Pre-Money and Post-Money Valuation Formulas

Understanding pre-money and post-money valuations is essential for founders and investors during funding rounds. These concepts determine ownership percentages, dilution, and how much equity founders retain after raising capital. Here's a quick breakdown:

Pre-Money Valuation: The company's value before new investment.

Formula:Pre-Money Valuation = Post-Money Valuation - Investment AmountPost-Money Valuation: The company's value after the investment.

Formula:Post-Money Valuation = Pre-Money Valuation + Investment Amount

Key Points:

Ownership Impact: Post-money valuation determines how much equity an investor gets. For example, a $1M investment in a $5M post-money company equals 20% ownership.

Dilution: Each funding round reduces existing shareholders' ownership. Understanding these valuations helps founders plan long-term equity strategies.

Option Pools: Employee stock options (usually 10–20%) can dilute founder equity. Negotiating whether these are pre- or post-money affects how dilution is shared.

Convertible Notes & SAFEs: These instruments convert into equity later, often at a discount or capped valuation, adding complexity to pre- and post-money calculations.

Why It Matters: A higher pre-money valuation means founders give up less equity, keeping more control. Post-money valuation simplifies ownership clarity for investors. Both are critical for fair negotiations and setting the stage for future funding rounds.

Pre-money and post-money valuations

Pre-Money Valuation: Formula and Components

Calculating a pre-money valuation is a critical step in equity negotiations, offering a clear foundation for discussions between founders and investors. While the formula itself is straightforward, the factors influencing the final valuation require thoughtful analysis. Let’s break down the formula and the key components that shape pre-money valuations.

Pre-Money Valuation Formula

The formula for pre-money valuation is simple:

Pre-money valuation = Post-money valuation - Investment amount.

This calculation works backward from the total company valuation after an investment (post-money valuation) to determine the value of the company before the new capital was added. It’s a foundational concept that helps clarify ownership stakes and subsequent calculations.

For example:

If a company raises $1 million in exchange for 10% equity, the post-money valuation is $10 million ($1 million ÷ 10%). Using the formula, the pre-money valuation would be $9 million ($10 million - $1 million) [2].

Consider FarmStack, an agri-tech platform. If their post-money valuation is set at $8 million, and they are raising $1.5 million, the pre-money valuation would be $6.5 million ($8 million - $1.5 million). With 1.5 million outstanding shares, the price per share would be $4.33 ($6.5 million ÷ 1.5 million) [3].

Pre-money valuation is not just a number; it determines the price per share and sets the stage for calculating investor ownership [1].

Key Factors That Affect Pre-Money Valuation

Several factors influence pre-money valuation, each playing a significant role in shaping investor perceptions and negotiations:

Growth Potential: Startups with a clear path to scaling revenue and expanding market often secure higher valuations. Investors want to see a business model with the potential for significant returns.

Market Size: Companies targeting large, expanding markets are more attractive to investors, as they offer greater potential upside. A business addressing a broad market opportunity typically commands a higher valuation compared to one serving a niche.

Traction and Revenue: Evidence of market validation, such as paying customers, recurring revenue, or strong user engagement, can justify higher valuations. This is especially important in early funding rounds when proof of concept is critical.

Team Expertise and Competitive Positioning: Founders with relevant industry experience and businesses with strong competitive advantages - such as proprietary technology or market dominance - tend to fare better in valuation discussions. Investors often view a capable team as a key asset.

Timing: The timing of a funding round can also impact valuation. Companies raising funds during favorable market conditions or in high-growth sectors often achieve higher valuations, whereas those fundraising in slower periods may face more conservative terms.

Option Pools and Other Adjustments

Pre-money valuations often require adjustments to account for factors like option pools, which are reserves of equity set aside for employee compensation. Typically, startups allocate 10–20% of equity for stock option plans, and the timing of when this pool is created has a direct impact on founder dilution.

If the option pool is created pre-money, only the founders experience dilution. However, if it’s created post-money, the dilution is shared between founders and new investors [4]. This distinction can significantly affect ownership percentages, making it a critical negotiation point.

