43]. This will guide where and how you connect with your audience.

Study your competitors. Look at the channels they’re using heavily and identify gaps or underutilized opportunities where you can stand out [43].

Test systematically. Instead of trying every channel at once, start with 2-3 that seem most promising based on your research. Expand based on what delivers results.

Ensure consistent messaging. Your brand identity and value proposition should shine through across all channels [41][44]. Consistency builds trust and recognition as customers move through different touchpoints.

A balanced mix of paid and organic strategies is also important [47]. Paid channels can bring quick results, but organic tactics like SEO and content marketing provide long-term, sustainable growth.

Performance Metrics and ROI

Once you’ve chosen your channels, tracking their performance is non-negotiable. In a competitive market, efficiency is everything, and metrics will help you fine-tune your efforts.

Key metrics to track include Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), conversion rates, and time to conversion. For instance, the ideal LTV/CAC ratio for early-stage companies is 3:1 - meaning each customer should generate at least three times what it costs to acquire them [49]. Monitoring these metrics by channel, campaign, and customer segment will help you identify what’s working and where adjustments are needed [48].

Cohort analysis is another valuable tool. By grouping customers based on their acquisition date, you can track their behavior over time and assess whether the quality of your acquisitions is improving or declining [48]. Set up alerts for sudden shifts in metrics, like rising CAC or dropping conversion rates, so you can address issues quickly.

For example, a business might find that customers acquired through content marketing have a CLV of $800 with a CAC of $200, while those from paid ads have a CLV of $500 with a CAC of $300 [48]. This kind of data helps you allocate resources to the most profitable channels.

Referral programs can also be a game-changer. Referred customers often have a 37% higher retention rate and convert 30% better than leads from other sources [50]. Once you’ve built an initial customer base, these programs can offer a cost-effective way to scale.

Finally, use dashboards to track your marketing performance. Focus on metrics that directly drive growth - like CAC and CLV - rather than vanity metrics that might look good but don’t impact revenue. And remember, acquiring customers is just the start. Since it costs 5-25 times more to acquire a new customer than to retain an existing one [51], your strategy should also include plans for retention and expanding revenue from your current customer base.

9. Competitive Landscape: Your Market Position

This is your chance to show investors that you not only understand your market but also have a solid plan to stand out. The goal here is to demonstrate why your solution is uniquely equipped to tackle the problem you've identified.

As Brett Brohl explains:

"Your differentiation slide is not about listing features or bashing competitors. It's about telling a compelling story of why your solution is uniquely positioned to solve the problem you've identified" [52].

Instead of diving into a feature-by-feature breakdown, focus on how the market currently addresses the problem and highlight what sets your approach apart [52].

Market Comparison

A great way to illustrate your position is by using a 2x2 matrix. This simple yet effective tool helps investors quickly see where you stand compared to competitors by plotting companies along two key dimensions that matter most to your customers [53][57].

Choose your axes wisely. They should reflect the most critical factors for your market - think price versus quality, ease of use versus functionality, or speed versus accuracy. The idea is to show a space in the market where your startup either stands alone or faces minimal competition.

When mapping competitors, go beyond just direct rivals. Consider three categories:

Direct competitors: Companies offering similar products at comparable price points.

Comparators: Businesses providing similar solutions but differing in price or quality.

Alternatives: Solutions that address the same customer problem in entirely different ways [55].

Take the food delivery space as an example. DoorDash didn't just compete with other delivery apps; they analyzed the entire competitive landscape. By doing so, they claimed 65% of market traffic by 2024, proving their deep understanding of market positioning [54].

As your startup grows, focus on building a competitive edge that lasts. Temporary advantages, like being a first mover, won't hold up long-term. Show how your approach will stay relevant as you scale [52].

Competitive Advantages

Once you've visually established your position, outline the specific advantages that make your solution stand out. This is where you explain how your strengths address gaps left by competitors [57].

Start by revisiting the problem and how it's traditionally been solved. Then, make your case for why your solution is significantly better - think 10x better [52]. This approach helps investors grasp not just what you do differently, but why it matters.

For example, a cybersecurity startup in 2025 built its pitch around "real-time threat detection using AI." Third-party benchmarks confirmed their faster response times compared to competitors, leading to a 120% surge in enterprise contracts [56]. They didn’t just claim superiority - they backed it up with data.

Use data to strengthen your claims and address potential doubts. Analyze competitors’ keyword rankings, benchmark your strategies, and assess market share to understand growth opportunities [53]. This kind of research-driven approach sends a clear message to investors: you've done your homework.

Consider how Via, a transportation startup, used competitive analysis to pivot from a B2C model to B2B. Spotting increased competition in the consumer market, they shifted to a less crowded space and saw a 180% jump in B2B revenue by 2024 [56].

