Mastering Discount Rates in SAFEs: A Founder’s Strategic Guide to Valuation & Equity

Key Takeaways

Essential Insights for Founders Navigating SAFE Discount Rates:

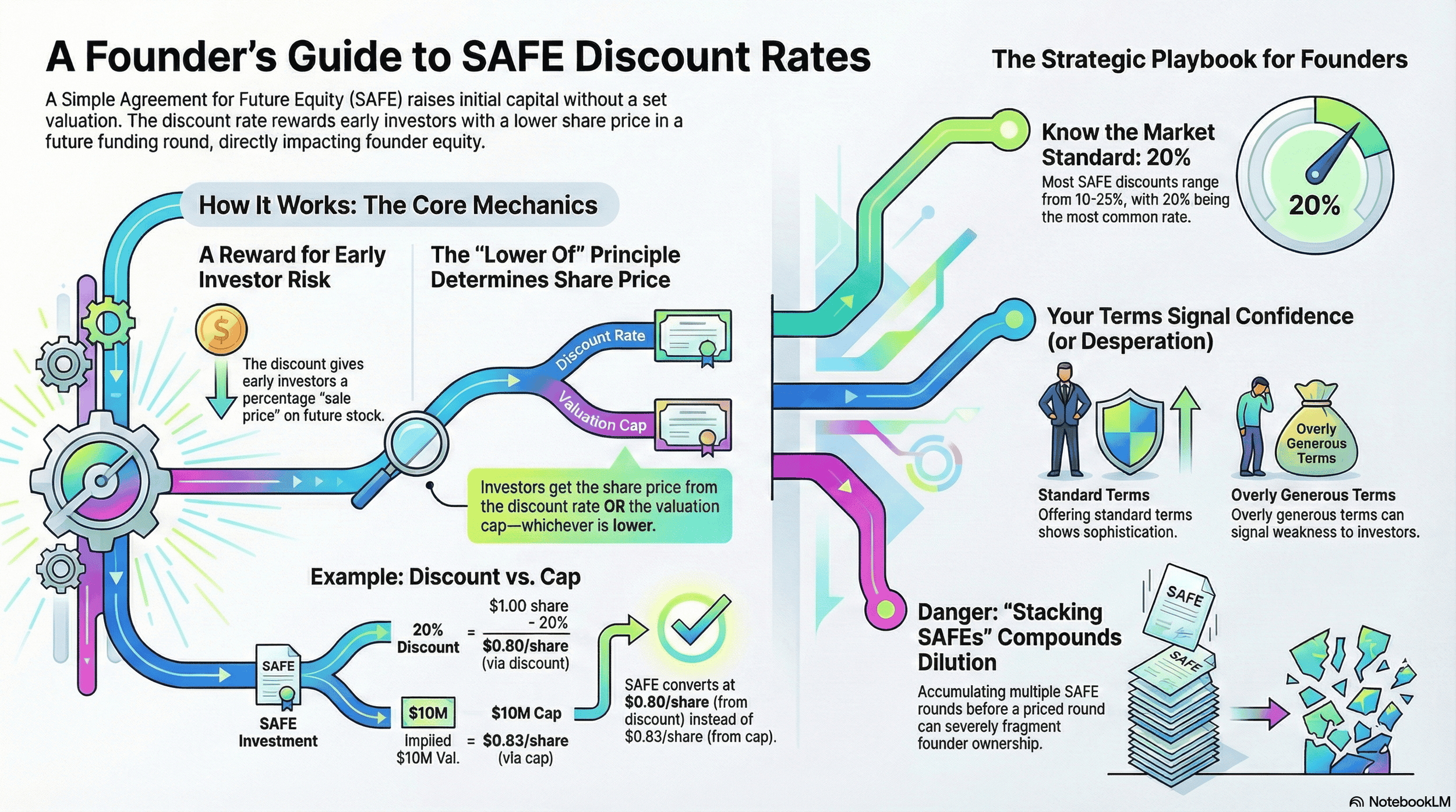

The discount rate is a direct cost of early-stage capital – Every percentage point translates to additional founder dilution, with industry-standard rates ranging from 10-25% (20% being most common).

