The Founders Playbook: Mastering Seed Funding Due Diligence for a Seamless Close

You've captivated an investor, navigated the pitch meetings, and now a term sheet is on the table. This is a moment of triumph for any founder, but it’s also the starting line for a new, often underestimated challenge: due diligence.

This intensive review process can feel like a daunting final exam, capable of derailing a promising funding round if you’re unprepared. In a world where seed-stage startups globally raised over $17.2 billion in 2024, mastering this phase is non-negotiable.

This guide is your playbook. It's designed to transform due diligence from a reactive burden into a proactive strategy. By following these steps, you will learn how to anticipate investor concerns, organize your business with precision, and build unshakeable confidence. You will leave this guide not just ready to survive due diligence, but equipped to leverage it for a faster, smoother, and more successful close, setting the stage for a powerful partnership with your new investors.

Key Takeaways

Due diligence is a strategic opportunity, not just a hurdle – Reframe this intensive investor review process as a chance to showcase your operational excellence, build trust, and accelerate your funding timeline rather than viewing it as a burden that slows momentum.

Preparation starts before the term sheet arrives – The most successful founders embed a diligence-ready mindset into their operations from day one, maintaining organized records, clean legal structures, and documented processes that demonstrate competence when investors come calling.

Transparency builds trust and closes deals faster – Attempting to hide risks or weaknesses will kill your funding round; instead, proactively identify potential red flags, address them honestly, and present clear plans to mitigate concerns, proving you're a credible partner investors can trust.

Your team is your most valuable asset at the Seed stage – Investors bet on people over products in early rounds; showcase your founding team's cohesion, vision, and ability to execute through detailed bios, clear vesting agreements, clean background checks, and documented processes for resolving disputes.

Intellectual property requires meticulous ownership documentation – Ensure every founder, employee, and contractor has signed a Confidential Information and Invention Assignment Agreement (CIIAA) to prove your company definitively owns its core assets, as any ambiguity here can be a deal-breaker.