Savvy founders often negotiate for post-money ESOP (Employee Stock Option Pool) creation to avoid unexpected dilution [5]. When the option pool is carved out pre-money, the founders bear the entire cost of employee equity. By structuring it post-money, the dilution is distributed among all shareholders.

Pre-money valuation calculations also consider a fully diluted basis, which includes all potential shares from warrants, options, or convertible securities already issued [2]. This ensures that the valuation reflects the total potential share count.

Additionally, convertible notes or SAFE agreements from earlier funding rounds may convert into equity during the current round, further affecting share counts and dilution. It’s essential for founders to account for these instruments when negotiating valuations by using a cap table modeling tool.

Investors may present offers using either pre-money or post-money frameworks, so it’s crucial for founders to clarify the terms. The framework used directly impacts ownership calculations and final equity distribution [1][2][4][5].

Post-Money Valuation: Formula and Calculation

Post-money valuation represents the total value of a company immediately after it receives new funding. Unlike pre-money valuation, which reflects a company's value before any investment, post-money valuation includes the fresh capital injected during the funding round. This figure plays a key role in determining investor ownership percentages and managing equity distribution on the cap table.

Post-Money Valuation Formula

The formula for calculating post-money valuation is simple:

Post-money valuation = Pre-money valuation + Investment amount.

This approach adds the new investment directly to the company's pre-money value, resulting in the total value after the funding round.

Example: Let’s say a software startup, TechFlow, has a pre-money valuation of $4.5 million and raises $1.5 million in a seed round. The post-money valuation would be $6.0 million ($4.5 million + $1.5 million).

To calculate the investor’s ownership percentage, divide the investment amount by the post-money valuation:

$1.5 million ÷ $6.0 million = 25%.

In this case, the investors would own 25% of the company in exchange for their $1.5 million investment.

Another method for determining post-money valuation is the ownership percentage approach:

Post-money valuation = Investment amount ÷ Ownership percentage.

For example, if investors agree to invest $2.0 million for 20% equity, the post-money valuation would be $10.0 million ($2.0 million ÷ 20%).

Post-money valuation also helps calculate the price per share. For example, if TechFlow has 3.0 million fully diluted shares outstanding after the round, the price per share would be $2.00 ($6.0 million ÷ 3.0 million shares). These calculations provide a clear framework for understanding how new investments affect ownership and equity distribution.

How Ownership and Investor Stakes Work

Post-money valuation directly impacts how ownership is divided among founders, employees, and investors. When investors contribute capital, they receive new shares, which dilute the ownership percentages of existing shareholders.

Using the TechFlow example, if the founders originally owned 100% of 2.4 million shares, a $1.5 million investment at $2.00 per share would create 750,000 new shares. After the round, the founders would own 2.4 million out of a total 3.15 million shares, reducing their ownership to 76.2%.

This is where cap table management becomes essential. Founders can use cap tables to model different funding scenarios and understand how various investment amounts affect their ownership. Negotiating a higher post-money valuation can minimize the dilution caused by new investments.

Employee stock option pools also factor into post-money valuation. For instance, if TechFlow sets aside 15% of post-money equity for employee options, this would account for 472,500 shares out of the total 3.15 million. After accounting for investor equity and the option pool, the founders’ ownership would drop to approximately 61%.

Post-money valuation also influences liquidation preferences in exit scenarios. For example, if TechFlow is sold for $12.0 million, investors with a 1x liquidation preference would receive their $1.5 million investment back first. The remaining proceeds would then be distributed based on ownership percentages.

These calculations are essential for understanding how funding rounds reshape equity distribution and stakeholder dynamics.

Using Post-Money Valuation in U.S. Fundraising Rounds

Post-money valuation plays a strategic role across different funding stages in the U.S. venture capital landscape:

Pre-seed rounds typically have post-money valuations between $2.0 million and $8.0 million, with investment amounts ranging from $250,000 to $1.5 million. At this stage, investors focus more on the founding team and market potential than financial metrics.