SAFEs eliminate debt risks, unlike convertible notes – Unlike convertible notes with interest rates and maturity dates, SAFE notes have no repayment obligations, making them more founder-friendly for early-stage companies.

The "lower of" principle determines your dilution – SAFE notes convert at whichever gives investors more equity: the discounted share price OR the valuation cap price, requiring founders to model both scenarios.

Post-money SAFEs provide cap table clarity – Unlike pre-money SAFEs where dilution is uncertain, post-money SAFEs let startup founders know their exact ownership percentage after conversion.

High valuations favor the cap, modest valuations favor the discount – If you expect a strong Series A, negotiate the valuation cap aggressively; if you anticipate a down round, focus on minimizing the discount rate.

Stacking multiple SAFE notes compounds dilution dangerously – Accumulating several SAFE rounds before equity financing can severely fragment ownership and create messy cap table outcomes that deter Series A investors.

Your SAFE terms signal market confidence – Offering standard 20% discounts shows sophistication; overly generous terms (25%+) without justification can signal desperation to angel investors and VCs.

Model everything before signing – Use cap table tools to calculate the cumulative conversion impact of all outstanding SAFE notes, including effects on your option pool and employee equity stake.

Negotiate strategically, not desperately – Start with market-standard terms, justify deviations with traction data, and be willing to trade concessions (e.g., higher discount for better valuation cap).

Today's SAFE terms echo through future rounds – Early investor protections, discount rates, and cap table structure set precedents that influence Series Seed, Series A negotiations, and long-term founder control.

Unlocking Your Startup's Future Equity

For early-stage founders, navigating the world of fundraising can feel like learning a new language—one where terms like "valuation cap," "pro-rata rights," and "discount rate" determine the future of your company. Among these, the discount rate on a Simple Agreement for Future Equity (SAFE) is one of the most critical yet frequently misunderstood variables. It’s not just a number on a term sheet; it's a powerful lever that directly influences your ownership, your investors' return, and the long-term health of your cap table. Getting it right is paramount.

The Crucial Role of Discount Rates in Early-Stage Fundraising

In the earliest days of a startup, placing a concrete valuation on your company is more art than science. You have a vision, a team, and perhaps an early product, but revenue and established metrics are often still on the horizon. This is where SAFEs, popularized by Y Combinator, have become a go-to instrument. They allow founders to secure essential capital without having to set a premature valuation. The discount rate is a core feature of this agreement, serving as a reward for the first investors who take a significant risk by backing your unproven idea. It gives them the right to purchase equity in your first priced round at a lower price than later investors, acknowledging their early faith and capital.

Why Founders Must Master SAFE Terms Beyond the Basics

Many founders focus intently on the valuation cap, seeing it as the primary determinant of their future dilution. While the cap is undoubtedly important, overlooking the strategic implications of the discount rate is a common and costly mistake. A high discount can be just as dilutive—or even more so—than a low valuation cap, depending on the outcome of your next fundraising round. Mastering this term means understanding its mechanics, its interplay with the valuation cap, and how to negotiate it effectively. It’s about moving from passively accepting terms to actively shaping an investment agreement that aligns with your company's long-term vision for growth and ownership.

What This Guide Will Cover: A Strategic Dive into Discount Rates

This guide is designed to be a founder's strategic playbook for mastering the discount rate. We will move beyond simple definitions to explore the deep mechanics and implications of this crucial term. We will deconstruct what a discount rate is, why it exists, and how it functions from both the founder's and the investor's perspective. We’ll walk through concrete examples of how it impacts equity conversion, explore its strategic relationship with the valuation cap, and provide actionable tactics for negotiating it with confidence. By the end, you will have the knowledge to treat the discount rate not as a fundraising hurdle, but as a strategic tool to build a stronger foundation for your startup.

The Foundation: Understanding SAFEs and Their Core Components

Before mastering the discount rate, it's essential to have a firm grasp of the instrument it belongs to: the SAFE. Understanding its purpose and key components is the first step toward navigating your early-stage fundraising with precision.