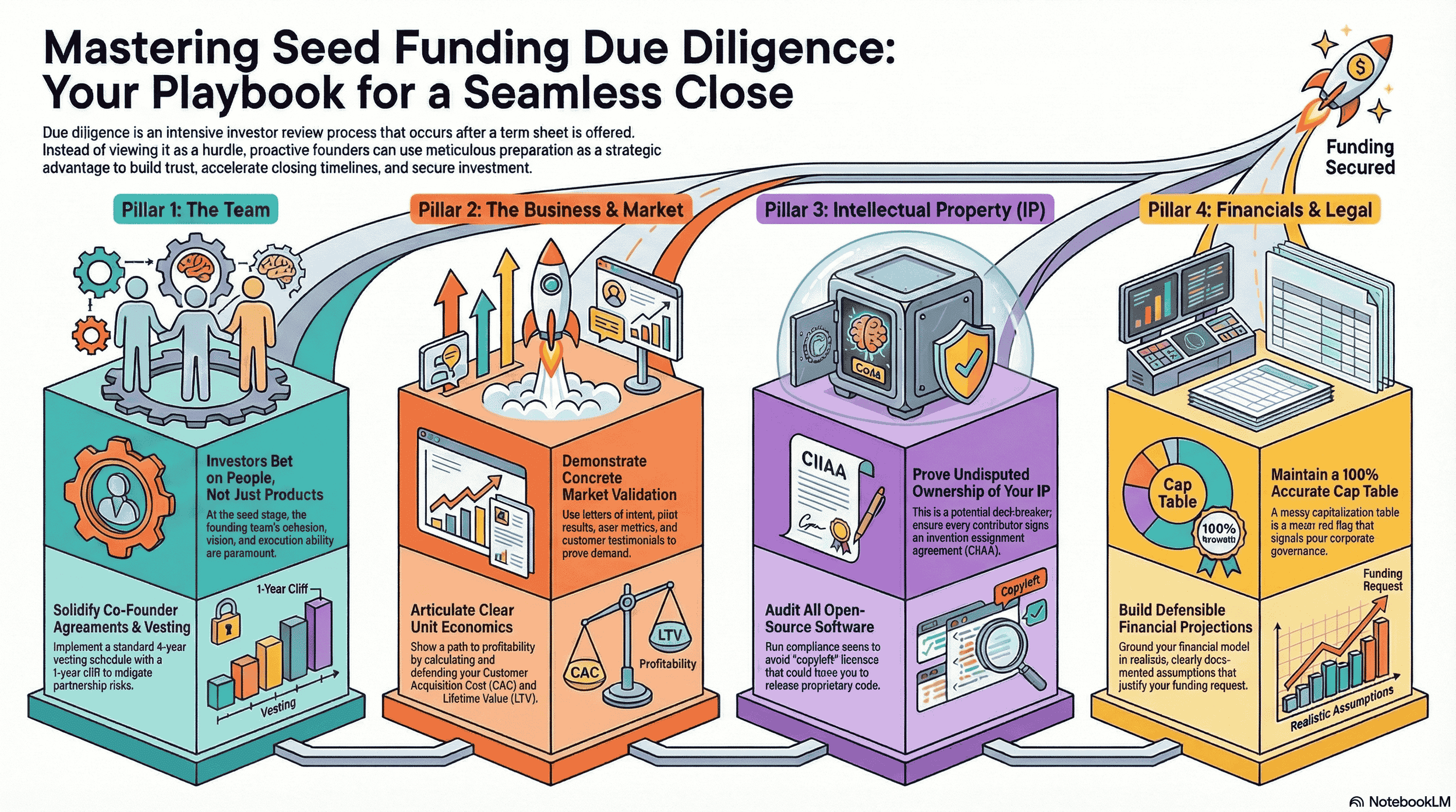

Master the four pillars of due diligence – Organize your preparation around Team (showcasing talent and cohesion), Business Model & Market (proving scalability and traction), Intellectual Property (securing clear ownership), and Financials & Legal Standing (demonstrating corporate health with accurate records).

Your cap table must be 100% accurate – A messy or incorrect capitalization table signals poor governance and can derail your funding; use dedicated software to maintain precise records of every share, option, convertible note, and SAFE issued to any stakeholder.

Evidence of market validation is essential – Gather concrete proof of customer demand through letters of intent, pilot results, engagement metrics, retention data, and enthusiastic customer references who can speak directly to the value your product provides.

Build and maintain a comprehensive virtual data room – Don't wait for investors to request documents; proactively organize all critical materials—financial models, contracts, IP agreements, employment records, and compliance documentation—into an accessible, well-structured repository.

A seamless diligence process becomes your competitive advantage – With only 3% of seed applications receiving funding, being meticulously prepared distinguishes you from competitors, accelerates closing timelines, and positions you as a low-risk, high-potential investment partner (source: Equidam).

Beyond the Pitch – Why Due Diligence is Your Secret Weapon

Due diligence is the systematic process by which potential investors investigate and verify the details of your business before finalizing an investment. It’s their method for mitigating risks and confirming that the opportunity is as compelling as your pitch suggests. The Global Due Diligence Investigation market is projected to grow significantly, underscoring its increasing importance in every funding decision. For founders, this process is far more than a simple background check; it’s an opportunity to prove your company’s value and your team’s operational excellence.

The Seed Stage Imperative: What Investors Really Seek

At the seed stage, investors are betting on potential more than on proven history. Their diligence reflects this. They aren't just scrutinizing financial statements; they are evaluating the very foundation of your enterprise.

The primary focus is on the founding team's ability to execute, the size and viability of the market opportunity, the defensibility of the product or technology, and early signs of customer traction. They are looking for signals that you have a clear vision, understand your business inside and out, and have the resilience to navigate the challenges ahead. A well-prepared founder demonstrates foresight and operational discipline, qualities that are often more valuable to a seed-stage investor than a perfect financial model.