Seed rounds usually see post-money valuations between $8.0 million and $25.0 million, with companies raising $1.0 million to $5.0 million. Here, investors expect to see indicators of product-market fit, early revenue, and a clear growth trajectory.

Series A rounds feature higher post-money valuations, often between $25.0 million and $75.0 million, with investment amounts ranging from $5.0 million to $15.0 million. Companies at this stage need to demonstrate scalable business models, recurring revenue, and a clear path to profitability.

Later-stage funding rounds often introduce complexities like multiple share classes, anti-dilution clauses, and participation rights. Investors in these rounds may negotiate for preferred shares with enhanced rights, while founders and employees holding common shares may face different terms during liquidity events.

Down rounds, where the post-money valuation falls below the previous round’s valuation, present unique challenges. These situations can trigger anti-dilution protections for existing investors, leading to significant dilution for founders and employees. Understanding post-money valuation mechanics helps all stakeholders navigate these scenarios effectively.

Allied Venture Partners collaborates with early-stage software and technology companies throughout these funding stages. Our network of over 2,000 angels and VCs provides insights into current valuation trends across pre-seed, seed, and Series A rounds in both the U.S. and Canadian markets.

Pre-Money vs Post-Money Valuation Comparison

Knowing when to use pre-money versus post-money valuation is crucial during fundraising negotiations. Each approach offers unique advantages depending on the circumstances and the goals of the parties involved. Building on the earlier definitions and formulas, let's dive into how these valuation methods impact both founders and investors.

Main Differences and When to Use Each

The key difference between the two lies in timing and perspective. Pre-money valuation measures a company's worth before new capital comes in, while post-money valuation reflects the company's value after the investment, including the new funds. This distinction significantly influences how deals are structured.

Pre-money valuation is particularly useful at the start of negotiations. It allows founders to establish a baseline value for their company, serving as a foundation for discussions. This approach helps founders understand how equity stakes will change with new investments.

On the other hand, post-money valuation is more relevant when investors need a clear picture of their ownership stake. It simplifies scenario modeling, showing exactly how much of the company the investor will own after the deal. For example, if an investor contributes $3.0 million for a 25% stake, the post-money valuation is instantly calculated as $12.0 million.

The choice between these methods often depends on market dynamics. In competitive funding landscapes, founders may lean on pre-money valuations to emphasize their company's current value. In contrast, when investors hold more leverage, discussions often revolve around post-money valuations and ownership percentages.

Interestingly, term sheets frequently alternate between the two approaches when defining legal terms like liquidation preferences and voting rights. These nuances directly influence negotiation strategies, especially regarding founder dilution and investor control.

Pros and Cons for Founders and Investors

Each valuation method has its own set of benefits and challenges, which can shape how both founders and investors approach funding rounds. Here's a quick comparison of the two:

For founders, pre-money valuation provides an opportunity to spotlight their company’s progress and potential without immediately diving into equity dilution. This can be particularly advantageous when pitching to angel investors, as it allows founders to focus on growth and traction before addressing ownership splits.

However, pre-money discussions can get tricky in complex funding rounds. If multiple investors are involved with varying contribution amounts, recalculating ownership percentages can become a headache. This can slow down negotiations and lead to confusion.

For investors, post-money valuation offers straightforward clarity. An investor putting $1.5 million into a $10.0 million post-money round knows they’ll own exactly 15% of the company. This transparency makes it easier to manage portfolios and allocate board seats.

That said, post-money frameworks can limit flexibility. If market conditions shift or due diligence uncovers new issues, renegotiating post-money valuations can feel like moving the goalposts, which may strain relationships with founders.

Strategic Considerations

The choice between pre-money and post-money valuation often comes down to strategic priorities. Pre-money valuation is better suited for companies with strong fundamentals looking to maximize their perceived value. On the flip side, post-money valuation appeals to investors who prioritize clear ownership thresholds and governance rights.