What is a SAFE (Simple Agreement for Future Equity)?

A Simple Agreement for Future Equity, or SAFE, is a financing contract that gives an investor the right to receive equity in your company at a future date. Developed by the accelerator Y Combinator, it allows a startup to raise capital without assigning a formal valuation to the business at the time of the investment. An investor provides capital now in exchange for a promise of company stock later, typically when the startup raises its first priced equity round (like a Series A). This deferral of valuation is the SAFE's defining feature, offering speed and simplicity for both founders and investors.

How SAFEs Differ from Convertible Notes: Simplicity vs. Complexity

SAFEs are often compared to convertible notes, another common instrument for early-stage investment. However, there are fundamental differences. A convertible note is a form of debt. As such, it includes an interest rate and a maturity date. If the startup doesn't raise a priced round before the maturity date, the noteholders could demand repayment of their principal plus accrued interest, potentially creating a financial crisis for a pre-revenue company.

SAFEs eliminate these debt-like features. There is no interest and, crucially, no maturity date (unless the investor includes one via side letter). A SAFE is not a loan; it is a warrant for future equity. This simplicity removes significant administrative overhead and reduces the risk of a startup facing a debt cliff, making it a more founder-friendly instrument in many early-stage scenarios. The investment only converts into equity upon a triggering event, like a fundraising round or an acquisition.

Key Terms Revisited: Valuation Caps and Their Purpose (Briefly)

To understand the discount rate, one must also understand its counterpart: the valuation cap. The valuation cap sets the maximum valuation at which an investor's SAFE will convert into equity. For example, if a SAFE has a $10 million valuation cap and the company raises its Series A at a $20 million valuation, the SAFE investor's money converts as if the valuation were only $10 million. This effectively gives them a lower share price than the Series A investors, rewarding their early risk. The cap protects investors from a scenario where the company's valuation skyrockets, which would otherwise diminish the value of their early investment.

The Discount Rate: Your Early Investor's Reward for Risk

The discount rate is the other primary mechanism for rewarding early SAFE investors. It offers a percentage discount on the share price paid by investors in the subsequent priced equity round. If the discount rate is 20%, the SAFE investor gets to purchase their shares at 80% of the price paid by the new investors. This ensures they are compensated for committing capital to the startup long before it achieves the milestones necessary to attract a priced round of investment. While the valuation cap provides protection against massive upside, the discount rate offers a guaranteed reward regardless of the next round's valuation, making it a vital term in any SAFE negotiation.

Deconstructing the Discount Rate: What It Is and Why It Matters

The discount rate is more than just a percentage; it’s a reflection of risk, timing, and negotiation. Understanding its purpose from both sides of the table is crucial for founders who want to secure capital while protecting their equity.

Defining the Discount Rate: A Premium for Early Capital

At its core, the discount rate is a mechanism to give early investors a better deal on their equity purchase compared to later investors. Think of it as a pre-negotiated "sale price" on future stock. If a SAFE has a 20% discount rate, the investor will convert their investment into equity at a 20% discount to the share price of the next financing round. For example, if Series A investors buy shares at $1.00 each, the SAFE holder with a 20% discount would get them for $0.80 per share. This means their investment buys them more shares—and thus more ownership—than if they had invested the same amount in the priced round itself.

The Investor's Perspective: Compensating for Pre-Priced Round Risk

From an investor's point of view, the discount is non-negotiable compensation for the immense risk they undertake. They are providing capital to a startup that has not yet been validated by a venture capital firm in a priced equity round. The company could fail to find product-market fit, run out of money, or never raise another dollar. The discount acknowledges this risk. It ensures that if the company does succeed and raises a priced round, the early believers are rewarded with a more favorable entry price. It aligns their risk with a tangible financial upside, making the high-risk, high-reward nature of early-stage investing more palatable.