The "Seamless Close" Advantage: Transforming Diligence from Hurdle to Hook

Many founders view due diligence as a hurdle—a grueling, time-consuming process that slows momentum. However, the most successful founders reframe it as a hook. By being meticulously prepared, you can accelerate the funding timeline, build profound trust with your investors, and even strengthen your negotiating position. A seamless diligence process signals that you are a low-risk, high-potential partner. It shows investors you respect their time and their process, which sets a positive tone for the entire relationship. This playbook will guide you in creating that seamless experience, ensuring that when the time comes, you can close your funding round with confidence and speed.

Building Your Foundation: The Proactive Founder's Mindset for Diligence

The key to mastering due diligence is to stop thinking of it as a final exam and start treating it as an ongoing strategic function of your business. A proactive mindset means building your company with diligence in mind from day one, ensuring your records, legal structures, and intellectual property are always in order. This approach doesn't just prepare you for funding; it builds a stronger, more resilient company.

Due Diligence as a Strategic Opportunity, Not a Reactive Burden

Viewing due diligence strategically means using the preparation process to identify and address weaknesses in your own business. It's a chance to pressure-test your assumptions, clean up your cap table, formalize key agreements, and gain a deeper understanding of your own operations. When an investor asks for a specific document or piece of data, having it ready isn't just efficient; it’s a powerful demonstration of your competence and control over the business. This transforms the diligence process from a stressful scramble into a showcase of your company's strength and your leadership’s ability.

Anticipating Investor Concerns: Understanding Their Perspective and Mitigating Risks Early

Investors are trained to find risks. Your job is to find them first. Put yourself in their shoes and critically examine every aspect of your business.

Are there potential conflicts of interest on your team?

Is the ownership of your core intellectual property crystal clear?

Are your financial projections based on defensible assumptions?

By identifying potential red flags ahead of time, you can develop clear, concise explanations or, better yet, take corrective action. With only 3% of pre-seed applications receiving funding, anticipating and mitigating these risks is crucial for distinguishing your company from the competition and demonstrating that you are a thoughtful, responsible steward of a potential investment.

Pro tip: If you're unsure how to address investor concerns during your pitch, check out our complete guide on Mastering Investor Q&A.

The Power of Transparency: Fostering Trust and Confidence

During the diligence process, transparency is your greatest asset. Attempting to hide or downplay risks is a critical mistake that can shatter trust and kill a deal instantly. Instead, be upfront about the challenges your business faces and, more importantly, present your well-reasoned plan to address them. This honesty shows maturity and self-awareness. It communicates to investors that you are not just a salesperson but a credible business leader they can partner with for the long term. Trust is the currency of venture capital, and it is earned through transparent, direct communication during the high-stakes diligence process.

Pillar 1: The Team – The Heartbeat of Your Business

At the seed stage, your team is arguably your most valuable asset. Investors know that early-stage companies will pivot and that initial business models will evolve. The constant factor they are betting on is the founding team's ability to navigate these changes. Your diligence preparation must showcase not just individual talent but the collective strength and vision of the people driving the business forward.

Your Founding Team: Showcasing Strength, Vision, and Cohesion

Prepare detailed biographies for each founder that go beyond a standard resume. Highlight relevant industry experience, previous startup successes (or valuable lessons from failures), and specific skills that align with your company's mission. Be ready to articulate a clear and unified vision for the company's future. Investors will probe for alignment among founders on key strategic decisions. Documenting a shared vision and demonstrating a healthy, respectful working relationship is critical. Disagreements are normal, but showing you have a process for resolving them constructively is a sign of a mature and resilient team.

Pro tip: Get professional headshots and make sure each team member's LinkedIn profile is up to date.

Key Personnel and Advisors: Highlighting Expertise and Ability

Beyond the founders, investors want to see that you are surrounding yourself with talent that fills your knowledge gaps. Create a list of key employees and formal advisors, detailing their roles, responsibilities, and the specific expertise they bring to the table. If you have a technical co-founder, highlight their technical ability and track record. If you have a sales lead with a deep network, quantify it. Strong advisors—whether industry veterans, successful entrepreneurs, or legal experts—signal to investors that you are coachable and resourceful, enhancing the credibility of your entire operation.

Pro tip: See our complete guide on How to Effectively Allocate Equity to Startup Advisors.