Allied Venture Partners, known for its expertise in early-stage software and technology investments, uses both valuation methods to guide founders through funding rounds. With a global network of angel investors and venture capitalists, we help founders determine the most effective approach based on their stage and target audience in the U.S. and Canadian markets.

Step-by-Step Examples and Calculations

Let’s break down pre-money and post-money valuation calculations with two practical examples. These examples focus on typical seed and Series A funding rounds, using concrete numbers to show how valuations evolve.

Example 1: Seed Round Valuation

Here’s how the valuation process looks during a seed funding round for TechFlow, a SaaS startup based in Austin, Texas. At this stage, the company has been operating for 18 months and generates $50,000 in monthly recurring revenue.

Initial Company Setup:

Founders own 100% of the company (2,000,000 shares).

15% of shares are reserved for an employee stock option pool.

The company is seeking $2.0 million in seed funding.

The pre-money valuation is set at $8.0 million.

Step 1: Calculate Post-Money Valuation

Post-Money Valuation = $8.0 million + $2.0 million = $10.0 million

Step 2: Determine Investor Ownership Percentage

Investor Ownership = $2.0 million ÷ $10.0 million = 20%

Step 3: Calculate New Share Issuance

Total shares after investment = 2,000,000 ÷ (1 - 0.20) = 2,500,000 shares

New shares issued to investors = 2,500,000 - 2,000,000 = 500,000 shares

Price per share = $2.0 million ÷ 500,000 = $4.00

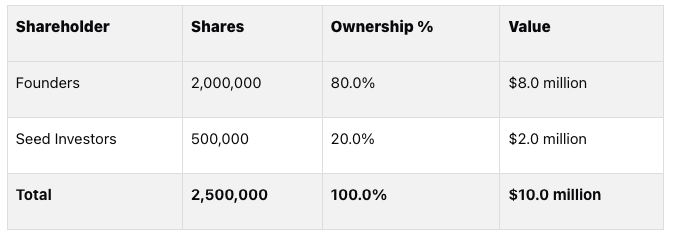

Cap Table:

The founders retain 80% ownership while securing the capital needed to grow. This level of dilution is fairly typical in seed funding, where founders often keep 70-85% of the company.

Example 2: Series A Round Valuation

Now, let’s see what happens during a Series A round, building on the seed round example. Eighteen months later, TechFlow has grown significantly, with $400,000 in monthly recurring revenue and a team of 25 employees.

Current Company Status:

Post-seed valuation: $10.0 million

Monthly recurring revenue: $400,000

Team size: 25 employees

Seeking $8.0 million in Series A funding

Pre-money valuation: $32.0 million

Step 1: Calculate Post-Money Valuation

Post-Money Valuation = $32.0 million + $8.0 million = $40.0 million

Step 2: Determine Series A Investor Ownership

Series A Ownership = $8.0 million ÷ $40.0 million = 20%

Step 3: Adjust Employee Option Pool

The company increases the employee option pool from 15% to 20% to prepare for new hires.

Step 4: Calculate Share Structure

Total shares before Series A = 2,500,000 ÷ 0.80 = 3,125,000 shares

New shares for Series A = 3,125,000 × 0.25 = 781,250 shares

Total shares after Series A = 3,125,000 + 781,250 = 3,906,250 shares

Price per share = $8.0 million ÷ 781,250 = $10.24

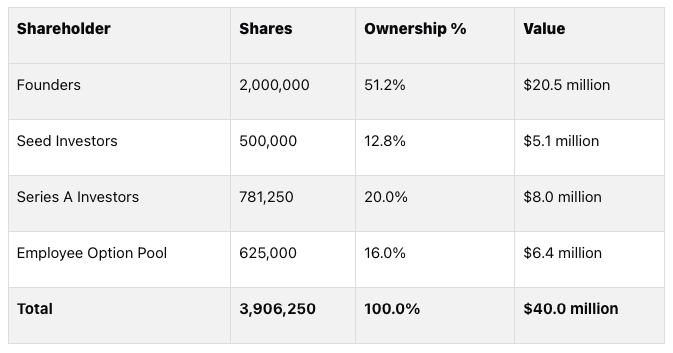

Cap Table:

Key Takeaways:

The founders’ ownership dropped from 80% to 51.2%, but their stake is now worth $20.5 million, up from $8.0 million.