The Founder's Perspective: The Cost of Raising Capital Early

For founders, the discount rate represents a direct cost of capital—the price you pay for securing funds before you have the traction to command a firm valuation. Every percentage point of discount translates directly into additional dilution of your ownership stake. A higher discount means giving away more equity for the same amount of investment. While it’s a necessary tool to attract early capital, it must be managed carefully. An overly generous discount can lead to significant dilution down the line, impacting not only the founders' ownership but also the equity pool available for future employees and investors. It's a strategic trade-off: securing vital runway today in exchange for a piece of the company's future tomorrow.

Common Discount Rate Ranges and Industry Norms (e.g., YC-style templates)

While discount rates are negotiable, industry norms provide a useful starting point. The most common range for a SAFE discount is between 10% and 25%. A standard or "market" rate is often considered to be 20%. This figure is frequently seen in standard SAFE templates, including those popularized by Y Combinator.

10-15%: This might be offered by a startup with strong early traction, a proven founding team, or significant investor demand. It signals confidence from the founders.

20%: This is the most common and widely accepted rate, representing a standard balance of risk and reward.

25% or higher: A higher discount may be necessary for very early-stage or higher-risk ventures. It can also be a concession made by founders in exchange for a higher valuation cap or other more favorable terms.

Understanding these benchmarks allows founders to enter negotiations with a clear idea of what is standard and what might be considered an outlier.

The Mechanics of Conversion: Discount Rates in Action

Understanding the theory behind the discount rate is one thing; seeing how it works in practice is another. The conversion mechanics determine exactly how much equity a SAFE investor receives, making this a critical process for founders to master.

How a SAFE Converts: The Priced Equity Round Trigger (e.g., Series A)

A SAFE lies dormant until a specific "trigger" event occurs. The most common trigger is a priced equity round, where the company sells a new class of shares (e.g., Series A Preferred Stock) to investors at a negotiated, fixed per-share price. This event establishes the company's first formal valuation. When this happens, the SAFE automatically converts. The capital invested via the SAFE transforms into equity, using the terms outlined in the agreement—namely, the valuation cap and the discount rate—to calculate the number of shares the SAFE investor receives.

The "Lower of" Principle: Discount Rate vs. Valuation Cap

Most modern SAFEs include both a valuation cap and a discount rate. In this structure, the investor benefits from whichever term provides them with a lower effective share price—and therefore more equity. This is often referred to as the "lower of" or "better of" principle.

Here’s how it works at the time of conversion:

Calculate the price per share using the valuation cap. This is done by dividing the valuation cap by the company's pre-money capitalization.

Calculate the price per share using the discount rate. This is done by taking the price per share of the new priced round and applying the discount.

Compare the two. The SAFE converts at whichever of these two calculated prices is lower.

This structure gives the investor downside protection (the discount) and upside protection (the cap). As a founder, you must model both scenarios to understand the potential dilution.

Calculating Equity: Step-by-Step Examples of Discount Rate Impact

To see the mechanics clearly, let's walk through a hypothetical scenario.

Startup Scenario:

SAFE Investment: $200,000

SAFE Terms: 20% discount rate and a $10 million valuation cap.

Series A Fundraise: Raises $2 million at a $12 million pre-money valuation.

Series A Share Price: The new investors are paying $1.00 per share.

Company Pre-Money Shares: 12,000,000 shares outstanding before the new round.

Now, let's determine the SAFE investor's conversion price using the "lower of" principle.

1. Conversion Price via Discount Rate:

Series A Price: $1.00 per share

Discount: 20%

Effective Price for SAFE Investor: $1.00 * (1 - 0.20) = $0.80 per share

2. Conversion Price via Valuation Cap:

Valuation Cap: $10,000,000

Pre-Money Shares: 12,000,000

Effective Price for SAFE Investor: $10,000,000 / 12,000,000 shares = $0.833 per share

The "Lower Of" Outcome: Comparing the two, the price calculated via the discount rate ($0.80) is lower than the price calculated via the valuation cap ($0.833). Therefore, the SAFE will convert at $0.80 per share.

Calculating Shares and Ownership:

Shares for SAFE Investor: $200,000 investment / $0.80 per share = 250,000 shares.

If the SAFE had converted at the Series A price of $1.00, the investor would have only received 200,000 shares. The discount rate gave them an additional 50,000 shares as a reward for their early risk.