Proactive Background Checks and Legal Clearances for Individual Team Members

Don't wait for investors to uncover potential issues. Conduct your own informal or formal background checks on key team members. This includes confirming past employment, checking for any legal entanglements, or identifying non-compete agreements from previous employers that could create conflicts. Addressing these details proactively demonstrates thoroughness. It assures investors that there are no hidden surprises that could jeopardize the business or their investment down the line. Clean legal clearances for every individual on the core team are a fundamental requirement.

Addressing Co-founder Dynamics and Vesting Schedules

Co-founder disputes are a leading cause of startup failure (source: HBS). Investors will scrutinize your co-founder relationship and the legal structures that govern it. Your founders' agreement should be clear and comprehensive. A standard four-year vesting schedule with a one-year cliff is essential. Furthermore, all IP should be assigned to the company. This protects the company and the investment if a founder departs prematurely. Be prepared to discuss how you handle disagreements and make critical decisions. Proving that you have a solid, legally sound framework for your partnership provides immense comfort to investors, as it de-risks one of the most significant vulnerabilities for any seed-stage business.

Pillar 2: The Business Model & Market – Proving Your Value Proposition

After evaluating the team, investors will turn their focus to the business itself. A compelling idea is not enough; you must demonstrate a clear path to building a large, profitable enterprise. This pillar of due diligence is about providing concrete evidence that you have a scalable business model, a deep understanding of your market, and a distinct competitive advantage.

Articulating Your Business Model: Clarity and Scalability

Your business model must be explained in simple, clear terms. How do you create value for your customer, and how do you capture a portion of that value as revenue? Prepare a document that outlines your revenue streams, pricing strategy, and the core assumptions behind them. More importantly, you need to show how this model can scale. For example, if your business is service-based, what is your plan to transition to a more productized or technology-leveraged offering to escape linear growth? For companies in hot sectors like AI, where the median seed deal size is $4.6M, demonstrating a scalable and defensible model is key to justifying higher valuations.

Market Validation: Demonstrating Product-Market Fit and Customer Demand

Investors need proof that people want what you're building. This is where market validation becomes crucial. Gather all evidence of customer demand, including:

Letters of intent

Pilot program results

User engagement metrics

Testimonials

If you have paying customers, be prepared to share anonymized data on usage, retention rates, and feedback. Customer interviews or reference calls are a common part of the diligence process, so select a handful of your most enthusiastic and articulate customers who can speak to the value your product provides. This direct feedback is often the most powerful validation you can offer.

Unpacking Your Unit Economics: Proving Profitability Potential

At the seed stage, you may not be profitable, but you must demonstrate a clear path to potential profitability. This requires a firm grasp of your unit economics. Be prepared to calculate and defend your Customer Acquisition Cost (CAC) and Lifetime Value (LTV). Show the math behind these figures and explain your strategies for improving the LTV/CAC ratio over time. Even if these numbers are based on early data, the ability to thoughtfully analyze and discuss them shows financial discipline and a sophisticated understanding of your core business drivers.

Competitive Landscape: Your Unique Edge and Sustained Advantage

Every business has competitors, direct or indirect. Investors want to see that you have a comprehensive understanding of this landscape and a compelling reason why your company will win. Prepare a competitive analysis that identifies key players, their strengths and weaknesses, and your unique differentiators. Is your advantage based on proprietary technologies, a unique business model, an exclusive partnership, or a superior customer experience? Your explanation must go beyond surface-level features to articulate a durable, long-term competitive moat.

Preparing a Compelling Product Demo and Sales Slides (if applicable)

A live product demo is often a central part of technical and business diligence. Ensure your demo is polished, reliable, and focused on showcasing the core value proposition and key differentiating features. It should tell a story about how a customer solves a critical problem using your product. Additionally, have your sales slides and any marketing materials organized and ready for review. This collateral provides insight into how you communicate your value proposition to the market and your strategy for acquiring your target customer.

Pillar 3: Intellectual Property (IP) – Protecting Your Innovation

For many technology companies, intellectual property is the cornerstone of their value and competitive advantage. During due diligence, investors will conduct a thorough review to ensure your IP is both valuable and properly protected. Any ambiguity or weakness in your IP ownership can be a major red flag, potentially halting an investment. Proactive management of your IP is essential for a smooth process.