Present a balanced view of your competitors' strengths and weaknesses. This builds credibility with investors and shows you're confident in your position [59].

As Jack Welch, former CEO of General Electric, famously said:

"If you don't have a competitive advantage, don't compete." [58]

Your job is to clearly outline that advantage and connect it to your potential for market success. Let your analysis underscore your startup's growth potential [59].

10. Traction: Proof of Progress

Your traction slide is your chance to show investors that your startup isn't just an idea - it's a growing, scalable business. It’s all about presenting clear evidence of progress across different aspects of your company. Investors want to see that you’re building something sustainable and ready for the next level.

Key Milestones

Milestones are the story of where you’ve been and where you’re headed. They give investors a sense of your ability to plan, prioritize, and execute.

Focus on 2–3 major milestones that highlight your journey so far. These could include your founding date, launching your first prototype, landing a significant client, or hitting a revenue goal. For instance, Airbnb gained early investor confidence by showcasing milestones like acquiring 1,000 hosts and generating $200 per week in revenue [62].

Looking ahead, outline specific goals for the next 3, 6, and 12 months across areas like product development, marketing, hiring, or partnerships. Make sure to connect these milestones directly to how you’ll use the funding you’re seeking. Use bold text or visual callouts to emphasize milestones that matter most.

Keep your timeline grounded in reality. Investors are quick to spot overly ambitious projections, so stick to achievable goals. A simple timeline or roadmap graphic can help make your plan easy to follow. And don’t forget to include milestones that add credibility, like strategic partnerships, industry awards, or key hires that strengthen your team.

These milestones help prove that there’s real demand for what you’re building.

Customer Validation

Milestones are important, but customer validation is what truly shows market acceptance. It’s one of the strongest signals that your product has found its place.

Consider this: 74% of early-stage startups that secure angel funding have tangible results, and 87% of them succeed in acquiring their first customers [62]. That’s why presenting evidence of customer traction is critical.

Share metrics that tell your growth story. For example, a 300% jump in sign-ups, 90% monthly retention rates, or steady 20% month-over-month revenue growth all point to strong traction [61]. Testimonials and case studies can further illustrate your product’s impact. Take Slack, for instance - they launched a beta version and showcased impressive engagement metrics like daily active users and high retention rates. This strategy helped them attract millions of users and grow quickly [62].

Be upfront about challenges you’ve faced and how you’ve adapted. Investors respect founders who acknowledge obstacles and use feedback to refine their approach. Explaining how you’ve turned constructive criticism into actionable improvements shows resilience and a commitment to continuous growth.

"Market validation forces you to step back and rely on concrete data rather than personal biases. Investors appreciate this objectivity as it demonstrates your willingness to pivot if necessary, a crucial trait in business." - SlideGenius [60]

Use visuals like graphs or charts to bring your data to life. Show trends over time to highlight consistent growth - whether it’s website traffic, beta sign-ups, app downloads, or pre-order numbers. The goal is to paint a clear picture of increasing demand and user engagement.

Here’s a key stat to keep in mind: Startups with monthly revenue growth rates of 15–20% are seen as having strong traction, and those with high user retention are 60% more likely to secure Series A funding. Focus on the metrics that matter most for your specific stage and industry, and provide context by comparing your numbers to industry benchmarks.

11. Financial Projections: Growth Forecast

To convince investors of your startup's potential, you need to present clear and detailed financial projections. These forecasts are essential for demonstrating your company's viability by outlining expected revenue and expenses. Essentially, they help investors decide whether your business is financially sound and worth their backing [64].

Revenue and Expense Projections

Start with a detailed breakdown of revenue and expenses. Provide monthly projections for the first 18-24 months and annual estimates for the years that follow. Break down revenue by unit sales and price points - this shows you’ve done your homework on market trends and pricing strategies.

Investors focus on specific metrics to assess your business's health, such as:

Burn rate and runway (how long your cash will last)

Pro tip: Calculate your Burn Multiple.

Gross margin

Customer Acquisition Cost (CAC) compared to Lifetime Value (LTV)

Sales Cycle Length and New Customer Payback Period

Monthly Recurring Revenue (MRR) growth [65]

For SaaS startups, benchmarks are especially important. Investors typically expect 10-15% monthly MRR growth for early-stage companies and a monthly churn rate under 5% [40]. These figures signal strong performance and customer retention.