Understanding "Pre-Money" and "Post-Money" Context in SAFE Conversions

The final piece of the conversion puzzle is understanding whether your SAFE is "pre-money" or "post-money." This difference greatly changes dilution.

Pre-Money SAFE: The original SAFE structure. It converts into equity before the new investment from the priced round is added to the company's capitalization. This means SAFE holders dilute alongside the founders when the new money comes in. The founders' ownership percentage is less certain until all SAFEs have converted.

Post-Money SAFE: The current standard, updated by Y Combinator. It converts after the new investment is accounted for, as part of the new round's capitalization. This means SAFE investors are not diluted by the priced round they are converting in. It provides founders with greater clarity on their post-round ownership from the outset, as the SAFE conversion is calculated based on a fixed "post-money" valuation.

When modeling your cap table, knowing which type of SAFE you have is critical for accurately projecting founder ownership.

Strategic Implications for Founders: Navigating Valuation & Equity

The discount rate isn’t just a mathematical input; it's a strategic decision with long-term consequences for your company. Understanding its impact on founder equity, investor perception, and future fundraising is essential for building a sustainable business.

The Direct Impact on Founder Equity and Ownership Stake

The most immediate impact of a discount rate is on founder dilution. Every percentage point in the discount corresponds to a greater number of shares issued to early investors upon conversion. While this may seem small in the early days, the effect compounds over time. Issuing multiple SAFEs with aggressive discounts can lead to a "death by a thousand cuts" scenario, where founders arrive at their Series A to find their ownership stake significantly smaller than anticipated. This can affect founder morale, control over the company, and the economic outcome of a future exit. It's crucial to model the cumulative impact of all outstanding SAFEs to maintain a clear picture of your ownership.

The Interplay Between Discount Rates and Valuation Caps

Founders must analyze the discount rate and valuation cap not as separate terms, but as an interconnected system. The relative importance of each term depends on the potential valuation of your next round.

If you expect a very high valuation at your next round: The valuation cap becomes the more impactful term. A high valuation will likely make the cap price lower than the discounted price, meaning the cap will dictate the conversion. In this scenario, negotiating a higher valuation cap is more critical for preserving your equity.

If you expect a modest or lower-than-hoped-for valuation: The discount rate becomes more important. In this case, the priced round valuation may be low enough that the discount provides a better price for the investor than the cap. Negotiating a lower discount rate is key to mitigating dilution in this situation.

Strategic founders anticipate different fundraising outcomes and negotiate the cap and discount accordingly, optimizing for the most likely scenarios while protecting themselves from the worst-case ones.

Communicating Value: How Discount Rates Signal Confidence (or Lack Thereof)

The terms you offer on a SAFE, including the discount rate, send a powerful signal to the market. Offering a standard 20% discount communicates that you understand industry norms and are confident in your startup's prospects. Conversely, immediately offering a very high discount (e.g., 30% or more) without strong justification can be perceived as a sign of weakness or desperation. It might suggest that you are struggling to attract capital or lack confidence in your ability to raise a priced round at a strong valuation. Smart investors will read these signals. It’s better to start with a standard term and justify any deviations based on your company's specific stage, risk profile, and traction.

Preparing for Future Rounds: How Early Discounts Can Influence Later Fundraising

The terms of your early SAFEs can set a precedent for future financing. If new investors in a priced round see that early SAFE investors received a particularly generous discount, they may perceive it as a benchmark. This can create an anchor point in negotiations, making it more challenging to secure better terms in subsequent rounds. Furthermore, significant dilution from early SAFEs can leave an insufficient equity pool for future employees and investors. Venture capitalists look closely at the cap table; a "messy" or overly diluted cap table can be a red flag, complicating or even jeopardizing your ability to raise a Series A. Thinking about the long-term health of your cap table starts with the very first SAFE you sign.

Negotiating the Discount Rate: A Founder's Playbook

Negotiating the discount rate is a critical skill for any founder. It's an opportunity to advocate for your company's value and set a favorable precedent for future fundraising. A thoughtful and strategic approach can save you significant equity down the road.