Understanding the Landscape of IP Diligence for Seed Stage Startups

At the seed stage, IP diligence focuses on establishing a clean chain of title and identifying any immediate risks. Investors aren't necessarily expecting a large portfolio of issued patents. Instead, they want to see that you have a clear strategy for protecting your core innovations and have taken the foundational steps to secure ownership. This includes verifying that all IP created by founders, employees, and contractors has been properly assigned to the company. The goal is to confirm that your business, and by extension their investment, truly owns the assets it claims to.

Documenting Ownership: Securing Your Company's Core Assets

The single most important step in IP diligence is ensuring that every person who has contributed to the creation of your company's intellectual property has signed a Confidential Information and Invention Assignment Agreement (CIIAA). This legal document formally transfers ownership of any work-related inventions from the individual to the company. Maintain a meticulous record of these signed agreements for all founders, employees, and consultants. Without these, you cannot definitively prove the company owns its own product, which is a deal-breaking issue for nearly all investors.

Patents, Trademarks, and Copyrights: What to Protect and How

Develop a clear IP strategy document that outlines what you are protecting and why. For patents, this might involve detailing provisional patent applications you have filed or plan to file for core technologies. For trademarks, have records of your brand name and logo registrations to protect your market identity. Copyright protection is automatic for software code, but you must ensure the company is the legal author, which again points back to the importance of assignment agreements. Having a thoughtful strategy shows investors you are thinking long-term about building a defensible business.

Software and Technologies: Licensing Agreements and Open-Source Compliance

If your product incorporates third-party software or technologies, you must have all licensing agreements readily available for review. Be especially vigilant about your use of open-source software. Run a scan to identify all open-source libraries in your codebase and ensure you are in full compliance with their respective licenses. Certain "copyleft" licenses (like GPL) can require you to make your own proprietary code open source, which can destroy your company's value. Demonstrating a clean and compliant open-source policy is a critical part of technical diligence.

Addressing Intellectual Property Risks and Ensuring Clear Titles

Proactively identify any potential IP risks. For example, did a founder develop part of the core technology while employed at a previous company or university? If so, you need to be able to prove that the prior employer has no claim to the IP. This might require legal review or formal waivers. Being upfront about these potential issues and presenting a clear resolution is far better than having an investor's counsel discover them. The ultimate goal is to provide a "clear title" to your IP, giving investors confidence that their funding is being used to grow an asset that the company unequivocally owns.

Pillar 4: Financials & Legal Standing – The Health of Your Enterprise

The final pillar of due diligence is a comprehensive review of your company's financial and legal health. This is where investors verify the numbers, scrutinize your corporate structure, and examine your contractual obligations. Meticulous organization and absolute clarity are paramount. Any discrepancies or sloppiness in these areas can create significant delays and erode investor trust at the final stages of the process.

Financial Review: Presenting Clear and Realistic Financial Projections

Prepare a clear set of historical financials (even if limited) and a detailed forward-looking financial model, typically for 3-5 years. Your projections should be ambitious but grounded in reality, with every key assumption (e.g., customer growth rate, pricing, churn) clearly documented and defensible. Investors will stress-test this model. Be prepared to explain the "why" behind your numbers. A clean, well-structured model signals that you have a deep understanding of your business's financial drivers. With the median Y Combinator seed round size at $3.1 million in 2025, your projections must logically support the funding you are seeking.

Understanding and Organizing Your Cap Table: Equity Ownership and Dilution

Your capitalization table (cap table) is one of the most scrutinized documents in due diligence. It must be 100% accurate, accounting for every share of stock issued to founders, employees, advisors, and previous investors. Ensure it correctly reflects all convertible notes, SAFEs, and options from your employee stock option pool. A messy or incorrect cap table is a major red flag that suggests poor corporate governance. Use dedicated software or work with a lawyer to maintain a clean and up-to-date record of your company's ownership structure. It's also critical to understand how this new round of investment will impact your dilution by using a Cap Table Modeling Tool.