The seed investors saw their $2.0 million investment grow to $5.1 million, a 155% increase.

The price per share more than doubled, rising from $4.00 to $10.24, reflecting the company’s improved financial performance.

TechFlow’s ability to achieve strong revenue growth between funding rounds justified a fourfold increase in its pre-money valuation. This approach allowed the company to raise significant capital while limiting dilution. Founders working with networks like Allied Venture Partners can use these calculations to navigate funding negotiations more effectively.

Additional Factors in Early-Stage Valuation

Building on the earlier discussion about valuation formulas, there are other elements - like convertible instruments and investor networks - that play a significant role in shaping funding outcomes. Understanding these factors can help both founders and investors navigate the often complex world of early-stage fundraising.

Convertible Notes and SAFE Agreements

Convertible notes and SAFE (Simple Agreement for Future Equity) agreements add layers of complexity to valuation. These tools are designed to delay setting a fixed valuation until a future funding round. While they serve as useful instruments, they also impact how ownership and equity are calculated.

Convertible notes are essentially loans that convert into equity during a later funding round, often at a discounted rate or capped valuation. These notes typically include terms like:

Discount rates, which allow note holders to convert their investment into equity at a lower share price compared to future investors.

Valuation caps, which set an upper limit on the price at which the notes convert.

Accrued interest, which increases the total amount converted into equity.

For instance, if a startup raises funds using a convertible note with both a discount and a valuation cap, and later secures a Series A round at a higher valuation, the note holders will convert their investment under whichever terms are more favorable to them. This can result in a less transparent "shadow cap table", where ownership percentages are harder to discern.

Another important feature is pro rata rights, which allow investors to maintain their ownership percentages in future rounds. These rights, combined with the terms of convertible instruments, directly influence the cap table, adding complexity to the pre-money and post-money valuation calculations.

The Role of Angel Investor Networks

While the numbers can get complicated, external support can help simplify the process. Angel investor networks, for example, play a key role in guiding founders through the intricacies of valuation and funding. These networks not only provide expertise but also streamline the fundraising process.

Take Allied Venture Partners as an example. With a network of over 2,000 angels and VCs, we connect founders with experienced investors across various industries and funding stages. This ensures valuations align with current market trends and conditions.

One of the major benefits of working with such networks is the reduction in administrative and legal burdens. Instead of managing multiple individual investors, founders deal with a single entity that pools investments through Special Purpose Vehicles (SPVs). This approach simplifies cap table management and helps cut down on legal expenses - particularly important when dealing with convertible instruments.

Additionally, these networks often accelerate funding timelines. For example, some funding rounds can be completed in as little as four weeks. This speed can prevent valuation drift, where prolonged fundraising causes the initial valuation to become outdated due to shifting market conditions. By locking in valuations quickly, founders can avoid complications that arise from changing market dynamics.

Beyond the financial aspects, angel networks also provide mentorship. Experienced entrepreneurs and investors offer advice on how various valuation strategies can impact long-term growth. The potential for follow-on funding from the same network further incentivizes founders to make thoughtful decisions about their initial valuations, ensuring they support sustainable growth.

In short, angel investor networks like Allied Venture Partners provide essential guidance, simplify complex cap table management, and help founders secure funding quickly - all while ensuring valuations remain relevant to the market.

Key Takeaways for Founders and Investors

Understanding valuation formulas is crucial for making strategic decisions that directly impact your company's future and investment outcomes. These formulas determine ownership percentages and how much control founders retain after each funding round.

For founders, every valuation decision comes with its challenges. A higher pre-money valuation means less dilution for the same investment amount, while a lower valuation results in greater equity dilution [3][6]. Valuations don’t just affect immediate ownership - they set the tone for future funding rounds. An appropriate pre-money valuation can attract more investors, while an unrealistic one might raise concerns [6][9]. These decisions require careful consideration, as they influence both short-term and long-term benefits.