When to Consider a Discount Rate: Stage, Traction, and Market Context

A discount rate is almost always expected in a SAFE, as it's the primary reward for an investor's early-stage risk. The question isn't if you should offer one, but what rate is appropriate. The answer depends heavily on context:

Pre-Seed/Idea Stage: At this very early stage, with little more than a concept and a team, a higher discount (e.g., 20-25%) is common. The investment risk is at its absolute peak, and investors require a significant incentive.

Seed Stage with Early Traction: If you have a working product, initial users, or early revenue, you have more leverage. You can justify a lower discount (e.g., 15-20%) because you have de-risked the venture to some degree.

Hot Market vs. Cold Market: In a frothy, founder-friendly market with abundant capital, you can often command more favorable terms, including lower discounts. In a tighter, investor-friendly market, you may need to offer more attractive terms to secure investment.

Factors Influencing the "Right" Discount Rate for Your Startup

There is no one-size-fits-all discount rate. The "right" rate for your startup will be a blend of several factors:

Investor Demand: If you have multiple investors competing to get into your round, you have significant leverage to negotiate a lower discount.

Lead Investor: The first investor to commit often sets the terms. Securing a lead investor on founder-friendly terms can create a strong precedent for others who follow.

Amount of Capital Raised: For smaller investment amounts, a standard discount is typical. If an investor is writing a uniquely large check that significantly extends your runway, they may ask for a slightly better term as a reward.

Founder Experience: A founding team with a previous successful exit or deep industry expertise can often command better terms, as they are perceived as less risky.

The Valuation Cap: The discount rate cannot be negotiated in a vacuum. You might agree to a slightly higher discount in exchange for a much higher valuation cap, or vice versa.

Tactics for Strategic Negotiation

Approaching the negotiation with a clear strategy is key. Here are some effective tactics:

Start with a Standard Term: Propose a SAFE with a standard 20% discount. This frames the conversation around a reasonable, market-accepted baseline.

Justify Your Position with Data: If you are pushing for a lower discount, be prepared to explain why. Point to specific milestones achieved, user growth metrics, revenue, or competitive interest.

Understand the Investor's Motivation: Ask the investor what is most important to them. Is it the discount, the cap, or something else like pro-rata rights? Understanding their priorities allows you to find areas for compromise that are less costly to you.

Trade Concessions: If an investor insists on a higher discount, see if you can get something in return. For example, "We can agree to a 25% discount if we can raise the valuation cap from $8M to $10M."

Be Willing to Walk Away: If an investor is pushing for terms that are significantly off-market and would excessively dilute your ownership, it's sometimes better to walk away than to accept a bad deal that will harm the company long-term.

Aligning Discount Rates with Overall Fundraising Strategy

Finally, ensure that the discount rates on your SAFEs align with your broader fundraising strategy. If you plan to raise multiple small SAFE rounds before a Series A, the cumulative dilutive effect of these discounts can be substantial. This is often called "stacking SAFEs." Model this out. It may be more strategic to raise a single, larger round on slightly better terms than to accumulate a series of small SAFEs with high discounts. Your goal is not just to close the current round, but to set the company up for a successful Series A and beyond. Every negotiation should be conducted with this long-term vision in mind.

Conclusion: Mastering Your SAFE Terms for Long-Term Success

The discount rate on a SAFE is far more than a simple percentage; it is a critical lever in the complex machinery of early-stage fundraising. For founders, mastering its nuances is not an academic exercise but a fundamental requirement for building a sustainable and valuable company. It directly shapes your ownership, sets precedents for future financing, and signals your confidence to the investment community.

The key takeaway is to move from a passive recipient of terms to an active architect of your fundraising strategy. This involves understanding the discount rate from both your perspective and that of your investors, recognizing it as a reward for their risk and a cost of your early capital. By learning how it interacts with the valuation cap, modeling its potential impact on your equity, and negotiating from a position of knowledge and confidence, you can protect your ownership stake while still attracting the vital capital needed to grow.