Key Contracts and Agreements: Customer, Vendor, and Employee Obligations

Organize all material contracts into a centralized data room. This includes:

Major customer agreements

Significant vendor or supplier contracts

Office leases

Employment offer letters

Investors will review these documents to understand your company's obligations, liabilities, and key business relationships. Pay special attention to any clauses that could be problematic, such as change-of-control provisions or non-standard terms. Having these documents neatly organized and summarized saves an immense amount of time and demonstrates professional management.

Legal Due Diligence Essentials: Corporate Formation and Compliance

Finally, investors will verify that your company is a legally sound and compliant entity. This involves:

Reviewing your articles of incorporation

Corporate bylaws

Board meeting minutes

Any relevant state, provincial, or federal filings

Ensure you are in good standing in the jurisdiction where you are incorporated and operating. If your business is in a regulated industry, such as MedTech where startups raised $3.7 billion in Q1 2025, you must have all necessary licenses and compliance documentation in order. This foundational legal review confirms that the corporate entity they are investing in is stable and legitimate.

Summary: What's Next?

By following this playbook, you have transformed due diligence from a source of anxiety into a strategic asset. You've learned to think like an investor, allowing you to anticipate their concerns and prepare your business with precision. You now understand that a seamless close isn't about having a perfect company, but about demonstrating preparedness, transparency, and a deep command of every facet of your enterprise.

You have deconstructed the process into four core pillars:

The Team: You have showcased your team’s unique ability, cohesion, and vision, de-risking the human element of the investment.

The Business Model & Market: You have provided concrete evidence of customer demand, a scalable model, and a defensible competitive edge.

Intellectual Property: You have secured your company’s most valuable assets with a clear chain of title and a proactive protection strategy.

Financials & Legal Standing: You have built a foundation of trust with clean, accurate records that prove your operational discipline and corporate health.

Your immediate next step is to begin building your virtual data room. Start organizing the documents and creating the strategic narratives outlined in each pillar. Don't wait for a term sheet. The work you do now—cleaning your cap table, securing IP assignments, and documenting your assumptions—will pay dividends in time saved and confidence gained.

Pro tip: Maintain a living Investor FAQ document in your data room, updating it with new questions and answers after each investor call. This will save you time by avoiding repeated answers and help investors progress through their due diligence faster.

Treat this preparation as an integral part of your business operations. By embedding this diligence-ready mindset into your company’s culture, you not only position yourself for a successful seed round but also build a stronger, more resilient business poised for long-term growth.

Frequently Asked Questions (FAQ)

What happens after I receive a term sheet from an investor?

Receiving a term sheet marks the beginning of the due diligence phase, not the end of the investment process. Investors will conduct a comprehensive assessment of your business to verify the information presented during your pitch discussions. This investigation helps them determine whether to finalize the investment under the conditions outlined in the term sheet. Your preparation during this phase directly impacts your fundraising timelines and can accelerate or delay the close.

How does due diligence differ between Seed funding and Series A rounds?

At the seed stage, investors focus primarily on the founding team's ability to execute, market opportunity, and early traction. Series A due diligence becomes more intensive, requiring proven metrics, established revenue streams, and demonstrated growth. While seed-stage investors bet on potential, Series A investors need concrete evidence of your business model's viability and scalability. Both stages require meticulous documentation, but Series A demands more extensive financial histories and operational data.

What are the most common risks investors look for during due diligence?

Investors systematically evaluate several key risks during their assessment. These include:

Unclear intellectual property ownership

Co-founder disputes without proper vesting agreements

Conflicts of interest among individual team members

Questionable unit economics

Competitive vulnerabilities

They also examine risks related to regulatory compliance, particularly for companies subject to federal law requirements or oversight by government agencies. Foreign affiliations and financial ties to entities outside the U.S. may trigger additional scrutiny depending on your industry. The best approach is to identify these risks before investors do and prepare clear explanations or corrective actions.

How should I handle requests for background checks on individual team members?