Your financial projections should include key elements such as:

Revenue projections

Cost of goods sold (COGS)

Operating expenses

Net profit or loss

Cash flow forecasts

Breakeven analysis

Relevant Key Performance Indicators (KPIs) [64]

Don’t forget to highlight your breakeven point and when you expect to achieve profitability. As Michael Burdick, Founder and Chief Strategy Officer of Paro, puts it:

"The north star of forecasting is to have predictability on your key drivers. If you have control and predictability on your inputs and outputs, you can make explicit strategic decisions about your company's direction." [64]

Investors also expect a 3:1 to 5:1 LTV to CAC ratio, meaning every customer should generate three to five times the revenue it costs to acquire them [40]. For SaaS startups, aim for gross margins between 70-90% to demonstrate strong unit economics [40].

While fixed expenses are relatively straightforward to predict, variable costs can be trickier since they fluctuate with sales. Be transparent about your assumptions and explain your calculations clearly [64].

Scenario Analysis

Uncertainty is a given in any business, and savvy investors want to see that you’ve planned for various possibilities. By presenting multiple scenarios, you show that you’re prepared for changing market conditions and have thought strategically about potential outcomes.

Develop three scenarios:

Base case: Your most realistic expectations based on current data.

Optimistic case: A best-case scenario where things exceed expectations - faster market adoption, higher conversion rates, etc.

Conservative case: A cautious outlook accounting for challenges like slower growth or increased competition.

Michael Burdick explains:

"For early-stage companies, forecasting is about pattern recognition and being pragmatic. It's a function of historical precedent, sample size, and how much control you have over the output." [64]

Each scenario must align internally. For example, if your optimistic case assumes rapid customer acquisition, your sales and marketing expenses should reflect that increased activity. Similarly, a conservative case with slower growth should show scaled-back hiring and operational costs.

Be realistic in your projections. Overly optimistic "hockey stick" growth patterns rarely pan out. In fact, Inc. Magazine notes that many successful companies take years to become profitable [64].

Visual aids like bar graphs, line charts, and pie charts can make your projections easier to digest. Use these tools to highlight trends and key moments where growth or profitability is expected to shift [67].

"Cash flow management is intrinsically tied to forecasting capabilities. If you can forecast accurately, you can manage your cash effectively." - Michael Burdick, Founder and Chief Strategy Officer, Paro [64]

Finally, remember that these projections aren’t static. As your business evolves, revisit and update them regularly - about every quarter - to reflect new conditions and insights [64].

12. Team: The People Behind Your Startup

Your team slide is a critical element of your pitch - it can either win over investors or leave them unconvinced. Why? Because investors don’t just invest in ideas; they invest in the people who can bring those ideas to life (especially at pre-Seed and Seed). To capture their attention, you need to show that your team has the skills, experience, and determination to succeed.

Founder Experience

Start by highlighting the most relevant achievements of your founding team. Be specific. For instance, if your CTO successfully scaled a platform to a million users or your CEO led a company to triple its revenue, include these details. These accomplishments demonstrate how your team is uniquely equipped to tackle challenges and drive success.

It’s also important to show that your team blends technical expertise with a shared passion for entrepreneurship. If you’ve worked together before, mention it - investors value teams with a proven track record of collaboration, as it reduces the risk of execution issues.

If there are gaps in your team’s expertise, acknowledge them briefly and outline how you plan to address those gaps. As Mike Grandinetti, CMO, points out:

"There is also the obvious financial obstacle of a limited marketing budget that hinders immediate growth if creative thinking and resourcefulness are not within the team's grasp... This is especially challenging for companies with customer functions where failure is simply not an option." [71]

Ensure that every team member’s skills align with your startup’s goals. For example, if you’re building a B2B SaaS product, having someone with enterprise sales expertise is essential. Similarly, if you’re entering a highly regulated industry, make sure your team includes someone who understands compliance requirements.

Beyond the core team, having a strong network of advisors and investors can further bolster your credibility.

Advisory Board and Investors

An advisory board can be a game-changer for your startup, not only strengthening your team but also boosting investor confidence. Research shows that companies with advisory boards achieve 24% higher sales and 18% more productivity compared to those without [72]. Additionally, 90% of businesses with advisory boards report a positive impact on their operations [70].

When selecting advisors, focus on addressing your team’s gaps. As Peter Szymanski, founder of Silicon Valley Counsel, explains:

"It helps to have worked with someone in the past so there's that connection." [68]

Choose advisors with diverse expertise and networks. This diversity helps you anticipate challenges from different angles and provides valuable perspectives [69]. Advisors who can communicate effectively both internally and externally are particularly valuable.

When showcasing existing investors, emphasize their credibility and the specific value they bring. Highlight how their expertise or network access benefits your startup. A reputable lead investor, for instance, serves as a strong signal of validation to other potential backers [73].