As you embark on your fundraising journey, remember these core principles:

Model Everything: Never sign a SAFE without modeling its potential conversion scenarios and understanding the cumulative impact on your cap table. Use a cap table modeling tool to help.

Negotiate Strategically: Use industry benchmarks as a starting point, justify your position with traction, and be prepared to trade concessions wisely. Try Carta's SAFE Insights tool to strategize the terms of your next round.

Think Long-Term: The terms you set today will echo through future fundraising rounds. Prioritize the long-term health of your company and your cap table over the short-term ease of closing a deal.

By treating the discount rate with the strategic importance it deserves, you are not just closing a funding round—you are laying a stronger foundation for your startup's future success.

Frequently Asked Questions (FAQ)

General Understanding of SAFEs

What exactly is a SAFE note and how does it work?

A SAFE note (Simple Agreement for Future Equity) is a financing instrument that allows early-stage companies to raise capital without immediately setting a valuation. Unlike a convertible note, a SAFE note doesn't include an interest rate or maturity date. When you invest via a SAFE note, you're essentially purchasing the right to receive equity later, typically when the company completes its first equity financing round. The SAFE converts based on predetermined terms including the discount rate and valuation cap, rewarding early investors for their risk.

How do SAFE notes differ from convertible notes?

While both are forms of convertible financing, convertible notes are debt instruments with an interest rate and maturity date, meaning the company could face repayment obligations. SAFE notes eliminate these debt-like features entirely, making them more founder-friendly. There are no legal costs associated with tracking interest accrual or managing maturity dates. This simplicity reduces legal fees and administrative burden, which is why simple agreements for future equity have become the preferred choice for angel investors and seed investors in Silicon Valley and beyond.

What are the main conversion triggers for a SAFE note?

The primary conversion triggers include:

A priced equity round (such as Series A), where the SAFE converts into preferred shares

A liquidation event, such as an acquisition or merger

In some cases, dissolution of the company.

The most common trigger is the priced equity financing round, which establishes the company's first formal valuation and determines the exact terms under which SAFE notes convert to equity.

Discount Rates and Valuation

How does the discount rate affect my equity stake as a founder?

The discount rate directly impacts equity dilution for startup founders. A higher discount means early investors receive more shares for their investment, which dilutes your ownership stake. For example, a 20% discount allows investors to purchase shares at 80% of the Series A price, giving them significantly more equity than they would receive at the full price. Smart startup founders model the cumulative effect of all outstanding SAFE notes to understand total dilution before their next funding round.

What's the difference between pre-money SAFEs and post-money SAFEs?

Pre-money SAFEs convert before the new investment is added to the company's capitalization, meaning SAFE holders get diluted alongside founders when new money comes in. Post-money SAFEs, now the standard template, convert after the new investment is accounted for as part of the round's post-money valuation. Post-money SAFEs provide startup founders with greater certainty about their ownership percentage after conversion, making cap table outcomes more predictable and transparent.

How do I know if the discount rate or valuation cap will determine my SAFE conversion?

SAFE notes use a "lower of" principle, converting at whichever price gives investors more equity. If you expect a high valuation in your next round, the cap typically dominates. If you face a down round or modest valuation, the discount rate becomes more impactful. This is why experienced startup founders model both scenarios when negotiating terms with seed investors and evaluate potential cap table outcomes under different fundraising conditions.

Negotiation and Strategy

What's a fair discount rate to offer angel investors and seed capital providers?

Industry standards for SAFE notes typically range from 10-25%, with 20% being most common. The appropriate rate depends on your stage, traction, and market conditions. Early-stage companies with just an idea might offer 20-25%, while those with proven traction can justify 10-15%. Friends and family rounds might use lower discounts, while competitive seed capital raises from professional investors usually settle around the 20% standard established in Silicon Valley.

How can I negotiate better SAFE terms without scaring away early investors?

Start with market-standard terms (20% discount) and justify any requested improvements with concrete traction metrics. Understand what matters most to seed investors—some prioritize the discount, others the cap or investor protections like pro-rata rights. Be prepared to trade concessions strategically: you might accept a higher discount in exchange for a better valuation cap or fewer veto rights. Avoid signaling desperation by offering excessively generous terms that could trigger FOMO-driven decisions you'll later regret.