For investors, post-money valuations offer immediate clarity on ownership stakes. As Mike Hinckley, Founder of Growth Equity Interview Guide, explains:

"In my 10+ years in the investment industry, I noticed that investors often prefer post-money valuations because they provide clear insight into ownership percentages immediately after an investment. This clarity reduces uncertainty and makes it easier to monitor equity stakes." [8]

With venture capital funding becoming increasingly competitive, accurate valuations have never been more important [8]. Misunderstanding valuation concepts can lead to "down rounds", where new shares are sold at lower prices, negatively impacting existing shareholders and complicating future fundraising [7][9][11].

Founders should focus on preparing detailed financials, market analyses, and growth projections to justify their valuations [6]. It’s also critical to clearly state whether discussions involve pre-money or post-money figures to avoid any confusion [8]. Engaging professional valuation services can provide independent assessments that boost credibility with potential investors [6].

For investors, evaluating pre-money valuations requires a close look at the company’s stage, performance, market potential, and competitive position [6]. Diversifying investments across multiple startups and asset classes can help manage risk while building a balanced portfolio [6]. In more complex funding scenarios, such as those involving convertible instruments, consulting financial experts ensures accuracy and avoids costly errors [8].

Convertible instruments, like pre-money versus post-money SAFEs, require extra attention to ensure investor ownership is properly accounted for [8][10]. Both founders and investors benefit from understanding these nuances, as they help structure deals that align with long-term goals.

Additionally, leveraging experienced networks can streamline the fundraising process. For example, groups like Allied Venture Partners help align valuations with market conditions, simplify fundraising efforts, and reduce administrative burdens. We can complete funding rounds in as little as four weeks, making the process more efficient for all parties involved.

Whether you're a founder aiming to minimize dilution or an investor looking to maximize returns, mastering valuation formulas is key to navigating today's competitive startup environment with confidence.

FAQs

How do pre-money and post-money valuations impact a founder's ownership and control after a funding round?

Pre-money and post-money valuations are key concepts that shape a founder's ownership and control after a funding round.

Pre-money valuation refers to how much the company is worth before any new investment comes in. The higher this number, the more equity founders can hold onto, as it minimizes the dilution of their ownership stake.

In contrast, post-money valuation factors in the new investment, representing the company’s value after the funding round. This figure is critical for calculating the ownership percentage that new investors will receive, which directly impacts how much of the company founders will give up.

For founders aiming to retain control, negotiating a higher pre-money valuation is vital. Meanwhile, investors often look at the post-money valuation to gauge the size of their stake in the business.

How do convertible notes and SAFEs affect pre-money and post-money valuations?

Convertible notes and SAFEs play a key role in shaping a company's pre-money and post-money valuations, primarily by influencing dilution and ownership distribution. Here's how they work:

Convertible notes usually convert into equity during a future funding round, often based on a valuation cap. This conversion process can dilute the ownership of existing shareholders and directly impact the company's valuation.

SAFEs (Simple Agreements for Future Equity) affect valuations in distinct ways, depending on their structure. For instance, post-money SAFEs set a fixed ownership percentage, making dilution more predictable for investors. On the other hand, pre-money SAFEs don't establish fixed ownership percentages, which can lead to greater dilution if additional SAFEs or convertible notes are issued before a priced funding round.

Both instruments are essential tools in fundraising, influencing how ownership and valuations evolve over time.

How can founders minimize dilution when creating an employee stock option pool?

Founders looking to protect their ownership stake can reduce dilution by strategically timing the creation of an employee stock option pool. A smart move is to start with a smaller pool and expand it only when necessary - ideally just before major funding rounds. This way, the pool remains right-sized without causing unnecessary dilution.

Investors often favor having the option pool in place before they invest, as it prevents immediate dilution following the funding. To strike the right balance, founders should work closely with investors to negotiate both the size and timing of the pool. This ensures they can attract and retain top talent while safeguarding their own equity.