Margot Schmorak, CEO of Hostfully, underscores the importance of advisors:

"Our advisors act as an extension of our team - sometimes there are these hard decisions when you need to talk only to people you trust. Advisors are really great for that." [68]

If you’ve secured angel investors, make sure to highlight those who bring relevant industry expertise. Their involvement not only signals market validation but can also open doors to valuable connections [74]. As Peter Szymanski advises:

"Ask if they know anyone in the industry who could accelerate your business... Angel investors, even if they don't invest, may introduce you to people who expand your network." [68]

When it comes to building your advisory board, quality matters far more than quantity. Resist the urge to fill positions just to have impressive names on your slide. Instead, focus on finding advisors who are the right fit for your specific needs [70]. The growing recognition of advisory boards’ value is evident, with the sector expanding 19% between 2020 and 2023 [70].

Your team slide should tell a compelling story about why this group of people is uniquely positioned to turn your vision into reality. Investors are betting on your team’s ability to execute - make sure their confidence is well-placed.

Conclusion: Building Your Startup Story

Your pitch deck is the backbone of your startup's story. These 12 essential slides come together to simplify complex business ideas and create a narrative that captivates investors. This isn't just about facts and figures - it's about crafting a story that connects emotionally.

Why is this important? Research shows that emotions play a big role in decision-making, helping your pitch stick in the minds of your audience [75]. Start with your personal "why" - that moment when the problem you're solving became real for you. One founder shared their experience after working with pitch coach Nir Eyal:

"Before working with Nir, I despised pitching - it felt forced. In our first session, he unlocked my potential and eased my anxiety, teaching me that every conversation is a pitch."

Once you've nailed your story, make sure your visuals do the same. Every image, chart, and design element should reinforce your message. Take BenchSci as an example: they revamped their pitch deck, cutting it from 20 slides to 12 while aligning their story with measurable results. The outcome? They raised $8 million in seed funding and attracted over 4,000 lab signups in just six months [77]. Visual storytelling, when done right, can amplify your message and make your pitch 43% more persuasive [78].

Practice is key. You should be able to explain your vision, problem, solution, metrics, and business model without relying on slides. And remember, the first 40 seconds are critical - use them to grab attention and set the tone.

Your energy and passion are just as important as your deck. As Lyn Graft, Founder of Storytelling for Entrepreneurs, says:

"You're not just pitching a business; you're inviting investors into your journey. A well-told story can be the most powerful tool in your entrepreneurial arsenal. It can make the difference between a forgettable pitch and one that resonates long after you've left the room." [75]

FAQs

What’s the difference between Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM), and why do they matter in a pitch deck?

TAM, SAM, and SOM are critical metrics that help startups clearly outline their market potential and communicate it effectively to investors.

TAM (Total Addressable Market): This represents the total revenue opportunity if your startup were to capture 100% of the market. Think of it as the big picture, theoretical figure.

SAM (Serviceable Available Market): This is the portion of the TAM that your startup can realistically target based on your specific products, services, and capabilities.

SOM (Serviceable Obtainable Market): A more focused metric, SOM refers to the share of the SAM that you can realistically capture in the short term, given your current resources and strategy.

Including these metrics in your pitch deck is crucial. They demonstrate the scale of the opportunity, the precision of your approach, and the feasibility of your goals. A well-thought-out TAM, SAM, and SOM not only adds credibility but also helps investors grasp your growth potential with clarity.

How can a startup showcase traction and customer validation in its pitch deck to attract investors (even at the early stage)?

To effectively highlight traction and customer validation in your pitch deck, focus on showcasing clear, measurable data that proves customer interest and market demand. Include metrics such as monthly active users, revenue growth, customer acquisition costs, or retention rates - these numbers tell a story of progress and potential.

Additionally, include qualitative insights to strengthen your case. Customer testimonials, case studies, or engagement data can vividly illustrate how your product connects with its audience. If you're an early-stage startup without substantial revenue, don't worry - emphasize achievements like pilot program results, pre-orders, or endorsements from respected industry figures. These elements signal promise and help build investor confidence by showing your startup is gaining traction and resonating with its target market.

What are the best strategies for startups to select the right sales and marketing channels for their go-to-market plan?

To choose the best sales and marketing channels, begin by clearly defining the target audience. Take the time to understand your customers - what are their demographics, behaviors, and challenges? This insight allows you to create messaging that truly connects with them. It’s also essential to identify where they spend their time. Are they active on social media? Do they attend industry events? Knowing this helps you zero in on the platforms worth your attention.

Look at what’s working in your industry by studying competitors. For instance, a sales-led approach might be better for complex products that require personal interaction, while a product-led strategy could work well for straightforward, self-service offerings. Experimentation is crucial - test different channels and track performance metrics closely. Use this data to refine your strategy, ensuring you’re maximizing engagement and reach. Staying adaptable and open to change will guide you toward the channels that best support your goals.