Should I be concerned about stacking multiple SAFE notes before my Series A?

Yes. Accumulating multiple SAFE notes with high discounts can lead to severe equity dilution and complicated cap table outcomes. Each additional legal agreement adds to the total dilution calculation. Before accepting more early-stage capital, model the cumulative conversion of all outstanding fundraising instruments. Consider whether raising one larger round on slightly better terms might be more strategic than stacking multiple smaller SAFE notes that could fragment your ownership and complicate your Series Seed or Series A negotiations.

Comparison with Other Funding Options

Are there alternatives to SAFE notes for startup funding?

Yes, early-stage companies have several options beyond simple agreements for future equity. These include:

Traditional convertible notes (with interest rates and maturity dates)

Revenue-based financing (which ties repayment to revenue)

Direct equity financing through priced rounds

Bootstrapping

Each financing instrument has trade-offs regarding control, governance, legal costs, and dilution. Many startup founders also start with friends and family funding before moving to institutional fundraising instruments like SAFE notes.

How do SAFE notes impact company control and governance compared to equity financing?

SAFE notes typically don't grant immediate control, governance rights, or shareholder rights until they convert. This is a major advantage for startup founders who want to maintain decision-making authority during the earliest stages. In contrast, direct equity financing often comes with board seats, veto rights, and other investor protections from day one. However, once SAFE notes convert, holders receive preferred shares with the same governance provisions as other investors in that round, including potential pay-to-play provisions in future fundraising.

Advanced Considerations

What happens to SAFE notes in a liquidation event or dissolution?

In a liquidation event such as an acquisition, SAFE notes typically convert immediately, allowing investors to participate in the proceeds. The specific treatment depends on the SAFE's terms and the size of the liquidation. In some cases, investors may receive a return of their capital or a multiple. In a dissolution scenario where the company shuts down, SAFE note holders generally have lower priority than debt holders but higher priority than common shareholders, though they often receive little to nothing in complete failures.

How do SAFE notes affect my option pool and employee equity?

When SAFE notes convert, they dilute not just founders but also the option pool allocated for employee equity. This is critical for attracting talent. Smart startup founders account for SAFE conversion when sizing their option pool, often increasing it before a priced round to ensure sufficient equity remains for key hires. Series Seed and Series A investors will scrutinize your cap table and may require option pool adjustments, so planning for SAFE dilution in advance helps avoid surprises during equity financing negotiations.

Can SAFE investors participate in secondary sales or liquidity events before conversion?

Typically no. Until conversion, SAFE note holders don't own actual shares and generally can't participate in secondary sales or early liquidity events. They must wait for conversion triggers to receive their equity stake. However, some sophisticated early investors may negotiate most favored nation clause provisions or special terms that grant them certain shareholder rights or participation in specific liquidity events. These are non-standard and should be carefully evaluated for their impact on founder control and future funding resources.

How do I manage legal costs and legal fees when issuing multiple SAFE notes?

One advantage of SAFE notes is their simplicity, which keeps legal costs low compared to more complex fundraising instruments. Use standardized templates (like Y Combinator's post-money SAFE) to minimize legal fees. When raising from multiple angel investors or seed investors, issue all SAFE notes on identical terms in a single close rather than negotiating custom terms with each investor. This reduces legal agreement complexity and administrative overhead. For friends and family rounds, you might even handle the process with minimal legal involvement, though consulting an attorney for your first SAFE is advisable.

What should I consider about my SAFE terms if I'm planning to convert to common shares versus preferred shares?

SAFE notes almost always convert to the same class of preferred shares issued in the priced equity round (like Series A Preferred), not common shares. This gives SAFE investors the same liquidation preferences and investor protections as new investors. Converting to common shares would be highly unusual and unfavorable for early investors. When modeling cap table outcomes, remember that SAFE holders will typically receive preferred equity with superior rights to common stockholders, affecting the economics for both founders and employees who hold common stock or options.