Proactively conduct background checks on all key personnel before investors request them. This includes verifying past employment, checking for legal entanglements, identifying non-compete agreements from previous employers, and confirming there are no conflicts regarding intellectual property created at former companies. If any individual has foreign affiliations, financial ties to a multinational company, or previous involvement with government agencies or programs, document these relationships clearly. Transparency about each person's background and any potential concerns demonstrates thoroughness and builds trust with potential VC funds.

What exactly should be included in my virtual data room?

Your data room should be organized around the four core pillars:

Team (founder bios, org charts, key personnel details, employment agreements)

Business Model & Market (financial projections, customer contracts, competitive analysis)

Intellectual Property (patent filings, trademark registrations, IP assignment agreements)

Financials & Legal Standing (cap table, articles of incorporation, board minutes, material contracts).

Include documentation for any awards, grants, or programs your company has participated in. Ensure your entity structure is clearly documented, including any subsidiaries or related entities. Every document should be current, accurate, and readily accessible to avoid any material misstatement during the investment process.

How do I prepare my cap table for investor review?

Your capitalization table must be 100% accurate and account for every share issued to founders, employees, advisors, and any previous funds that have invested. Include all convertible notes, SAFEs, and options from your employee stock option pool. Document the entity that holds each ownership stake and verify that there are no discrepancies. Use dedicated cap table software and work with legal counsel to ensure accuracy. Also, prepare a model showing how the new investment will affect dilution. A messy cap table suggests poor corporate governance and can derail a term sheet that's otherwise ready to close (source: Auptimate).

What intellectual property documentation do seed-stage investors typically request?

Investors will request Confidential Information and Invention Assignment Agreements (CIIAAs) signed by every individual who has contributed to your IP—founders, employees, and contractors (source: Cooley Go). They'll want to see any patent applications (provisional or filed), trademark registrations, and documentation of your open-source software compliance. If your technology was developed with involvement from a university, previous employer, or through government-funded programs, you must prove the entity has no competing claims. This documentation helps investors assess IP risks and determine that your company has clear title to its core assets.

How can I demonstrate product-market fit during due diligence?

Gather concrete evidence of customer demand, including letters of intent, pilot program results, user engagement metrics, and retention data. Prepare anonymized customer data that shows how users interact with your product and the value they derive. Select your most enthusiastic customers who can serve as references during the investment process. Investors may request direct conversations with these recipients of your product or service. Quantifiable metrics—such as month-over-month growth, customer acquisition trends, and usage patterns—provide the strongest validation and help generate interest among investors in competitive funding environments (source: Quibit Capital).

What financial projections should I prepare?

Create detailed financial models covering 3-5 years with clear documentation of every assumption. Show how you'll use the funds you're raising and the milestones you'll achieve. Include unit economics analysis (CAC and LTV), revenue projections by customer segment or product line, expense forecasts by category, and anticipated staff growth. Your projections should align with the funding amount in your term sheet and demonstrate a path to profitability or the next funding milestone. Be prepared to explain your risk criteria for key assumptions and defend the rationale behind your numbers during investor meetings.

How should I address co-founder dynamics during due diligence?

Investors will assess both the relationship between co-founders and the legal structures protecting it. Ensure you have a comprehensive founders' agreement with a standard four-year vesting schedule and one-year cliff. Document how you make critical decisions and resolve disagreements. If there's been any previous involvement, affiliation, or ties between founders that could create conflicts of interest, address these proactively. Be prepared to discuss each individual founder's role, equity stake, and commitment to the entity. Demonstrating a healthy, legally sound partnership structure helps investors understand that co-founder risks are properly mitigated.

What are the most critical mistakes that can kill a deal during due diligence?

The fastest deal-killers include:

Attempting to hide risks or problems

Having unclear IP ownership

Maintaining an inaccurate cap table

Making a material misstatement about your business metrics or entity structure

Failing to respond promptly to investor requests.

Poor organization that forces investors to repeatedly ask for the same documents signals operational weakness. Undisclosed conflicts of interest, foreign affiliations that weren't mentioned earlier, or financial ties to problematic entities can also derail funding. The key is radical transparency—acknowledge challenges while presenting your plan to address concerns. This approach builds the trust necessary to successfully close your term sheet and secure the funds you need.